Gold Market Update: Analyzing Two Consecutive Weeks Of Losses (2025)

Table of Contents

Rising Interest Rates and Their Impact on Gold Prices

Gold, unlike interest-bearing assets, doesn't offer a yield. This means its attractiveness as an investment is inversely related to interest rates. Recent interest rate hikes by major central banks have significantly impacted gold prices. Higher rates increase the opportunity cost of holding non-yielding assets like gold; investors are incentivized to shift their capital towards interest-bearing instruments offering higher returns.

- Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. The potential return from a savings account or bond becomes more appealing than the relatively static value of gold.

- Investors may shift from gold to interest-bearing assets for higher returns. This reduced demand for gold directly impacts its price, pushing it downwards.

- Impact of potential future rate hikes on gold market predictions. The Federal Reserve's future monetary policy decisions will continue to influence gold price forecasts, with further rate increases potentially putting more downward pressure on gold. This makes accurate gold price prediction challenging, requiring careful consideration of monetary policy.

The Strengthening US Dollar and Its Influence on Gold

Gold is typically priced in US dollars. A strong dollar negatively correlates with the gold price. The recent strength of the US dollar has exerted downward pressure on gold prices, making it more expensive for investors using other currencies.

- A stronger dollar makes gold more expensive for holders of other currencies, reducing demand. This directly impacts global gold investment and price fluctuations.

- The dollar's role as a safe haven asset competing with gold. In times of uncertainty, investors often flock to the dollar, reducing the relative appeal of gold as a safe haven.

- Analysis of the dollar's future trajectory and its potential effect on gold. The future strength of the dollar remains a critical factor in predicting short-term gold price movements. Forecasting dollar movements is essential for accurate gold price prediction.

Geopolitical Factors and Their Role in Gold Market Volatility

Geopolitical events significantly impact investor sentiment and gold market volatility. Uncertainty and instability often drive investors towards gold as a safe haven asset. However, recent events have had a mixed impact. While some geopolitical tensions might increase demand for a safe haven like gold, others might indirectly lead to increased dollar strength, thereby negatively influencing gold prices.

- Specific examples of geopolitical events and their impact. For instance, escalating tensions in a specific region could trigger a flight to safety, boosting gold demand. Conversely, an unexpected resolution to a major conflict might reduce the safe haven appeal of gold.

- Analysis of investor behavior during times of geopolitical uncertainty. Investors’ behavior during uncertainty is often characterized by increased volatility and rapid shifts in investment strategies, affecting gold price prediction.

- Potential future geopolitical risks and their potential impact on gold. Ongoing geopolitical risks and potential future conflicts will significantly shape investor sentiment towards gold as a safe haven asset and will affect the gold price in the coming months.

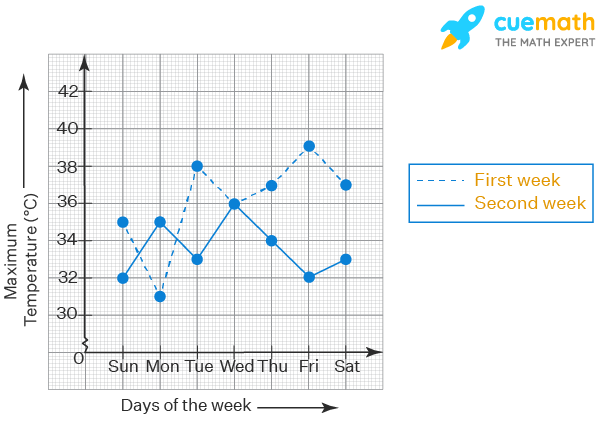

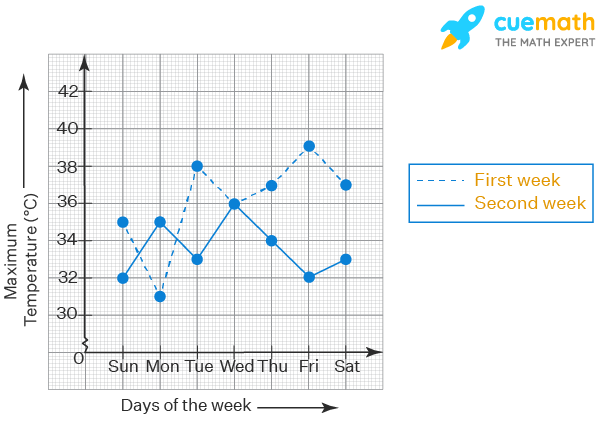

Technical Analysis of the Gold Market's Recent Performance

Technical analysis provides valuable insights into gold price trends using charts and indicators. Recent gold price movements have shown specific patterns that deserve attention.

- Key support and resistance levels. Identifying these levels helps predict potential price reversals or breakouts.

- Analysis of chart patterns (e.g., head and shoulders, double top). These patterns can signal potential price changes, offering clues for effective investment strategies.

- Technical indicators suggesting potential future price movements. Indicators such as moving averages and Relative Strength Index (RSI) can provide additional insight into potential future price direction, assisting in formulating more informed trading strategies.

Conclusion: Navigating the Gold Market's Recent Losses

The recent two-week decline in gold prices can be attributed to a combination of factors: rising interest rates increasing the opportunity cost of holding gold, the strengthening US dollar reducing demand, the impact of geopolitical factors on investor sentiment, and technical indicators suggesting a potential downward trend. While the short-term outlook for gold remains uncertain, long-term investors should consider the inherent value of gold as a hedge against inflation and diversification tool. Stay updated on the latest gold market trends and consider diversifying your investment portfolio with gold for long-term stability. Consult with a financial advisor to determine the best gold investment strategy for your individual circumstances.

Featured Posts

-

Bredli Kuper I Leonardo Di Kaprio Pochemu Druzhba Zakonchilas

May 04, 2025

Bredli Kuper I Leonardo Di Kaprio Pochemu Druzhba Zakonchilas

May 04, 2025 -

Ufc On Espn 67 Results Sandhagen Vs Figueiredo Full Fight Card Breakdown

May 04, 2025

Ufc On Espn 67 Results Sandhagen Vs Figueiredo Full Fight Card Breakdown

May 04, 2025 -

Simone Biles At The Kentucky Derby Announcing A Riders Up

May 04, 2025

Simone Biles At The Kentucky Derby Announcing A Riders Up

May 04, 2025 -

Analyzing Marvels Thunderbolts Success Or Failure

May 04, 2025

Analyzing Marvels Thunderbolts Success Or Failure

May 04, 2025 -

Why Did Teddy Magic Quit Britains Got Talent Simon Cowells Surprise

May 04, 2025

Why Did Teddy Magic Quit Britains Got Talent Simon Cowells Surprise

May 04, 2025