Gas Prices Fall As Economic Concerns Mount: National Average Under $3

Table of Contents

Factors Contributing to the Decline in Gas Prices

Several interconnected factors are driving the current decline in gas prices. Understanding these elements is crucial to grasping the full context of this seemingly contradictory situation.

Reduced Demand

High inflation and rising interest rates are significantly impacting consumer spending. This translates to less disposable income for discretionary purchases, including driving. People are driving less, opting for public transport where available, or combining errands to reduce fuel consumption.

- Reduced consumer spending: Recent reports from the Bureau of Economic Analysis show a marked decrease in consumer spending on non-essential goods and services, impacting gasoline demand.

- Increased interest rates: Higher interest rates make borrowing more expensive, further dampening consumer confidence and reducing spending on fuel.

- Changes in driving habits: Anecdotal evidence and surveys suggest a shift in driving behavior, with consumers consciously reducing their mileage to save money. AAA reports show a noticeable decrease in daily commutes and leisure driving.

Increased Oil Supply

The global oil market plays a vital role in determining gas prices. Recent developments have contributed to an increase in the oil supply.

- OPEC+ production increases: The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have gradually increased their oil production, helping to alleviate supply constraints.

- Strategic Petroleum Reserve releases: Government intervention, such as the release of oil from strategic petroleum reserves in various countries, has also added to the available supply.

- Impact of sanctions on Russian oil: While sanctions on Russian oil have disrupted the market, alternative supply sources have partially offset the impact, contributing to the increased global oil supply. The International Energy Agency (IEA) provides regular updates on global oil production and supply dynamics.

Refineries Catching Up

The efficiency and capacity of oil refineries also influence gas prices. Recent improvements in this area have contributed to the current decline.

- Recovery from shutdowns: Many refineries experienced shutdowns and operational disruptions in the past due to various factors, including maintenance and supply chain issues. The recovery of this refining capacity is now contributing to increased gasoline supply.

- Refining capacity expansion: Some refineries have undergone expansion or modernization projects, enhancing their processing capacity and overall efficiency. Industry reports from organizations like the American Fuel & Petrochemical Manufacturers (AFPM) track these developments.

The Paradox: Falling Gas Prices Amidst Economic Uncertainty

The simultaneous occurrence of falling gas prices and growing economic anxieties creates a fascinating paradox. While lower gas prices offer some relief, the broader economic picture remains uncertain.

Inflationary Pressures

Falling gas prices can alleviate inflationary pressures, as gasoline is a significant component of the Consumer Price Index (CPI). However, this effect is limited, as overall inflation remains stubbornly high due to various other factors.

- CPI impact: A reduction in gas prices directly impacts the CPI calculation, leading to a slight decrease in the overall inflation rate.

- Overall inflationary environment: While gas prices are falling, other goods and services continue to experience price increases, maintaining a high inflationary environment.

Economic Recession Risks

Despite the current fall in gas prices, the risk of a recession remains a significant concern. A recession could lead to even lower gas prices due to reduced demand, but this would be a consequence of a broader economic downturn.

- Demand reduction in a recession: During a recession, consumer spending plummets across the board, leading to a further decrease in demand for gasoline.

- Uncertainty surrounding economic predictions: Economic forecasts remain uncertain, making it difficult to predict the precise impact of a potential recession on gas prices.

Geopolitical Instability

Global geopolitical events continue to impact the energy market and gas prices, creating volatility and uncertainty.

- The war in Ukraine: The ongoing war in Ukraine continues to disrupt global oil supply chains and create significant uncertainty in the energy market.

- Potential for future volatility: Unexpected geopolitical developments could easily cause sudden shifts in gas prices, reversing the current downward trend.

Looking Ahead: Predictions and Potential Scenarios for Gas Prices

Predicting future gas prices involves considering both short-term and long-term factors.

Short-Term Outlook

The short-term outlook for gas prices depends on several interconnected factors.

- Seasonal changes in demand: Gas prices often fluctuate seasonally, with higher demand during summer travel months.

- Unexpected geopolitical events: Unexpected global events can trigger significant price swings.

- Shifts in oil production: Changes in OPEC+ production policies or unexpected disruptions in oil supply can influence gas prices.

Long-Term Outlook

The long-term outlook for gas prices is intertwined with the energy transition.

- Energy transition and renewable energy development: The global shift towards renewable energy sources, such as solar and wind power, will likely have a significant long-term impact on demand for gasoline.

- Electric vehicle adoption: The growing adoption of electric vehicles (EVs) will gradually reduce the demand for gasoline over time.

Conclusion: Gas Prices Fall as Economic Concerns Mount: What It Means for You

The fall in gas prices, despite rising economic anxieties, is a complex phenomenon driven by a confluence of factors, including reduced consumer demand, increased oil supply, and improved refinery operations. While lower gas prices offer some temporary relief from inflation, the broader economic outlook remains uncertain. Consumers should strategically utilize lower gas prices while maintaining fiscal prudence given the ongoing economic uncertainty.

Stay informed about fluctuations in gas prices by regularly checking reputable sources for the latest updates and analysis of gas price trends. Understanding the dynamics of gas price changes is key to navigating the current economic climate effectively.

Featured Posts

-

April Nyc Concert Vybz Kartel To Headline Barclay Center

May 22, 2025

April Nyc Concert Vybz Kartel To Headline Barclay Center

May 22, 2025 -

Klopps Liverpool Transforming Doubters Into Believers A Journey Through The Years

May 22, 2025

Klopps Liverpool Transforming Doubters Into Believers A Journey Through The Years

May 22, 2025 -

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 22, 2025

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 22, 2025 -

Exploring The Downtown Manhattan Real Estate Market A Focus On High Net Worth Buyers

May 22, 2025

Exploring The Downtown Manhattan Real Estate Market A Focus On High Net Worth Buyers

May 22, 2025 -

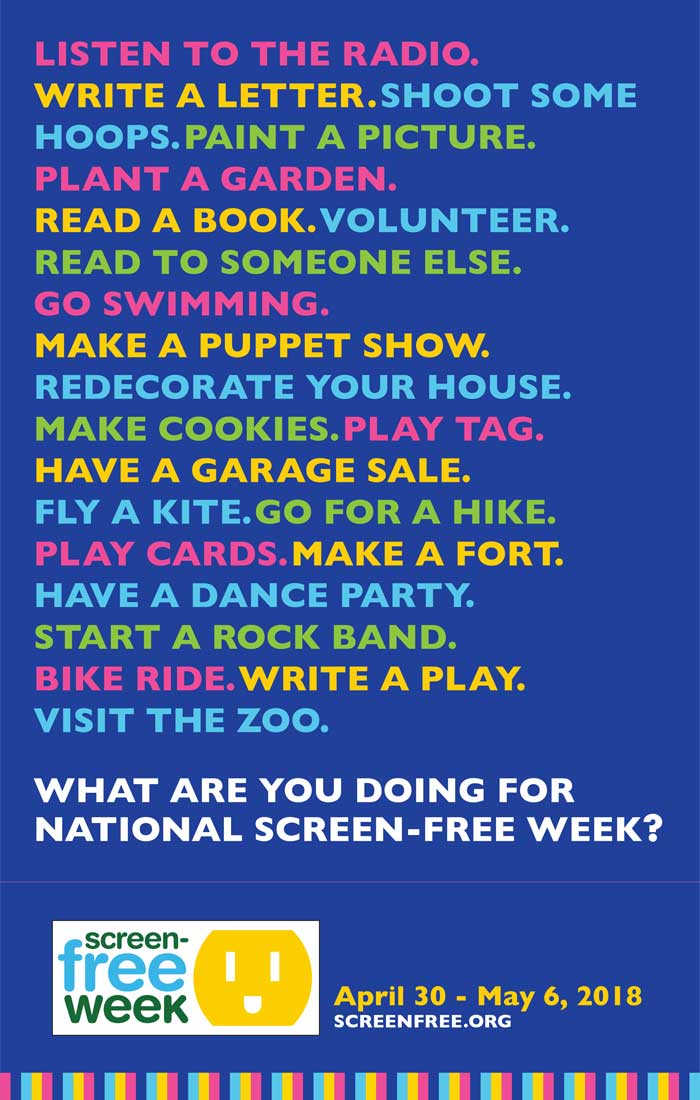

A Parents Guide To A Successful Screen Free Week

May 22, 2025

A Parents Guide To A Successful Screen Free Week

May 22, 2025

Latest Posts

-

Noviy Zakonoproekt Pro Sanktsiyi Zagroza Rosiyi Vid Lindsi Grem

May 22, 2025

Noviy Zakonoproekt Pro Sanktsiyi Zagroza Rosiyi Vid Lindsi Grem

May 22, 2025 -

Washington Attack Chancellor Merz Issues Strong Condemnation

May 22, 2025

Washington Attack Chancellor Merz Issues Strong Condemnation

May 22, 2025 -

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Posilenni Tisku

May 22, 2025

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Posilenni Tisku

May 22, 2025 -

Latest Developments Israeli Diplomat Shot In Washington

May 22, 2025

Latest Developments Israeli Diplomat Shot In Washington

May 22, 2025 -

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025