Gold Investment: Assessing The Impact Of Recent Price Falls

Table of Contents

Understanding the Recent Gold Price Decline

The recent decline in gold prices is a multifaceted issue stemming from several interconnected factors. A primary driver is the rise in interest rates by central banks globally, particularly the Federal Reserve in the United States. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, making alternative investments more attractive.

- Impact of rising interest rates on gold's appeal: Higher interest rates make bonds and other fixed-income securities more appealing, diverting investment away from gold.

- Strengthening US dollar and its correlation with gold prices: The US dollar and gold prices typically exhibit an inverse relationship. A stronger dollar makes gold more expensive for investors holding other currencies, thus reducing demand.

- Shifts in inflation expectations and their influence on gold demand: Gold is often seen as a hedge against inflation. If inflation expectations decrease, the demand for gold as a safe haven asset also diminishes.

- Geopolitical factors affecting gold markets: Global political instability and uncertainty usually drive up gold prices, acting as a safe haven. Conversely, periods of relative geopolitical calm can lead to price decreases.

- Supply and demand dynamics impacting gold prices: The interplay between gold production and investor demand significantly influences price fluctuations. A surplus in supply can put downward pressure on prices.

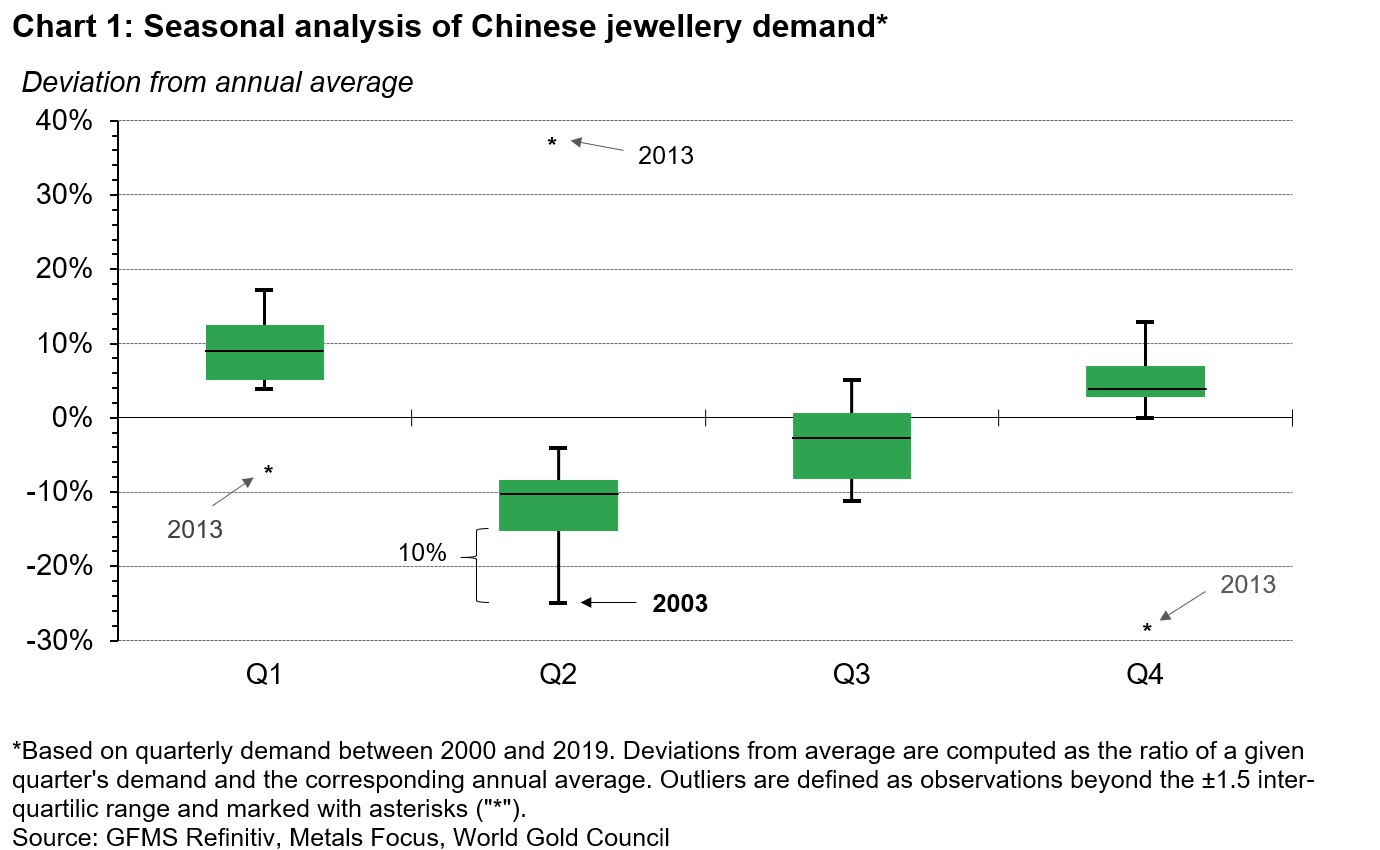

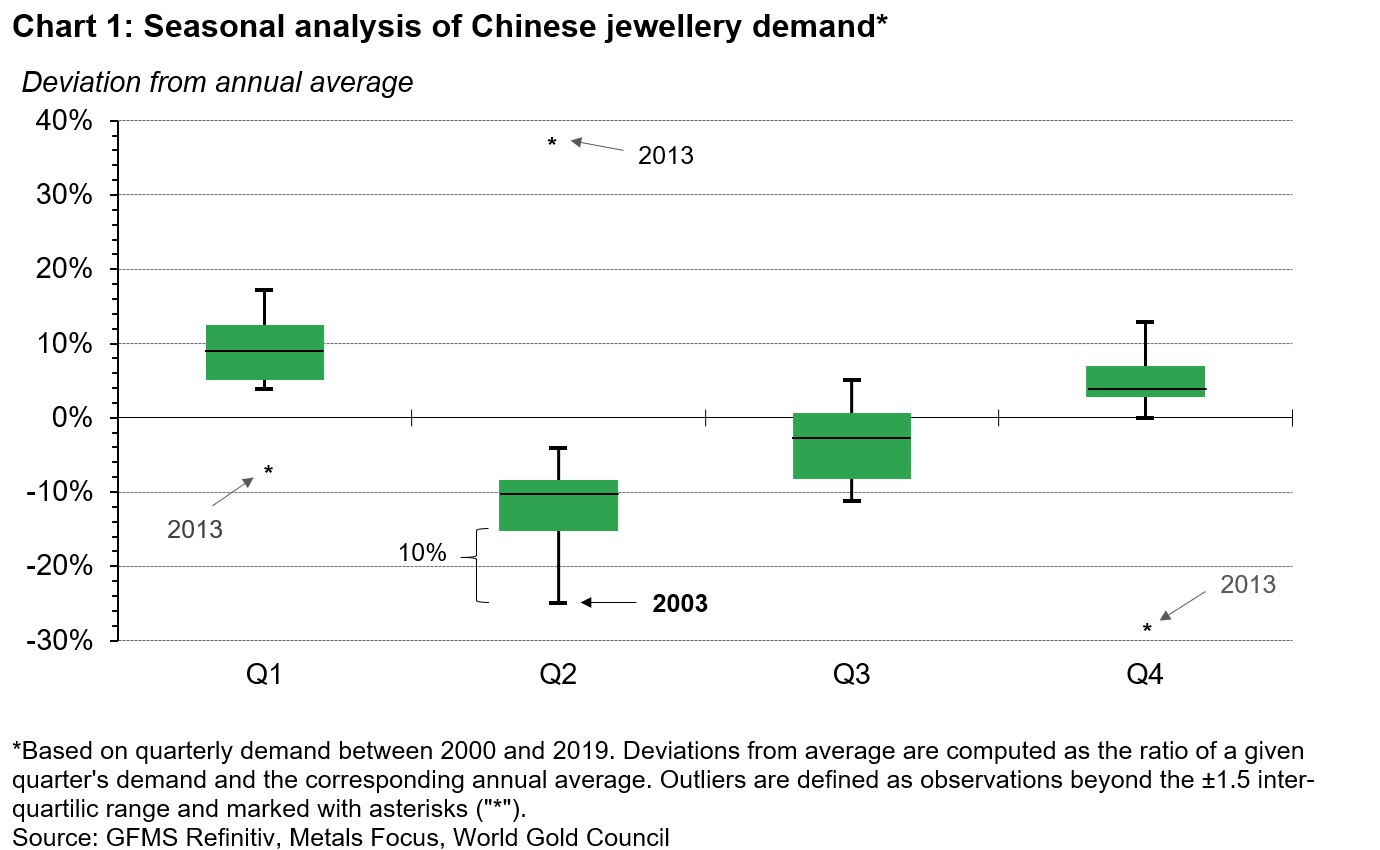

[Insert relevant chart or graph here illustrating recent gold price fluctuations.]

Evaluating the Risks and Opportunities in Gold Investment

While gold offers potential benefits, it's crucial to understand the associated risks. Gold is a non-yielding asset; it doesn't pay dividends or interest, meaning your returns depend entirely on price appreciation.

- Price volatility and risk management strategies: Gold prices can fluctuate significantly, presenting considerable risk for short-term investors. Strategies like dollar-cost averaging can help mitigate this risk.

- Diversification benefits of including gold in a portfolio: Gold can act as a portfolio diversifier, reducing overall portfolio volatility as it often moves independently of stocks and bonds.

- Long-term vs. short-term investment strategies for gold: A long-term perspective is generally recommended for gold investment due to its inherent volatility. Short-term trading can be highly speculative.

- Different ways to invest in gold (physical gold, ETFs, mining stocks): Investors can access the gold market through various instruments, each with its own set of risks and rewards.

- Comparing gold's performance against other asset classes: Historically, gold has performed differently from other asset classes, offering diversification benefits in a well-balanced portfolio.

The recent price decline, however, presents a potential opportunity for long-term investors to acquire gold at a relatively lower price point.

Analyzing Different Gold Investment Vehicles

Choosing the right vehicle for your gold investment is crucial. Each option presents a unique set of advantages and disadvantages:

- Pros and cons of physical gold ownership (storage costs, security): Owning physical gold offers tangible ownership but involves storage costs and security concerns.

- Advantages and disadvantages of gold ETFs (liquidity, diversification): Gold ETFs offer liquidity and diversification but may be subject to management fees.

- Risks and rewards of investing in gold mining companies: Mining stocks offer leveraged exposure to gold prices but carry higher risk due to company-specific factors.

- Expense ratios and management fees for gold mutual funds: Gold mutual funds provide diversification but incur management fees.

Developing a Gold Investment Strategy Post-Price Fall

Creating a successful gold investment strategy requires careful consideration of your risk tolerance and financial goals.

- Setting realistic investment goals and time horizons: Determine your investment objectives and the timeframe for achieving them.

- Determining appropriate allocation of gold in a diversified portfolio: The ideal allocation depends on your risk tolerance and overall portfolio strategy.

- Dollar-cost averaging as a risk mitigation strategy: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Importance of staying informed about market trends and news affecting gold prices: Keeping abreast of market developments is crucial for making informed decisions.

- Seeking advice from financial advisors for personalized strategies: Consulting a financial advisor can provide personalized guidance tailored to your specific circumstances.

Conclusion

Recent falls in gold prices have presented both challenges and opportunities for investors. While gold investment inherently carries risks like price volatility, understanding these risks and utilizing appropriate strategies can help mitigate potential losses. The current market conditions may offer attractive entry points for long-term investors. Remember to carefully consider the different gold investment vehicles available and their associated risks before making any investment decisions.

Ready to capitalize on the current market conditions for gold investment? Learn more about creating a robust gold investment strategy tailored to your financial goals. Research different gold investment options and consider seeking professional advice to make informed decisions about gold investments.

Featured Posts

-

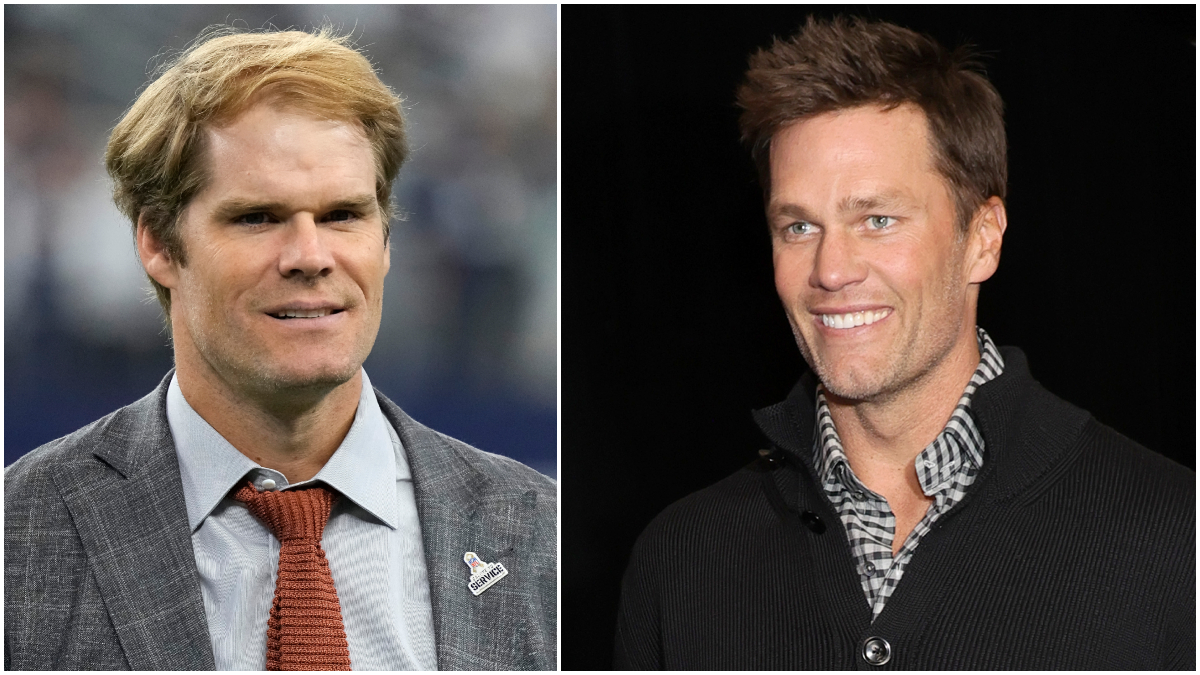

Emmy Nomination Greg Olsen Edges Out Tom Brady For Third Nomination

May 05, 2025

Emmy Nomination Greg Olsen Edges Out Tom Brady For Third Nomination

May 05, 2025 -

Disaster Capitalism The Commodification Of The Los Angeles Wildfires Through Betting

May 05, 2025

Disaster Capitalism The Commodification Of The Los Angeles Wildfires Through Betting

May 05, 2025 -

Addressing The Issue Of Slow Traffic Movement In Darjeeling

May 05, 2025

Addressing The Issue Of Slow Traffic Movement In Darjeeling

May 05, 2025 -

Oscars 2024 Lizzos Stunning Weight Loss Reveal

May 05, 2025

Oscars 2024 Lizzos Stunning Weight Loss Reveal

May 05, 2025 -

Fallica Criticizes Trumps Actions Towards Putin

May 05, 2025

Fallica Criticizes Trumps Actions Towards Putin

May 05, 2025

Latest Posts

-

Bredli Kuper I Leonardo Di Kaprio Pravda O Razrushennoy Druzhbe

May 05, 2025

Bredli Kuper I Leonardo Di Kaprio Pravda O Razrushennoy Druzhbe

May 05, 2025 -

Erfolg Oder Flop Analyse Der Zuschauerzahlen Fuer Den Ersten Vorentscheid Esc 2025 In Deutschland

May 05, 2025

Erfolg Oder Flop Analyse Der Zuschauerzahlen Fuer Den Ersten Vorentscheid Esc 2025 In Deutschland

May 05, 2025 -

Deutschland Sucht Den Esc Star 2025 Die Chefsache Semi Finalisten

May 05, 2025

Deutschland Sucht Den Esc Star 2025 Die Chefsache Semi Finalisten

May 05, 2025 -

Leslie And The Eurovision Song Contest Next Phase

May 05, 2025

Leslie And The Eurovision Song Contest Next Phase

May 05, 2025 -

Wer Singt Fuer Deutschland Beim Esc 2025 Die Sieben Semi Finalisten

May 05, 2025

Wer Singt Fuer Deutschland Beim Esc 2025 Die Sieben Semi Finalisten

May 05, 2025