Gibraltar Highlights At The Sidoti Small-Cap Conference

Table of Contents

Gibraltar's Overall Performance and Financial Highlights

Gibraltar showcased strong financial performance, exceeding expectations in several key areas. The presentation highlighted impressive growth and solidified investor confidence in the company's trajectory.

Revenue Growth and Key Performance Indicators (KPIs)

Gibraltar reported robust revenue growth, significantly outpacing industry averages.

- Year-over-Year Revenue Growth: [Insert Percentage]% increase in revenue compared to the previous year.

- EBITDA: [Insert Figure] demonstrating strong profitability and operational efficiency.

- Net Income: [Insert Figure] reflecting a healthy bottom line.

- Awards and Recognitions: [Mention any awards received, e.g., "Recently awarded 'Best in Class' for innovation by [Awarding Organization]'"]

[Insert a relevant chart or graph visualizing revenue growth and key KPIs here.] This visual representation further emphasizes Gibraltar's strong financial performance.

Financial Strategy and Outlook

Gibraltar outlined a well-defined financial strategy focused on strategic investments and efficient capital allocation. The company plans to continue investing in research and development to maintain its competitive edge and expand its product portfolio.

- Capital Allocation: Focus on reinvesting profits into high-growth areas and exploring strategic acquisitions.

- Short-Term Outlook: Maintain strong revenue growth and improve profitability margins.

- Long-Term Outlook: Expand market share, explore new geographic markets, and diversify revenue streams.

- Guidance: [Mention any specific financial guidance provided for the upcoming year(s).]

Key Strategic Initiatives and Developments

Beyond strong financials, Gibraltar's presentation showcased exciting strategic initiatives poised to drive future growth.

New Product Launches or Services

Gibraltar unveiled [Name of new product/service], a game-changing innovation targeting the [target market segment] market. This new offering leverages [mention key features and technologies] to offer a superior solution compared to existing alternatives. Market penetration is projected at [Percentage]% within the first [Timeframe].

Strategic Partnerships and Acquisitions

The company highlighted the recent strategic partnership with [Partner Name], which will enhance Gibraltar's [mention specific area of improvement, e.g., distribution network, technological capabilities]. This collaboration is expected to result in significant synergies and increased market reach. [Mention any acquisitions and their expected impact].

Expansion Plans and Market Penetration

Gibraltar outlined ambitious expansion plans, including geographic expansion into [mention new target markets] and diversification into new product categories like [mention new categories]. Their market penetration strategy will leverage [mention key strategies, e.g., digital marketing, strategic partnerships].

Management's Q&A Session and Investor Sentiment

The Q&A session provided further insight into Gibraltar's plans and addressed key investor concerns.

Key Questions and Answers from the Q&A

Analysts and investors focused on key questions surrounding Gibraltar's growth strategies, financial projections, and risk mitigation plans. Management addressed these concerns transparently, building investor confidence. [Summarize 2-3 key questions and answers here].

Overall Investor Reception and Market Reaction

The overall investor sentiment following Gibraltar's presentation was overwhelmingly positive. The detailed presentation, coupled with the strong financial performance and strategic initiatives, significantly boosted investor confidence. [Mention any stock price movements or relevant financial news articles here. Include links if available.]

Conclusion: Key Takeaways and Call to Action

Gibraltar's presentation at the Sidoti Small-Cap Conference highlighted impressive financial results, innovative strategic initiatives, and a positive outlook for the future. The strong revenue growth, coupled with the unveiling of new products and strategic partnerships, underscore the company's commitment to growth and innovation. The positive investor reception reflects a strong belief in Gibraltar's future prospects. Stay updated on Gibraltar's progress and future Gibraltar Highlights at the Sidoti Small-Cap Conference by visiting [link to investor relations website].

Featured Posts

-

Will Elsbeth Defeat Judge Crawford Good Fight Season 2 Episode 18 Preview

May 13, 2025

Will Elsbeth Defeat Judge Crawford Good Fight Season 2 Episode 18 Preview

May 13, 2025 -

Las Vegas Aces Release Player Amidst Training Camp Cuts

May 13, 2025

Las Vegas Aces Release Player Amidst Training Camp Cuts

May 13, 2025 -

No New Elsbeth On March 20th When To Expect Season 2 Episode 16

May 13, 2025

No New Elsbeth On March 20th When To Expect Season 2 Episode 16

May 13, 2025 -

Sabalenka Triumphs Over Gauff At Madrid Open

May 13, 2025

Sabalenka Triumphs Over Gauff At Madrid Open

May 13, 2025 -

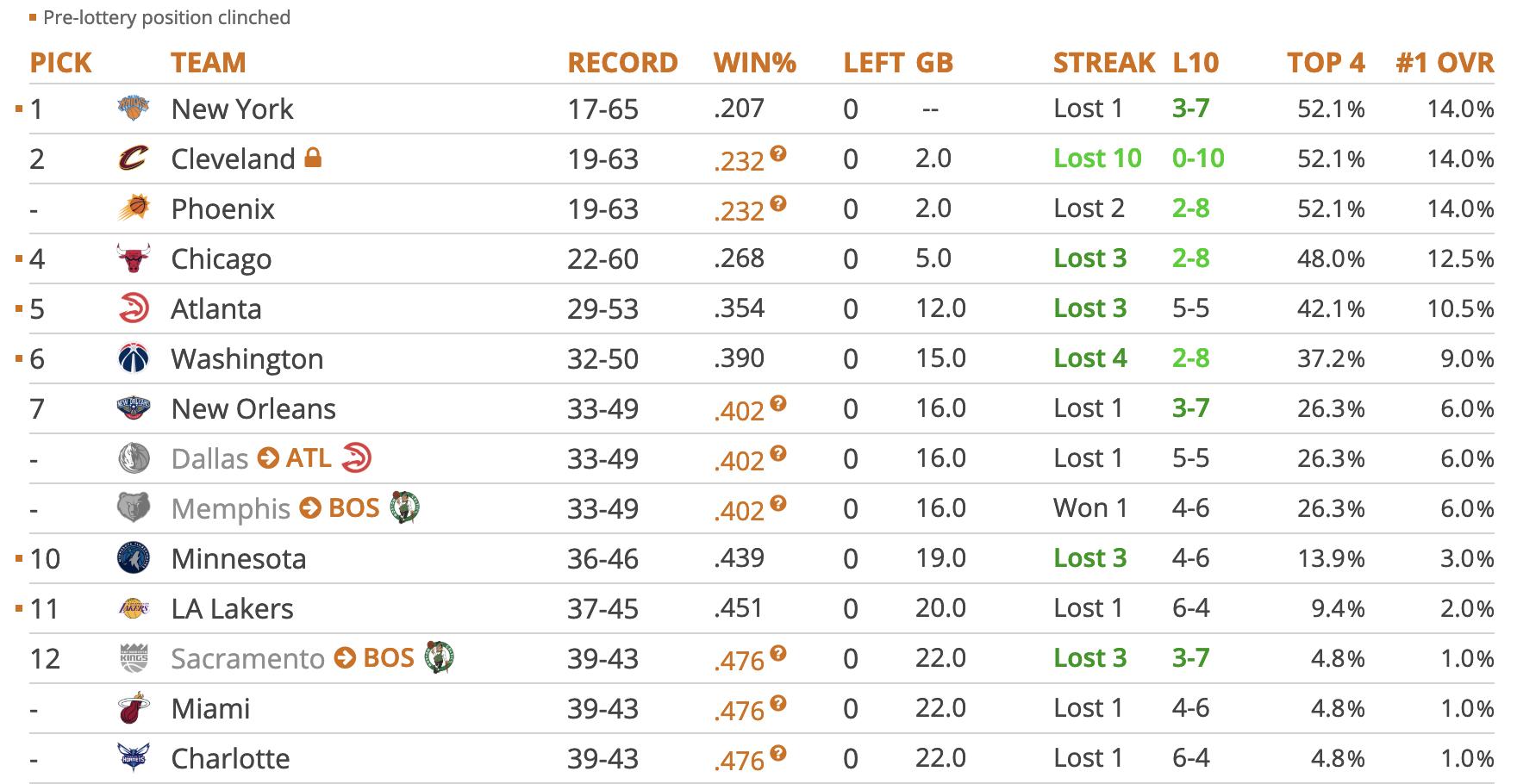

Nba Tankathon More Than Just A Game For Miami Heat Fans

May 13, 2025

Nba Tankathon More Than Just A Game For Miami Heat Fans

May 13, 2025