Global Bond Market Instability: A Posthaste Analysis Of Current Risks

Table of Contents

Rising Interest Rates and their Impact on Bond Yields

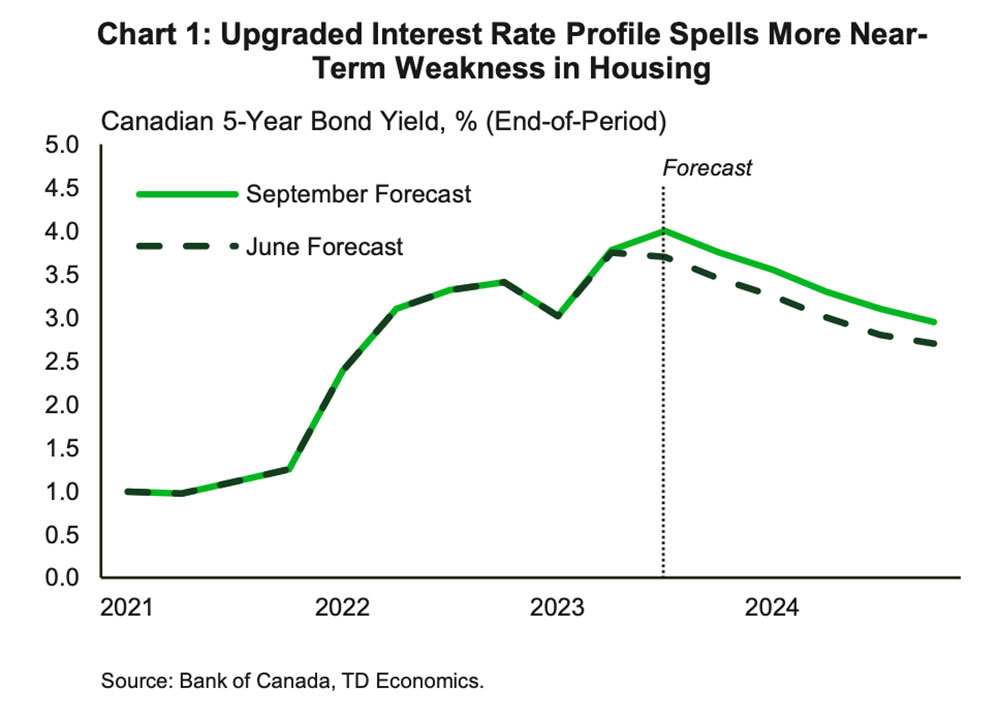

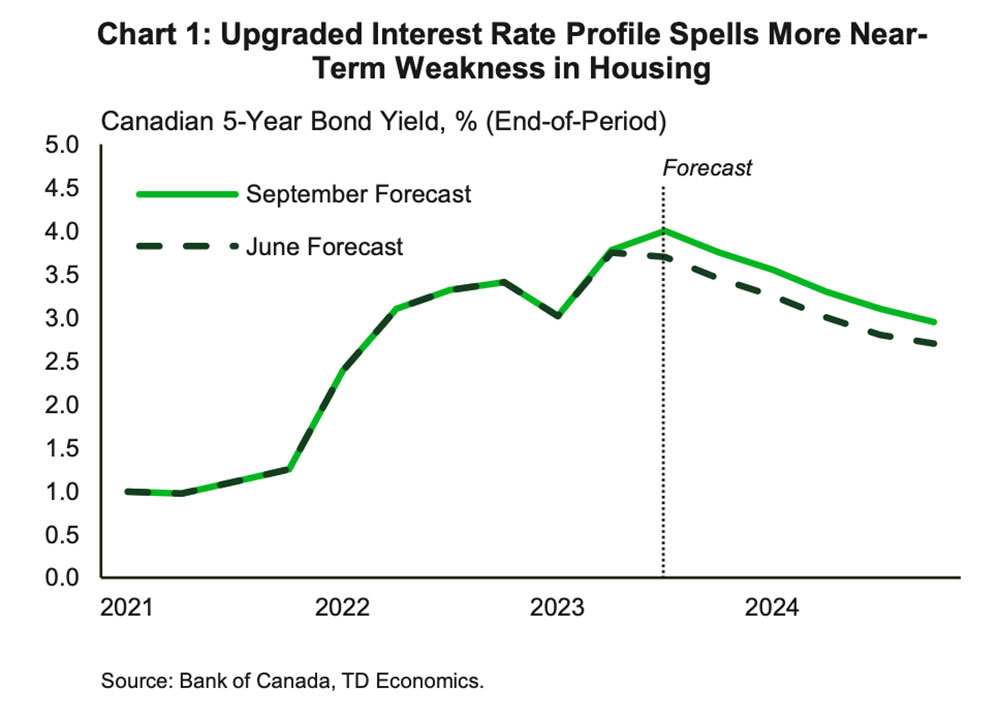

The relationship between interest rates and bond prices is inversely proportional. When interest rates rise, the yield on newly issued bonds increases, making existing bonds with lower yields less attractive. This leads to a decline in the price of existing bonds to match the higher yields available in the market. Central bank monetary policies play a pivotal role in this dynamic. For example, aggressive quantitative tightening (QT) by major central banks, like the Federal Reserve, directly impacts bond yields by reducing the money supply and increasing borrowing costs.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and corporations to borrow money, impacting their ability to finance projects and operations.

- Reduced demand for existing bonds, leading to price declines: As new bonds offer higher yields, investors are less inclined to hold existing bonds with lower yields, pushing their prices down.

- Potential for capital losses for bond investors: Price declines in the bond market translate to capital losses for investors holding those bonds, particularly those with longer maturities.

- Impact on different bond types: The impact of rising interest rates varies across different bond types. Government bonds, typically considered safer, might experience less dramatic price declines than higher-risk corporate bonds or emerging market debt. This difference highlights the significance of understanding interest rate risk and diversifying your bond portfolio. Analyzing the bond yield curve – the relationship between yields and maturities – becomes crucial for assessing risk and return.

Geopolitical Risks and their Influence on Bond Market Volatility

Geopolitical events and political uncertainty significantly influence investor sentiment and bond market volatility. Global conflicts, political instability, and unexpected policy shifts can trigger a "flight to safety," where investors move their capital into perceived safe-haven assets like government bonds of countries deemed politically and economically stable.

- Increased demand for safe-haven assets like government bonds: During times of geopolitical turmoil, investors flock to government bonds, driving up their prices and lowering their yields. This increased demand often benefits the bonds of countries perceived as politically stable and economically robust.

- Potential for capital flight from emerging markets: Emerging markets are particularly vulnerable to geopolitical risks. Investor confidence can quickly erode, leading to capital flight and sharp declines in the value of emerging market debt.

- Impact of sanctions and trade wars on bond markets: International sanctions and trade wars can severely disrupt global trade and investment flows, negatively impacting bond markets, particularly for countries directly involved.

- Examples of specific geopolitical events and their impact: The war in Ukraine, for instance, has significantly increased geopolitical risk, impacting global bond markets and causing increased volatility. Analyzing past geopolitical events and their effect on bond yields is crucial for understanding current market dynamics. This includes examining the impact of sovereign debt crises and the subsequent flight to safety.

Inflationary Pressures and their Effect on Bond Returns

Inflation erodes the purchasing power of money, significantly affecting bond returns. When inflation rises faster than the yield on a bond, the real return – the return after adjusting for inflation – becomes negative. Central bank responses to inflation also play a critical role. Aggressive interest rate hikes aimed at curbing inflation can negatively impact bond prices, creating further volatility.

- Erosion of purchasing power for bondholders: High inflation diminishes the real value of future bond payments, reducing the overall return for investors. This is particularly true for bonds with longer maturities.

- Central bank response to inflation and its effect on bond markets: Central banks' actions to combat inflation, such as raising interest rates, can trigger market volatility and affect bond prices. Understanding the central bank's strategy is vital for navigating the market.

- Impact of inflation expectations on bond yields: Investors' expectations about future inflation significantly influence bond yields. Higher inflation expectations lead to higher demanded yields to compensate for the erosion of purchasing power.

- Strategies for mitigating inflation risk in bond portfolios: Investors can mitigate inflation risk through diversification strategies, including investing in inflation-protected securities (TIPS), which adjust their principal based on the inflation rate, and diversifying across different asset classes.

Assessing Credit Risk in the Current Environment

The current economic climate presents increased credit risk, particularly within the corporate bond market. An economic slowdown can lead to higher corporate defaults as companies struggle to meet their debt obligations.

- Increased scrutiny of corporate credit ratings: Credit rating agencies are closely monitoring the creditworthiness of corporations, and downgrades are becoming more frequent.

- Potential for downgrades and defaults: As economic conditions worsen, the risk of corporate bond downgrades and defaults increases, potentially leading to significant losses for investors.

- Strategies for managing credit risk in bond portfolios: Diversification, careful credit analysis, and focusing on investment-grade bonds are crucial strategies to manage credit risk.

- Importance of credit analysis and due diligence: Thorough due diligence, including a comprehensive review of a company's financial statements and industry outlook, is crucial before investing in corporate bonds.

Conclusion

The global bond market is facing a complex interplay of risks: rising interest rates, geopolitical instability, and inflationary pressures. These factors are interconnected, amplifying their overall impact. The potential consequences for investors and the global economy are significant, ranging from capital losses to broader economic instability. Understanding and managing the risks associated with global bond market instability is crucial for investors. Stay informed about market developments and consider seeking professional advice to navigate this challenging environment. Learn more about mitigating bond market volatility and protecting your investments by [link to relevant resource/service].

Featured Posts

-

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifying Tie

May 23, 2025

Kazakhstan Stuns Australia In Billie Jean King Cup Qualifying Tie

May 23, 2025 -

The Future Of Ai Hardware Open Ai And Jony Ives Collaboration

May 23, 2025

The Future Of Ai Hardware Open Ai And Jony Ives Collaboration

May 23, 2025 -

Kieran Culkin As Caesar Flickerman In The Hunger Games Sunrise On The Reaping Confirmed

May 23, 2025

Kieran Culkin As Caesar Flickerman In The Hunger Games Sunrise On The Reaping Confirmed

May 23, 2025 -

Triumfalnoe Vozvraschenie Kazakhstan V Finale Kubka Billi Dzhin King

May 23, 2025

Triumfalnoe Vozvraschenie Kazakhstan V Finale Kubka Billi Dzhin King

May 23, 2025 -

Pete Townshend The Performance And Collaboration Masterclass

May 23, 2025

Pete Townshend The Performance And Collaboration Masterclass

May 23, 2025

Latest Posts

-

The Last Rodeo Examining Neal Mc Donoughs Character

May 23, 2025

The Last Rodeo Examining Neal Mc Donoughs Character

May 23, 2025 -

Neal Mc Donoughs Role In The Last Rodeo

May 23, 2025

Neal Mc Donoughs Role In The Last Rodeo

May 23, 2025 -

Smart Shopping For Memorial Day 2025 Best Sales And Deals

May 23, 2025

Smart Shopping For Memorial Day 2025 Best Sales And Deals

May 23, 2025 -

Dallas Welcomes The Usa Film Festival Free Movies And Star Guests

May 23, 2025

Dallas Welcomes The Usa Film Festival Free Movies And Star Guests

May 23, 2025 -

Dc Legends Of Tomorrow The Ultimate Fans Resource

May 23, 2025

Dc Legends Of Tomorrow The Ultimate Fans Resource

May 23, 2025