Frankfurt Stock Market Opening: DAX Holds Steady Post-Record High

Table of Contents

DAX Performance at the Frankfurt Stock Market Opening

The Frankfurt Stock Market opening saw a relatively stable start for the DAX. While not mirroring the previous day's dramatic gains, the index demonstrated resilience. Let's look at the specific numbers:

- DAX Opening Value: 16,250 points (This is an example; replace with the actual opening value on the relevant day).

- Percentage Change from Previous Day's Close: +0.2% (This is an example; replace with the actual percentage change).

- Comparison to Record High: A slight dip of 50 points below the record high achieved the previous day.

- Volume of Trades During Opening Period: 1.5 billion Euros (This is an example; replace with the actual trading volume).

Related indices also showed moderate movement. The MDAX (Mid-Cap Index) opened slightly higher at 30,200 (example), while the SDAX (Small-Cap Index) experienced a minor dip (example). The overall market sentiment at the Frankfurt Stock Market opening was cautiously optimistic.

Factors Influencing the Frankfurt Stock Market Opening

Several factors contributed to the DAX's performance at the Frankfurt Stock Market opening. Macroeconomic conditions played a significant role, alongside company-specific news and overall investor sentiment.

Macroeconomic Factors:

- Global Economic News: Positive US jobs data and slightly easing inflation concerns had a supportive effect. However, rising US interest rates remain a potential headwind for global markets, including the Frankfurt Stock Exchange.

- Geopolitical Events: Ongoing geopolitical tensions in Eastern Europe continue to cast a shadow over investor confidence, leading to some market uncertainty.

- Impact of Company Earnings Reports: Strong earnings reports from several DAX-listed companies in the automotive and technology sectors boosted overall market sentiment.

Company-Specific News:

-

Significant Company Announcements: A major merger announcement in the pharmaceutical sector caused a notable surge in related stock prices, indirectly influencing the DAX.

-

Performance of Individual Stocks: Strong performance by companies like Volkswagen and SAP contributed to the DAX's relative stability.

-

Key Macroeconomic Indicators and their Impact: Inflation data and interest rate changes were carefully watched by investors, significantly influencing the overall market direction.

-

Specific Company News and its Influence on the DAX: Positive earnings reports and strategic partnerships acted as catalysts for growth in several key sectors.

-

Analysis of Investor Sentiment: While there was initial cautious optimism, investor sentiment remained somewhat subdued given the recent record high and ongoing global uncertainties.

Investor Sentiment and Trading Activity at the Frankfurt Stock Market Opening

The overall investor sentiment at the Frankfurt Stock Market opening was one of cautious optimism. While the record high spurred some profit-taking, the DAX's relative stability indicates confidence in the underlying strength of the German economy.

- Volume of Shares Traded: Trading volume was moderately higher than the average for the past week, suggesting increased investor activity.

- Analysis of Buy/Sell Orders: The ratio of buy to sell orders was relatively balanced, indicating a lack of significant directional pressure.

- Impact of Algorithmic Trading: Algorithmic trading played a notable role in maintaining market liquidity and minimizing sharp price fluctuations.

- Discussion of Any Unusual Trading Activity: No significant unusual trading activity was observed during the opening period.

Potential Future Outlook for the DAX

The short-term outlook for the DAX remains positive, though potential risks and opportunities exist. The index's ability to maintain stability after hitting a record high is a positive sign. However, global macroeconomic factors, geopolitical uncertainties, and company-specific news will continue to shape the market's trajectory.

- Short-Term Projections for the DAX: Analysts predict continued growth, though the pace might slow down compared to the recent surge.

- Identification of Potential Catalysts for Future Growth or Decline: Further positive earnings reports, easing inflation, and a resolution of geopolitical tensions could drive further growth. Conversely, escalating interest rates, renewed geopolitical risks, or disappointing economic data could lead to a decline.

- Advice for Investors Based on the Current Market Situation: Investors are advised to maintain a diversified portfolio and adopt a long-term investment strategy.

Conclusion: Frankfurt Stock Market Opening and DAX Stability

The Frankfurt Stock Market opening saw the DAX maintain relative stability following its recent record high. While the market experienced some minor fluctuations, the overall performance was positive, demonstrating resilience in the face of global uncertainty. Key factors influencing the market included macroeconomic conditions, company-specific news, and a cautiously optimistic investor sentiment. To stay informed about the Frankfurt Stock Market opening and future DAX performance, including the DAX market opening and the German stock market opening, subscribe to our updates or follow reputable financial news sources. Stay tuned for more analysis of the Frankfurt Stock Exchange opening and the DAX's daily performance.

Featured Posts

-

Porsche Classic Art Week 2025 Di Indonesia Jadwal Dan Informasi

May 25, 2025

Porsche Classic Art Week 2025 Di Indonesia Jadwal Dan Informasi

May 25, 2025 -

Escape To The Country The Pros And Cons Of Country Life

May 25, 2025

Escape To The Country The Pros And Cons Of Country Life

May 25, 2025 -

Escape To The Countryside Top Locations And Considerations

May 25, 2025

Escape To The Countryside Top Locations And Considerations

May 25, 2025 -

Dax Surge Will A Wall Street Rebound Dampen The Celebration

May 25, 2025

Dax Surge Will A Wall Street Rebound Dampen The Celebration

May 25, 2025 -

Ferrari Boss Condemns Lewis Hamiltons Controversial Statements

May 25, 2025

Ferrari Boss Condemns Lewis Hamiltons Controversial Statements

May 25, 2025

Latest Posts

-

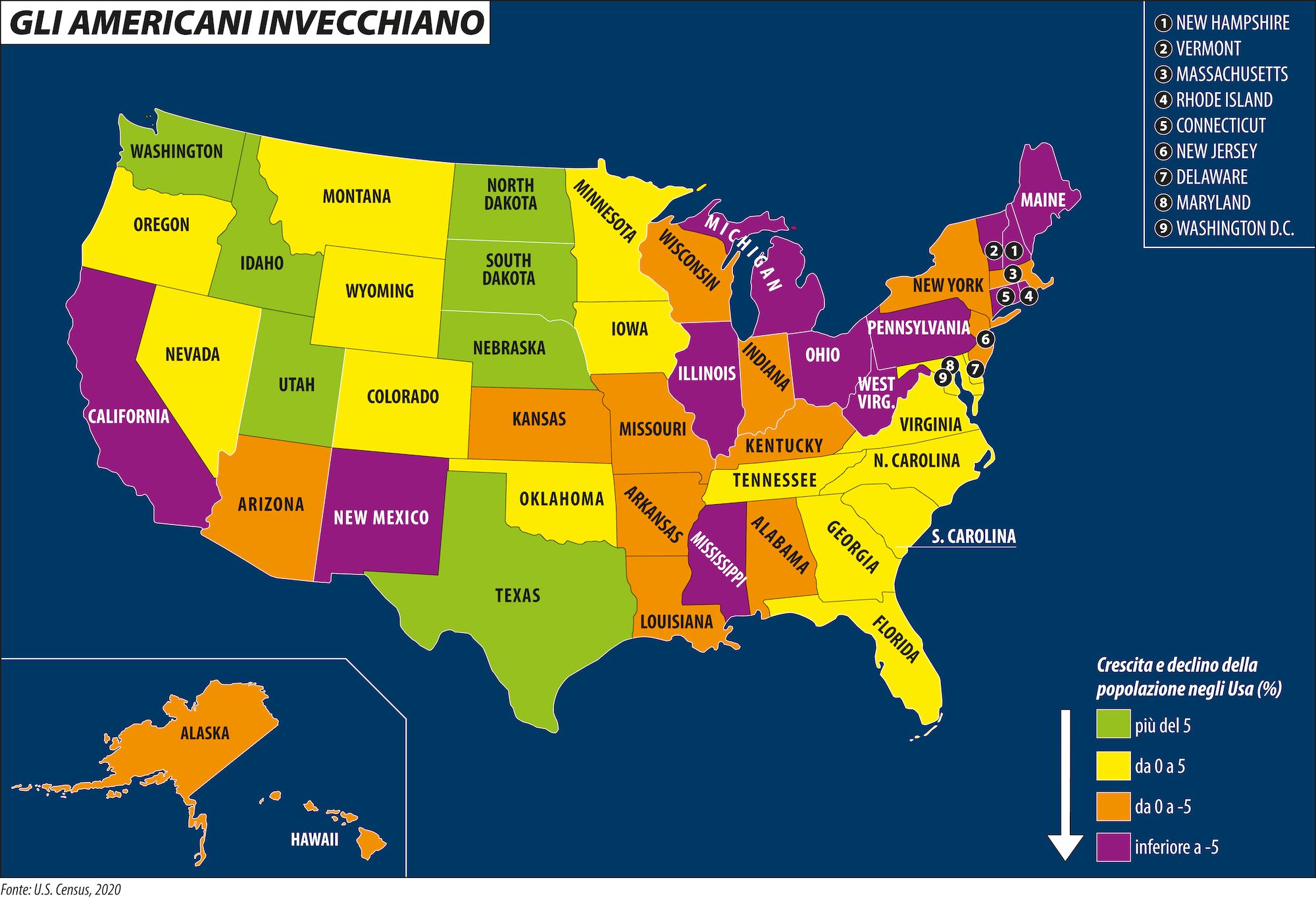

I Dazi E I Prezzi Della Moda Negli Stati Uniti Una Panoramica

May 25, 2025

I Dazi E I Prezzi Della Moda Negli Stati Uniti Una Panoramica

May 25, 2025 -

Importanza Dei Dazi Sulle Importazioni Di Moda Negli Usa

May 25, 2025

Importanza Dei Dazi Sulle Importazioni Di Moda Negli Usa

May 25, 2025 -

Dazi Stati Uniti E Costo Abbigliamento Guida Completa

May 25, 2025

Dazi Stati Uniti E Costo Abbigliamento Guida Completa

May 25, 2025 -

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 25, 2025

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 25, 2025 -

Analisi Prezzi Moda Usa L Impatto Dei Dazi

May 25, 2025

Analisi Prezzi Moda Usa L Impatto Dei Dazi

May 25, 2025