High Stock Valuations: BofA's Rationale For A Positive Outlook

Table of Contents

BofA's Bullish Argument: Why High Valuations Aren't Necessarily a Bear Market Signal

BofA's optimistic view isn't blind faith; it's rooted in a careful analysis of several key market indicators. Their argument centers around the strength of corporate fundamentals, the historical impact of low interest rates, and the immense potential of technological innovation.

Strong Corporate Earnings and Profitability

BofA's assessment of current corporate earnings points to a level of sustainability that justifies the seemingly elevated valuations. They highlight resilient profit margins, defying expectations amidst persistent inflationary pressures. This resilience suggests a degree of pricing power among major corporations, allowing them to pass on increased costs to consumers.

- Resilient profit margins despite inflationary pressures: Many companies have demonstrated an impressive ability to maintain profitability even with rising input costs.

- Strong revenue growth across various sectors: This isn't confined to a single industry; growth is evident across a broad spectrum of sectors, indicating a robust overall economy.

- Evidence of pricing power among major corporations: The ability of companies to raise prices without significantly impacting demand suggests strong underlying market strength. This pricing power is a key factor supporting BofA's positive outlook. Projected EPS (earnings per share) growth further reinforces this positive assessment. Analysts at BofA predict continued EPS growth in the coming quarters, further bolstering their bullish stance.

The Role of Low Interest Rates (Historically):

Historically low interest rates have played a significant role in inflating stock valuations. These low borrowing costs have fueled corporate investment and expansion, leading to increased profitability and higher stock prices. However, it's crucial to understand the nuanced impact.

- Impact of low interest rates on company debt and expansion strategies: Low interest rates make borrowing cheaper, encouraging companies to invest more aggressively, expanding operations, and ultimately boosting earnings.

- Comparison with historical interest rate environments and their effect on stock markets: By comparing current conditions with past cycles of low interest rates, BofA can identify patterns and predict potential future market movements.

- Potential future impact of interest rate changes on valuations: While historically low rates have contributed to higher valuations, any future increases in interest rates could impact this dynamic, necessitating careful monitoring and adjustments to investment strategies.

Technological Innovation and Future Growth Potential

Technological advancements are a key component of BofA's bullish narrative. The potential for future growth driven by innovation is substantial, particularly in sectors like technology and renewable energy.

- Growth potential in emerging technologies (AI, etc.): Artificial intelligence, along with other emerging technologies, offers immense potential for long-term growth and transformative change, supporting higher valuations in related sectors.

- Long-term investment opportunities in innovative sectors: Investing in companies at the forefront of technological innovation offers significant long-term growth potential.

- How technological disruption supports higher valuations: Technological disruption often leads to increased efficiency, new market opportunities, and enhanced profitability, justifying higher valuations for companies leveraging these innovations.

Addressing Concerns about High Stock Valuations

While acknowledging the concerns surrounding high stock valuations, BofA addresses these anxieties by emphasizing the limitations of traditional valuation metrics and advocating for prudent risk management strategies.

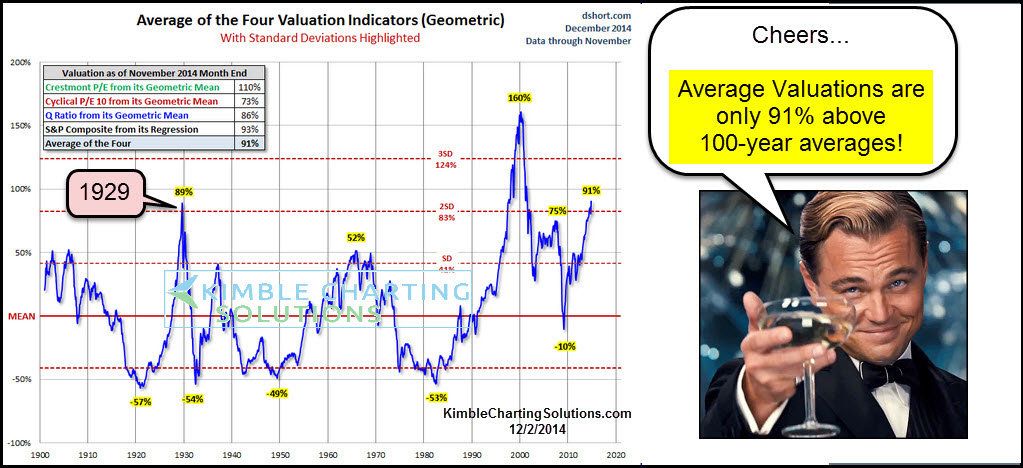

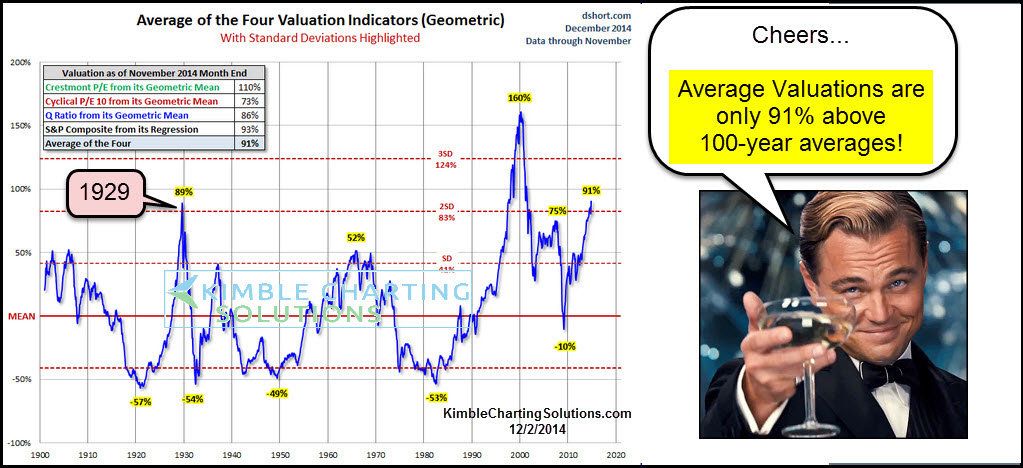

Valuation Metrics and Their Limitations

BofA recognizes the limitations of traditional valuation metrics like the P/E ratio and PEG ratio in accurately reflecting the current market dynamics. These metrics, while useful, don't always capture the full picture, especially in a rapidly evolving environment.

- Limitations of using historical valuation ratios in a rapidly changing market: Historical data may not accurately reflect the impact of disruptive technologies and evolving economic conditions.

- The importance of considering future growth potential alongside current valuations: Future growth potential should be a key factor alongside current valuations when assessing investment opportunities. Forward-looking metrics become crucial.

- Other relevant metrics and indicators beyond traditional ratios: BofA likely incorporates alternative metrics and indicators, such as cash flow analysis and qualitative factors, to arrive at a more comprehensive assessment.

Managing Risk in a High-Valuation Market

Managing risk is crucial in a high-valuation market. BofA emphasizes the importance of diversification and adopting prudent risk management techniques.

- Importance of a diversified investment portfolio: Spreading investments across different asset classes and sectors is essential to mitigate potential losses.

- Strategies for managing portfolio risk in a high-valuation market: Techniques like hedging and setting stop-loss orders can help limit potential downsides.

- Potential downsides and risks to consider: Investors should be aware of the inherent risks associated with high valuations, including the possibility of market corrections or declines.

Conclusion

BofA's positive outlook on the market, despite high stock valuations, rests on strong corporate earnings, historically low interest rates, and the substantial growth potential of technological innovation. While acknowledging the inherent risks, they advocate for strategic diversification and careful risk management. Understanding BofA's rationale regarding high stock valuations is crucial for investors. To effectively navigate the current market, explore resources dedicated to understanding high stock valuations and developing robust investment strategies. Learn more about managing your portfolio in this environment and making informed decisions based on a thorough understanding of high stock valuations.

Featured Posts

-

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025 -

The Future Of Browsers A Conversation With Perplexitys Ceo On The Ai Revolution And Competition With Google

Apr 28, 2025

The Future Of Browsers A Conversation With Perplexitys Ceo On The Ai Revolution And Competition With Google

Apr 28, 2025 -

The Truck Bloat Problem In America Solutions And Strategies

Apr 28, 2025

The Truck Bloat Problem In America Solutions And Strategies

Apr 28, 2025 -

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 28, 2025

Covid 19 Pandemic Lab Owner Pleads Guilty To Fraudulent Testing

Apr 28, 2025 -

Why Are Gpu Prices Skyrocketing Again

Apr 28, 2025

Why Are Gpu Prices Skyrocketing Again

Apr 28, 2025

Latest Posts

-

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025 -

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025

Starbucks Union Vote Rejects Companys Pay Raise Plan

Apr 28, 2025 -

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

Unionized Starbucks Stores Reject Companys Wage Guarantee

Apr 28, 2025

Unionized Starbucks Stores Reject Companys Wage Guarantee

Apr 28, 2025