Gold Fields Acquires Gold Road Resources For A$3.7 Billion

Table of Contents

Deal Details and Financial Implications

The A$3.7 billion acquisition price represents a significant investment for Gold Fields. While the exact breakdown between cash and stock components remains to be fully disclosed, analysts are closely scrutinizing the valuation to determine if it represents a fair price for Gold Road Resources' assets. This deal will undoubtedly impact Gold Fields' share price and market capitalization, potentially leading to both short-term volatility and long-term adjustments.

- Acquisition Price Breakdown: Further details regarding the financing mechanism – a mix of cash and potentially equity – are awaited with bated breath by investors.

- Deal Valuation: Independent assessments of the deal's fairness are crucial, considering Gold Road Resources' proven reserves and future exploration potential.

- Impact on Share Price: The market will react to the news, and the subsequent share price fluctuations will depend on investor confidence and overall market conditions.

- Financing Methods: The strategy used to finance this substantial acquisition will influence Gold Fields' future financial flexibility and ability to pursue further expansion. The use of debt could increase financial risk, while equity dilution could affect existing shareholder stakes. Keywords: Acquisition price, deal valuation, share price, market capitalization, financing, debt, equity.

Synergies and Strategic Rationale

Gold Fields' acquisition of Gold Road Resources isn't merely a financial transaction; it's a strategic move aimed at enhancing its position in the global gold mining market. The rationale likely centers around several key synergies:

- Operational Efficiencies: Combining operations could lead to significant cost savings through streamlined processes and shared resources.

- Resource Expansion: Gold Road Resources possesses valuable assets, including the Gruyere gold mine, which will expand Gold Fields' existing portfolio and resource base. This diversification reduces risk associated with reliance on a limited number of mines.

- Market Share Gains: The combined entity will command a larger market share, giving Gold Fields increased negotiating power with suppliers and buyers.

- Portfolio Diversification: The acquisition adds a new dimension to Gold Fields' geographic footprint and operational experience, strengthening its overall resilience. Keywords: Synergies, strategic rationale, operational efficiencies, cost savings, resource expansion, market share, portfolio diversification.

Impact on the Gold Mining Industry

This mega-deal will undeniably reshape the gold mining landscape. Its implications are far-reaching:

- Increased Competition: While leading to consolidation, this acquisition intensifies competition among the remaining players, potentially prompting further mergers and acquisitions.

- Gold Prices and Supply: The combined production capacity of Gold Fields and Gold Road Resources could influence gold supply in the market, although the overall impact on prices is complex and dependent on various market factors.

- Geopolitical Implications: The location of Gold Road Resources' mines adds a geopolitical dimension to the acquisition, with considerations for regulatory environments and potential international relations.

- Industry Consolidation: This acquisition signals a trend towards greater industry consolidation, with larger companies seeking to acquire smaller players to gain economies of scale and market dominance. Keywords: Competition, gold prices, supply, geopolitical implications, industry consolidation.

Regulatory Approvals and Future Outlook

The successful completion of the acquisition hinges on securing necessary regulatory approvals from relevant authorities. This process could present challenges and potential delays.

- Regulatory Hurdles: Antitrust reviews and environmental impact assessments are standard procedures that could pose obstacles.

- Integration Plans: Gold Fields will need a robust integration plan to seamlessly combine operations and leverage the synergies between the two companies.

- Future Operational Strategies: Post-acquisition, Gold Fields' operational strategies will likely focus on optimizing production, controlling costs, and exploring new opportunities.

- Growth and Profitability: The successful integration of Gold Road Resources has the potential to significantly boost Gold Fields' growth and profitability in the long term. Keywords: Regulatory approvals, integration, operational strategy, growth, profitability, future outlook.

Conclusion: Analyzing the Future After the Gold Fields Acquisition of Gold Road Resources

The A$3.7 billion acquisition of Gold Road Resources by Gold Fields is a landmark event in the gold mining industry. This analysis highlights the deal's financial aspects, strategic reasoning, industry-wide impact, and future prospects. The successful integration of Gold Road Resources' assets is crucial for Gold Fields to realize the predicted synergies and achieve its long-term growth objectives. The acquisition sets a precedent, potentially sparking further consolidation within the sector. To stay informed on the unfolding developments and the evolving landscape of the gold mining industry, subscribe to our newsletter or follow our blog for further updates on Gold Fields and Gold Road Resources. This transformative acquisition could significantly reshape the future of gold mining.

Featured Posts

-

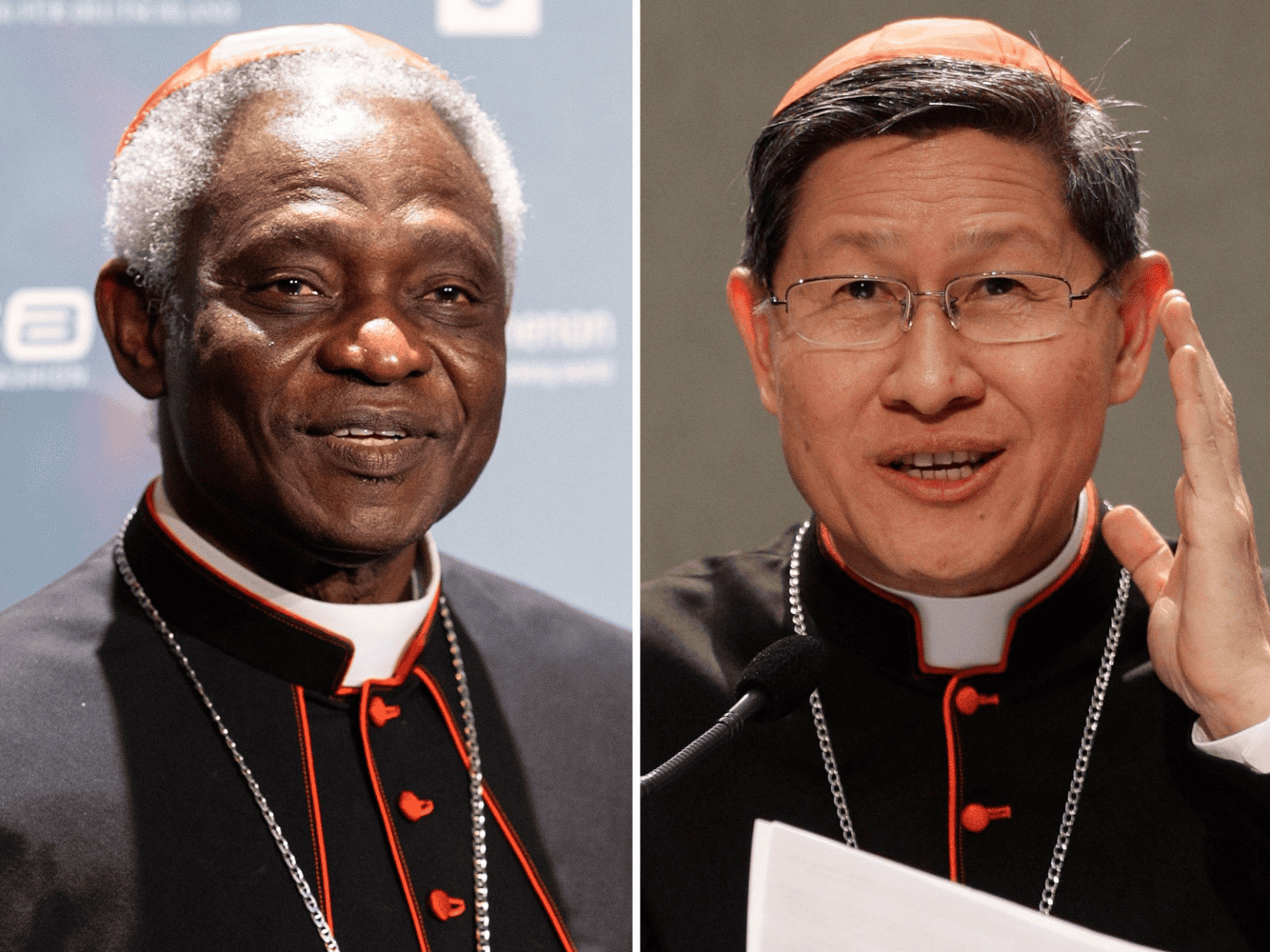

Understanding Papal Name Changes History And Predictions For The Next Pope

May 06, 2025

Understanding Papal Name Changes History And Predictions For The Next Pope

May 06, 2025 -

Mark Carney And Canadas West Gary Mars Perspective On Economic Growth

May 06, 2025

Mark Carney And Canadas West Gary Mars Perspective On Economic Growth

May 06, 2025 -

Chris Pratt Responds To Brother In Laws White Lotus Nudity

May 06, 2025

Chris Pratt Responds To Brother In Laws White Lotus Nudity

May 06, 2025 -

Effective Communication With Trump Preparing For Successful Meetings

May 06, 2025

Effective Communication With Trump Preparing For Successful Meetings

May 06, 2025 -

Trumps Trade Agenda A Risk Assessment Amidst Economic Uncertainty

May 06, 2025

Trumps Trade Agenda A Risk Assessment Amidst Economic Uncertainty

May 06, 2025

Latest Posts

-

How To Watch Knicks Vs Celtics 2025 Nba Playoffs

May 06, 2025

How To Watch Knicks Vs Celtics 2025 Nba Playoffs

May 06, 2025 -

Celtics Vs 76ers Betting Preview Expert Predictions And Best Bets For February 20th 2025

May 06, 2025

Celtics Vs 76ers Betting Preview Expert Predictions And Best Bets For February 20th 2025

May 06, 2025 -

Celtics Vs 76ers Game Prediction Odds Stats And Expert Picks For February 20 2025

May 06, 2025

Celtics Vs 76ers Game Prediction Odds Stats And Expert Picks For February 20 2025

May 06, 2025 -

Where To Watch Celtics Vs Knicks Live Stream Tv Broadcast Details

May 06, 2025

Where To Watch Celtics Vs Knicks Live Stream Tv Broadcast Details

May 06, 2025 -

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 06, 2025

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 06, 2025