G-7's Consideration Of Reduced De Minimis Tariffs For Chinese Imports

Table of Contents

Understanding De Minimis Tariffs and Their Impact on Chinese Imports

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties. This seemingly small detail plays a significant role in international trade, influencing consumer prices, business competitiveness, and government revenue.

Defining De Minimis Value

The de minimis value is a crucial threshold. Any goods imported with a value below this threshold are typically exempt from tariffs. For example, if the de minimis value is set at $800, a package of goods from China worth $700 would enter duty-free, while one worth $900 would be subject to applicable tariffs. This threshold significantly impacts the volume of low-value goods traded internationally. Changes to this threshold directly impact the cost of imports and purchasing power for consumers.

Current De Minimis Levels in G-7 Countries

Currently, de minimis thresholds for imports from China vary considerably across G7 nations, leading to inconsistencies in trade practices. Some countries have significantly lower thresholds than others, creating an uneven playing field for businesses and potentially distorting trade flows. Harmonizing these thresholds is a key objective of the G-7 discussions. A detailed comparison across all G7 nations would reveal these discrepancies. (Specific data on current thresholds in each G7 nation would need to be added here based on up-to-date research).

The Economic Impact of Lowering De Minimis Tariffs

Lowering de minimis tariffs for Chinese imports could have far-reaching economic consequences.

- Increased consumer spending due to cheaper goods: Lower import costs translate directly into lower prices for consumers, boosting purchasing power and potentially stimulating domestic demand.

- Potential job losses in domestic industries: A surge in cheaper imports could lead to increased competition and potential job losses within domestic industries that produce similar goods.

- Increased competition for domestic businesses: Domestic businesses would face stronger competition from cheaper Chinese imports, potentially necessitating adjustments in pricing and business strategies.

- Impact on government revenue: Lower tariffs would likely reduce government revenue from import duties, forcing governments to potentially adjust their budgets or consider alternative revenue streams.

G-7's Rationale Behind Considering Reduced Tariffs

The G-7's consideration of reducing de minimis tariffs stems from multiple factors.

Addressing Inflationary Pressures

Reducing tariffs on imports could ease inflationary pressures by lowering the cost of goods, making them more accessible to consumers and potentially slowing the rise in prices. This is a crucial consideration in the current global economic climate.

Strengthening Global Supply Chains

Lowering tariffs might contribute to more resilient and efficient global supply chains. This is particularly pertinent given recent disruptions caused by geopolitical instability and pandemics. More efficient and streamlined import processes are a direct benefit.

Promoting Free Trade and Economic Growth

Advocates argue that reducing tariffs aligns with the principles of free trade, potentially stimulating economic growth on a global scale. This perspective emphasizes the economic benefits of open markets and increased competition.

- Economic benefits of open markets: Free trade agreements and the reduction of trade barriers often stimulate economic growth.

- Geopolitical considerations and potential for improved relations: Reduced tariffs could be viewed as a gesture of goodwill and a step towards improved relations with China.

- Potential risks and counterarguments to reduced tariffs: It is important to acknowledge potential downsides, such as the impact on domestic industries and the need for robust safeguards against unfair trade practices.

Potential Challenges and Concerns of Lowering Tariffs

While there are potential benefits to reducing de minimis tariffs, significant challenges and concerns need to be addressed.

Impact on Domestic Industries

Lowering tariffs could negatively impact domestic industries in G7 countries that compete with Chinese imports. This could lead to job losses, factory closures, and a decline in domestic production. Targeted support measures for affected industries might be necessary.

Concerns Regarding Fair Trade Practices

Concerns exist regarding China's trade practices, including accusations of dumping (selling goods below market value) and government subsidies. Robust safeguards and enforcement mechanisms are essential to ensure fair competition.

National Security Implications

Reducing tariffs on certain Chinese imports, especially those with national security implications like advanced technologies or critical materials, raises concerns. Careful consideration and strategic safeguards are crucial to protect national interests.

- Need for robust trade enforcement mechanisms: Effective monitoring and enforcement are crucial to prevent unfair trade practices.

- Safeguarding national security interests: The reduction of tariffs should not compromise national security.

- Addressing concerns about intellectual property rights: Protecting intellectual property rights is crucial to avoid exploitation.

Conclusion: The Future of De Minimis Tariffs for Chinese Imports within the G-7

The decision regarding reduced de minimis tariffs for Chinese imports is complex, with both potential economic benefits and significant challenges. Lowering these tariffs could lead to cheaper goods for consumers and potentially stronger global supply chains, but also carries the risk of harming domestic industries and exacerbating unfair trade practices. The G-7's approach will need to carefully balance these competing factors. Stay updated on the evolving landscape of de minimis tariffs for Chinese imports, follow the G-7 discussions on de minimis tariffs, and learn more about the implications of adjusted de minimis tariffs on Chinese goods. The future of trade hinges on these decisions.

Featured Posts

-

The Woody Allen Dylan Farrow Case Sean Penn Offers A Different Perspective

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penn Offers A Different Perspective

May 25, 2025 -

The Woody Allen Controversy Sean Penns Backing And The Resurgence Of Sexual Abuse Claims

May 25, 2025

The Woody Allen Controversy Sean Penns Backing And The Resurgence Of Sexual Abuse Claims

May 25, 2025 -

Dealers Double Down Fighting Ev Mandate Requirements

May 25, 2025

Dealers Double Down Fighting Ev Mandate Requirements

May 25, 2025 -

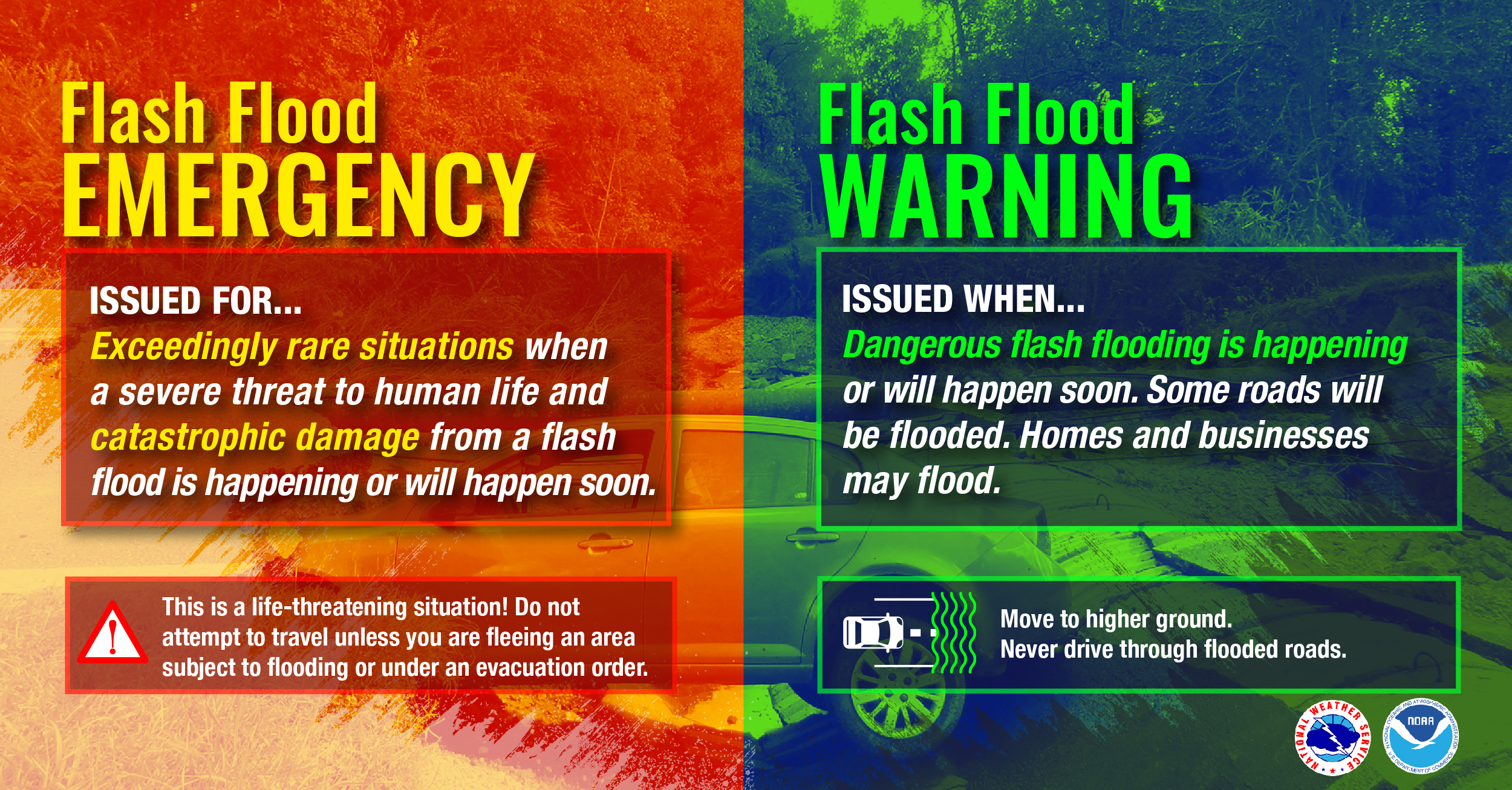

Flash Flood Warning Essential Information And Safety Precautions

May 25, 2025

Flash Flood Warning Essential Information And Safety Precautions

May 25, 2025 -

Canada Posts Struggles Fueling The Rise Of Alternative Delivery Services

May 25, 2025

Canada Posts Struggles Fueling The Rise Of Alternative Delivery Services

May 25, 2025

Latest Posts

-

Flash Flood Emergency What You Need To Know To Stay Safe

May 25, 2025

Flash Flood Emergency What You Need To Know To Stay Safe

May 25, 2025 -

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025 -

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025 -

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025 -

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025