Gold Investment Soars On Renewed Trade War Concerns: Trump's Impact

Table of Contents

The Safe Haven Effect of Gold During Trade Wars

Understanding Gold's Role as a Hedge Against Uncertainty

Gold has long been recognized as a safe haven asset, a go-to investment during times of economic and political instability. This is because gold's value is largely independent of traditional market fluctuations. Unlike stocks and bonds, which are susceptible to market downturns, gold's value tends to hold steady or even increase during periods of uncertainty.

- Lack of Correlation: Gold demonstrates a low correlation with other asset classes, meaning its price movements don't necessarily mirror those of stocks or bonds. This makes it an ideal diversifier in an investment portfolio.

- Tangible Asset: Unlike digital assets, gold is a physical commodity, offering a tangible sense of security and ownership. This tangible nature provides comfort to investors during times of economic uncertainty.

- Historical Performance: Historically, gold has performed well during periods of geopolitical instability and economic downturns. For example, during the 2008 financial crisis, gold prices surged as investors sought refuge from the collapsing markets. Similar trends were observed during previous trade disputes.

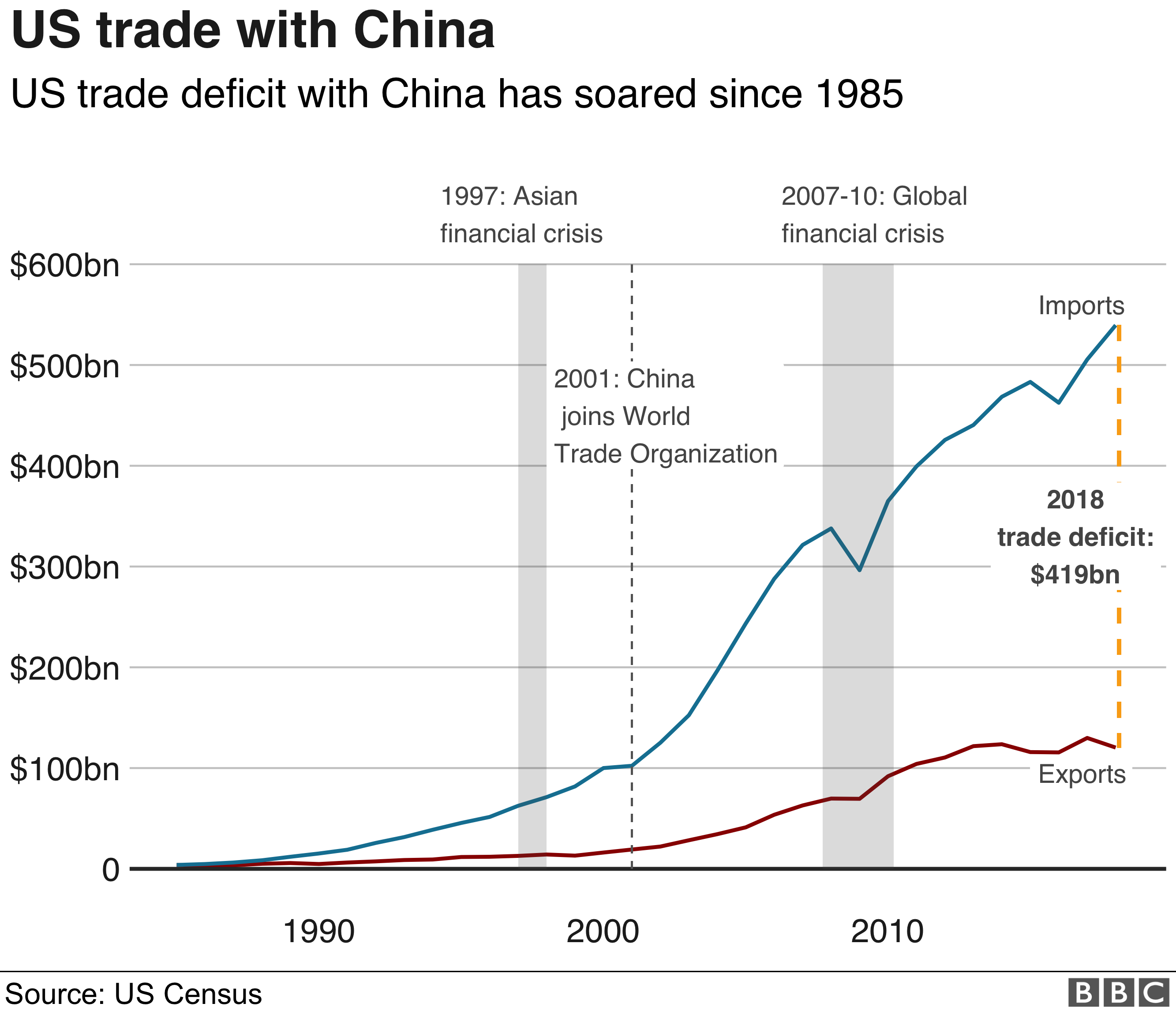

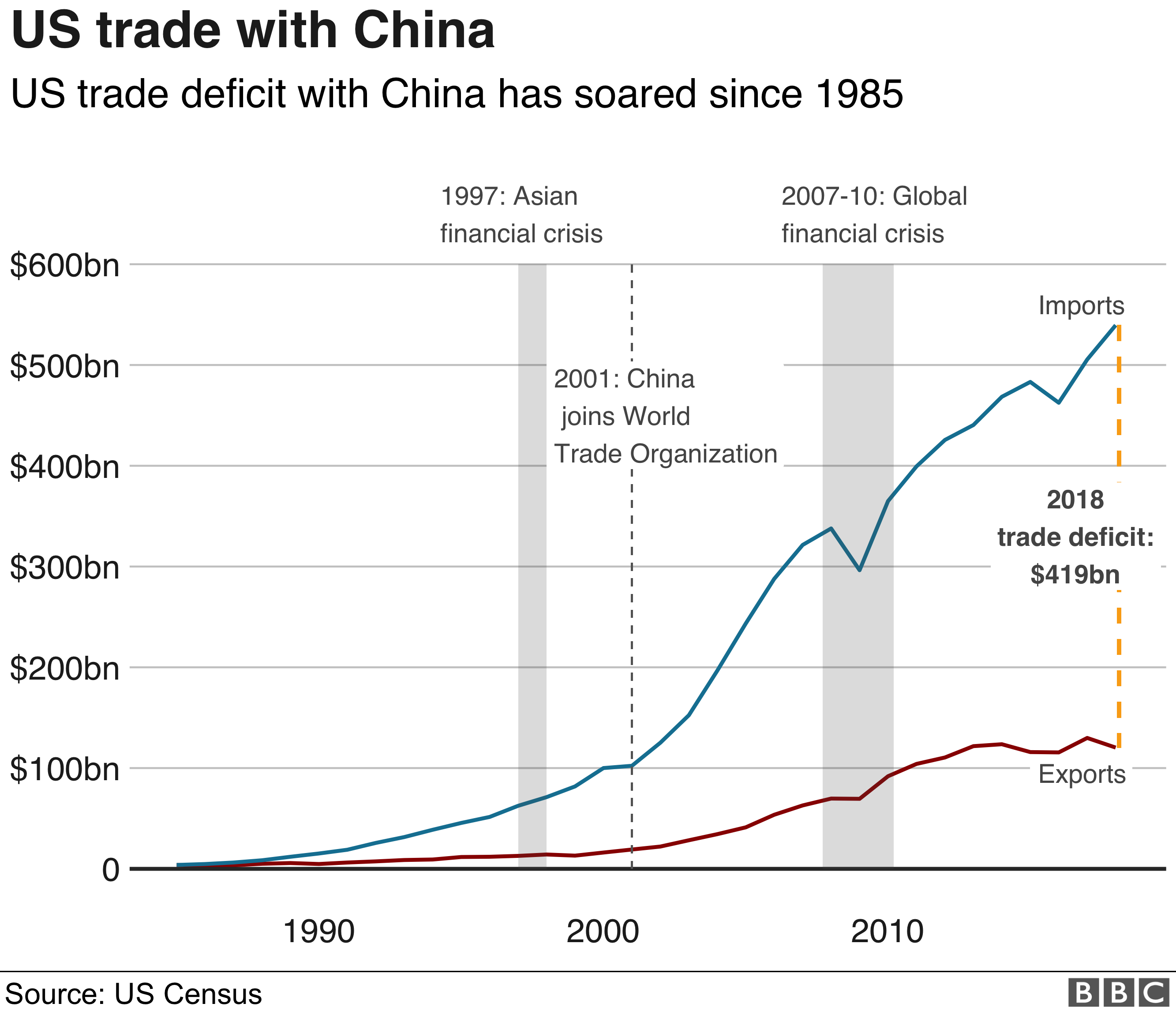

Trump's Trade Policies and Market Volatility

President Trump's trade policies, characterized by aggressive tariffs and trade disputes with major global economies, have significantly increased market volatility. This uncertainty has driven investors towards gold, a perceived safe haven, for its stability and resilience during times of economic turmoil.

- Tariffs and Retaliation: The imposition of tariffs on goods from various countries has led to retaliatory measures, creating a climate of uncertainty and apprehension. This uncertainty directly impacts investor confidence, pushing them towards safer assets like gold.

- Trade Wars and Market Sentiment: The ongoing trade disputes have negatively impacted market sentiment, leading to increased volatility and investor apprehension. This uncertainty fuels the demand for gold as a hedge against potential losses in other asset classes.

- Impact on Gold Prices: Each escalation in trade tensions has been closely followed by a rise in gold prices, clearly demonstrating the direct correlation between trade wars and increased gold investment.

Increased Demand for Gold ETFs and Physical Gold

The Surge in Gold ETF Investments

Gold Exchange-Traded Funds (ETFs) have become increasingly popular as a convenient and accessible way to invest in gold. These ETFs track the price of gold, allowing investors to easily buy and sell shares representing a fraction of an ounce of gold. Recent data shows a significant inflow of capital into gold ETFs, reflecting the growing interest in gold investment.

- Ease of Access: Gold ETFs provide easy access to gold investment, eliminating the need for physical storage or specialized knowledge.

- Liquidity: Gold ETFs are highly liquid, allowing investors to quickly buy or sell their holdings without significant price impact.

- Diversification Benefits: Gold ETFs can be easily incorporated into a diversified investment portfolio, helping to mitigate overall portfolio risk.

Retail Investor Interest in Physical Gold

Beyond ETFs, we're also seeing a significant increase in retail investors purchasing physical gold, such as bars and coins. This reflects a desire for a tangible asset that holds inherent value and is perceived as a safe haven from economic instability.

- Currency Devaluation Concerns: Concerns about currency devaluation and inflation are driving investors to seek alternative stores of value, with physical gold being a preferred choice.

- Tangible Security: Many investors find comfort in owning a physical asset that they can hold, providing a sense of security amidst economic uncertainty.

Geopolitical Uncertainty and Its Impact on Gold Investment

Global Economic Slowdown and Gold's Inverse Correlation

Gold prices often exhibit an inverse relationship with economic growth. As global economic growth slows or concerns about a recession emerge, investors tend to flock to gold, viewing it as a safe haven during times of economic downturn.

- Recessionary Fears: Rising anxieties about a global recession are driving demand for safe-haven assets like gold, bolstering investment.

- Inverse Correlation Data: Historical data consistently shows a negative correlation between gold prices and economic growth indicators, further supporting this trend.

The Role of the US Dollar and Interest Rates

Fluctuations in the US dollar and interest rates also play a significant role in influencing gold investment.

- US Dollar and Gold: Generally, there's an inverse relationship between the US dollar and gold prices. A weaker dollar usually leads to higher gold prices, making gold more attractive to international investors.

- Interest Rate Impact: Changes in interest rates can influence investment decisions. Lower interest rates can make gold a more appealing investment compared to interest-bearing assets.

Conclusion

In summary, President Trump's trade policies, coupled with broader geopolitical uncertainties and economic anxieties, have driven increased demand for gold as a safe haven asset. This has led to a surge in gold investment, evident in increased demand for both gold ETFs and physical gold. Given the ongoing uncertainty surrounding trade relations and the potential for further market volatility, now is a crucial time to consider diversifying your investment portfolio with gold. Explore various gold investment options—such as ETFs or physical gold—to protect your wealth amidst global economic fluctuations and ensure a more secure financial future. Consider how gold investment can help mitigate risks in your portfolio and provide a stable hedge against economic uncertainty.

Featured Posts

-

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025

Turning Poop Into Prose An Ai Powered Podcast Revolution

May 25, 2025 -

Sixth Century Vessel Unearthed At Sutton Hoo Evidence Of Cremated Remains Burial Practices

May 25, 2025

Sixth Century Vessel Unearthed At Sutton Hoo Evidence Of Cremated Remains Burial Practices

May 25, 2025 -

Nicki Chapmans 700 000 Country Home Investment A Smart Property Move

May 25, 2025

Nicki Chapmans 700 000 Country Home Investment A Smart Property Move

May 25, 2025 -

Us Band Teases Glastonbury Performance No Official Confirmation Yet

May 25, 2025

Us Band Teases Glastonbury Performance No Official Confirmation Yet

May 25, 2025 -

Italian Open 2024 Zheng Qinwens Semifinal Appearance And Future Prospects

May 25, 2025

Italian Open 2024 Zheng Qinwens Semifinal Appearance And Future Prospects

May 25, 2025

Latest Posts

-

Swiateks Winning Streak Continues Madrid Open Victory Over Keys De Minaurs Loss

May 25, 2025

Swiateks Winning Streak Continues Madrid Open Victory Over Keys De Minaurs Loss

May 25, 2025 -

Madrid Open Results De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025

Madrid Open Results De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025 -

Iga Swiatek Triumphs In Madrid Keys Defeated In Straight Sets

May 25, 2025

Iga Swiatek Triumphs In Madrid Keys Defeated In Straight Sets

May 25, 2025 -

Alex De Minaurs Madrid Open Exit Straight Sets Defeat And Swiateks Victory

May 25, 2025

Alex De Minaurs Madrid Open Exit Straight Sets Defeat And Swiateks Victory

May 25, 2025 -

Ealas Grand Slam Opportunity Paris 2024

May 25, 2025

Ealas Grand Slam Opportunity Paris 2024

May 25, 2025