Gold Market Update: Back-to-Back Weekly Declines For 2025

Table of Contents

Analyzing the Factors Contributing to the Gold Price Decline

Several interconnected factors contribute to the recent gold price decline. Let's examine some key elements:

Weakening US Dollar and its Impact

The US dollar and gold prices generally share an inverse relationship. A strengthening dollar often leads to lower gold prices, as gold, priced in dollars, becomes more expensive for holders of other currencies. Recent economic indicators suggest a strengthening US dollar, potentially contributing to the gold price drop.

- Economic Indicators: Positive US economic data, such as strong employment figures and increased consumer spending, can bolster the dollar's value.

- Dollar Indices: The US Dollar Index (DXY), a measure of the dollar against other major currencies, has shown upward movement in recent weeks, indicating dollar strength.

- Future Dollar Forecasts: Many analysts predict continued dollar strength in the short-term, which could put further downward pressure on gold prices. However, longer-term forecasts are more varied, depending on global economic conditions.

Rising Interest Rates and Their Influence

Higher interest rates increase the attractiveness of bonds and other fixed-income investments, diverting capital away from non-yielding assets like gold. This is because bonds offer a predictable return, making them a more appealing option for investors seeking safe havens during times of economic uncertainty.

- Federal Reserve Policy: The Federal Reserve's monetary policy decisions significantly impact interest rates. Recent interest rate hikes have made bonds more competitive with gold.

- Interest Rate Hikes and Gold: Historically, periods of significant interest rate increases have often correlated with periods of lower gold prices, although the correlation isn't always direct or immediate.

- Analysis: The increased attractiveness of higher-yielding alternatives directly impacts investor demand for gold, leading to price declines.

Shifting Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a crucial role in gold price fluctuations. Negative news or a shift in market confidence can trigger sell-offs, driving prices down.

- Negative News Events: Geopolitical uncertainty, economic slowdowns, and negative news related to gold mining companies can all contribute to negative investor sentiment. For example, concerns about inflation may shift investor preferences away from gold.

- Geopolitical Factors: Global events can significantly impact investor confidence and the demand for gold as a safe-haven asset. Increased geopolitical stability can reduce demand.

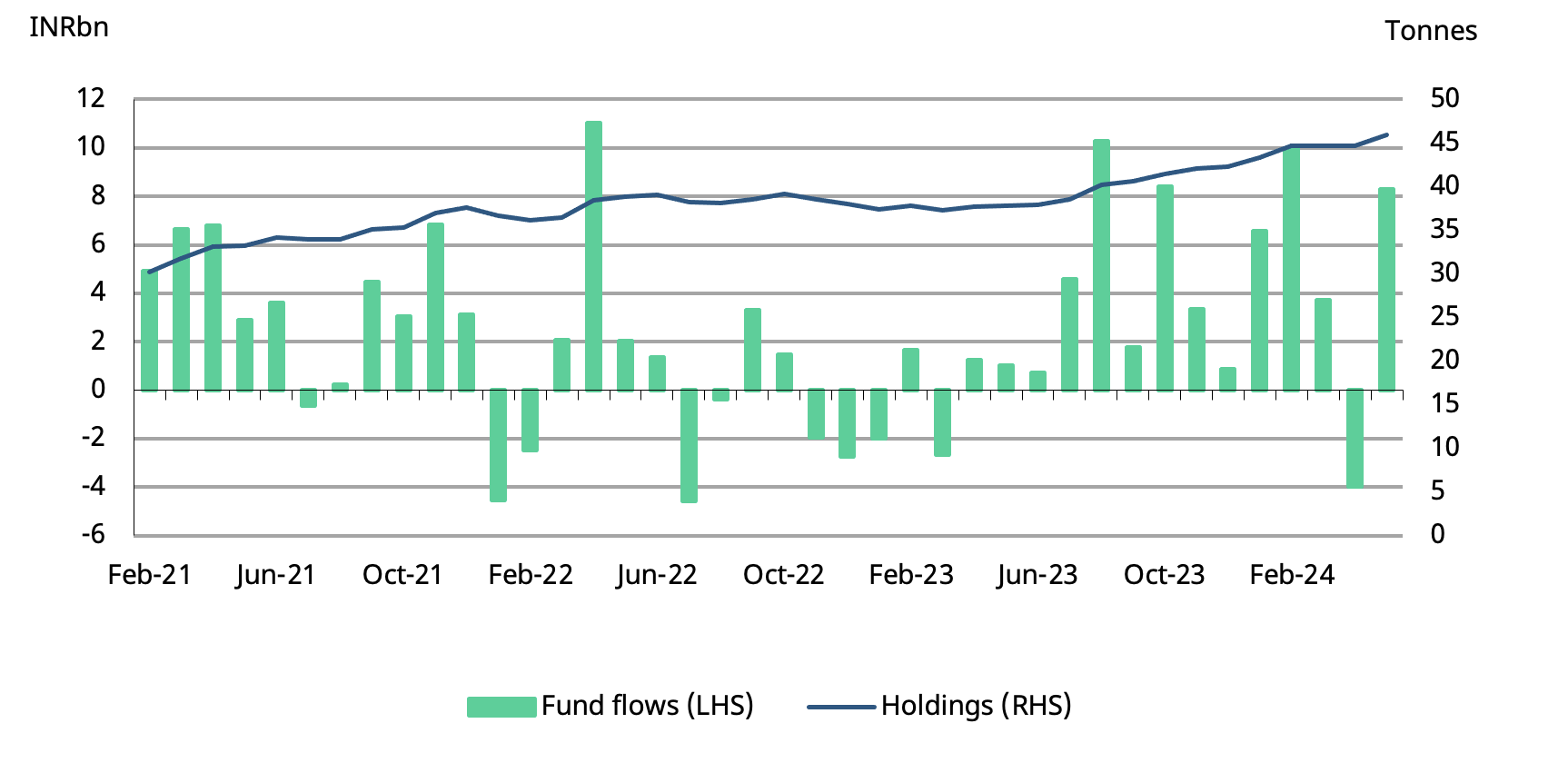

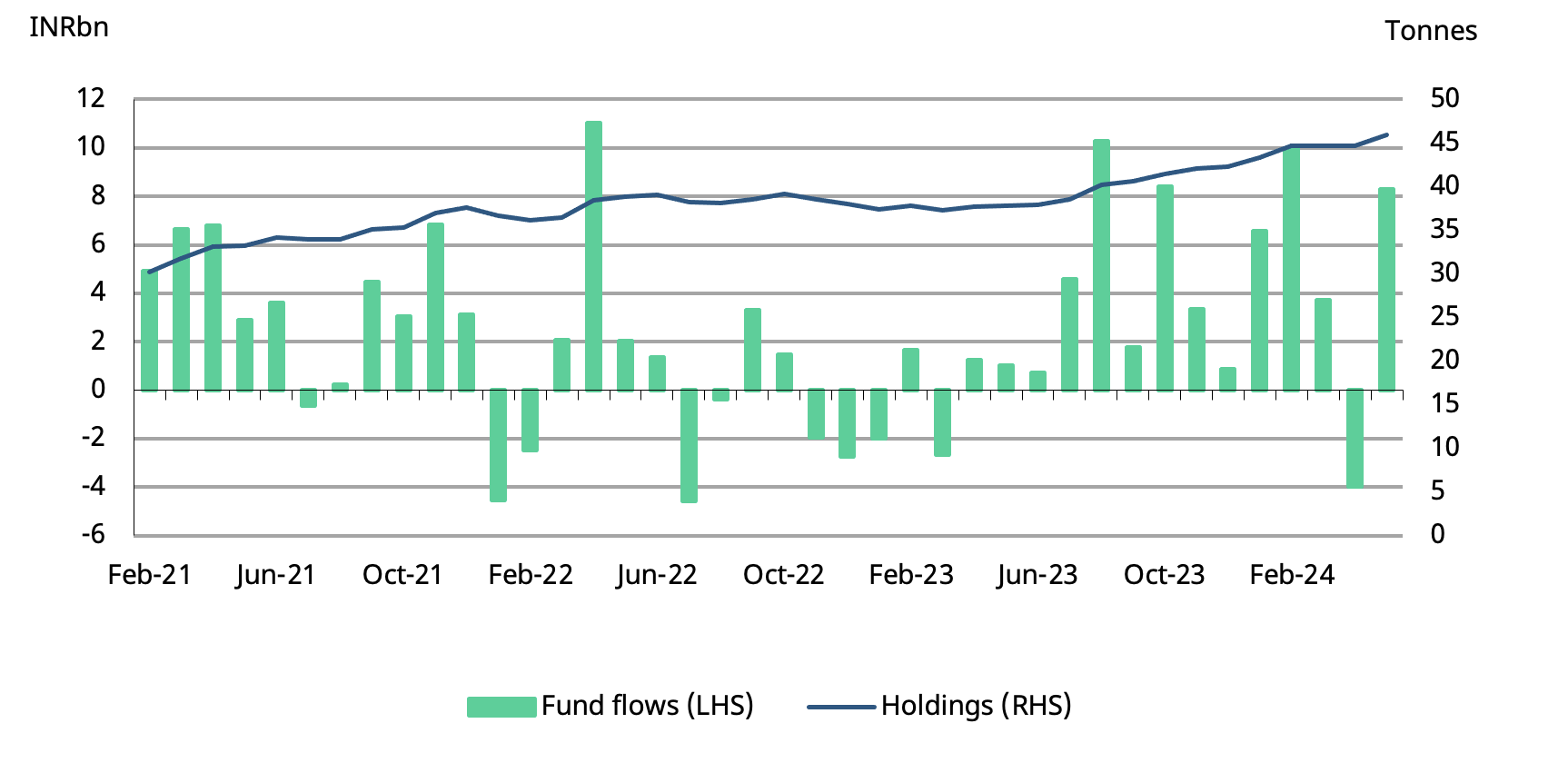

- Gold ETF Flows: Monitoring the flow of investments into and out of gold exchange-traded funds (ETFs) provides insights into overall investor sentiment towards gold. Outflows often indicate decreasing demand.

Technical Analysis of the Gold Market: Chart Patterns and Predictions

Technical analysis helps to interpret price trends and predict future movements. Examining recent gold price charts reveals some key patterns.

Chart Patterns and Support/Resistance Levels

- Chart Patterns: While specific patterns (like head and shoulders or double tops) need to be analyzed on real-time charts, identifying these formations can signal potential price reversals or continuations of the current trend.

- Support and Resistance: Identifying key support and resistance levels is crucial for assessing potential price floors and ceilings. Breaching these levels often signifies significant price movements. For example, if a key support level is breached, it suggests a potential continuation of the downward trend.

- Technical Indicators: Moving averages and Relative Strength Index (RSI) are valuable tools for confirming trends and identifying potential overbought or oversold conditions.

Short-Term and Long-Term Outlook for Gold

The short-term outlook for gold appears bearish given the current factors. However, the long-term outlook remains more uncertain.

- Short-Term: Continued dollar strength and further interest rate hikes could put downward pressure on gold prices in the coming weeks or months.

- Long-Term: Long-term gold price predictions are highly dependent on macroeconomic factors such as inflation, geopolitical stability, and central bank policies. Some analysts still see long-term potential in gold due to its role as a hedge against inflation.

Strategies for Navigating the Current Gold Market Volatility

The current market volatility necessitates a cautious approach.

Diversification and Risk Management

- Diversification: Diversifying your investment portfolio beyond gold is essential to mitigate risk. Consider allocating assets across different asset classes such as stocks, bonds, and other precious metals.

- Risk Management: Employ appropriate risk management techniques, such as setting stop-loss orders to limit potential losses.

Potential Opportunities in the Dip

- Buy the Dip Strategy: Some investors might see the current decline as a potential buying opportunity ("buy the dip"). However, this strategy is inherently risky and should only be considered by experienced investors with a high-risk tolerance.

- Thorough Research: Before making any investment decisions, conduct thorough research and consult with a qualified financial advisor to assess your risk tolerance and investment goals.

Conclusion: Looking Ahead at the Gold Market and Next Steps

The back-to-back weekly declines in the gold market are primarily driven by a strengthening US dollar, rising interest rates, and shifting investor sentiment. Monitoring key economic indicators, interest rates, and investor confidence remains crucial for assessing future gold price movements. While the short-term outlook appears bearish, the long-term prospects are more nuanced and depend on various unpredictable factors. Remember, stay informed about Gold Market Updates, consult with financial advisors before making any investment decisions related to gold, and consider alternative strategies like gold price predictions and gold market trends analysis to make informed choices about gold investment strategies.

Featured Posts

-

Is Australias Election A Reflection Of Worldwide Anti Trump Sentiment

May 05, 2025

Is Australias Election A Reflection Of Worldwide Anti Trump Sentiment

May 05, 2025 -

Blue Origin Scraps Rocket Launch Due To Vehicle Subsystem Problem

May 05, 2025

Blue Origin Scraps Rocket Launch Due To Vehicle Subsystem Problem

May 05, 2025 -

Fox Bolsters Streaming Ambitions With Peter Distads Leadership

May 05, 2025

Fox Bolsters Streaming Ambitions With Peter Distads Leadership

May 05, 2025 -

Why We Love A Special Little Bag Versatility And Design

May 05, 2025

Why We Love A Special Little Bag Versatility And Design

May 05, 2025 -

James Burns Ex Soldiers Fear And The Belfast Hospital Incident

May 05, 2025

James Burns Ex Soldiers Fear And The Belfast Hospital Incident

May 05, 2025

Latest Posts

-

Fleetwood Macs Legacy A Deep Dive Into Their Supergroup Status And Rumours

May 05, 2025

Fleetwood Macs Legacy A Deep Dive Into Their Supergroup Status And Rumours

May 05, 2025 -

The Story Behind Rumours Fleetwood Macs Personal Lives And The Making Of A Masterpiece 48 Years Later

May 05, 2025

The Story Behind Rumours Fleetwood Macs Personal Lives And The Making Of A Masterpiece 48 Years Later

May 05, 2025 -

Rumours At 48 Fleetwood Macs Implosion And The Album That Defined A Generation

May 05, 2025

Rumours At 48 Fleetwood Macs Implosion And The Album That Defined A Generation

May 05, 2025 -

Novo Izdanje Gibonija Promoviranje Na Sajmu Knjiga U Sarajevu

May 05, 2025

Novo Izdanje Gibonija Promoviranje Na Sajmu Knjiga U Sarajevu

May 05, 2025 -

48 Years On How Fleetwood Macs Personal Turmoil Forged Rumours

May 05, 2025

48 Years On How Fleetwood Macs Personal Turmoil Forged Rumours

May 05, 2025