High Stock Market Valuations: A BofA Analyst's Case For Calm

Table of Contents

Understanding the Current High Stock Market Valuations

High stock market valuations are a significant concern for investors. Several key metrics highlight this.

Metrics Indicating High Valuations

-

Price-to-Earnings ratios (P/E): This classic valuation metric compares a company's stock price to its earnings per share. Elevated P/E ratios across the market suggest potentially inflated prices relative to earnings. Currently, many sectors show P/E ratios exceeding historical averages.

-

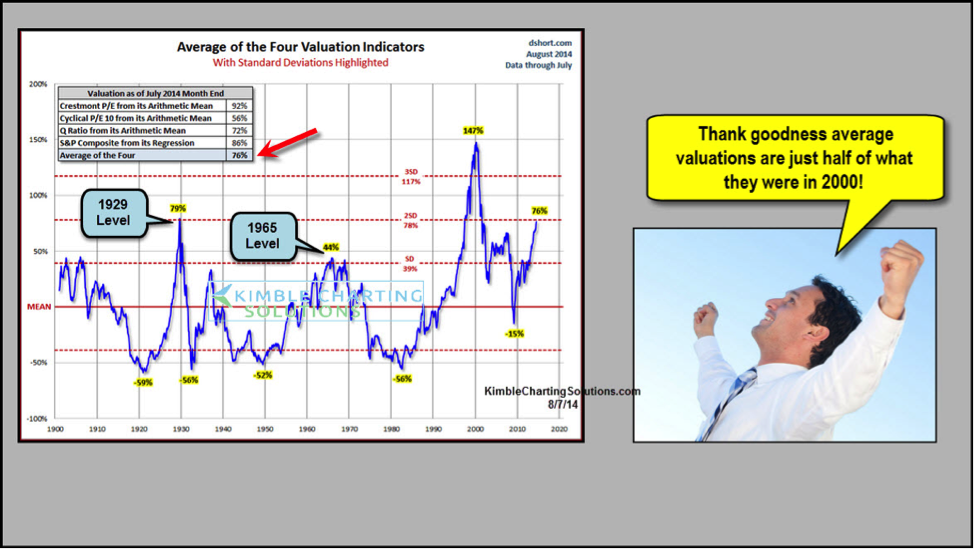

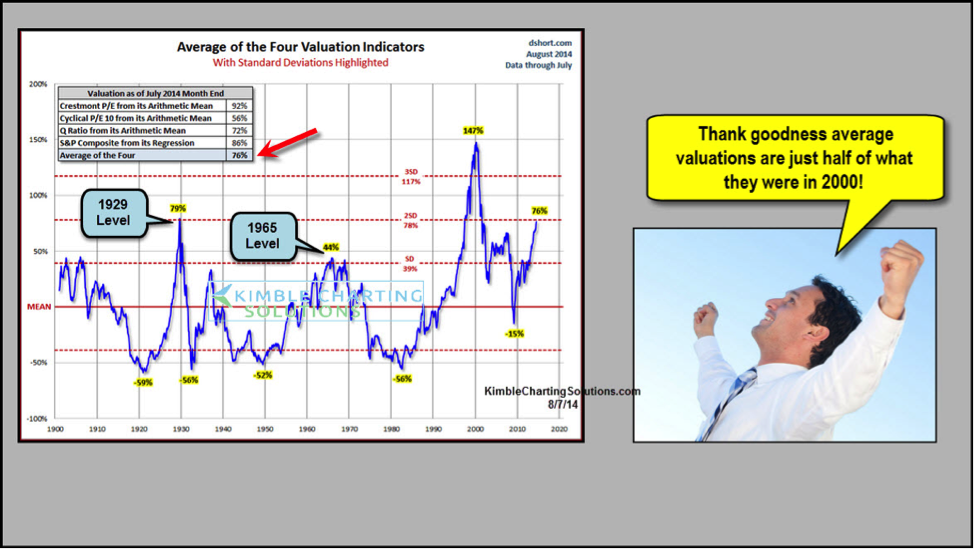

Shiller P/E (CAPE): The cyclically adjusted price-to-earnings ratio, or CAPE, smooths out earnings fluctuations over a longer period (typically 10 years). This provides a more stable measure of valuation, adjusting for business cycle effects. A high CAPE ratio can signal overvaluation.

-

Other Valuation Multiples: Other metrics, such as Price-to-Sales (P/S) and Price-to-Book (P/B) ratios, also offer valuable insights into market valuations. Analyzing these in conjunction provides a more holistic view.

-

Why High P/E Ratios Alone Might Not Be Sufficient: High P/E ratios don't always indicate an overvalued market. Factors like low interest rates and expectations of future growth can significantly influence these ratios.

-

Influence of Low Interest Rates: Low interest rates reduce the discount rate used in valuation models, leading to higher present values of future earnings and thus higher P/E multiples.

-

Comparison to Historical Averages: Comparing current valuations to historical averages is crucial. However, simply relying on historical data without considering the unique economic context of today's market can be misleading. Factors like technological innovation and shifts in global economic power must be considered.

Factors Driving High Stock Market Valuations

Several factors contribute to the current high stock market valuations:

-

Strong Corporate Earnings Growth: Robust corporate earnings, particularly in certain sectors, have supported higher stock prices.

-

Low Interest Rate Environment: The prolonged period of low interest rates has made equities more attractive relative to bonds, driving up demand and valuations. This low-interest-rate environment has also fueled borrowing for investments, further inflating prices.

-

Technological Innovation: Continuous technological advancements and the potential for future disruption fuel investor optimism and expectations of high future earnings, justifying higher valuations for growth stocks.

-

Investor Sentiment and Market Psychology: Market psychology plays a significant role. Periods of optimism and confidence can push valuations beyond what fundamental analysis alone would suggest. FOMO (fear of missing out) can also drive up prices.

The BofA Analyst's Perspective on Maintaining Calm

Despite the high valuations, the BofA analyst's perspective remains relatively calm. Their reasoning centers on long-term growth potential and a strategic investment approach.

Long-Term Growth Potential

The BofA analyst's long-term optimistic outlook is based on:

-

Forecast for Economic Growth: The analyst predicts continued, albeit potentially slower, economic growth, translating into sustained corporate profitability.

-

Strong Growth Sectors: The analyst identifies specific sectors like technology, healthcare, and renewable energy as having particularly strong growth potential, offering opportunities for investors.

-

Mitigating Factors: The analyst also acknowledges potential headwinds, but believes several mitigating factors could offset the risks associated with high valuations. These factors might include innovative business models, productivity gains, and successful navigation of global challenges.

Strategic Investment Approach

The BofA analyst suggests a measured approach:

-

Diversified Portfolio: A well-diversified portfolio across different asset classes and sectors can help mitigate risk associated with high valuations in specific areas.

-

Focus on Quality Companies: Investing in companies with strong fundamentals, sustainable business models, and a history of consistent profitability reduces exposure to volatile, overvalued stocks.

-

Avoid Rash Decisions: The analyst cautions against making impulsive decisions based solely on valuation concerns, emphasizing the importance of a long-term investment horizon.

Risks and Potential Downsides

While the BofA analyst advocates for calm, several risks and potential downsides warrant consideration:

Inflationary Pressures

Rising inflation erodes purchasing power and can lead to higher interest rates, potentially impacting corporate earnings and stock valuations. Inflation can also reduce consumer spending and affect overall economic growth.

Interest Rate Hikes

Interest rate hikes by central banks aim to control inflation but can negatively impact stock prices by increasing borrowing costs for companies and reducing the attractiveness of equities relative to bonds.

Geopolitical Uncertainty

Global events and geopolitical uncertainty can create market volatility and significantly impact investor sentiment and stock valuations. Unexpected geopolitical shifts can influence investor confidence and investment decisions.

Conclusion

High stock market valuations present a complex challenge. While metrics like high P/E ratios raise concerns, the BofA analyst's perspective offers a balanced view, emphasizing long-term growth potential and strategic investment. Understanding the factors influencing these high stock market valuations, along with a thorough assessment of potential risks, is crucial for navigating the current market environment. Don't let fear dictate your decisions. Instead, consider a diversified portfolio focused on quality companies and maintain a long-term perspective to effectively manage these high stock market valuations. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Wednesday Lottery Results April 30 2025

May 02, 2025

Wednesday Lottery Results April 30 2025

May 02, 2025 -

Boulangerie Normande Cadeau Gourmand Pour Le Premier Bebe 2024

May 02, 2025

Boulangerie Normande Cadeau Gourmand Pour Le Premier Bebe 2024

May 02, 2025 -

Nashville News Anchor Nikki Burdine Leaves Wkrn After Seven Years Sources

May 02, 2025

Nashville News Anchor Nikki Burdine Leaves Wkrn After Seven Years Sources

May 02, 2025 -

Ps 5 Vs Xbox Series X S A Detailed Look At Us Sales Figures

May 02, 2025

Ps 5 Vs Xbox Series X S A Detailed Look At Us Sales Figures

May 02, 2025 -

South Carolina Elections Public Trust Remains High 93 Approval Rating

May 02, 2025

South Carolina Elections Public Trust Remains High 93 Approval Rating

May 02, 2025