High Stock Market Valuations: Understanding BofA's Optimistic Outlook

Table of Contents

BofA's Core Argument for High Stock Market Valuations

BofA's rationale centers on several key economic indicators and trends that suggest the current high stock market valuations are justified, at least in the near term. Their argument isn't simply about ignoring the elevated price-to-earnings (P/E) ratios; instead, it incorporates a nuanced view of the broader economic picture.

-

Strong corporate earnings growth, despite inflationary pressures: Despite persistent inflation impacting input costs, many companies have demonstrated remarkable resilience, delivering strong earnings growth. This is partly due to pricing power, allowing businesses to pass on increased costs to consumers. For example, [cite a specific example of a company exceeding earnings expectations, linking to a relevant news source]. This suggests underlying economic strength and a capacity for businesses to navigate inflationary challenges.

-

Resilience of the consumer sector, indicating continued spending: Consumer spending remains a significant driver of economic growth. While inflation has squeezed household budgets, the consumer sector has shown surprising resilience, suggesting continued demand. Factors such as strong employment numbers and accumulated savings have contributed to this strength. [Link to relevant data from the Bureau of Economic Analysis or similar]. This sustained consumer spending supports corporate profitability and justifies higher stock valuations.

-

Technological innovation driving new growth opportunities: Technological advancements continue to fuel innovation and create new growth avenues. The expansion of sectors like artificial intelligence, renewable energy, and biotechnology offers exciting opportunities for investment and future growth. This potential for disruptive innovation justifies premium valuations in certain sectors. [Cite examples of high-growth tech companies and their market capitalization].

-

The potential for further interest rate cuts by central banks: While interest rates have risen significantly in the past year, there's speculation that central banks might begin cutting rates in response to slowing economic growth or indications of disinflation. Lower interest rates generally lead to increased investment and higher stock valuations. This anticipation, according to BofA's analysis, underpins their optimistic outlook. [Link to a relevant BofA report or news article discussing their interest rate predictions].

Counterarguments and Risks Associated with High Valuations

Acknowledging the potential downsides is crucial for a balanced perspective. While BofA presents a bullish case, several counterarguments and significant risks are associated with high stock market valuations:

-

The risk of a potential recession impacting corporate profits: The possibility of a recession remains a significant headwind. A recession would likely lead to reduced consumer spending, lower corporate profits, and consequently, a decline in stock prices. [Cite economic forecasts from reputable sources that discuss recession probabilities]. Investors need to carefully assess the likelihood of a recession and its potential impact on their portfolios.

-

The possibility of further inflation eroding the value of investments: Persistent inflation erodes the purchasing power of investments, potentially negating the gains from rising stock prices. If inflation remains stubbornly high, the real returns from investments could be significantly lower than nominal returns. [Link to data on current inflation rates and projections].

-

Geopolitical uncertainties that could negatively influence markets: Geopolitical instability, such as the ongoing war in Ukraine or escalating trade tensions, can significantly impact global markets and lead to volatility. These uncertainties represent a considerable risk to high stock market valuations. [Cite examples of geopolitical events and their impact on markets].

-

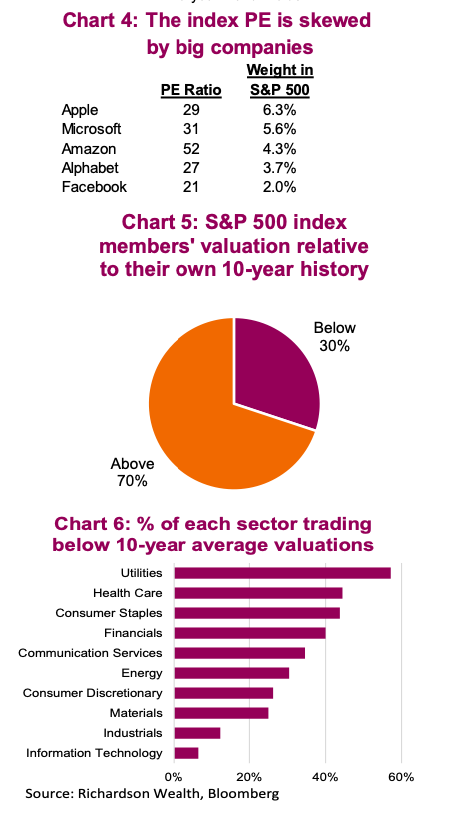

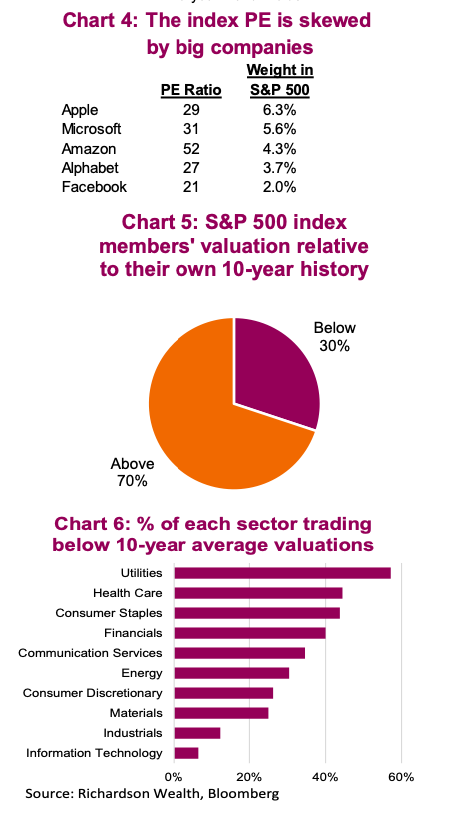

The potential for overvaluation in specific sectors, leading to corrections: Some sectors might be experiencing overvaluation, increasing the risk of significant corrections. Identifying these overvalued sectors and diversifying investments are crucial risk mitigation strategies. [Give examples of sectors potentially experiencing overvaluation].

Analyzing the Current Economic Landscape and its Impact on Valuations

Understanding the current macroeconomic factors is essential for interpreting high stock market valuations. The interplay between these factors significantly influences stock prices:

-

Inflation rates and their potential trajectory: The trajectory of inflation is a crucial factor. Falling inflation generally supports higher stock valuations, while persistent high inflation can lead to market corrections. [Link to charts or graphs illustrating inflation trends].

-

Unemployment figures and their implications for consumer spending: Low unemployment generally indicates strong consumer spending, supporting higher stock valuations. However, rising unemployment suggests weakening consumer demand and could lead to lower valuations. [Link to current unemployment data].

-

Government policies and their impact on economic growth: Government fiscal and monetary policies significantly impact economic growth and, therefore, stock market valuations. Expansionary policies might boost growth and valuations, while contractionary policies might have the opposite effect. [Discuss relevant government policies and their potential impact].

-

Global economic growth forecasts: Global economic growth forecasts influence investor sentiment and market valuations. Strong global growth forecasts tend to support higher valuations, while weaker forecasts can lead to lower valuations. [Link to global growth forecasts from reputable organizations].

Sector-Specific Analysis within High Stock Market Valuations:

Analyzing valuations on a sector-specific basis provides a more nuanced understanding of the current market.

-

Technology sector valuations and their justification: The technology sector often commands premium valuations, driven by innovation, high growth potential, and the dominance of large-cap tech companies. However, this sector is also vulnerable to changes in investor sentiment and interest rates. [Discuss the performance of major tech indices].

-

Energy sector performance and future prospects: The energy sector has experienced significant volatility recently, influenced by geopolitical factors and the transition to renewable energy sources. Future prospects depend on global energy demand, energy transition policies, and technological advancements. [Discuss recent performance and future outlook for the energy sector].

-

Consumer staples and their resilience during economic uncertainty: Consumer staples companies, providing essential goods and services, generally exhibit resilience during economic uncertainty. Their valuations often reflect their defensive nature and relatively stable earnings. [Analyze the performance of consumer staples companies].

Conclusion

This article analyzed BofA's optimistic outlook on high stock market valuations, exploring supporting arguments and counterarguments. We examined key economic indicators and their impact on market performance, while also acknowledging inherent risks. The current economic landscape presents both opportunities and challenges for investors navigating these high valuations.

Call to Action: Understanding the complexities surrounding high stock market valuations is crucial for informed investment decisions. Further research into BofA's reports and ongoing economic data will help you develop a comprehensive strategy for managing your investments in this dynamic market environment. Stay informed about the latest developments in high stock market valuations to make the best choices for your portfolio. Consider consulting with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Heitingas Coaching Style The Story Behind The Bum Pats And Forehead Kisses

May 29, 2025

Heitingas Coaching Style The Story Behind The Bum Pats And Forehead Kisses

May 29, 2025 -

Musks Starbase The Official Company Town

May 29, 2025

Musks Starbase The Official Company Town

May 29, 2025 -

Nintendo Switch Technological Innovation And Its Impact

May 29, 2025

Nintendo Switch Technological Innovation And Its Impact

May 29, 2025 -

Hujan Di Semarang Siang Hari Prakiraan Cuaca Lengkap Jawa Tengah 22 April

May 29, 2025

Hujan Di Semarang Siang Hari Prakiraan Cuaca Lengkap Jawa Tengah 22 April

May 29, 2025 -

Joan Mirs Absence Qatar Moto Gp Sprint Update

May 29, 2025

Joan Mirs Absence Qatar Moto Gp Sprint Update

May 29, 2025