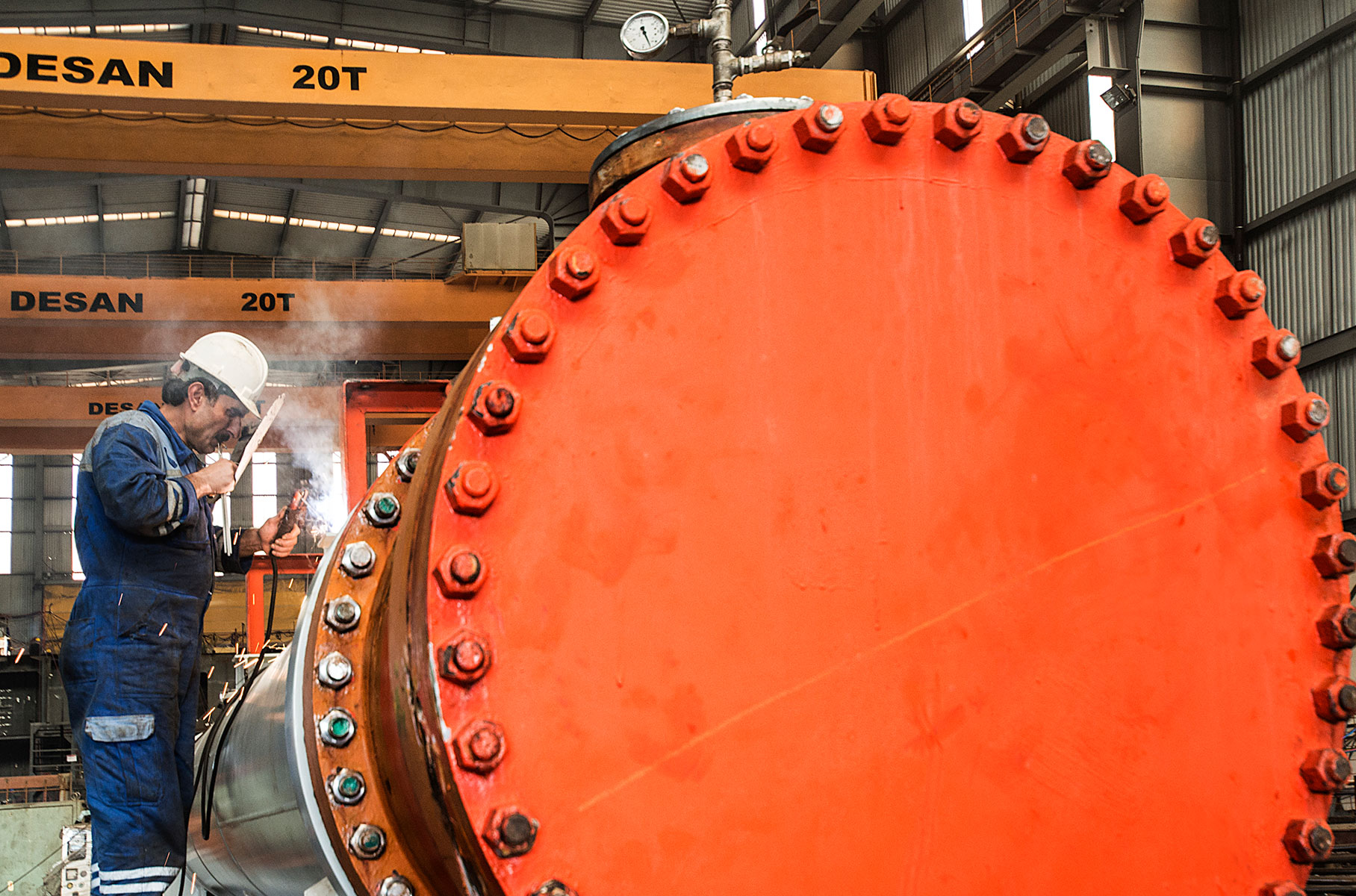

Future Of Mangalia Shipyard: Desan's Acquisition Bid

Table of Contents

Desan's Acquisition Bid: Details and Implications

Desan's bid represents a significant investment in Romania's shipbuilding sector. Understanding the financial aspects and Desan's strategic vision is crucial to assessing its potential impact.

Financial Aspects of the Bid:

The financial details of Desan's acquisition bid remain partially undisclosed, adding to the anticipation. However, initial reports suggest a substantial investment aimed at revitalizing the shipyard.

- Desan's Investment Size: While the exact figure hasn't been publicly confirmed, analysts estimate the investment to be in the tens of millions of Euros.

- Funding Sources: Desan's financial strength is expected to be a crucial factor in the success of the bid. Potential funding sources include a combination of internal equity and external financing from banks or investment firms specializing in infrastructure projects. Securing favorable financing terms will be key to the project's viability.

- Acquisition Cost: The final acquisition cost will be determined through negotiations and will likely be influenced by the shipyard's current condition and assessed value.

Keyword optimization: Desan's financial strength, acquisition cost, investment in Mangalia Shipyard, Mangalia Shipyard privatization.

Desan's Business Plan for Mangalia Shipyard:

Desan’s vision for Mangalia Shipyard hinges on modernization, expansion, and diversification. Their stated goals suggest a transformation aimed at boosting competitiveness on the global stage.

- Infrastructure Upgrades: Plans include substantial investments in upgrading existing infrastructure, including dry docks, cranes, and other essential equipment.

- Technological Implementation: The introduction of advanced shipbuilding technologies and automation is expected to streamline operations and improve efficiency.

- Market Diversification: Desan aims to expand Mangalia Shipyard's capabilities to include new ship types, potentially targeting niche markets with high growth potential.

- Workforce Development: Plans for workforce retraining and upskilling are crucial to ensuring a skilled workforce can operate the modernized shipyard effectively.

Keyword optimization: Mangalia Shipyard modernization, Desan's business strategy, shipbuilding expansion, shipyard investment plan, Mangalia Shipyard future.

Potential Benefits for Romania:

A successful acquisition could offer significant benefits to the Romanian economy.

- Job Creation: The modernization and expansion plans are expected to create numerous direct and indirect jobs, boosting employment in the region and beyond.

- Increased Export Revenue: A more competitive and efficient shipyard could significantly increase Romania's export revenue in the shipbuilding sector.

- Technological Advancements: The introduction of advanced technologies could stimulate innovation and technological advancements within the Romanian maritime industry.

- Boost to Romanian Maritime Expertise: The project can contribute to the overall skill development and expertise within the Romanian maritime sector, solidifying its position in the global market.

Keyword optimization: Economic benefits of Desan's acquisition, Romanian job creation, boost to Romanian maritime industry, Romanian shipbuilding.

Challenges and Risks Associated with the Acquisition

While the potential benefits are significant, the acquisition faces several challenges and risks.

Regulatory Hurdles and Approval Process:

Navigating the regulatory landscape is crucial for the successful completion of the acquisition.

- Government Approvals: Securing necessary approvals from Romanian authorities and potentially EU institutions will be a time-consuming process.

- Antitrust Concerns: Potential antitrust issues related to market competition will need to be addressed.

- Approval Timeline: The entire approval process could take several months, even years, introducing uncertainty into the timeline.

Keyword optimization: Regulatory approval, antitrust concerns, Mangalia Shipyard privatization process.

Economic and Geopolitical Factors:

External factors could significantly influence the acquisition's outcome.

- Global Shipbuilding Market Trends: Fluctuations in global demand for ships and competition from other shipbuilding nations present inherent risks.

- Geopolitical Risks: International conflicts or political instability could disrupt supply chains and investment flows.

- Economic Uncertainty: Global economic downturns or energy price volatility could impact the shipyard's profitability and viability.

Keyword optimization: Global shipbuilding market, geopolitical risks, economic uncertainty, Mangalia Shipyard future prospects.

Potential Workforce Concerns:

Addressing workforce integration concerns is critical for a smooth transition.

- Employee Retention: Strategies to retain skilled workers and ensure a smooth transition are paramount to avoid disruptions.

- Retraining Initiatives: Investment in retraining programs will be necessary to equip workers with the skills needed for new technologies.

- Job Security Concerns: Addressing potential job security concerns among existing employees through transparent communication and proactive planning is vital.

Keyword optimization: Mangalia Shipyard workforce, employee retention, job security, workforce integration.

Alternative Scenarios and Future Outlook for Mangalia Shipyard

If Desan's bid fails, several alternative scenarios are possible. The Romanian government might seek alternative investors, potentially leading to a different modernization plan. Alternatively, the shipyard could face prolonged stagnation or even closure, significantly impacting the Romanian economy and local employment. The long-term outlook for Mangalia Shipyard, regardless of the Desan bid's outcome, hinges on addressing its operational inefficiencies and adapting to the changing dynamics of the global shipbuilding industry.

Keyword optimization: Mangalia Shipyard future, alternative scenarios, government intervention, shipyard privatization alternatives.

Conclusion:

Desan's acquisition bid presents a pivotal moment for the Mangalia Shipyard and the Romanian maritime industry. While the potential benefits—modernization, job creation, and economic growth—are considerable, the acquisition faces significant regulatory, economic, and geopolitical challenges. The future of the Mangalia Shipyard remains uncertain, but the outcome of this bid will significantly shape the Romanian shipbuilding landscape for years to come. Stay informed about the developments concerning the future of the Mangalia Shipyard and Desan's acquisition bid to understand the long-term implications for Romania's maritime sector. The success or failure of Desan's bid for the Mangalia Shipyard will be a critical determinant of the future of Romanian shipbuilding.

Featured Posts

-

Bizarre Injury For Lando Norris Partying With A Famous Dj

Apr 26, 2025

Bizarre Injury For Lando Norris Partying With A Famous Dj

Apr 26, 2025 -

Chelsea Handlers No Holds Barred Response To Dating Elon Musk Goes Viral

Apr 26, 2025

Chelsea Handlers No Holds Barred Response To Dating Elon Musk Goes Viral

Apr 26, 2025 -

George Santos Faces 7 Year Prison Sentence Wire Fraud And Identity Theft Charges

Apr 26, 2025

George Santos Faces 7 Year Prison Sentence Wire Fraud And Identity Theft Charges

Apr 26, 2025 -

Solve Todays Nyt Spelling Bee Feb 5th Puzzle 339 Hints And Answers

Apr 26, 2025

Solve Todays Nyt Spelling Bee Feb 5th Puzzle 339 Hints And Answers

Apr 26, 2025 -

Boosting Global Ties Indonesia Considers Exporting Unique Rice Strains

Apr 26, 2025

Boosting Global Ties Indonesia Considers Exporting Unique Rice Strains

Apr 26, 2025

Latest Posts

-

Resumption Of Construction Worlds Tallest Abandoned Skyscraper Project

Apr 26, 2025

Resumption Of Construction Worlds Tallest Abandoned Skyscraper Project

Apr 26, 2025 -

Construction To Restart On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

Construction To Restart On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

Worlds Tallest Abandoned Skyscraper Construction Resumes After 10 Year Hiatus

Apr 26, 2025

Worlds Tallest Abandoned Skyscraper Construction Resumes After 10 Year Hiatus

Apr 26, 2025 -

Florida A Cnn Anchors Guide To An Unforgettable Trip

Apr 26, 2025

Florida A Cnn Anchors Guide To An Unforgettable Trip

Apr 26, 2025 -

The Worlds Richest Man An American Battleground

Apr 26, 2025

The Worlds Richest Man An American Battleground

Apr 26, 2025