Get The Best Personal Loan Interest Rates Today: Financing From 6%

Table of Contents

Understanding Personal Loan Interest Rates

Understanding personal loan interest rates is crucial for securing the best deal. The interest rate is the cost of borrowing money, expressed as a percentage of the principal loan amount. This percentage is applied annually, hence the term Annual Percentage Rate (APR). The APR represents the total cost of the loan, including interest and any fees. A lower APR means you'll pay less overall.

Several factors influence the interest rate you'll receive:

- Credit Score: Your credit score is the most significant factor. A higher credit score demonstrates your creditworthiness to lenders, resulting in lower interest rates. Aim for a score above 700 for the best rates.

- Loan Amount: Generally, larger loan amounts may come with slightly higher interest rates due to the increased risk for the lender.

- Loan Term: The length of the loan (loan term) impacts your interest rate. Shorter loan terms typically result in lower interest rates because the lender's risk is reduced.

Improving Your Credit Score for Better Rates

A good credit score is paramount for securing low personal loan interest rates. Lenders use your credit score to assess your risk. A higher score signals to lenders that you're a responsible borrower, making you a less risky investment. Here's how to improve your credit score:

-

Pay Bills on Time: Consistent on-time payments are the most significant factor influencing your credit score. Set up automatic payments to avoid late fees and negative marks on your report.

-

Keep Credit Utilization Low: Credit utilization refers to the amount of credit you're using compared to your total available credit. Aim to keep your credit utilization below 30% to avoid negatively impacting your score.

-

Monitor Your Credit Report for Errors: Regularly check your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) for any inaccuracies. Dispute any errors you find to ensure your score reflects your true creditworthiness.

-

Check your credit report regularly (using free services): AnnualCreditReport.com is a great resource for free credit reports.

-

Dispute any inaccuracies on your credit report: Don't hesitate to contact the credit bureaus to correct any mistakes.

-

Consider a secured credit card to build credit: If you have limited credit history, a secured card can help you establish credit responsibly.

Comparing Loan Offers from Different Lenders

Once you've worked on improving your credit score, it's time to compare loan offers. Don't settle for the first offer you receive. Shop around! Compare offers from various lenders, including banks, credit unions, and online lenders. Using online comparison tools can streamline this process.

- Don't settle for the first offer you receive: Take the time to explore different options.

- Compare APR, fees, and repayment terms carefully: Don't just focus on the interest rate; consider all associated costs.

- Read the fine print before signing any loan agreement: Understand all terms and conditions before committing to a loan.

Finding Personal Loans with 6% Interest Rates (or Lower)

Securing a personal loan with a 6% interest rate or lower is achievable, but it typically requires excellent credit and favorable loan terms. Credit unions are often a good place to start your search, as they frequently offer competitive rates and may have more flexible lending criteria than traditional banks.

- Focus on lenders known for competitive rates: Research and compare lenders known for offering lower interest rates.

- Consider loans with shorter repayment periods for lower rates: While shorter terms mean higher monthly payments, they generally result in lower overall interest costs.

- Explore options like balance transfers for existing high-interest debts: Consolidating high-interest debt onto a lower-rate personal loan can save you money.

Securing the Best Personal Loan for Your Needs

Choose a loan type that aligns with your financial situation and goals. Secured loans require collateral (like a car or savings account), while unsecured loans don't. Unsecured loans typically have higher interest rates due to the increased risk for the lender.

- Carefully consider your financial situation before applying: Ensure you can comfortably afford the monthly payments.

- Ensure you can comfortably afford the monthly payments: Create a realistic budget to ensure repayment is manageable.

- Understand the terms and conditions of the loan: Read the fine print carefully before signing any loan agreement.

Conclusion

Getting the best personal loan interest rates, potentially even financing from 6%, is achievable with careful planning and strategic steps. By improving your credit score, comparing loan offers diligently, and understanding your financial needs, you can significantly reduce the overall cost of borrowing. Don't delay your financial goals; start your search for the best personal loan interest rates today! Find the perfect financing solution that fits your budget and secure the best personal loan interest rates for your situation.

Featured Posts

-

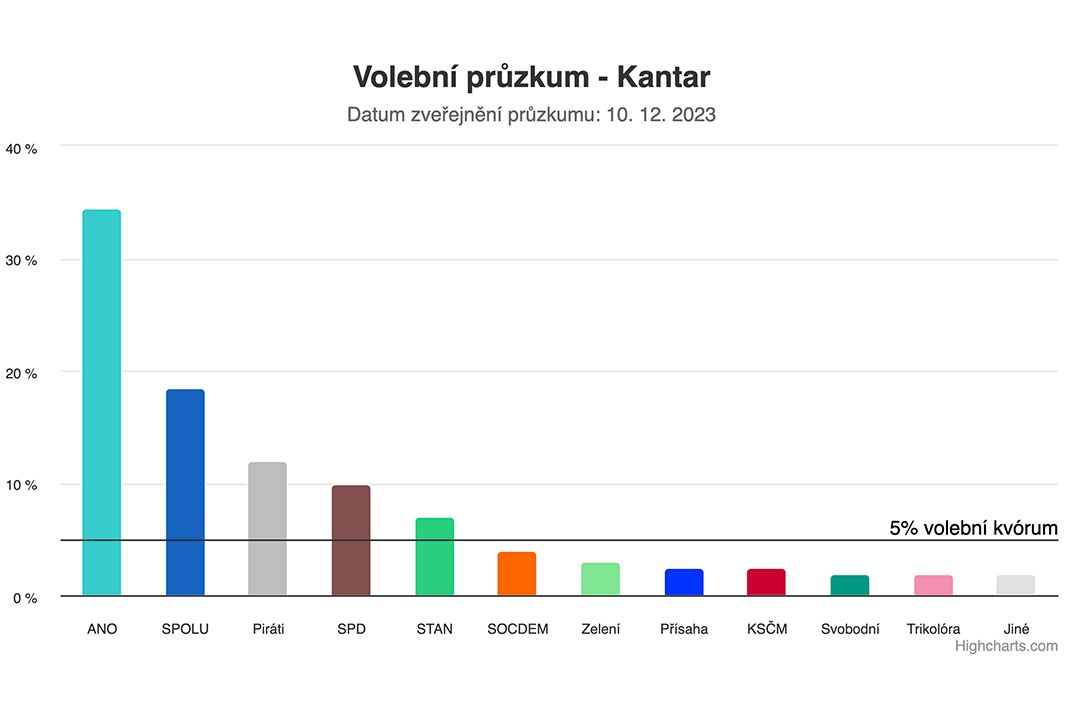

Pirati A Zeleni Spoluprace Pro Volby Do Poslanecke Snemovny

May 28, 2025

Pirati A Zeleni Spoluprace Pro Volby Do Poslanecke Snemovny

May 28, 2025 -

Where To Watch Arizona Diamondbacks Games Without Cable In 2025

May 28, 2025

Where To Watch Arizona Diamondbacks Games Without Cable In 2025

May 28, 2025 -

Sinners Straight Sets Win Over Rinderknech At Roland Garros 2025

May 28, 2025

Sinners Straight Sets Win Over Rinderknech At Roland Garros 2025

May 28, 2025 -

Jannik Sinners Comeback Hamburg Tournament Confirmed

May 28, 2025

Jannik Sinners Comeback Hamburg Tournament Confirmed

May 28, 2025 -

Hailee Steinfelds Pregnancy Fact Or Fiction The Josh Allen Connection

May 28, 2025

Hailee Steinfelds Pregnancy Fact Or Fiction The Josh Allen Connection

May 28, 2025

Latest Posts

-

Kalyteres Tileoptikes Ekpompes Savvatoy 3 5

May 30, 2025

Kalyteres Tileoptikes Ekpompes Savvatoy 3 5

May 30, 2025 -

Primera For Women Effective Natural Ingredients For Bladder Health

May 30, 2025

Primera For Women Effective Natural Ingredients For Bladder Health

May 30, 2025 -

A Study Of Manila Bays Environmental Health

May 30, 2025

A Study Of Manila Bays Environmental Health

May 30, 2025 -

Nissan Primera Electric Sedan Comeback Or Rumor

May 30, 2025

Nissan Primera Electric Sedan Comeback Or Rumor

May 30, 2025 -

Can Manila Bay Maintain Its Vibrancy

May 30, 2025

Can Manila Bay Maintain Its Vibrancy

May 30, 2025