High Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

Recent headlines scream about record-high stock prices, leaving many investors feeling anxious. The fear of a market correction, fueled by seemingly high stock market valuations, is palpable. However, Bank of America (BofA), a financial giant, offers a contrasting perspective: investors shouldn't be overly worried. This article will delve into BofA's reasoning, providing context and a balanced view of the current market conditions and high stock market valuations.

BofA's Argument: Why Current Valuations Aren't Necessarily Overvalued

BofA's analysis suggests that current high stock market valuations aren't necessarily a sign of an impending crash. Their perspective is based on several key factors, which we will explore in detail.

The Role of Interest Rates and Monetary Policy:

Interest rates play a crucial role in shaping stock valuations. Lower interest rates generally support higher Price-to-Earnings (P/E) ratios, as investors are willing to pay more for future earnings when borrowing costs are low. BofA's analysis considers the relationship between the current interest rate environment and projected future earnings growth.

- Lower interest rates can support higher Price-to-Earnings (P/E) ratios. This is because the opportunity cost of investing in stocks is lower when borrowing money is cheaper.

- BofA's projection of interest rate trajectory and its impact on valuations. Their forecasts suggest a gradual, controlled increase in interest rates, which they believe is manageable and won't significantly derail current market growth.

- Comparison of current rates to historical context. Comparing current interest rates to historical averages reveals that, while they are rising, they remain relatively low in a historical context, providing continued support for higher valuations.

Strong Corporate Earnings and Profitability:

BofA points to robust corporate earnings growth as a key justification for the current high stock market valuations. Their data reveals sustained profitability across various sectors, suggesting the market's valuation isn't purely speculative.

- Examples of high-performing sectors and their contributions to overall market valuation. Technology, healthcare, and consumer staples are among the sectors driving strong earnings, contributing significantly to the overall market capitalization.

- Analysis of profit margins and their resilience. Despite inflationary pressures, many companies have demonstrated resilience in maintaining healthy profit margins, indicating strong underlying fundamentals.

- Discussion of future earnings expectations based on BofA's forecasts. BofA's projections indicate continued, albeit potentially slower, earnings growth in the coming years, supporting the argument that current valuations are justified.

Long-Term Growth Potential and Innovation:

BofA emphasizes the significant role of long-term economic growth prospects and technological innovation in shaping market valuations. They believe that ongoing advancements in various sectors justify the current elevated valuations.

- Mention specific technological advancements and their potential market impact. Artificial intelligence, renewable energy, and biotechnology are examples of areas driving significant innovation and potential for future market growth.

- BofA's predictions for long-term economic growth and its effects on stock prices. Their long-term growth outlook remains positive, suggesting continued potential for upward stock price movement.

- Focus on sectors poised for significant growth. Investing in sectors poised for significant growth, such as those mentioned above, could help mitigate risks associated with high stock market valuations.

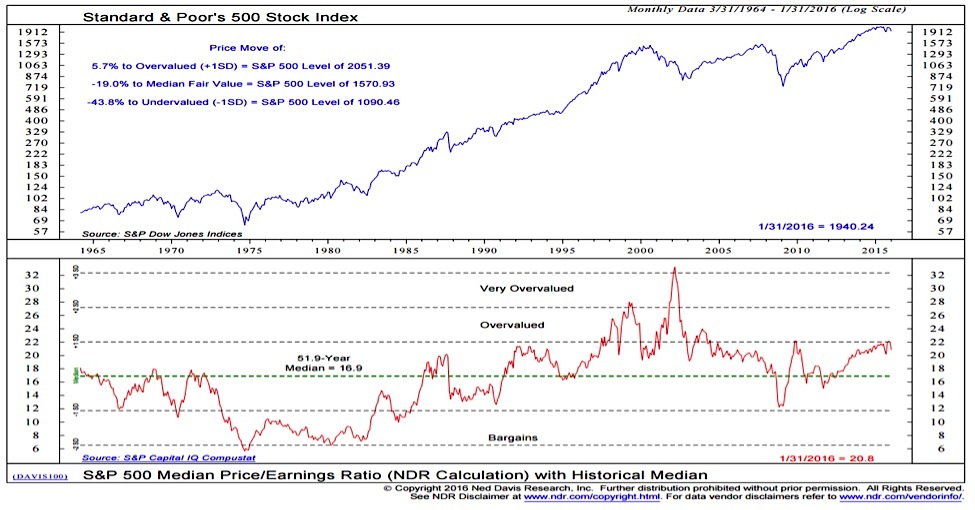

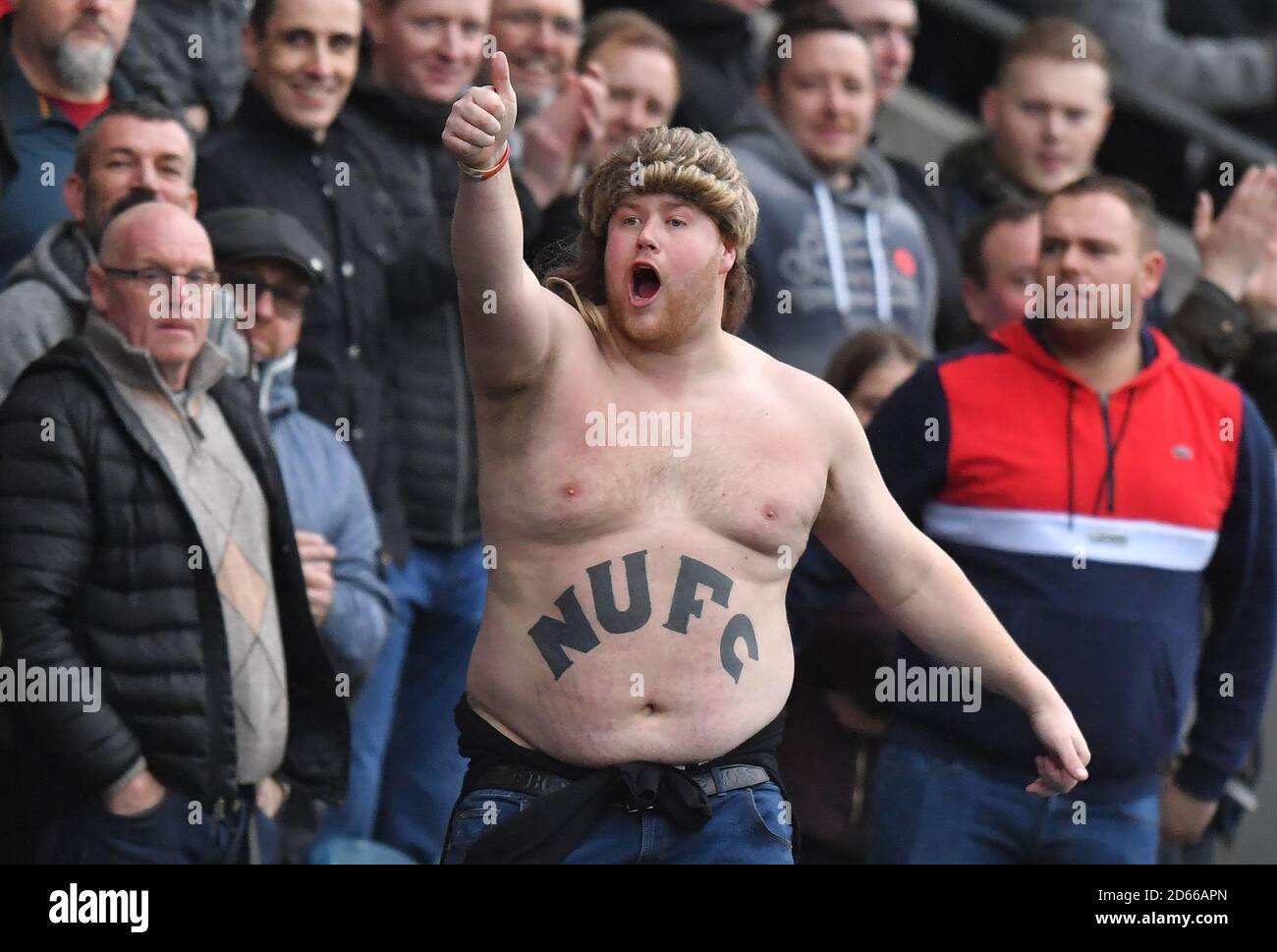

Addressing Specific Valuation Metrics (P/E Ratio, etc.):

Understanding valuation metrics is key to interpreting market conditions. BofA cautions against relying solely on the P/E ratio.

- Explain the limitations of using P/E ratios in isolation. The P/E ratio, while useful, doesn't tell the whole story and should be considered alongside other metrics and contextual factors.

- Comparison of current valuation metrics to historical averages and other market benchmarks. BofA's analysis compares current metrics to historical averages and global market benchmarks, providing a broader perspective on current valuations.

- Provide alternative valuation metrics and their interpretations. Metrics like price-to-sales ratio (P/S) and dividend yield offer additional insights and can help provide a more comprehensive understanding of market valuation.

Navigating High Stock Market Valuations – A Balanced Perspective

BofA's analysis suggests that while high stock market valuations exist, they aren't necessarily cause for immediate alarm. Their arguments center on strong corporate earnings, the impact of low interest rates, and the potential for long-term growth fueled by technological innovation. While inherent market risks always exist, BofA emphasizes the potential for continued growth. It's crucial to remember that investing always involves risk. A long-term investment strategy, diversified across various asset classes, is vital. For further insights on managing your portfolio in a market with potentially high stock market valuations, consult with a financial advisor. They can help you navigate these complex market conditions and develop a strategy tailored to your specific financial goals and risk tolerance.

Featured Posts

-

12 1 Rout Tennessees Impressive Win Against Indiana State Sycamores

May 12, 2025

12 1 Rout Tennessees Impressive Win Against Indiana State Sycamores

May 12, 2025 -

White House Minimizes Auto Industry Concerns Over Uk Trade Deal

May 12, 2025

White House Minimizes Auto Industry Concerns Over Uk Trade Deal

May 12, 2025 -

Filming Alligators In Florida Springs A Guide For Filmmakers

May 12, 2025

Filming Alligators In Florida Springs A Guide For Filmmakers

May 12, 2025 -

Is John Wick 5 A Good Idea A Fans Perspective

May 12, 2025

Is John Wick 5 A Good Idea A Fans Perspective

May 12, 2025 -

Getting To Know Debbie Elliott

May 12, 2025

Getting To Know Debbie Elliott

May 12, 2025

Latest Posts

-

Pl Retro On Sky Sports How To Find And Watch Premier League Classics In Hd

May 13, 2025

Pl Retro On Sky Sports How To Find And Watch Premier League Classics In Hd

May 13, 2025 -

15 Year Old School Stabbing Victim Laid To Rest

May 13, 2025

15 Year Old School Stabbing Victim Laid To Rest

May 13, 2025 -

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025 -

Watch Premier League Retro Matches In Hd On Sky Sports A Guide

May 13, 2025

Watch Premier League Retro Matches In Hd On Sky Sports A Guide

May 13, 2025 -

Newcastle United Fans Championship Play Off Predictions

May 13, 2025

Newcastle United Fans Championship Play Off Predictions

May 13, 2025