Goldman Sachs On Trump's Oil Price Preferences: A Social Media Deep Dive

Table of Contents

Goldman Sachs' Stance on Trump's Energy Policy

Goldman Sachs' analysts consistently published reports evaluating the potential effects of Trump's energy policies on the oil market. Their stance was generally characterized by a focus on the administration's deregulation efforts and its withdrawal from international agreements like the Paris Climate Accord. This approach, Goldman Sachs argued, would likely lead to increased domestic oil production and potentially lower oil prices in the short term.

- Key Predictions: Goldman Sachs predicted a period of increased oil supply due to deregulation, leading to price stabilization or even a slight decrease, countering previous predictions of escalating prices based on supply-demand dynamics alone.

- Policy Changes Analyzed: The analysts closely monitored the impact of deregulation on shale oil production, the easing of environmental restrictions, and the implications of the withdrawal from the Iran nuclear deal on global oil supply.

- Conflicting Viewpoints: While Goldman Sachs generally held a relatively bullish outlook on US oil production under Trump's policies, some internal disagreements or discrepancies compared to other financial institutions existed. This highlights the inherent complexity in predicting oil prices, even with sophisticated analyses.

Social Media Sentiment Analysis: Gauging Public Opinion

To gauge public opinion surrounding Goldman Sachs' perspectives and Trump's energy policy, a comprehensive social media sentiment analysis was undertaken. This involved:

- Methodology: We utilized keyword searches (e.g., "Goldman Sachs oil," "Trump energy policy," "oil price predictions") across Twitter, Facebook, and Reddit, employing sentiment analysis tools to gauge the emotional tone (positive, negative, or neutral) of posts.

- Key Findings: The analysis revealed a mixed public response. While some users echoed Goldman Sachs' predictions of increased production and potentially lower prices, others expressed concerns about environmental impacts and long-term energy security.

- Correlation with Goldman Sachs Predictions: Interestingly, the social media sentiment did not always directly correlate with Goldman Sachs' predictions. While the bank's bullish outlook on US production was reflected in some online conversations, other narratives focused on global geopolitical factors and potential price volatility, demonstrating the complexity and diversity of public perception.

The Impact of "Fake News" and Misinformation

The prevalence of misinformation and "fake news" significantly complicated the analysis of social media sentiment. The spread of inaccurate or misleading information, often through biased news sources or targeted propaganda, skewed online discussions.

- Examples of Misinformation: We encountered numerous instances of posts claiming that Trump's policies would immediately lead to drastically lower gas prices, which was not supported by Goldman Sachs' analysis or broader market trends.

- Algorithmic Amplification: Social media algorithms often amplified sensationalized content and conspiracy theories, giving them greater visibility than more nuanced analyses from reputable sources like Goldman Sachs.

- Critical Thinking and Fact-Checking: The findings highlighted the critical need for media literacy and critical thinking when interpreting social media data regarding complex financial issues like Trump's oil policy and its impact on prices.

Connecting Social Media Buzz to Real-World Market Impacts

Determining the direct causal link between social media sentiment and actual oil price fluctuations proved challenging.

- Influence on Trading Decisions: While it's difficult to definitively prove, increased social media chatter on specific topics related to Trump's oil policy might have influenced some trading decisions among retail investors.

- Evidence of Causal Link: No clear, direct causal relationship between overall social media sentiment and significant oil price volatility was evident. Macroeconomic factors and geopolitical events exerted a far greater influence on price fluctuations.

- Limitations: Social media sentiment is only one factor among many influencing market behavior and oil prices. Connecting the two requires careful consideration of many other market forces, making direct causal inference difficult.

Goldman Sachs on Trump's Oil Price Preferences: Key Takeaways and Future Outlook

This social media deep dive reveals a complex interplay between Goldman Sachs' analysis of Trump's energy policy, public perception as reflected in online discussions, and the actual impact on oil prices. While Goldman Sachs largely focused on the potential for increased production and price stabilization due to deregulation, social media sentiment was more varied, influenced by factors ranging from environmental concerns to geopolitical instability. Misinformation further complicated this already complex landscape. Understanding the influence of financial institution viewpoints, government policy, and social media narratives is crucial to comprehending oil price dynamics.

Stay informed on the evolving relationship between Goldman Sachs’ views, Trump’s legacy on energy policy, and the impact on oil prices by following our future analyses on "Goldman Sachs on Trump's Oil Price Preferences."

Featured Posts

-

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

May 16, 2025

Are We Normalizing Disaster The Case Of Betting On The Los Angeles Wildfires

May 16, 2025 -

Padres Vs Yankees Predicting The Outcome In New York

May 16, 2025

Padres Vs Yankees Predicting The Outcome In New York

May 16, 2025 -

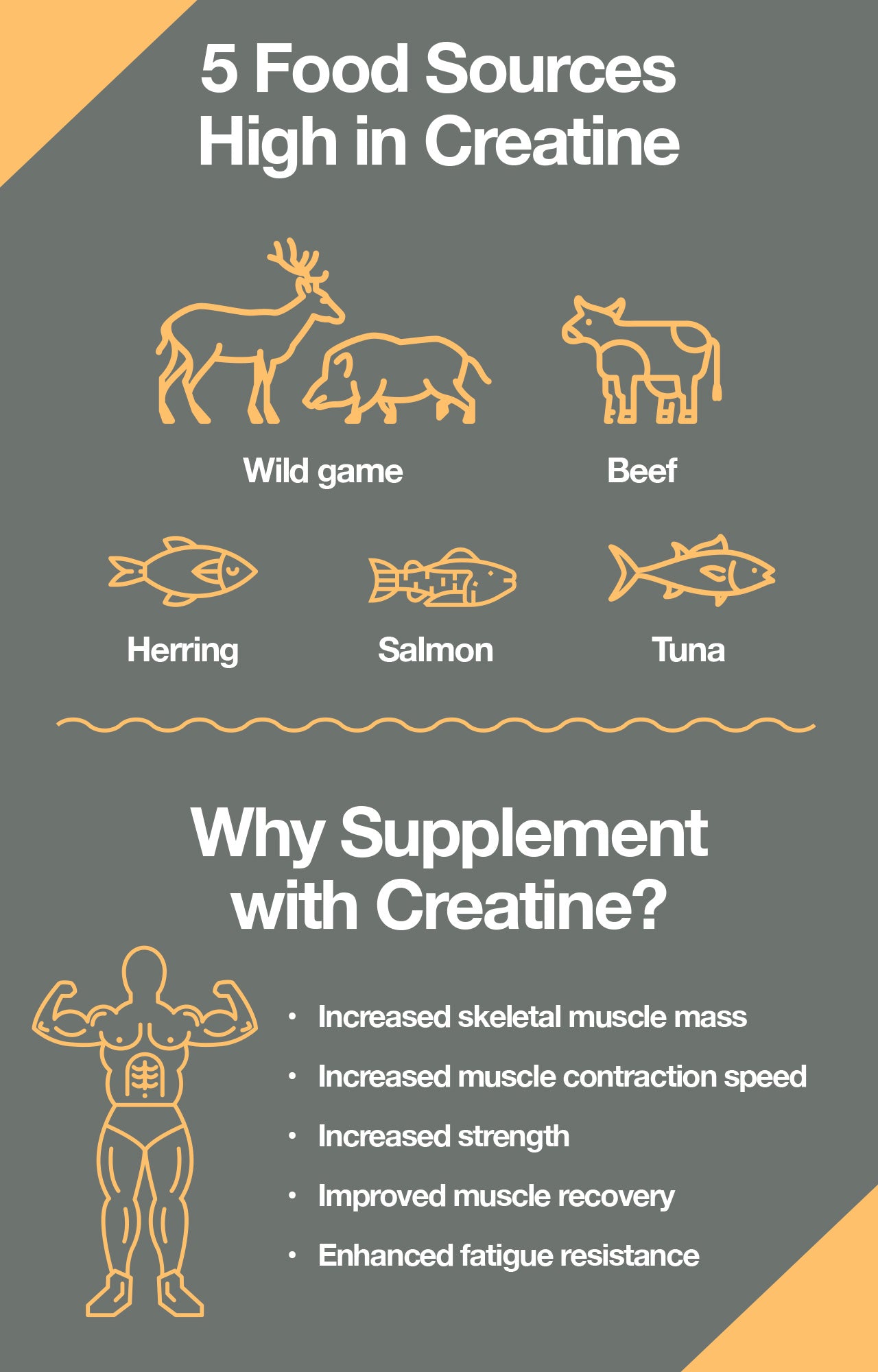

What Is Creatine And How Does It Work

May 16, 2025

What Is Creatine And How Does It Work

May 16, 2025 -

Penarol 0 2 Olimpia Reporte Completo Del Partido

May 16, 2025

Penarol 0 2 Olimpia Reporte Completo Del Partido

May 16, 2025 -

China Secures Us Deal The Role Of Xis Experienced Advisors

May 16, 2025

China Secures Us Deal The Role Of Xis Experienced Advisors

May 16, 2025

Latest Posts

-

The Padres Vs The Dodgers A Battle Of Strategies

May 16, 2025

The Padres Vs The Dodgers A Battle Of Strategies

May 16, 2025 -

Rookie Simpsons Three Hits Key To Rays Sweep Of Padres

May 16, 2025

Rookie Simpsons Three Hits Key To Rays Sweep Of Padres

May 16, 2025 -

Three Hit Game Propels Rookie Simpson And Rays To Series Sweep Over Padres

May 16, 2025

Three Hit Game Propels Rookie Simpson And Rays To Series Sweep Over Padres

May 16, 2025 -

Will The Padres Foil The Dodgers Master Plan

May 16, 2025

Will The Padres Foil The Dodgers Master Plan

May 16, 2025 -

Resilient Padres Overcome Cubs In Thrilling Victory

May 16, 2025

Resilient Padres Overcome Cubs In Thrilling Victory

May 16, 2025