Guaranteed Approval Loans: No Credit Check Direct Lender Options

Table of Contents

Understanding Guaranteed Approval Loans

Guaranteed approval loans, also sometimes referred to as loans with guaranteed approval, imply a higher likelihood of approval compared to traditional loans. It's crucial to understand that "guaranteed" doesn't mean automatic approval; it signifies that lenders are more lenient with their approval criteria. This often comes with a trade-off: higher interest rates and stricter terms.

The key difference between guaranteed approval loans and traditional loans lies in the credit check. Traditional loans heavily rely on a strong credit score for approval. Guaranteed approval loans often bypass this stringent process, focusing instead on factors like income verification.

- Higher interest rates compared to traditional loans: Expect to pay significantly more in interest over the life of the loan.

- Shorter repayment terms: These loans typically have shorter repayment periods, leading to higher monthly payments.

- Higher fees and charges: Be prepared for various fees, including origination fees, late payment fees, and potentially prepayment penalties.

- Often smaller loan amounts: The loan amounts offered are generally smaller than traditional loans.

- Requires a reliable income source: Lenders will need proof of consistent income to assess your ability to repay.

No Credit Check Direct Lender Options

Direct lenders offering no credit check loans provide a faster and more convenient application process. They bypass the traditional credit check, making approval quicker. However, this convenience often comes at a cost: higher interest rates and fees. It's essential to carefully weigh the benefits against the risks.

Several types of lenders provide these loans, including:

-

Payday lenders: These lenders typically offer short-term, small loans due on your next payday. They are known for their high-interest rates.

-

Online lenders: Many online lending platforms specialize in connecting borrowers with lenders offering no credit check loans. It's crucial to carefully research these platforms to avoid scams.

-

Faster application and approval process: Get your funds much faster than with traditional loans.

-

Avoids the hassle of a credit check: No need to worry about your credit score affecting your chances.

-

Potential for higher interest rates and fees: Be prepared to pay significantly more than you would with a traditional loan.

-

Importance of responsible borrowing: Borrow only what you can comfortably repay to avoid a debt cycle.

-

Comparison of different direct lender types: Carefully compare the terms, fees, and interest rates of different direct lenders before applying.

Finding Reputable Direct Lenders for Guaranteed Approval Loans

Navigating the world of guaranteed approval loans requires careful research to avoid predatory lenders. Always prioritize reputable lenders to protect yourself from unfair practices.

- Check for licensing and registration: Ensure the lender is legally operating in your state or region.

- Read online reviews and testimonials: See what other borrowers have to say about their experiences.

- Avoid lenders with hidden fees or unclear terms: Transparency is key. Be wary of lenders who are vague about their fees and terms.

- Look for transparent interest rates and repayment terms: Clearly understand what you'll be paying and when.

- Consider using comparison websites to find the best offers: Websites that compare loans can help you find the most suitable option.

Alternatives to Guaranteed Approval Loans

If guaranteed approval loans aren't the right fit, several alternative financing options exist:

- Personal loans with credit checks: While requiring a credit check, these loans often offer lower interest rates and longer repayment terms.

- Loans from credit unions: Credit unions often offer more favorable terms than banks or online lenders.

- Borrowing from family or friends: A personal loan from a trusted source can offer flexible terms and lower interest rates (or none at all).

- Debt consolidation options: If you have multiple debts, consolidating them into a single loan can simplify repayments and potentially lower your interest rate.

Improving Your Credit Score for Future Loan Applications

Improving your creditworthiness will open doors to better loan terms in the future. Consider these steps:

- Pay bills on time: Consistent on-time payments significantly impact your credit score.

- Keep credit utilization low: Avoid maxing out your credit cards. Aim to keep your credit utilization below 30%.

- Monitor your credit report regularly: Check for errors and ensure accuracy.

- Dispute any errors on your credit report: Contact the credit bureaus to correct any inaccuracies.

- Consider a secured credit card: A secured credit card can help you build credit responsibly.

Conclusion

Guaranteed approval loans with no credit checks from direct lenders can provide quick access to funds, but they often come with higher interest rates and fees. Responsible borrowing is crucial. Carefully weigh the benefits and drawbacks, compare offers from multiple lenders, and thoroughly understand the terms before committing. Need a loan with guaranteed approval and no credit check? Start your search for a reputable direct lender today! Remember to carefully compare options and understand the associated costs before applying for a guaranteed approval loan.

Featured Posts

-

Predicting The Winner Phillies Vs Mets Opener Arraez Carpenter And The Key Players

May 28, 2025

Predicting The Winner Phillies Vs Mets Opener Arraez Carpenter And The Key Players

May 28, 2025 -

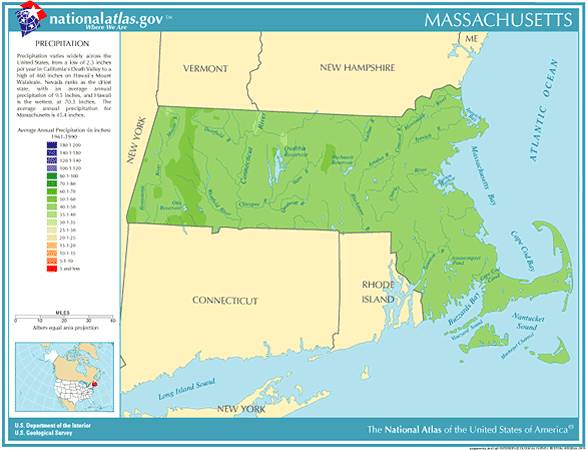

Western Massachusetts Rainfall The Climate Change Connection

May 28, 2025

Western Massachusetts Rainfall The Climate Change Connection

May 28, 2025 -

Hasil Imbang Belanda Vs Spanyol 2 2 Di Uefa Nations League

May 28, 2025

Hasil Imbang Belanda Vs Spanyol 2 2 Di Uefa Nations League

May 28, 2025 -

Is Kanye Wests Behavior Towards Bianca Censori A Red Flag

May 28, 2025

Is Kanye Wests Behavior Towards Bianca Censori A Red Flag

May 28, 2025 -

Rayan Cherki To Liverpool Lyon Stars Transfer Speculation Heats Up

May 28, 2025

Rayan Cherki To Liverpool Lyon Stars Transfer Speculation Heats Up

May 28, 2025

Latest Posts

-

Franceinfo Arcelor Mittal Et La Russie Retour Sur L Emission Du 9 Mai 2025

May 30, 2025

Franceinfo Arcelor Mittal Et La Russie Retour Sur L Emission Du 9 Mai 2025

May 30, 2025 -

Proces Rn En Appel Une Decision En 2026 Selon Laurent Jacobelli

May 30, 2025

Proces Rn En Appel Une Decision En 2026 Selon Laurent Jacobelli

May 30, 2025 -

Elections 2027 Marine Le Pen Empechee De Se Presenter Jacobelli Denonce Un Diktat

May 30, 2025

Elections 2027 Marine Le Pen Empechee De Se Presenter Jacobelli Denonce Un Diktat

May 30, 2025 -

Laurent Jacobelli Et Arcelor Mittal Focus Sur La Russie Le 9 Mai 2025

May 30, 2025

Laurent Jacobelli Et Arcelor Mittal Focus Sur La Russie Le 9 Mai 2025

May 30, 2025 -

Le Depute Jacobelli Se Felicite De La Celerite Du Proces Rn En Appel

May 30, 2025

Le Depute Jacobelli Se Felicite De La Celerite Du Proces Rn En Appel

May 30, 2025