Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Recent Financial Performance and Key Metrics

Analyzing Gibraltar Industries' recent quarterly and annual performance is vital for predicting future earnings. We'll examine key financial metrics to gauge the company's health and trajectory.

-

Review of previous quarter's revenue growth and profitability: [Insert data on previous quarter's revenue growth percentage and net income/profit margin. Example: "In the previous quarter, Gibraltar Industries reported a 5% year-over-year revenue growth and a net income margin of 12%."] This demonstrates the company's ability to generate revenue and translate it into profit. Investors should look for consistent and increasing profitability.

-

Analysis of gross margins and operating expenses: [Insert data on gross margin and operating expenses. Example: "Gross margins remained steady at 35%, while operating expenses increased by 3% due to [mention specific reasons, e.g., increased material costs or investments in R&D]."] Understanding these cost structures is crucial for projecting future earnings. Sustained or improved gross margins suggest efficient operations and pricing power.

-

Comparison to analyst expectations and industry benchmarks: [Compare reported data to analyst consensus estimates and industry averages. Example: "The previous quarter's results slightly exceeded analyst expectations, outperforming industry competitors in terms of revenue growth."] This contextualizes Gibraltar Industries' performance relative to its peers and market expectations.

-

Key performance indicators (KPIs) to watch: Beyond revenue and EPS, watch for changes in backlog, order rates, and pricing actions. These offer insights into future performance. [Insert any available data or expected trends in these KPIs.] Tracking these indicators provides a more comprehensive understanding of Gibraltar Industries’ financial health.

Market Trends and Industry Outlook

The building products and infrastructure markets are significantly impacted by macroeconomic conditions. Understanding these trends is essential for predicting Gibraltar Industries' performance.

-

Impact of inflation and supply chain disruptions: [Discuss the effects of inflation on material costs and supply chain disruptions on production and delivery timelines. Example: "Continued inflationary pressures and lingering supply chain issues pose challenges for Gibraltar Industries, potentially affecting production costs and delivery schedules."] Analyzing the company’s mitigation strategies is crucial here.

-

Analysis of demand for Gibraltar Industries' products: [Assess the demand for the company's products based on industry trends and macroeconomic factors like housing starts and infrastructure spending. Example: "Despite macroeconomic headwinds, demand for sustainable building materials remains robust, presenting a growth opportunity for Gibraltar Industries."]

-

Examination of the competitive landscape and potential threats: [Identify key competitors and potential threats to Gibraltar Industries’ market share. Example: "Competition in the building products sector is intense, with several established players vying for market share. Gibraltar Industries' competitive advantage lies in [mention their unique selling proposition]."]

-

Relevant macroeconomic factors (e.g., interest rates, housing starts): [Analyze the influence of interest rates and housing starts on the demand for Gibraltar Industries’ products. Example: "Rising interest rates could dampen demand in the housing market, potentially impacting sales of certain Gibraltar Industries products."]

Analyst Expectations and Price Targets

Analyst forecasts provide valuable insights into market sentiment and future expectations for Gibraltar Industries (ROCK).

-

Review of average EPS estimates and revenue projections: [Summarize the consensus estimates for EPS and revenue for the upcoming quarter. Example: "Analysts forecast an EPS of $X.XX and revenue of $Y.YY for the current quarter, representing a [percentage]% increase/decrease year-over-year."]

-

Highlight any significant revisions to analyst forecasts: [Mention any upward or downward revisions in analyst forecasts and their reasons. Example: "Several analysts have recently upgraded their forecasts for Gibraltar Industries, citing increased demand and improved supply chain conditions."]

-

Discuss the range of price targets and their implications: [Discuss the range of price targets set by different analysts and their implications for investors. Example: "Price targets for Gibraltar Industries range from $Z to $W, indicating a potential upside/downside of [percentage]% from the current market price."]

-

Mention any notable upgrades or downgrades from analysts: [Highlight any significant changes in analyst ratings, along with their justifications. Example: "Analyst firm XYZ upgraded Gibraltar Industries to a 'Buy' rating, citing strong growth potential in the renewable energy sector."]

Potential Upside and Downside Risks for Gibraltar Industries (ROCK) Earnings

Several factors could influence Gibraltar Industries' upcoming earnings report.

-

Positive: Strong demand for its products, successful new product launches, effective cost-cutting measures, and strategic acquisitions could boost earnings.

-

Negative: Supply chain disruptions, increased material costs, a macroeconomic slowdown, intense competition, and unforeseen geopolitical events could negatively impact the results. Careful consideration of these factors is critical for accurate forecasting.

Conclusion

This preview of Gibraltar Industries (ROCK) earnings has highlighted key factors to consider as the company prepares to release its next financial report. By analyzing recent performance, market trends, and analyst expectations, investors can gain a clearer understanding of the potential outcomes. While positive indicators exist, potential risks should also be carefully evaluated. Remember to conduct your own thorough research before making any investment decisions related to Gibraltar Industries (ROCK) earnings. Stay tuned for the official announcement and further analysis following the release of the Gibraltar Industries (ROCK) earnings report. Understanding the intricacies of Gibraltar Industries (ROCK) earnings is vital for informed investment strategies.

Featured Posts

-

Court Upholds Trump Administrations Use Of Irs Data In Undocumented Immigrant Search

May 13, 2025

Court Upholds Trump Administrations Use Of Irs Data In Undocumented Immigrant Search

May 13, 2025 -

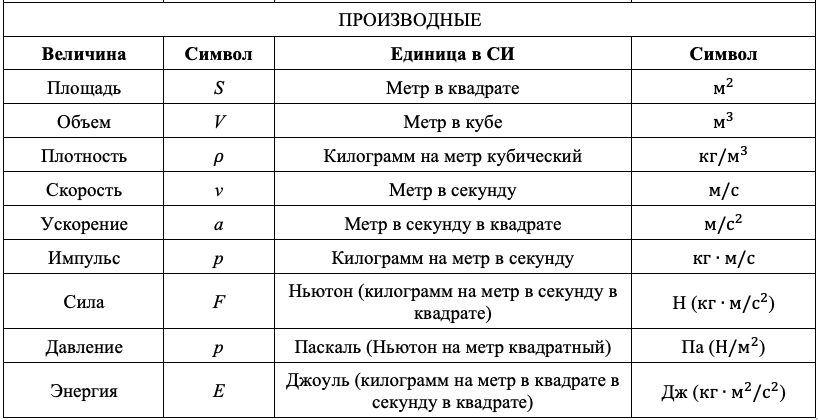

Doshkolnoe Obrazovanie Obnovlennye Standarty Po Fizike I Khimii

May 13, 2025

Doshkolnoe Obrazovanie Obnovlennye Standarty Po Fizike I Khimii

May 13, 2025 -

White South Africans Granted Us Refugee Status Under Trump Arrive In America

May 13, 2025

White South Africans Granted Us Refugee Status Under Trump Arrive In America

May 13, 2025 -

A Szerelem Es A Gyuloelet Hollywoodban Filmes Parok Akik Nem Birtak Egymast

May 13, 2025

A Szerelem Es A Gyuloelet Hollywoodban Filmes Parok Akik Nem Birtak Egymast

May 13, 2025 -

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025