Harvard President Condemns Attempts To Revoke University's Tax-Exempt Status

Table of Contents

Harvard University, a cornerstone of American higher education, finds itself at the center of a significant controversy. President Lawrence Bacow has forcefully condemned recent attempts to revoke the university's tax-exempt status, igniting a heated debate with far-reaching implications for the future of higher education funding and the non-profit sector. This article delves into the details of this ongoing battle, examining the arguments from both sides and exploring the potential consequences for Harvard and other institutions.

The President's Statement and its Key Arguments

President Bacow's statement vehemently rejected the calls to strip Harvard of its tax-exempt status, characterizing them as a misguided attack on a vital pillar of American society. His arguments centered on several key points:

-

Harvard's commitment to its mission: The President emphasized Harvard's unwavering dedication to its educational mission, highlighting its extensive research, its commitment to undergraduate and graduate education, and its substantial contributions to the broader community through various outreach programs and charitable initiatives. He stated (insert direct quote from President Bacow's statement here, if available), underscoring the university's commitment to its public purpose.

-

Extensive charitable activities and community impact: The statement detailed Harvard's significant charitable activities, including financial aid for students, research grants benefiting society, and community engagement programs. These contributions, President Bacow argued, directly fulfill the requirements for tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

-

Legal basis for tax-exempt status: President Bacow firmly grounded his defense in the legal framework governing non-profit institutions. He stressed that Harvard operates in full compliance with the regulations that grant it tax-exempt status, emphasizing the meticulous oversight and accountability measures in place.

-

Consequences of losing tax-exempt status: The President warned about the devastating consequences of losing tax-exemption, not only for Harvard but for the entire higher education landscape. This could significantly hinder research, reduce access to education for deserving students, and severely impact the ability of universities to fulfill their crucial social role.

Reasons Behind the Attempts to Revoke Tax-Exemption

The calls to revoke Harvard's tax-exempt status stem from a confluence of factors, reflecting a growing discontent with the higher education system in the United States:

-

Political motivations and criticisms of the endowment: A substantial portion of the criticism stems from political motivations, focusing on Harvard's substantial endowment. Critics argue that the university's immense wealth contradicts its non-profit status and that its tax exemption represents an unfair advantage. This criticism often conflates the size of the endowment with a lack of accessibility and affordability.

-

Concerns about affordability and accessibility: A central concern driving the calls for tax-exemption revocation is the perceived lack of affordability and accessibility in higher education. Critics argue that Harvard, despite its financial resources, does not do enough to ensure equitable access to education for students from diverse socioeconomic backgrounds.

-

Specific grievances and incidents: While the general arguments focus on endowment size and affordability, some critics point to specific grievances or incidents (mention any specific examples here if relevant) as justifications for their stance.

-

Relevant legislation and legal challenges: The attempts to revoke Harvard's tax-exempt status are not merely rhetorical; they are often accompanied by specific legal challenges or proposed legislation (mention any specific legislation or lawsuits here, if relevant).

The Broader Implications for Higher Education

The outcome of this controversy will set a significant precedent for other universities and non-profit organizations across the country. The potential consequences are far-reaching:

-

Precedent for other institutions: A successful challenge to Harvard's tax-exempt status could embolden similar challenges against other prestigious universities and non-profit organizations, potentially destabilizing the entire sector.

-

Chilling effect on philanthropy: The uncertainty surrounding tax-exempt status could create a chilling effect on philanthropy, discouraging charitable giving to institutions of higher learning.

-

Impact on financial stability of universities: Losing tax-exempt status would dramatically impact the financial stability of universities, potentially leading to tuition increases, reduced research funding, and scaled-back programs.

-

Effect on students and research funding: The ultimate victims of this controversy would be the students and the future of research. Reduced funding would limit access to education and hamper vital scientific breakthroughs.

Public Reaction and the Ongoing Debate

The controversy surrounding Harvard's tax-exempt status has sparked a vigorous public debate:

-

Reactions from other universities and educational organizations: Many universities and educational organizations have voiced their concerns, expressing solidarity with Harvard and warning of the potential ramifications for the entire sector.

-

Opinions from students, faculty, and alumni: The opinions within the Harvard community itself are diverse, reflecting the complexities of the issue. While some support the criticisms, many defend the university's mission and its right to maintain its tax-exempt status.

-

Public opinion polls and surveys: Public opinion on the matter is likely divided (mention any available public opinion data here).

-

Media coverage and analysis: The controversy has garnered significant media attention, with numerous news outlets and commentators offering diverse perspectives on the issue.

Conclusion

The debate surrounding Harvard's tax-exempt status is far from over. President Bacow's impassioned defense highlights the crucial role that universities play in society and the potential devastating consequences of undermining their financial stability. While legitimate concerns about affordability and accessibility in higher education need to be addressed, the methods used to challenge Harvard's tax-exempt status raise significant questions about the future of non-profit organizations and the very fabric of American higher education. The potential precedent this case sets is enormous. Stay informed about the ongoing debate surrounding Harvard's tax-exempt status and the future of higher education funding. Follow developments in this crucial discussion about the tax exemption of universities and other non-profit institutions. Learn more about the implications of this case on higher education funding and the future of tax exemption for universities.

Featured Posts

-

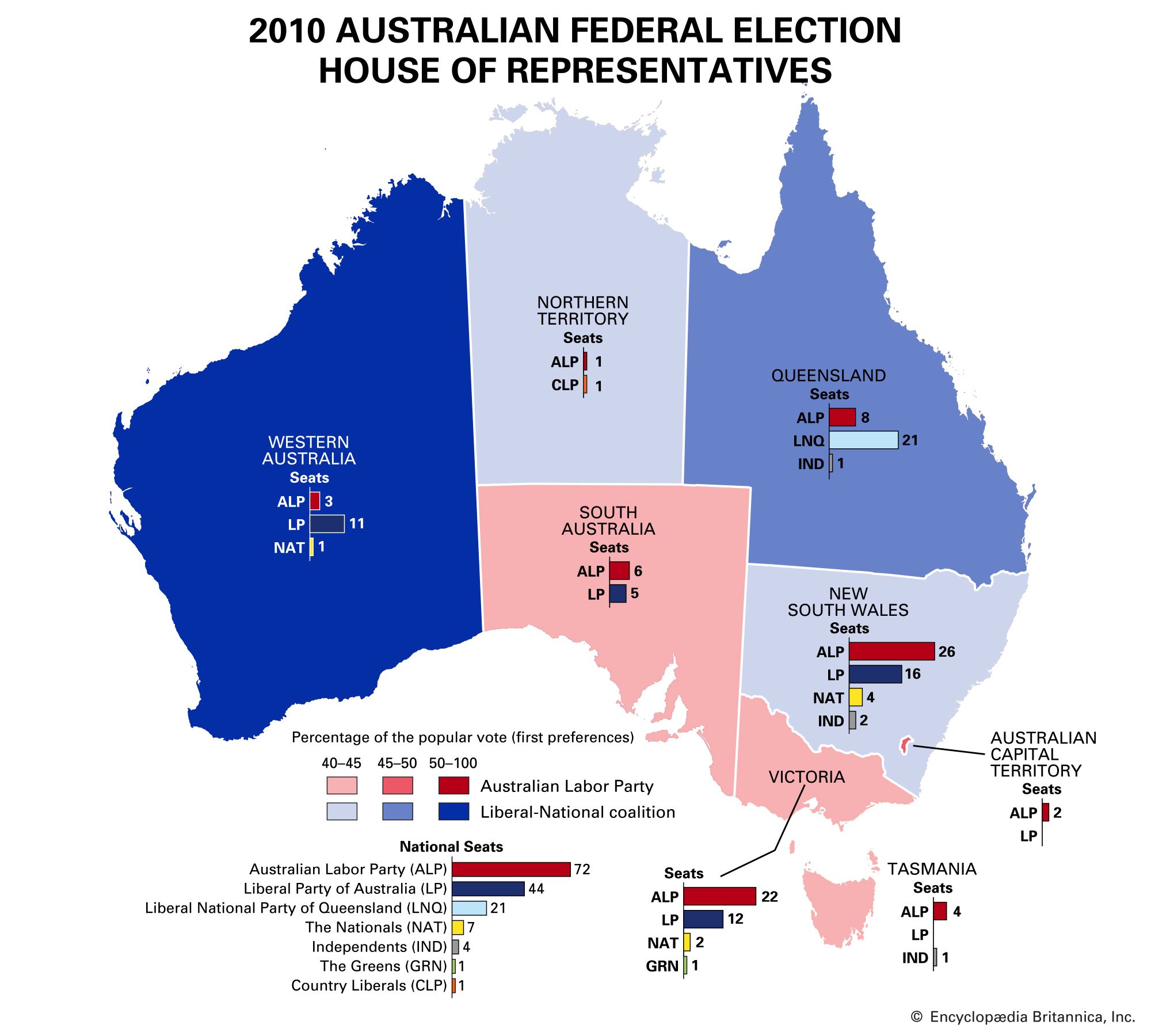

Australian Election Albaneses Labor Party Favored As Voting Commences

May 04, 2025

Australian Election Albaneses Labor Party Favored As Voting Commences

May 04, 2025 -

Anger Over Bgt Semi Final Winner Was It Rigged

May 04, 2025

Anger Over Bgt Semi Final Winner Was It Rigged

May 04, 2025 -

Ao Vivo Corinthians X Internacional Horario E Escalacoes Dos Times

May 04, 2025

Ao Vivo Corinthians X Internacional Horario E Escalacoes Dos Times

May 04, 2025 -

Verstappens First Child Name Revealed Before Miami Grand Prix

May 04, 2025

Verstappens First Child Name Revealed Before Miami Grand Prix

May 04, 2025 -

East Anglias Great Leslie Eurovision Update

May 04, 2025

East Anglias Great Leslie Eurovision Update

May 04, 2025