GOP Tax Plan: Does It Really Cut The Deficit? A Mathematical Look

Table of Contents

1. Analyzing the Initial Claims of the GOP Tax Plan:

The GOP Tax Cuts and Jobs Act of 2017, commonly referred to as the GOP tax plan, promised significant economic growth and ultimately, a reduction in the national deficit. However, understanding the true effect requires careful scrutiny of the economic projections and actual outcomes.

H3: Projected Revenue Increases vs. Reality:

Proponents of the GOP tax plan projected substantial revenue increases driven by stimulated economic activity. These projections, however, often relied on dynamic scoring – a method that incorporates the anticipated effects of tax cuts on economic growth. This contrasts with static scoring, which assumes no change in economic behavior.

- Projected vs. Actual: The Congressional Budget Office (CBO) initially projected a smaller deficit reduction than the administration's estimates. Later analyses revealed that the tax cuts actually increased the deficit significantly. For example, the Tax Policy Center estimated a loss of approximately $2 trillion in revenue over ten years.

- Dynamic vs. Static Scoring: The difference between dynamic and static scoring highlights the inherent uncertainty in forecasting the effects of tax cuts. Dynamic scoring often overestimates the positive effects, as it's difficult to accurately model the complex interplay of economic factors.

H3: The Role of Economic Growth:

A central argument for the GOP tax plan was that the cuts would spur economic growth through increased investment and job creation. This argument relies on the Laffer Curve, suggesting that lower tax rates can incentivize higher economic activity, leading to increased tax revenues.

- Laffer Curve Applicability: The applicability of the Laffer Curve is a subject of ongoing debate. While some argue that the tax cuts fall within the optimal range of the curve, others contend that the effects have been minimal or even negative.

- Potential Downsides: Critics pointed to potential downsides, such as increased income inequality due to disproportionate benefits for high-income earners and potential inflation from increased aggregate demand. Empirical studies have shown mixed results regarding the plan's actual impact on economic growth.

2. Examining the Spending Side of the Equation:

Analyzing the GOP tax plan's effect on the deficit requires examining both revenue and spending.

H3: Mandatory vs. Discretionary Spending:

The plan's impact differs significantly across spending categories. Mandatory spending, largely driven by entitlement programs like Social Security and Medicare, is less directly influenced by economic growth stimulated by tax cuts. Discretionary spending, on the other hand, can be affected by changes in tax revenue and economic conditions.

- Mandatory Spending Impacts: While the tax cuts might indirectly affect mandatory spending through changes in the economy and healthcare costs, these effects are complex and difficult to predict precisely.

- Discretionary Spending and Economic Growth: Increased economic growth might lead to higher demand for certain government services, potentially increasing discretionary spending, thus offsetting any revenue gains from the tax cuts.

H3: Long-Term Projections and Uncertainty:

Long-term projections are inherently uncertain. Unforeseen events like recessions, unexpected international conflicts, or major technological shifts can dramatically alter the deficit trajectory.

- Unforeseen Economic Shocks: The COVID-19 pandemic serves as a stark reminder of the unpredictability of economic events and their significant impact on government finances.

- The Importance of Ranges: Instead of relying on a single point projection, analysts often present a range of possible outcomes, reflecting the inherent uncertainty associated with long-term economic forecasting.

3. Alternative Perspectives and Criticisms:

A balanced evaluation of the GOP tax plan requires considering alternative perspectives.

H3: Counterarguments and Opposing Views:

Numerous economists and organizations, including the CBO and the Tax Policy Center, provided analyses challenging the claim of deficit reduction. These criticisms often focused on the understated revenue losses and the overestimation of economic growth stimulated by the plan.

- Differing Methodologies: Differences in modeling assumptions and methodologies contribute to varying conclusions about the plan's effects.

- Political Considerations: Political motivations and biases can also influence interpretations of economic data and policy analysis.

H3: The Importance of Transparency and Data Access:

Accessible and transparent data is crucial for evaluating economic policy effectively. Without it, informed debate and public trust become significantly hindered.

- Data Accessibility Challenges: Obtaining comprehensive and reliable economic data can sometimes prove difficult, hindering independent analyses.

- Data Interpretation: Even with access to data, its interpretation can be complex and subject to different analyses.

Conclusion:

Analyzing the GOP tax plan's impact on the deficit reveals a complex picture. While proponents emphasized projected revenue increases from economic growth, independent analyses often pointed to increased deficits due to significant revenue losses and uncertain economic effects. Understanding the GOP tax plan requires careful consideration of both revenue projections and spending implications, along with an awareness of the limitations of economic forecasting. The inherent uncertainties highlight the need for transparent data and diverse perspectives in evaluating such impactful economic policies. To delve deeper into this critical issue, explore resources like the Congressional Budget Office and the Tax Policy Center reports to gain a more comprehensive understanding of the GOP tax plan's effect on the deficit. Analyzing the GOP tax plan's impact requires a nuanced approach, carefully weighing the interplay of revenue generation, spending levels, and unforeseen economic circumstances.

Featured Posts

-

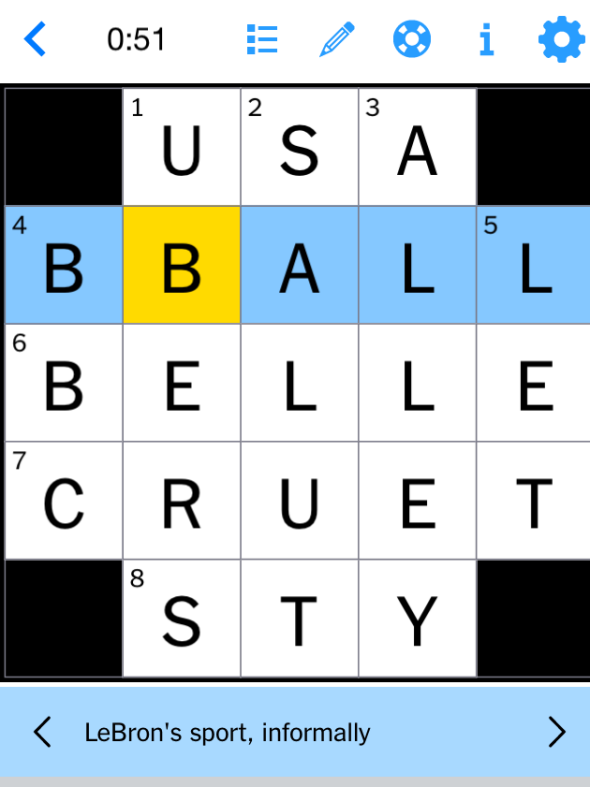

Solve The Nyt Mini Crossword March 8 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 8 Answers

May 20, 2025 -

Mikhael Shumakher Radostnaya Novost On Stal Dedushkoy

May 20, 2025

Mikhael Shumakher Radostnaya Novost On Stal Dedushkoy

May 20, 2025 -

Solve The Nyt Mini Crossword March 13 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 13 Answers And Hints

May 20, 2025 -

Tampoy Mega Analytiko Proepiskopisi Toy Apopsinoy Epeisodioy

May 20, 2025

Tampoy Mega Analytiko Proepiskopisi Toy Apopsinoy Epeisodioy

May 20, 2025 -

Restrictions Des 2 Et 3 Roues Sur Le Boulevard Fhb Debut Le 15 Avril

May 20, 2025

Restrictions Des 2 Et 3 Roues Sur Le Boulevard Fhb Debut Le 15 Avril

May 20, 2025

Latest Posts

-

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025