Hengrui Pharma Secures China Regulator Approval For Hong Kong IPO

Table of Contents

Details of the Hong Kong IPO Approval

The approval of Hengrui Pharma's Hong Kong IPO represents a crucial step forward. The precise details are still emerging, but key information is beginning to surface. This signifies a significant endorsement from the relevant regulatory bodies, paving the way for a successful listing on the Hong Kong Stock Exchange.

- Specific regulatory body: While the exact body isn't yet publicly specified, it's likely the approval came from the China Securities Regulatory Commission (CSRC), the primary regulatory body for securities markets in China.

- Date of approval: [Insert date of approval if available at the time of writing. Otherwise, use phrasing like "The date of approval has not yet been officially announced, but is expected imminently."]

- Expected IPO size and valuation: Estimates for the IPO size and valuation vary widely amongst analysts, with projections ranging from [insert range of estimates]. The final figures will depend on various factors, including market conditions and investor demand.

- Lead underwriters involved: [Insert names of lead underwriters if known. If not, state "The lead underwriters for the IPO have yet to be officially announced."]

These "Hengrui Pharma IPO details" are crucial for understanding the potential success and impact of this significant financial event. The "IPO timeline" will be closely followed by investors and market analysts alike. The "IPO valuation" will ultimately determine the level of investment and its effect on the company's future trajectory.

Hengrui Pharma's Business and Market Position

Hengrui Pharma is a leading pharmaceutical company in China, renowned for its innovation and strong market presence. The company operates across several key therapeutic areas, showcasing significant expertise and market share within the competitive Chinese pharmaceutical industry.

- Key therapeutic areas: Hengrui Pharma's focus lies primarily in oncology and cardiovascular drugs, two sectors with significant growth potential in China's rapidly expanding healthcare market.

- Major products and their market position: [Insert details on Hengrui Pharma’s key products, including brand names and their market share within their respective therapeutic areas. Include data and statistics wherever possible. For example: "Product X holds a Y% market share in the Z segment."]

- Competitive landscape within the Chinese pharmaceutical industry: The Chinese pharmaceutical market is highly competitive. Hengrui Pharma's success is attributed to its focus on innovation, robust research and development capabilities, and strategic partnerships.

- Recent company performance and financial highlights: [Include recent financial performance data, such as revenue growth, profit margins, and key performance indicators (KPIs). Cite reliable sources.]

This "Hengrui Pharma" overview highlights the company's strong position within the "Chinese pharmaceutical market," emphasizing its expertise in "oncology drugs" and "cardiovascular drugs" and demonstrating its impressive "pharmaceutical market share." The company's impressive "company performance" further strengthens its appeal to investors.

Implications for Investors and the Market

The Hengrui Pharma Hong Kong IPO presents both significant opportunities and potential risks for investors. The success of the IPO will have ripple effects throughout the Hong Kong stock market and the broader Chinese pharmaceutical sector.

- Potential investment opportunities and risks associated with the IPO: Investors should carefully assess the potential returns and risks before investing. Market volatility, regulatory changes, and competition are among the key risks. The potential rewards include high growth prospects within the rapidly expanding Chinese pharmaceutical market.

- Expected market reaction to the IPO: The market is expected to react positively to the IPO, given Hengrui Pharma's strong track record and market position. However, short-term fluctuations are possible based on broader market conditions.

- Impact on the Hong Kong Stock Exchange: The IPO will likely add to the Hong Kong Stock Exchange's already diverse pharmaceutical sector, increasing trading volume and liquidity.

- Long-term implications for Hengrui Pharma and the broader industry: The successful IPO will provide Hengrui Pharma with the resources to fuel further research and development, expansion, and potentially acquisitions, shaping the competitive landscape of the Chinese pharmaceutical industry for years to come.

This "market analysis" indicates substantial "investment opportunities" and potential "IPO risks" to consider when evaluating this "Hong Kong stock market" listing. The IPO's impact on the "Chinese pharmaceutical industry" and the broader "stock market implications" are expected to be significant.

Comparison to Other Recent Chinese Pharmaceutical IPOs

[Optional section: If data is available, compare Hengrui Pharma's IPO with other recent IPOs in the Chinese pharmaceutical sector, analyzing similarities and differences in valuation, size, market reception, and overall performance. Include bullet points listing comparable IPOs and a table comparing key metrics.]

Conclusion: Hengrui Pharma's Hong Kong IPO – A Key Development

Hengrui Pharma's successful securing of Chinese regulatory approval for its Hong Kong IPO is a pivotal development. The details of the IPO, as they emerge, will provide a clearer picture of its potential impact on investors and the broader market. The event signifies a major step forward for Hengrui Pharma and underscores the growing attractiveness of the Chinese pharmaceutical sector to international investors. This significant event signals a positive outlook for the future of the "Chinese pharmaceutical market."

To stay abreast of developments, follow "Hengrui Pharma IPO updates" closely. Consider the possibility of "investing in Hengrui Pharma," a company with a strong track record and significant potential. Stay informed by following "Hengrui Pharma" and tracking "Chinese pharmaceutical market trends."

Featured Posts

-

Community Mourns Fort Belvoir Honors Soldiers Killed In Dc Helicopter Crash

Apr 29, 2025

Community Mourns Fort Belvoir Honors Soldiers Killed In Dc Helicopter Crash

Apr 29, 2025 -

Capital Summertime Ball 2025 Your Guide To Ticket Purchase

Apr 29, 2025

Capital Summertime Ball 2025 Your Guide To Ticket Purchase

Apr 29, 2025 -

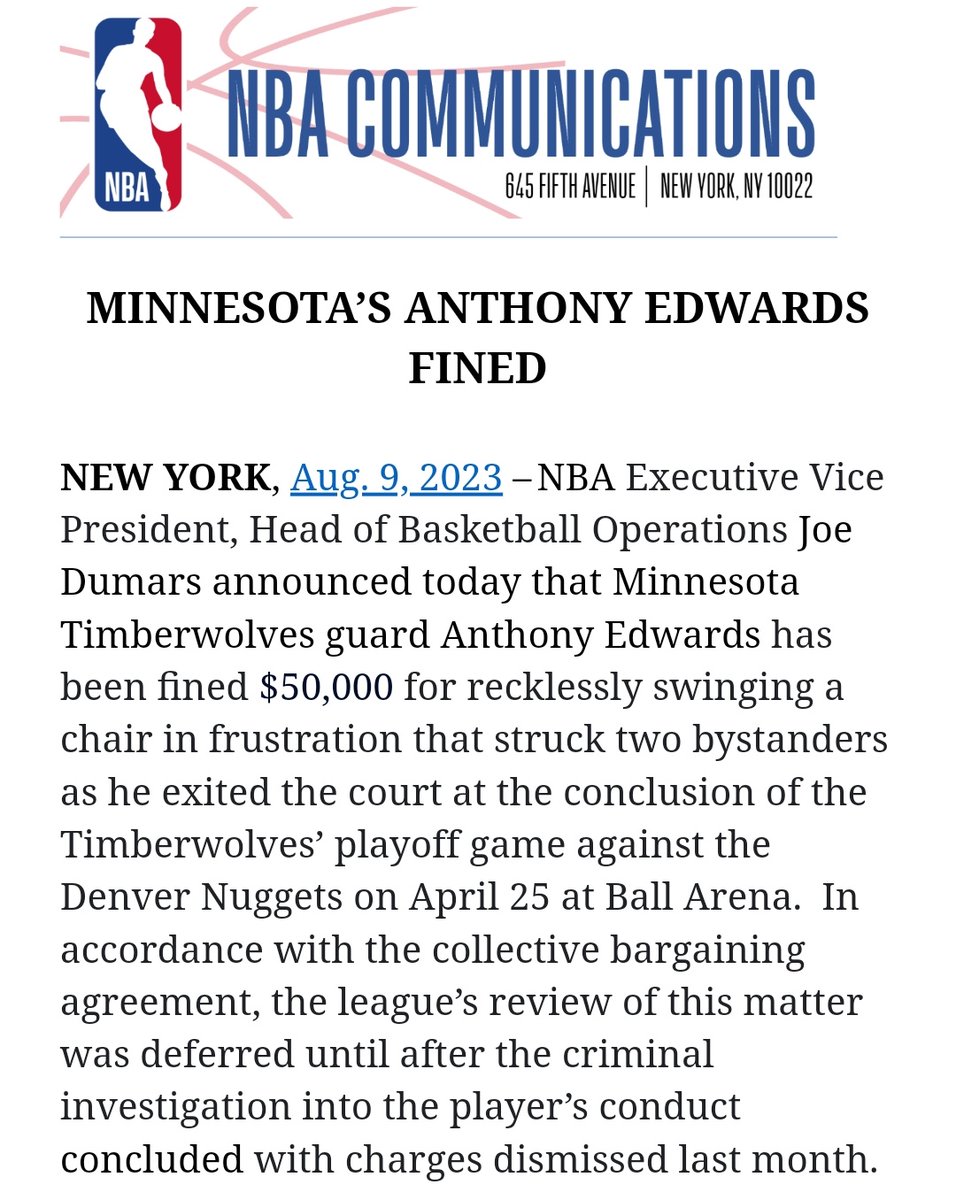

Nbas 50 000 Fine For Anthony Edwards Details Of The Incident

Apr 29, 2025

Nbas 50 000 Fine For Anthony Edwards Details Of The Incident

Apr 29, 2025 -

Mhairi Blacks Stance Misogynys Impact On Women And Girls Safety

Apr 29, 2025

Mhairi Blacks Stance Misogynys Impact On Women And Girls Safety

Apr 29, 2025 -

2024 Metais Porsche Pardavimu Augimas Lietuvoje

Apr 29, 2025

2024 Metais Porsche Pardavimu Augimas Lietuvoje

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni