Half-Point Interest Rate Cut: Will The Bank Of England Stay Ahead Of The Curve?

Table of Contents

The Rationale Behind the Half-Point Interest Rate Cut

The Bank of England's decision to cut interest rates by half a point was likely driven by a confluence of concerning economic indicators. While inflation remained a persistent worry just months prior, recent data might point to a significant slowdown. Falling inflation rates, coupled with slowing GDP growth and mounting concerns about a potential recession, appear to have prompted this drastic action. The aim is to stimulate the economy and prevent a deeper downturn.

The impact of this half-point interest rate cut will be felt across the board. Lower borrowing costs for consumers will likely encourage increased spending, boosting economic activity. Businesses, too, will benefit from cheaper loans, potentially leading to increased investment and job creation. However, it's important to consider the specific impacts:

- Falling inflation rates: While still above the Bank of England's target, the rate of inflation shows signs of easing.

- Slowing economic growth: GDP growth has slowed considerably, signaling a potential recession.

- Concerns about a potential recession: The risk of a recession has increased, prompting intervention.

- Impact on mortgage rates: Lower interest rates will likely translate into lower mortgage rates, making homeownership more affordable.

- Impact on consumer spending: Reduced borrowing costs could stimulate consumer spending and boost economic growth.

Assessing the Effectiveness of the Monetary Policy

The effectiveness of a half-point interest rate cut in addressing current economic challenges is a complex issue. While lower interest rates can stimulate borrowing and spending, their impact is often not immediate. There's a significant time lag before the full effects are felt. This inherent delay makes it difficult to accurately predict the policy's success.

Potential drawbacks exist as well. Stimulating the economy through lower rates risks fueling inflation in the long term, potentially undoing the progress made in bringing inflation down. The Bank of England must carefully balance the need for economic stimulus with the need to control inflation.

Other monetary policy options could have been considered, such as quantitative easing or targeted lending programs. The choice of a half-point interest rate cut reflects the Bank's judgment on the most effective approach given the current circumstances. It’s also critical to compare this action with those taken by other central banks globally – are they acting similarly or diverging in response to seemingly similar conditions? The impact on the pound sterling is also a key consideration – a weakened currency could exacerbate inflationary pressures.

- Lagged effects of interest rate changes: The full impact of the rate cut may not be felt for several months.

- Effectiveness in stimulating economic growth: The success of the policy hinges on boosting consumer and business confidence.

- Potential for increased inflation in the long term: Lower interest rates could reignite inflationary pressures down the line.

- Comparison with other central banks' actions: Analyzing the responses of other central banks provides valuable context.

- Impact on the pound sterling: Currency fluctuations can significantly impact the UK's economy.

Market Reactions and Future Predictions

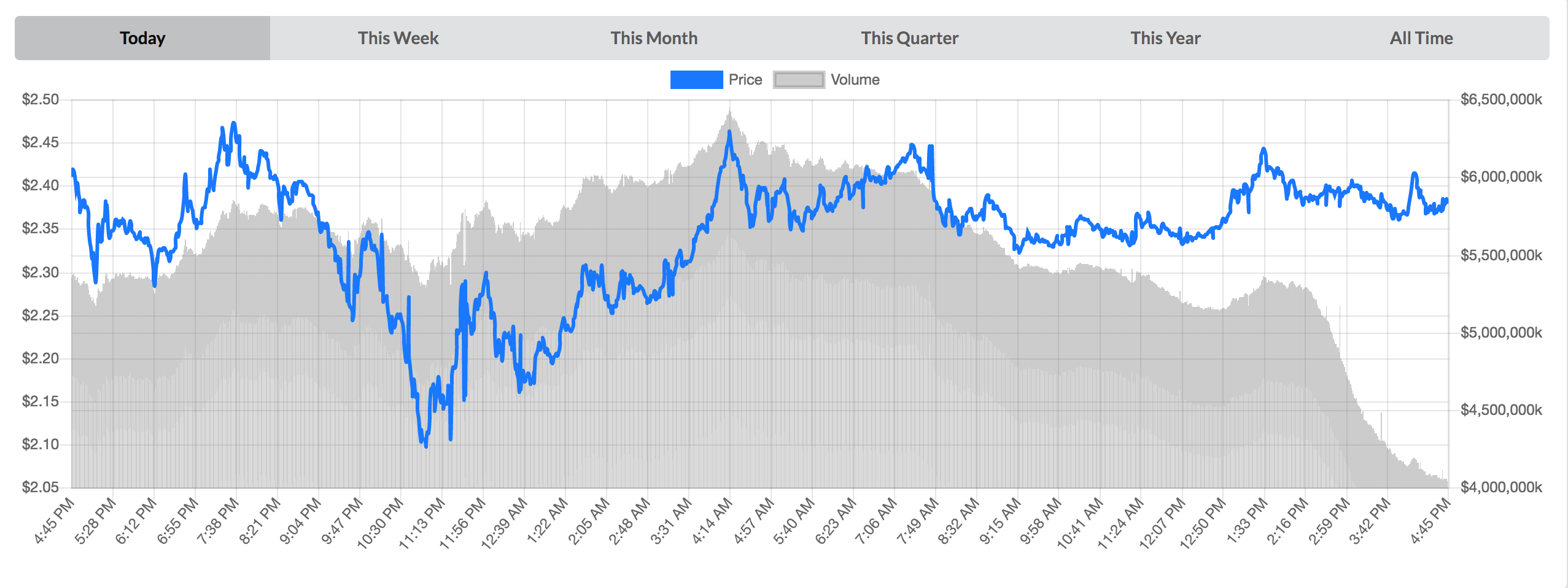

The market's initial response to the half-point interest rate cut was mixed. While some sectors saw a boost, others experienced volatility. Stock market fluctuations reflected the uncertainty surrounding the policy's effectiveness. Bond yields also responded, reflecting investor sentiment towards the future direction of interest rates.

Expert opinions on future interest rate changes are diverse. Some predict further cuts if economic conditions worsen; others anticipate rate hikes if inflation shows signs of resurgence. The ongoing debate underlines the complexity of forecasting economic trends accurately. The potential for further interest rate cuts or hikes will greatly influence the UK's financial stability and overall economic outlook.

- Stock market fluctuations: Initial market reactions showed a degree of uncertainty.

- Changes in bond yields: Bond yields reflected changing investor perceptions of risk.

- Expert predictions for future interest rates: Forecasts vary, highlighting the uncertainty surrounding future policy.

- Potential for further interest rate cuts or hikes: The possibility of both scenarios exists, depending on economic developments.

- Impact on the UK's economic outlook: The success or failure of this policy will significantly shape the UK's economic future.

Staying Ahead of the Curve: A Challenging Task for the Bank of England

The Bank of England faces a formidable challenge in navigating the complex and unpredictable UK economy. Balancing inflation control with economic growth is an intricate task, made even more challenging by a multitude of factors beyond its direct control.

Global economic uncertainties, geopolitical risks, supply chain disruptions, the lingering effects of Brexit, and uncertainty surrounding future inflation all contribute to the difficulty of accurate economic forecasting. The Bank must adapt quickly to evolving circumstances, making timely and effective decisions in the face of considerable uncertainty.

- Global economic uncertainties: Global economic instability complicates the UK's economic management.

- Geopolitical risks: International events and conflicts can significantly impact the UK economy.

- Supply chain disruptions: Ongoing disruptions hinder economic activity and fuel inflation.

- Brexit's lingering effects: The long-term consequences of Brexit continue to impact the UK economy.

- Uncertainty surrounding future inflation: Predicting future inflation rates remains a significant challenge.

The Half-Point Interest Rate Cut and the Road Ahead

In conclusion, the Bank of England's half-point interest rate cut represents a significant strategic move aimed at stimulating economic growth and mitigating the risks of a recession. However, the effectiveness of this policy remains uncertain, given the inherent time lag and potential for unintended consequences. The Bank faces significant challenges in navigating the complex economic landscape and balancing inflation control with economic growth. Whether they have successfully stayed ahead of the curve remains to be seen.

Understanding the implications of future interest rate decisions is crucial. Stay informed about future half-point interest rate cuts and other monetary policy adjustments by following further updates on the Bank of England's monetary policy and related economic news. Our continued analysis of future Bank of England interest rate changes will provide you with the insights you need to navigate this challenging economic climate.

Featured Posts

-

Speculating On The Counting Crows 2025 Setlist

May 08, 2025

Speculating On The Counting Crows 2025 Setlist

May 08, 2025 -

A New Challenger Appears Is Saving Private Ryan No Longer The Top War Film

May 08, 2025

A New Challenger Appears Is Saving Private Ryan No Longer The Top War Film

May 08, 2025 -

Live Stream Inter Vs Barcelona Champions League Match

May 08, 2025

Live Stream Inter Vs Barcelona Champions League Match

May 08, 2025 -

Discover 7 Great Movies Streaming Now On Paramount

May 08, 2025

Discover 7 Great Movies Streaming Now On Paramount

May 08, 2025 -

Enhanced Gaming Analyzing Sonys Ps 5 Pro Upgrade

May 08, 2025

Enhanced Gaming Analyzing Sonys Ps 5 Pro Upgrade

May 08, 2025

Latest Posts

-

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025

Xrp Price Analysis Factors Influencing A Potential Rise To 3 40

May 08, 2025 -

Understanding Xrp Ripple Before You Invest

May 08, 2025

Understanding Xrp Ripple Before You Invest

May 08, 2025 -

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025

Ripples Xrp Potential For Growth To 3 40 And Beyond

May 08, 2025 -

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025

A Beginners Guide To Investing In Xrp Ripple

May 08, 2025 -

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025

Is Now The Right Time To Buy Xrp Ripple

May 08, 2025