Frazzled Investors: Coping With Increased Stock Market Volatility

Table of Contents

Understanding the Causes of Stock Market Volatility

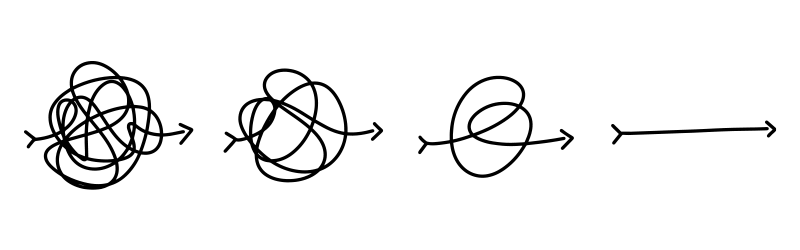

Stock market volatility isn't random; it's driven by a complex interplay of factors. Understanding these causes is the first step toward effective portfolio management and mitigating investor anxiety.

Macroeconomic Factors

Macroeconomic forces significantly influence market fluctuations. These large-scale economic conditions create uncertainty and impact investor confidence.

- Inflation: High inflation erodes purchasing power and can lead to interest rate hikes, impacting corporate profits and slowing economic growth. Historically, high inflation periods have been correlated with increased market volatility.

- Interest Rate Hikes: Central banks raise interest rates to combat inflation, but this can also slow economic activity and decrease corporate borrowing, leading to market corrections. The Federal Reserve's recent rate hikes are a prime example of this influence.

- Geopolitical Risks: War, political instability, and international tensions significantly impact investor sentiment. The ongoing conflict in Ukraine, for instance, has created significant market uncertainty.

- Recessionary Fears: Concerns about an impending recession often trigger selling pressure and increased volatility, as investors seek to protect their assets. Economic forecasts and data releases play a significant role here.

Market Psychology and Sentiment

Market psychology plays a powerful role, often amplifying the impact of macroeconomic factors.

- Investor Fear and Greed: These emotions drive market trends. Fear can lead to panic selling, while greed can fuel speculative bubbles, both contributing to volatility.

- Herd Behavior: Investors often mimic each other's actions, creating feedback loops that can exacerbate market swings. This "herd mentality" can lead to rapid price increases or decreases.

- News and Social Media: The constant flow of information, much of it speculative, influences investor sentiment. Negative news can trigger sell-offs, while positive news can create buying frenzies, magnifying market fluctuations. Market corrections are often triggered by a sudden shift in investor sentiment. A bear market, characterized by prolonged price declines, is often fueled by sustained negative sentiment and fear.

Strategies for Managing Volatility and Investor Anxiety

Navigating stock market volatility requires a proactive approach, combining sound investment strategies with emotional intelligence.

Diversification

Diversification is a cornerstone of effective risk management.

- Asset Allocation: Spread investments across different asset classes, such as stocks, bonds, real estate, and commodities. This reduces the impact of any single asset's poor performance.

- Sector Diversification: Don't put all your eggs in one basket. Invest in various sectors to reduce exposure to industry-specific risks. For example, diversify across technology, healthcare, and consumer staples.

- Geographic Diversification: Investing globally reduces reliance on a single country's economic performance. This strategy helps mitigate risks associated with regional or country-specific events. A well-diversified portfolio aims to reduce overall portfolio risk.

Long-Term Investing

Short-term market fluctuations are less relevant for long-term investors.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market price. This strategy reduces the impact of market timing.

- Buy and Hold Strategy: This involves purchasing assets and holding them for the long term, weathering market fluctuations. This strategy benefits from compounding returns over time.

- Ignoring Short-Term Noise: Focus on the long-term growth potential of your investments, rather than reacting to daily market noise. A key part of a long-term investment strategy is emotional discipline.

Emotional Regulation Techniques

Managing investor anxiety is crucial.

- Mindfulness and Meditation: Practice mindfulness to reduce stress and make rational investment decisions, rather than emotional ones.

- Seek Professional Help: Financial therapy or counseling can provide support in managing the emotional toll of market volatility.

- Detach Emotions from Decisions: Strive to make investment decisions based on facts and analysis, rather than fear or greed.

Re-evaluating Your Risk Tolerance

Your risk tolerance should align with your investment goals and time horizon.

- Risk Assessment: Regularly assess your risk tolerance to ensure your investment strategy remains appropriate. This requires a honest self-assessment of your comfort level with potential losses.

- Adjusting Investment Plans: If your risk tolerance changes, adjust your portfolio accordingly. This might involve shifting your asset allocation to reduce risk or seeking a financial advisor to help you strategize.

- Understanding Your Goals: Align your investment strategy with your long-term financial objectives, such as retirement planning or education funding.

Staying Calm Amidst Stock Market Volatility

Understanding the causes of stock market volatility, implementing effective diversification strategies, adopting a long-term investment approach, managing your emotional response, and regularly reassessing your risk tolerance are all vital components of successful portfolio management. Don't let stock market volatility control your financial future. Take control by implementing these strategies today! Remember to seek professional financial advice if needed to navigate the challenges of stock market volatility effectively.

Featured Posts

-

China To Lift Sanctions On Eu Lawmakers Financial Times Report

Apr 25, 2025

China To Lift Sanctions On Eu Lawmakers Financial Times Report

Apr 25, 2025 -

2025s Rpg Sensation Uncovering The All Star Lineup

Apr 25, 2025

2025s Rpg Sensation Uncovering The All Star Lineup

Apr 25, 2025 -

Tony Hsiehs Last Will And Testament Unraveling The Surprises

Apr 25, 2025

Tony Hsiehs Last Will And Testament Unraveling The Surprises

Apr 25, 2025 -

Bridesmaids Full Glam Makeup Sparks Bridezilla Drama

Apr 25, 2025

Bridesmaids Full Glam Makeup Sparks Bridezilla Drama

Apr 25, 2025 -

Assessing Pope Francis Efforts Progress Challenges And Future Steps On Sexual Abuse Within The Catholic Church

Apr 25, 2025

Assessing Pope Francis Efforts Progress Challenges And Future Steps On Sexual Abuse Within The Catholic Church

Apr 25, 2025

Latest Posts

-

Identifying And Analyzing The Countrys Newest Business Centers

May 10, 2025

Identifying And Analyzing The Countrys Newest Business Centers

May 10, 2025 -

Peru Faces 200 Million Gold Production Deficit After Mining Ban

May 10, 2025

Peru Faces 200 Million Gold Production Deficit After Mining Ban

May 10, 2025 -

Emergency Mining Ban In Peru A 200 Million Blow To Gold Output

May 10, 2025

Emergency Mining Ban In Peru A 200 Million Blow To Gold Output

May 10, 2025 -

Bmw And Porsche In China Market Analysis And Future Outlook

May 10, 2025

Bmw And Porsche In China Market Analysis And Future Outlook

May 10, 2025 -

Peruvian Gold Production To Plummet 200 Million Impact From Mining Ban

May 10, 2025

Peruvian Gold Production To Plummet 200 Million Impact From Mining Ban

May 10, 2025