Gold Market Update: Back-to-Back Weekly Declines For The First Time In 2025

Table of Contents

Analyzing the Recent Gold Price Drop

The recent drop in the gold price isn't an isolated event; it's the result of a confluence of factors impacting the gold market. Let's break down the key contributors:

Impact of Rising Interest Rates

The correlation between rising interest rates and a weakening gold price is well-established. Higher interest rates make bonds more attractive to investors, as they offer a fixed income with relatively lower risk compared to the volatility often associated with gold investment. This shift in investor preference often leads to a decline in demand for gold, pushing the gold price lower.

- Mechanism: Increased interest rates generally lead to higher bond yields, making fixed-income investments more appealing. Investors, seeking better returns, may liquidate their gold holdings to invest in higher-yielding bonds.

- Specific Example: While specific data would need to be inserted here reflecting actual interest rate changes from a real-time news source, mentioning any recent interest rate hikes by central banks (e.g., the Federal Reserve) and their magnitude is crucial. For instance, "The recent 0.25% increase in the Federal Funds rate has contributed to increased bond yields, making them a more attractive alternative to gold for some investors."

- Economic Data: Referencing relevant economic data, such as inflation figures, would strengthen the analysis and support the claim of interest rate impact on gold price. For instance: "The persistent inflationary pressures, alongside the recent interest rate hike, are contributing factors to the current gold decline."

Dollar Strength and its Influence on Gold

Gold is priced in US dollars, meaning a stronger dollar generally leads to a lower gold price. This is because it becomes more expensive for holders of other currencies to buy gold.

- Inverse Relationship: The US dollar index (DXY) and the gold price typically show an inverse relationship. A rising DXY indicates a stronger dollar, which usually translates to lower gold prices.

- Recent USD Index Data: Insert real-time data for the US Dollar Index here, showcasing its recent upward trend. For example: "The US Dollar Index currently stands at [insert current DXY value], reflecting a strengthening dollar and potentially contributing to the pressure on gold prices."

- Geopolitical Impacts: Geopolitical events can significantly impact the dollar's strength and, consequently, gold prices. Any recent global events affecting the dollar should be mentioned and their connection to the gold price decline should be analyzed.

Technical Analysis of Gold Charts

Technical analysis offers another perspective on the recent gold price drop. Examining chart patterns and key indicators can provide insights into potential future price movements, although it's crucial to remember that technical analysis is not an exact science.

- Support and Resistance Levels: Mention any significant support and resistance levels that have been broken. For example: "The recent breach of the [price level] support level suggests further downside potential in the short term."

- Chart Patterns: Briefly describe any relevant chart patterns observed, such as head and shoulders or double tops, explaining their potential implications for future price movements.

- Moving Averages: Discuss how moving averages, such as the 50-day and 200-day moving averages, are positioned relative to the current gold price, providing an indication of the prevailing trend. Including a relevant chart here would enhance the analysis.

Investor Sentiment and Market Reactions

Shifting Investor Sentiment

The recent gold price drop has undoubtedly impacted investor sentiment. A decline in gold price can lead to reduced confidence, potentially causing some investors to reconsider their gold investment strategies.

- Gold ETF Holdings: Mention any significant changes in gold ETF holdings, as this can reflect overall investor confidence in the asset. Decreases in ETF holdings might signal a shift in sentiment.

- Investor Surveys: Refer to any recent surveys or polls gauging investor sentiment towards gold. These sources can provide valuable insights into how investors are currently perceiving the gold market.

- News Articles: Cite relevant news articles reflecting the changing sentiment around gold investments. This helps provide context and support the analysis.

Market Reaction and Future Predictions (Cautious)

The market's response to the gold price decline includes increased volatility and possibly adjustments to trading strategies. However, it is crucial to approach future predictions with caution.

- Trading Volume Changes: Discuss any significant changes in trading volume, which can indicate heightened market activity and investor response to the price movement.

- Analyst Opinions: Mention the views of reputable financial analysts and their outlook on the gold market, citing their sources for transparency and credibility.

- Potential Scenarios: Outline potential short-term and medium-term scenarios for the gold price, emphasizing the uncertainty inherent in market predictions. For instance, a possible scenario could be: "If inflation remains high, the gold price might find support. Conversely, further interest rate hikes could continue to exert downward pressure."

Conclusion

The back-to-back weekly decline in gold prices, a first in 2025, is attributed to a combination of factors: rising interest rates making bonds more attractive, a strengthening US dollar putting downward pressure on the gold price, and a shift in investor sentiment. This unexpected downturn highlights the dynamic nature of the gold market and the importance of carefully considering various market indicators when formulating a gold investment strategy.

Call to Action: Stay updated on the latest gold market updates and adjust your gold investment strategy based on ongoing market developments. Continue monitoring the gold price and its correlation with other market indicators. Understanding the interplay between interest rates, the dollar's strength, and investor sentiment is key to navigating the gold market effectively and making informed gold investment decisions.

Featured Posts

-

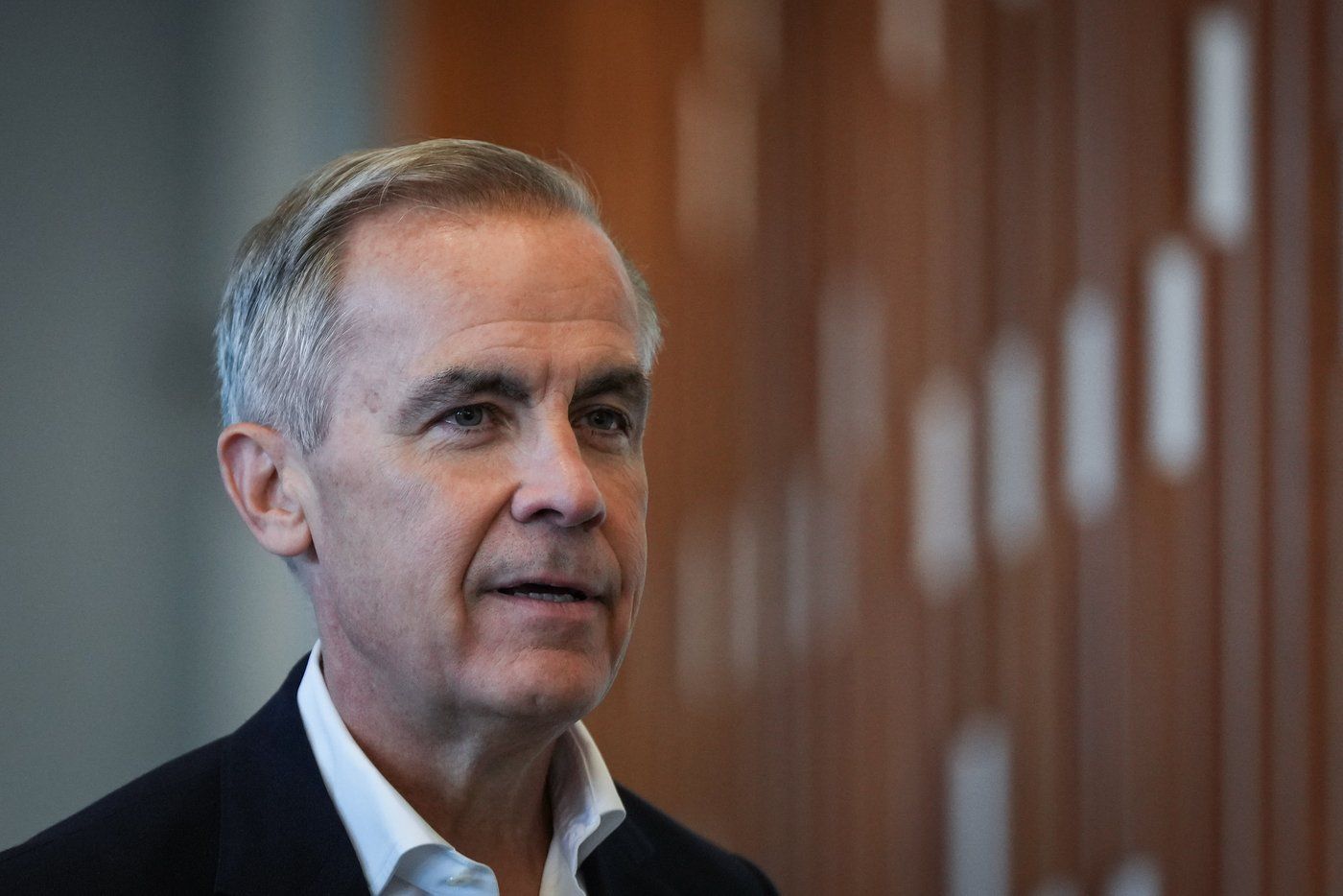

Mark Carney And Canadas West Gary Mars Perspective On Economic Growth

May 06, 2025

Mark Carney And Canadas West Gary Mars Perspective On Economic Growth

May 06, 2025 -

Exploring The B J Novak And Mindy Kaling Relationship Friends More Than Friends

May 06, 2025

Exploring The B J Novak And Mindy Kaling Relationship Friends More Than Friends

May 06, 2025 -

April 4th Celtics Vs Suns How To Watch The Game Live

May 06, 2025

April 4th Celtics Vs Suns How To Watch The Game Live

May 06, 2025 -

Pratt Comments On Schwarzeneggers White Lotus Performance

May 06, 2025

Pratt Comments On Schwarzeneggers White Lotus Performance

May 06, 2025 -

Polski Trotyl Dla Us Army Kontrakt Nitro Chem Szczegoly Umowy

May 06, 2025

Polski Trotyl Dla Us Army Kontrakt Nitro Chem Szczegoly Umowy

May 06, 2025

Latest Posts

-

Wielkie Zamowienie Na Trotyl Z Polski Szczegoly Kontraktu

May 06, 2025

Wielkie Zamowienie Na Trotyl Z Polski Szczegoly Kontraktu

May 06, 2025 -

Fans Love Leon Thomas And Halle Baileys Rather Be Alone A Deep Dive

May 06, 2025

Fans Love Leon Thomas And Halle Baileys Rather Be Alone A Deep Dive

May 06, 2025 -

Halle Baileys 25th Birthday A Look At The Celebration

May 06, 2025

Halle Baileys 25th Birthday A Look At The Celebration

May 06, 2025 -

Halle Baileys 25th Birthday Cake Cuteness And Love

May 06, 2025

Halle Baileys 25th Birthday Cake Cuteness And Love

May 06, 2025 -

Hos Kokmamanin Marka Degerine Etkisi Oernek Calismalar

May 06, 2025

Hos Kokmamanin Marka Degerine Etkisi Oernek Calismalar

May 06, 2025