Gold Price Record Rally: Bullion As A Trade War Safe Haven

Table of Contents

Understanding the Recent Gold Price Surge

The recent surge in gold prices is undeniable. [Insert chart or graph visually showcasing the gold price increase over a specific period, clearly labeled and sourced]. This dramatic rise isn't a random fluctuation; several interconnected factors are driving this gold price record rally, solidifying gold's position as a precious metal and a sought-after investment.

Factors Driving the Gold Rally

Several key factors contribute to this gold price record rally and the increased demand for bullion:

-

Geopolitical Uncertainty: Escalating trade wars, geopolitical instability, and international conflicts create significant uncertainty in global markets. Investors, seeking to protect their assets, flock to gold, a traditional safe haven asset, driving up demand and prices. The ongoing US-China trade dispute, for example, has significantly fueled this trend.

-

Currency Devaluation: Weakening currencies, often a consequence of trade wars and economic instability, make gold, priced in US dollars, more attractive to international investors. This increased demand further contributes to the gold price record rally. As the value of a national currency declines, the purchasing power of that currency also falls. Gold, on the other hand, holds its value relatively better, hence the surge in investment.

-

Safe Haven Demand: Gold has a long history of serving as a safe haven asset during times of economic uncertainty and market volatility. Historically, during periods of crisis – like the 2008 financial crisis – investors have turned to gold, driving its price upwards. This current gold price record rally follows a similar pattern.

-

Central Bank Buying: Central banks worldwide are increasingly accumulating gold reserves, further bolstering demand and contributing to the price increase. This strategic move reflects the perceived stability and value retention qualities of gold in a volatile global landscape.

Bullion as a Hedge Against Trade War Risks

The current gold price record rally underscores bullion's effectiveness as a hedge against the risks associated with trade wars and other economic disruptions.

Gold's Historical Performance During Economic Downturns

Historically, gold has demonstrated resilience during economic downturns and periods of geopolitical instability. [Insert historical data or chart comparing gold's performance against other asset classes during past trade disputes or economic crises]. This historical performance reinforces gold's reputation as a reliable safe haven asset.

Diversification and Portfolio Protection

Including bullion in a diversified investment portfolio is a crucial strategy for mitigating risks associated with trade wars and other economic uncertainties. Diversification reduces the overall risk by spreading investments across different asset classes. Holding gold can provide a buffer against potential losses in other, more volatile investments. Consider strategies like allocating a percentage of your portfolio (5-10% is often suggested) to gold ETFs or physical gold.

Inflationary Pressures

Trade wars can contribute to inflationary pressures as tariffs increase the cost of imported goods. Gold has historically served as a hedge against inflation, maintaining its value or even appreciating as the purchasing power of fiat currencies diminishes. This makes it a valuable component of an inflation-conscious investment portfolio.

Investing in Bullion During Times of Uncertainty

The current gold price record rally presents an opportunity for investors to consider adding bullion to their portfolios.

Different Ways to Invest in Gold

Several ways exist to invest in gold, each with its own advantages and disadvantages:

-

Physical Gold: Buying physical gold (bars or coins) offers tangible ownership, but involves storage and security considerations.

-

Gold ETFs (Exchange-Traded Funds): Gold ETFs offer a convenient and cost-effective way to invest in gold without the hassle of physical storage.

-

Gold Mining Stocks: Investing in gold mining companies provides exposure to the gold market, but carries higher risk compared to directly owning gold.

Risk Management Strategies

Responsible gold investing requires careful consideration of risk management strategies. Avoid impulsive decisions based solely on short-term price fluctuations. Diversification and a long-term investment horizon are crucial.

Considering Transaction Costs

Remember to factor in transaction costs when investing in gold. These include premiums on physical gold, commissions on ETFs or stocks, and potential storage fees. Understanding these costs is essential for making informed investment decisions.

Conclusion

The current gold price record rally, fueled by escalating trade wars and global uncertainty, highlights the enduring value of bullion as a safe haven asset. This article has explored the factors driving the price surge and the various ways investors can incorporate gold into their portfolios to mitigate risks. The key takeaways emphasize the importance of diversification, responsible investing, and considering the historical performance of gold during periods of economic instability. With the continued uncertainty surrounding global trade, consider adding bullion to your investment strategy as a safe haven asset. Learn more about diversifying your portfolio with gold and protect your investments from the volatility of a trade war.

Featured Posts

-

Ten Years Later Construction Resumes On The Worlds Tallest Abandoned Building

Apr 26, 2025

Ten Years Later Construction Resumes On The Worlds Tallest Abandoned Building

Apr 26, 2025 -

12 Guests We D Love To See On A New York Knicks Roommates Show

Apr 26, 2025

12 Guests We D Love To See On A New York Knicks Roommates Show

Apr 26, 2025 -

Justice Department Seeks Seven Year Sentence For George Santos

Apr 26, 2025

Justice Department Seeks Seven Year Sentence For George Santos

Apr 26, 2025 -

Early Birthday Celebrations For A King Plans And Preparations

Apr 26, 2025

Early Birthday Celebrations For A King Plans And Preparations

Apr 26, 2025 -

The Rise Of Nepotism Babies In Television Fact Or Fiction

Apr 26, 2025

The Rise Of Nepotism Babies In Television Fact Or Fiction

Apr 26, 2025

Latest Posts

-

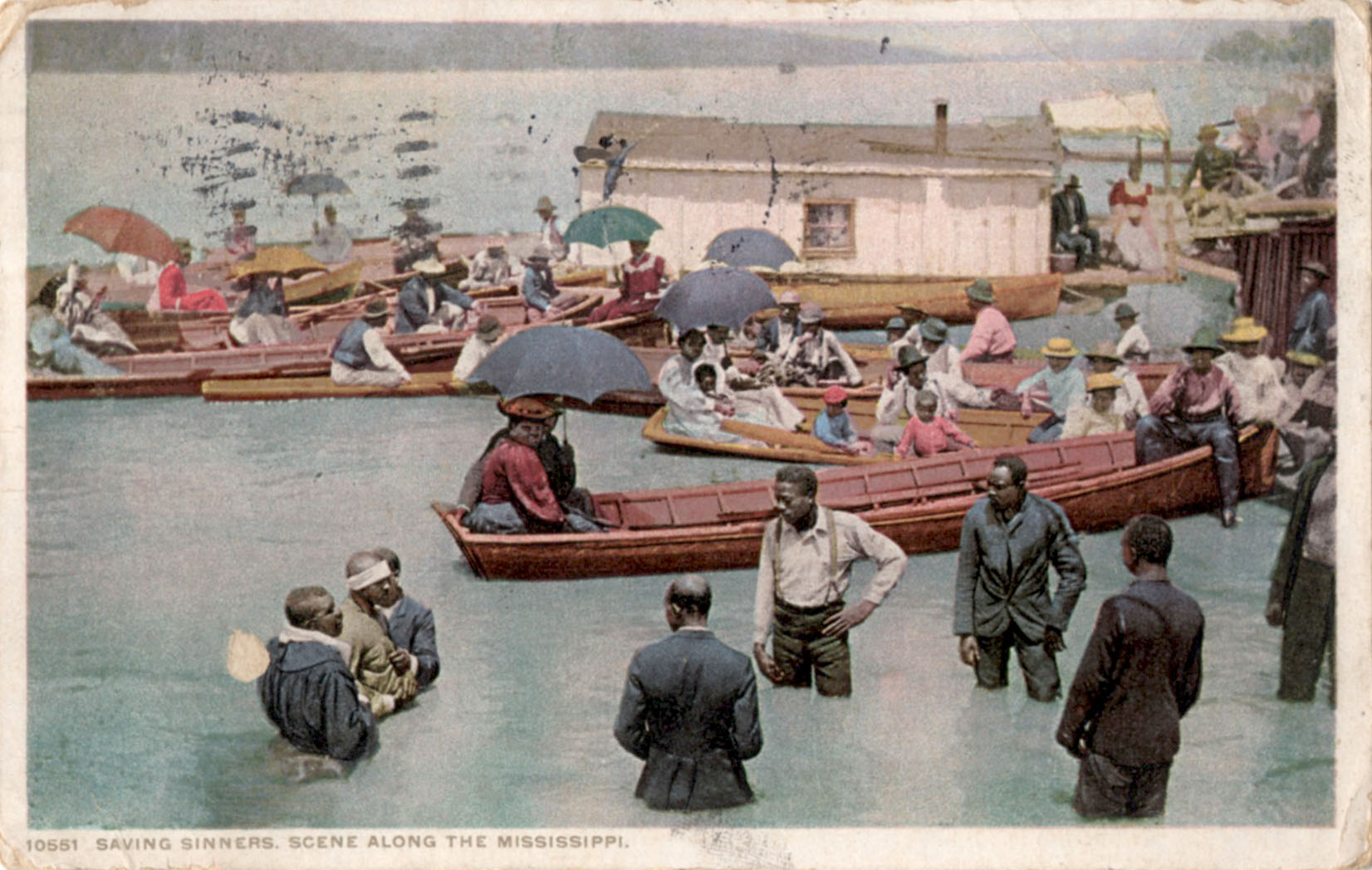

Exploring The Mississippi Delta Through The Lens Of Sinners Cinematographer

Apr 26, 2025

Exploring The Mississippi Delta Through The Lens Of Sinners Cinematographer

Apr 26, 2025 -

The Visual Scope Of Sinners Cinematography And The Mississippi Deltas Landscape

Apr 26, 2025

The Visual Scope Of Sinners Cinematography And The Mississippi Deltas Landscape

Apr 26, 2025 -

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025 -

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025 -

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025