Global Investment In Saudi Arabia: Deutsche Bank's Strategic Approach

Table of Contents

Understanding Saudi Arabia's Investment Landscape

Vision 2030 has fundamentally reshaped Saudi Arabia's economic trajectory, shifting focus from oil dependence to a diversified, sustainable economy. This ambitious plan prioritizes several key sectors ripe for foreign investment: renewable energy, infrastructure development, technological advancements, and tourism. The Saudi government actively encourages FDI through various initiatives, creating a favorable environment for international investors.

- Growth in Non-Oil Sectors: Significant investments are fueling rapid growth in sectors like tourism, technology, and renewable energy, presenting diverse investment opportunities.

- Ease of Doing Business Improvements: The Kingdom has implemented reforms to streamline regulations and improve the ease of doing business, making it more attractive to foreign investors.

- Attractive Tax Incentives: Competitive tax incentives and attractive investment packages are designed to lure international businesses and capital.

- Development of Special Economic Zones: The development of specialized economic zones, such as NEOM, further enhances the appeal of Saudi Arabia as an investment destination, offering specific sector-focused advantages and streamlined regulations.

Deutsche Bank's Key Investment Strategies in Saudi Arabia

Deutsche Bank's approach to investment in Saudi Arabia is characterized by a long-term perspective aligned with the goals of Vision 2030. Their strategies prioritize sustainable investments, focusing on sectors with high growth potential and long-term stability. This includes collaborations and partnerships with local Saudi entities, leveraging local expertise and knowledge.

- Focus on Sustainable Investments: Deutsche Bank prioritizes investments that contribute to environmental sustainability and align with Saudi Arabia's commitment to renewable energy and green initiatives.

- Emphasis on Long-Term Growth Potential: Their investment strategy emphasizes projects and ventures with demonstrable potential for sustainable, long-term growth.

- Risk Mitigation Strategies: Robust risk assessment and mitigation strategies are employed to ensure the security and stability of their investments.

- Collaboration with Local Partners: Deutsche Bank actively seeks partnerships with Saudi companies and institutions, fostering local collaboration and knowledge transfer.

Analyzing the Impact of Deutsche Bank's Investments

Deutsche Bank's investments in Saudi Arabia have had a tangible economic impact, contributing significantly to job creation, technological advancement, and infrastructure development. These contributions have positively influenced Saudi Arabia's GDP growth across multiple sectors.

- Job Creation: Deutsche Bank's investments have directly and indirectly created numerous jobs, boosting employment across various sectors.

- Successful Investment Projects: Examples of successful projects, showcasing Deutsche Bank's contribution to specific sectors, are publicly available (mention specific examples if available and verifiable).

- Contribution to Sector Growth: The bank's investment has demonstrably contributed to the expansion of key sectors, aligned with Vision 2030 targets.

- Positive Social and Environmental Impact: Many of the investments boast a positive social and environmental impact, aligned with both Deutsche Bank's and Saudi Arabia's sustainability goals.

Future Prospects and Challenges for Deutsche Bank in Saudi Arabia

The outlook for investment in Saudi Arabia remains positive, with continued growth expected across various sectors. However, Deutsche Bank, like any investor, faces potential challenges. Geopolitical factors and regulatory changes will require adaptability and careful risk management.

- Potential Risks and Mitigation Strategies: Addressing potential geopolitical risks and employing effective mitigation strategies are crucial for continued success.

- Long-Term Growth Projections: Positive long-term growth projections for Saudi Arabia indicate continued opportunities for substantial returns on investment.

- Opportunities in Emerging Sectors: Emerging sectors present exciting investment opportunities for Deutsche Bank, particularly in technology and renewable energy.

- Adapting to Changing Regulatory Environments: The ability to adapt to changes in the regulatory landscape will be crucial for navigating the evolving investment climate.

Conclusion: Global Investment in Saudi Arabia: A Deutsche Bank Perspective

Deutsche Bank's strategic approach to investment in Saudi Arabia demonstrates a commitment to long-term growth and alignment with Vision 2030. Their investments have already yielded significant positive impacts on the Saudi economy, creating jobs, fostering technological advancements, and contributing to GDP growth. The future outlook remains promising, but requires careful navigation of potential challenges. Deutsche Bank's role in facilitating global investment in Saudi Arabia is vital, and its continued engagement will contribute significantly to the Kingdom’s ongoing economic transformation. Learn more about how Deutsche Bank is shaping the future of global investment in Saudi Arabia and explore the exciting investment opportunities available.

Featured Posts

-

35 Mal For Kasper Dolberg Analyse Af Potentialet I En Saeson

May 30, 2025

35 Mal For Kasper Dolberg Analyse Af Potentialet I En Saeson

May 30, 2025 -

Isere Les Attaques Contre Les Prisons Et La Visite Ministerielle Sous Le Feu Des Critiques

May 30, 2025

Isere Les Attaques Contre Les Prisons Et La Visite Ministerielle Sous Le Feu Des Critiques

May 30, 2025 -

Top Riders And Hondas Winning Machines A Winning Combination

May 30, 2025

Top Riders And Hondas Winning Machines A Winning Combination

May 30, 2025 -

Is Manila Bays Vibrancy Sustainable

May 30, 2025

Is Manila Bays Vibrancy Sustainable

May 30, 2025 -

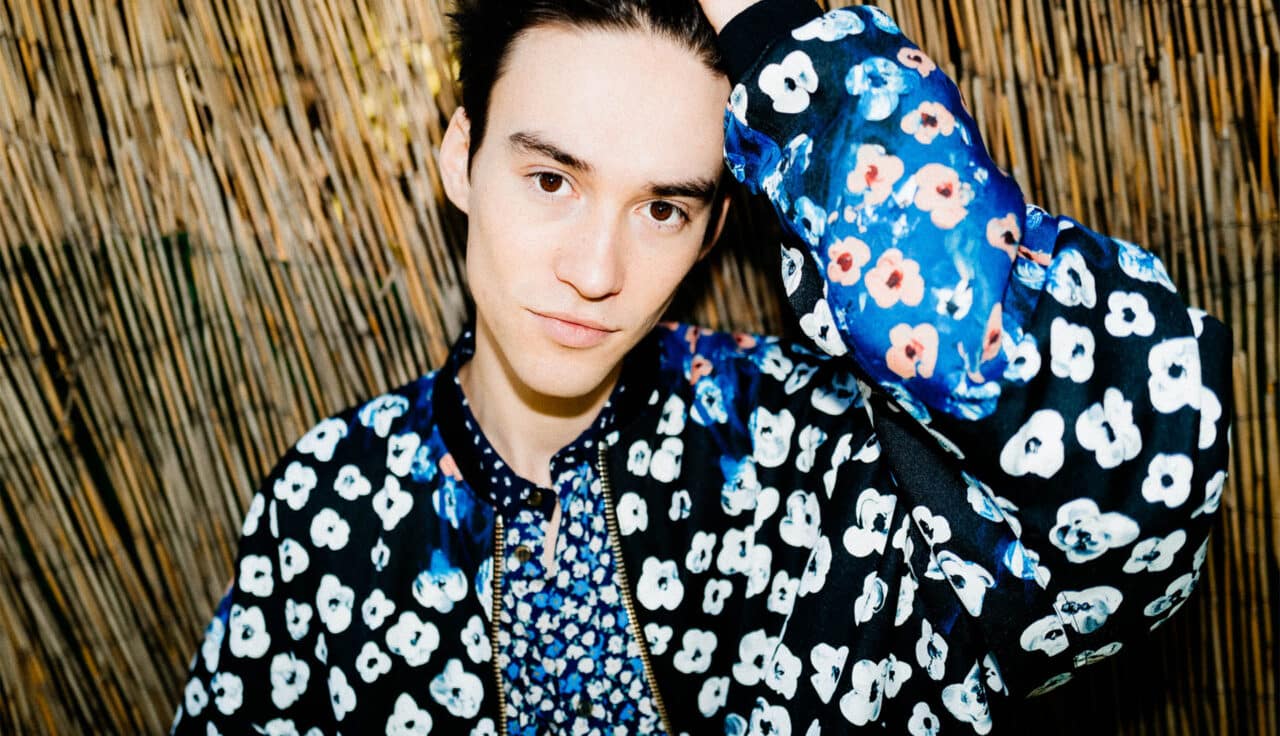

Why Jacob Alon Is One To Watch

May 30, 2025

Why Jacob Alon Is One To Watch

May 30, 2025