Global Economic Uncertainty: Inflation And Unemployment On The Rise

Table of Contents

The Inflationary Spiral: Understanding the Current Crisis

Inflation, a persistent increase in the general price level of goods and services in an economy, is currently at crisis levels in many parts of the world. This inflationary spiral is driven by several interconnected factors.

- Supply Chain Disruptions: The lingering effects of the pandemic, geopolitical instability, and natural disasters have severely disrupted global supply chains, leading to shortages and increased prices.

- Increased Energy Prices: The surge in energy costs, particularly oil and natural gas, is a significant contributor to inflation, impacting transportation, manufacturing, and heating costs.

- Demand-Pull Inflation: Strong consumer demand, fueled in part by government stimulus packages and pent-up demand following lockdowns, has outpaced supply, further driving up prices.

Specific examples of rising prices include:

- Food Prices: The cost of staple foods, such as wheat, corn, and cooking oil, has skyrocketed, impacting food security globally.

- Energy Prices: Electricity bills, gasoline prices, and heating costs have seen dramatic increases, squeezing household budgets.

- Housing Costs: Rent and property prices continue to rise in many areas, making housing increasingly unaffordable.

This relentless increase in the cost of living significantly erodes consumer purchasing power and savings. Governments are responding with measures such as interest rate hikes to cool down the economy and fiscal policy adjustments aimed at supporting vulnerable populations. Understanding the intricacies of the Consumer Price Index (CPI) and its fluctuations is crucial to grasping the severity of the current inflationary crisis.

Unemployment's Upward Trend: A Consequence of Economic Slowdown

The upward trend in unemployment is a direct consequence of the current economic slowdown. As businesses struggle with rising costs and reduced consumer demand, job losses are becoming increasingly common. Several factors contribute to this trend:

- Cyclical Unemployment: Economic downturns lead to decreased production and job cuts.

- Structural Unemployment: Technological advancements and shifts in market demand render certain skills obsolete, leading to long-term unemployment.

- Frictional Unemployment: This refers to temporary unemployment between jobs. While typically short-term, it can become more significant during economic instability.

Global unemployment rates are rising, with particularly concerning trends observed in specific regions. Automation and technological advancements, while increasing productivity, are also contributing to job displacement in various sectors. The social and economic consequences of high unemployment, including increased poverty, social unrest, and reduced tax revenue, pose significant challenges for governments and societies.

The Intertwined Challenges of Inflation and Unemployment: The Stagflation Risk

The simultaneous occurrence of high inflation and high unemployment is known as stagflation. This perilous economic condition is characterized by slow economic growth, high inflation, and high unemployment – a particularly difficult combination to address. Historical examples, such as the stagflation of the 1970s, highlight the devastating consequences: reduced living standards, economic instability, and social upheaval.

Analyzing current economic indicators, such as inflation rates, GDP growth, and unemployment figures, is crucial to assessing the risk of stagflation. The challenge for policymakers lies in implementing economic policies that effectively combat inflation without exacerbating unemployment. This involves navigating the complex inflation-unemployment trade-off and finding effective solutions through monetary and fiscal policies.

Navigating Global Economic Uncertainty: Strategies for Individuals and Businesses

Navigating the current climate of global economic uncertainty requires proactive strategies for both individuals and businesses.

For Individuals:

- Budgeting: Carefully track expenses and create a realistic budget to manage limited resources.

- Saving: Build an emergency fund to cover unexpected expenses and job loss.

- Investing: Diversify investments to mitigate risks and protect savings from inflation.

For Businesses:

- Cost-Cutting Measures: Identify areas for efficiency and cost reduction without compromising quality or essential services.

- Diversification: Expand into new markets or product lines to reduce reliance on single sources of revenue.

- Strategic Planning: Develop adaptable business strategies to respond effectively to changing economic conditions.

Government intervention plays a critical role in mitigating the impact of global economic uncertainty. This includes providing social safety nets, supporting businesses through targeted programs, and implementing effective macroeconomic policies.

Conclusion: Addressing Global Economic Uncertainty

The interconnectedness of inflation and unemployment, the potential risk of stagflation, and the challenges faced by policymakers underscore the severity of global economic uncertainty. This economic volatility significantly impacts individuals, businesses, and governments, demanding proactive and adaptive strategies. Staying informed about current economic trends, adapting financial and business strategies to navigate the present climate, and understanding the implications of global economic uncertainty on your personal and professional life are crucial steps. Further research into macroeconomic indicators, economic policy discussions, and relevant resources will empower you to make informed decisions and navigate this challenging period successfully. Understanding and addressing global economic uncertainty is no longer optional – it is essential for securing a stable and prosperous future.

Featured Posts

-

Harga Dan Spesifikasi Kawasaki W175 Cafe Retro Modern Yang Menggoda

May 30, 2025

Harga Dan Spesifikasi Kawasaki W175 Cafe Retro Modern Yang Menggoda

May 30, 2025 -

Programma Metadoseon M Savvatoy 19 4

May 30, 2025

Programma Metadoseon M Savvatoy 19 4

May 30, 2025 -

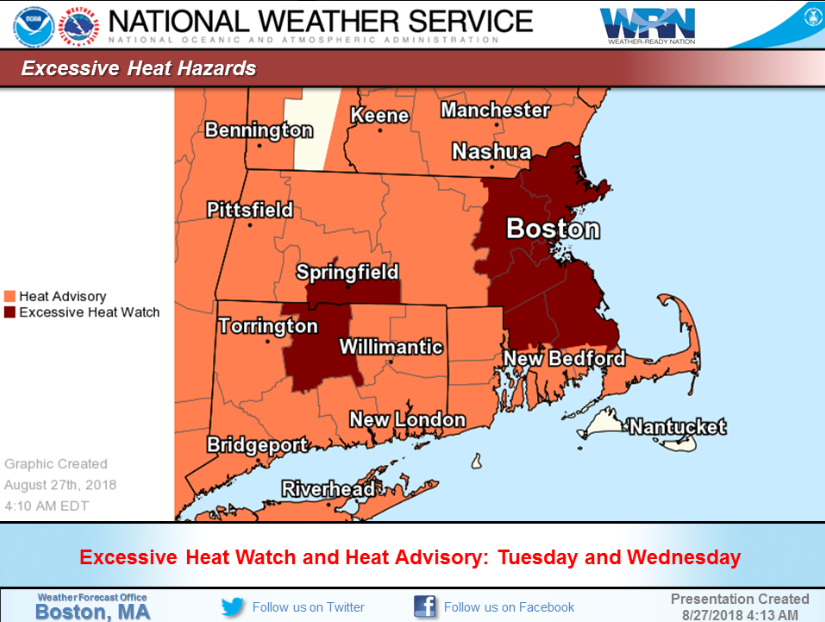

Reduced Excessive Heat Warnings Explaining The New Approach

May 30, 2025

Reduced Excessive Heat Warnings Explaining The New Approach

May 30, 2025 -

Friday Forecast Continued Drop For Live Music Stocks

May 30, 2025

Friday Forecast Continued Drop For Live Music Stocks

May 30, 2025 -

Ti Na Deite Stin Tileorasi Tin Kyriaki 11 5

May 30, 2025

Ti Na Deite Stin Tileorasi Tin Kyriaki 11 5

May 30, 2025