High Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Justification for Elevated Stock Prices

BofA's relatively sanguine view on current high stock market valuations isn't based on blind optimism. Instead, their analysis points to several key factors supporting current price levels. Let's examine these contributing elements.

Strong Corporate Earnings and Profitability

Robust corporate earnings and healthy profit margins are significant pillars supporting BofA's assessment of the current stock market. Many companies are demonstrating impressive financial strength, defying concerns of an impending downturn. This strong performance is driven by several key factors:

- Increased productivity boosting profit margins: Technological advancements and streamlined operations have led to increased efficiency and higher profit margins for many companies. This translates to stronger earnings per share (EPS) and justifies higher stock prices.

- Resilient consumer spending driving demand: Despite economic uncertainties, consumer spending remains relatively strong in key sectors, fueling demand and supporting corporate revenues. This resilient consumer base underpins the continued profitability of many businesses.

- Strategic cost-cutting measures enhancing profitability: Companies have implemented various cost-cutting strategies, improving operational efficiency and bolstering their bottom lines. This contributes to increased profitability and supports higher stock valuations. Examples include streamlining supply chains and optimizing workforce structures.

Low Interest Rates and Abundant Liquidity

The current environment of low interest rates and readily available liquidity significantly impacts stock valuations and investor behavior. This combination encourages investment in the stock market as alternatives offer less attractive returns.

- Lower discount rates increase present value of future earnings: Low interest rates reduce the discount rate used in valuation models, thereby increasing the present value of future earnings. This makes stocks appear more attractive relative to other investments.

- Easy access to credit encourages investment: The availability of credit at low interest rates empowers both individuals and institutions to invest more aggressively in the stock market, further driving up prices.

- Quantitative easing policies continue to impact market liquidity: While tapering has begun in many jurisdictions, the lingering impact of quantitative easing policies continues to provide ample liquidity in the market, supporting asset prices including stocks.

Technological Innovation and Growth Sectors

Technological innovation is a crucial driver of future growth, justifying higher valuations in certain sectors. Investment continues to flow into high-growth areas, further supporting the overall market.

- Artificial intelligence (AI) and machine learning: The rapid advancements in AI and machine learning are transforming numerous industries, attracting significant investment and driving valuations higher in related companies.

- Renewable energy and sustainable technologies: The increasing focus on sustainability and the transition to renewable energy sources are fueling significant growth and investment in this sector, contributing to higher stock valuations within this space.

- Biotechnology and pharmaceutical advancements: Breakthroughs in biotechnology and pharmaceuticals continue to drive substantial investment and high valuations in this rapidly evolving sector.

Addressing Concerns about Overvaluation

While BofA acknowledges the seemingly high valuations, their analysis incorporates various factors to mitigate potential risks and uncertainties.

BofA's Valuation Metrics and Models

BofA doesn't rely solely on simple price-to-earnings ratios (P/E) to assess valuations. Their sophisticated approach considers a broader range of factors:

- Use of discounted cash flow (DCF) models: DCF models provide a more comprehensive valuation by discounting future cash flows back to their present value, providing a more nuanced picture than simple P/E ratios.

- Incorporation of macroeconomic factors: Their analysis accounts for various macroeconomic factors such as inflation, interest rates, and economic growth, providing a more holistic valuation.

- Analysis of industry-specific trends: BofA's assessments are not generalized; they consider industry-specific trends and growth prospects, tailoring valuations to each sector's unique circumstances.

Managing Portfolio Risk in a High-Valuation Environment

Even with BofA's positive outlook, managing risk in a high-valuation environment is crucial. Several strategies can help mitigate potential downsides:

- Diversify across asset classes and sectors: Diversification remains a cornerstone of risk management, spreading investments across various asset classes and sectors to reduce the impact of underperformance in any single area.

- Focus on companies with strong fundamentals: Prioritize companies with strong balance sheets, consistent earnings growth, and competitive advantages to reduce exposure to weaker performers.

- Consider defensive stocks or alternative investments: Incorporate defensive stocks (less susceptible to market fluctuations) or alternative investments (such as real estate or commodities) to balance portfolio risk.

Conclusion

BofA's rationale for investor calm regarding high stock market valuations centers on strong corporate earnings, low interest rates, and the continued growth potential fueled by technological innovation. While acknowledging inherent risks, their analysis and suggested strategies offer a measured perspective for navigating the current market environment. Understanding BofA's assessment of these high stock market valuations is crucial for informed investment decisions. Continue your research and consult with a financial advisor to develop a personalized investment plan suited to your risk tolerance. Remember to stay updated on market trends and consider the potential impact of high stock market valuations on your portfolio.

Featured Posts

-

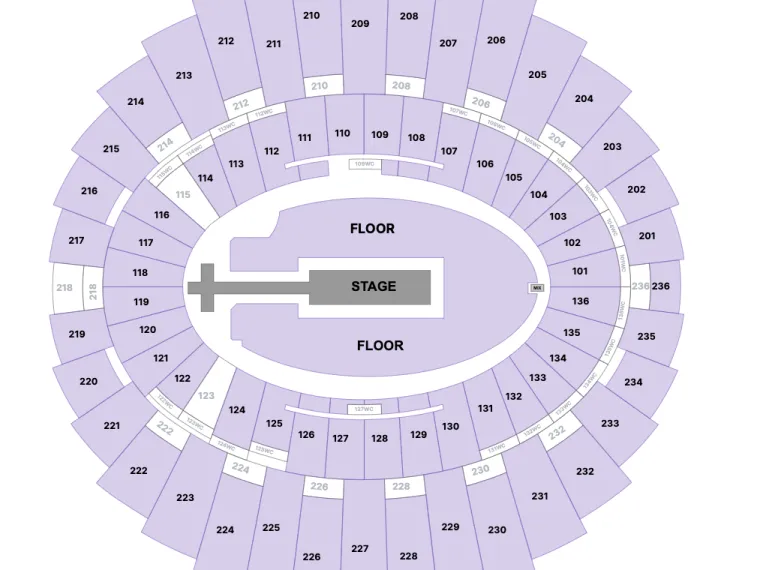

Kendrick Lamar Hampden Concert Ticket Prices Spark Fan Fury

Apr 26, 2025

Kendrick Lamar Hampden Concert Ticket Prices Spark Fan Fury

Apr 26, 2025 -

Ace The Private Credit Job Hunt 5 Dos And Don Ts To Follow

Apr 26, 2025

Ace The Private Credit Job Hunt 5 Dos And Don Ts To Follow

Apr 26, 2025 -

Secret Service Ends Probe Of Cocaine Discovery At White House

Apr 26, 2025

Secret Service Ends Probe Of Cocaine Discovery At White House

Apr 26, 2025 -

Numbers Never Lie Is Deion Sanders Hurting Shedeur Sanders Nfl Draft Stock

Apr 26, 2025

Numbers Never Lie Is Deion Sanders Hurting Shedeur Sanders Nfl Draft Stock

Apr 26, 2025 -

Shedeur Sanders And The New York Giants A Winning Combination

Apr 26, 2025

Shedeur Sanders And The New York Giants A Winning Combination

Apr 26, 2025

Latest Posts

-

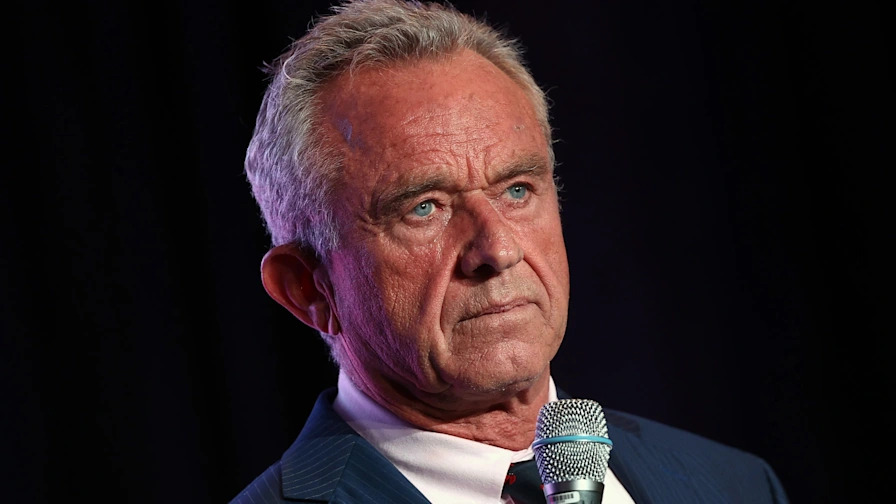

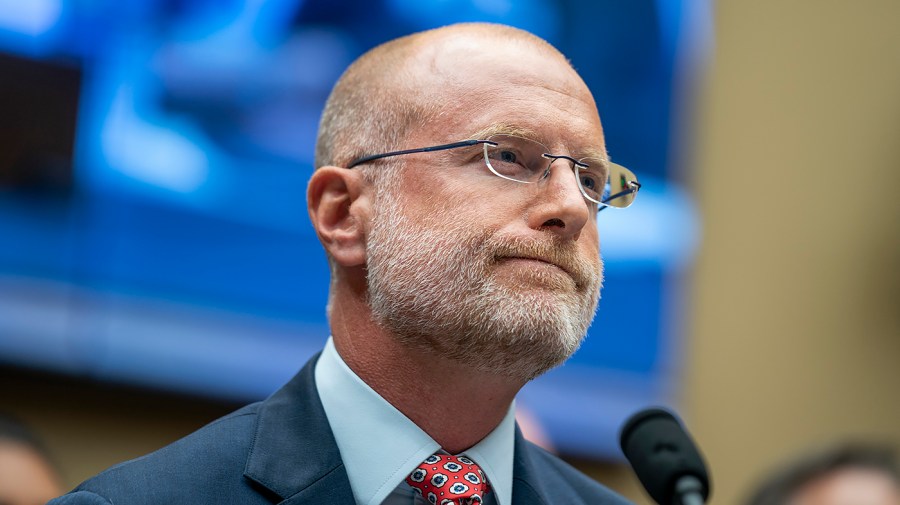

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025 -

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025 -

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025 -

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025 -

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025