Frankfurt Stock Market Opening: DAX Holds Steady After Record High

Table of Contents

DAX Performance at the Frankfurt Stock Market Opening

The DAX opened today at 16,250.33 points, a mere 0.12% decrease from yesterday's closing price of 16,270. This relatively minor fluctuation shows remarkable resilience following the recent record high. While the opening price didn't quite match the previous day's peak, the lack of significant volatility suggests a generally positive market sentiment.

- Opening Price: 16,250.33 points

- Percentage Change from Previous Day's Close: -0.12%

- Comparison to Record High: A slight dip, but minimal compared to the record high achieved earlier this week.

- Intraday Fluctuations: Early trading saw minor fluctuations within a 50-point range, indicating relatively stable trading conditions.

[Insert a relevant chart or graph here visually representing the DAX's opening and early trading activity]

Key Factors Influencing the DAX's Stability

Several factors contributed to the DAX's steady performance despite the recent record high. These factors highlight the complex interplay of global and domestic economic conditions impacting the Frankfurt Stock Exchange.

- Global Economic News: Positive economic data from the US, including moderate inflation figures and stable interest rate projections, helped maintain investor confidence. Concerns remain regarding global growth, however, and this could influence future DAX performance.

- Performance of Other Major European Indices: The CAC 40 in France and the FTSE 100 in the UK also showed minor fluctuations, suggesting a broader European market stability that buoyed investor sentiment regarding the DAX.

- Strong Company Performances within the DAX: Strong earnings reports from key DAX components like Volkswagen and Allianz contributed to the overall stability. Conversely, weaker-than-expected results from other companies could impact future trading.

- Geopolitical Considerations: While geopolitical tensions persist in certain regions, their immediate impact on the German economy and the DAX remained relatively subdued today. However, escalating geopolitical uncertainty could negatively affect investor sentiment.

Investor Sentiment and Trading Activity

Despite the recent record high, investor sentiment remains cautiously optimistic. Trading volume was slightly lower than average, suggesting a period of consolidation rather than significant buying or selling pressure.

- Trading Volume: Approximately 10% below the average daily trading volume for the last month.

- Buy/Sell Ratio: The buy/sell ratio was relatively balanced, indicating a lack of strong directional pressure.

- Investor Behavior: Investors appear to be taking a "wait-and-see" approach, monitoring economic data and company earnings before making significant investment decisions.

- Expert Opinion: "The DAX's stability reflects a market digesting recent gains and anticipating future economic indicators," commented Dr. Schmidt, Chief Economist at Deutsche Bank. "We expect continued moderate growth in the coming weeks."

Future Outlook for the DAX

Based on current market conditions and expert opinions, the short-term outlook for the DAX remains positive, with potential for further, albeit moderate, growth.

- Potential Catalysts for Growth: Positive earnings reports from major companies and continued positive economic data from both Germany and abroad.

- Key Economic Indicators to Watch: Inflation figures, employment data, and consumer confidence indicators will be crucial for shaping the DAX's future trajectory.

- Expert Forecasts: Most analysts predict continued growth, but caution against significant upward movements until further economic clarity emerges.

- Potential Risks: Rising inflation, escalating geopolitical risks, and unexpected negative economic data could trigger a correction.

Conclusion: Understanding the Frankfurt Stock Market Opening and DAX Movement

The DAX's relatively steady performance at the Frankfurt Stock Market opening following its recent record high reflects a cautious but optimistic investor sentiment. Global economic news, performance of other European indices, strong company earnings, and manageable geopolitical concerns contributed to the stability observed. While the short-term outlook remains positive, investors should carefully monitor key economic indicators and remain aware of potential risks. Stay updated on the latest developments in the Frankfurt Stock Market and DAX movements by subscribing to our newsletter for in-depth analysis of the German stock market and DAX trading, and get valuable German market insights. Follow us for regular Frankfurt stock market updates!

Featured Posts

-

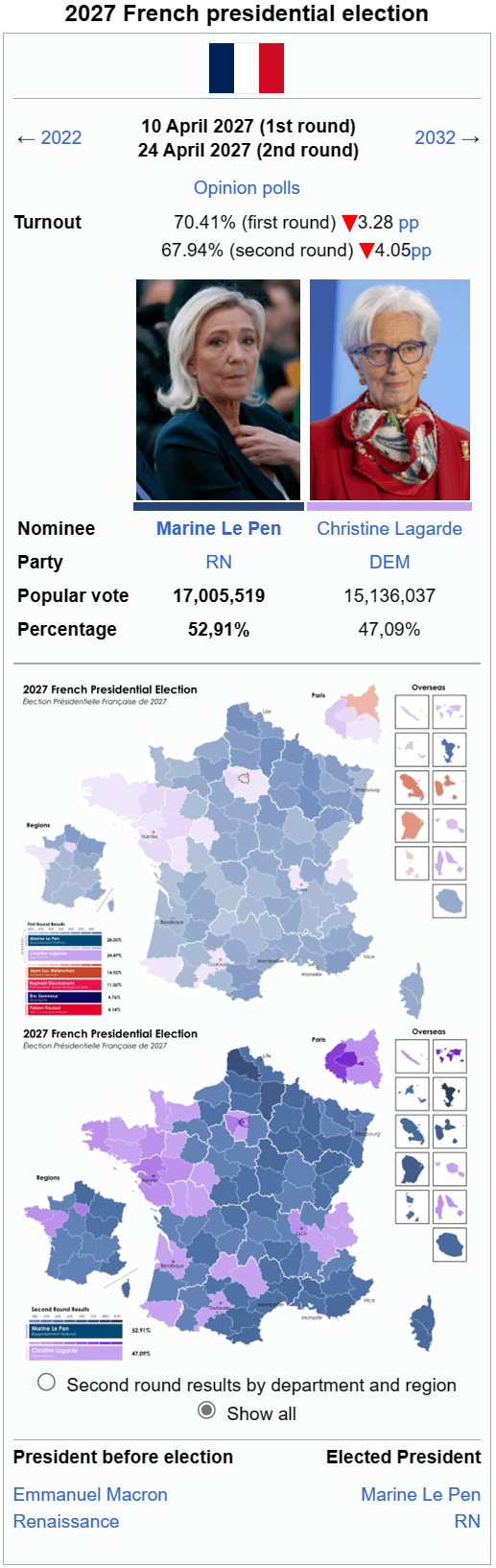

The 2027 French Election Will Bardellas Leadership Bring Change

May 24, 2025

The 2027 French Election Will Bardellas Leadership Bring Change

May 24, 2025 -

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025

Krasivaya Data 89 Svadeb Na Kharkovschine

May 24, 2025 -

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025 -

Avrupa Borsalari Buguen Nasil Kapandi

May 24, 2025

Avrupa Borsalari Buguen Nasil Kapandi

May 24, 2025 -

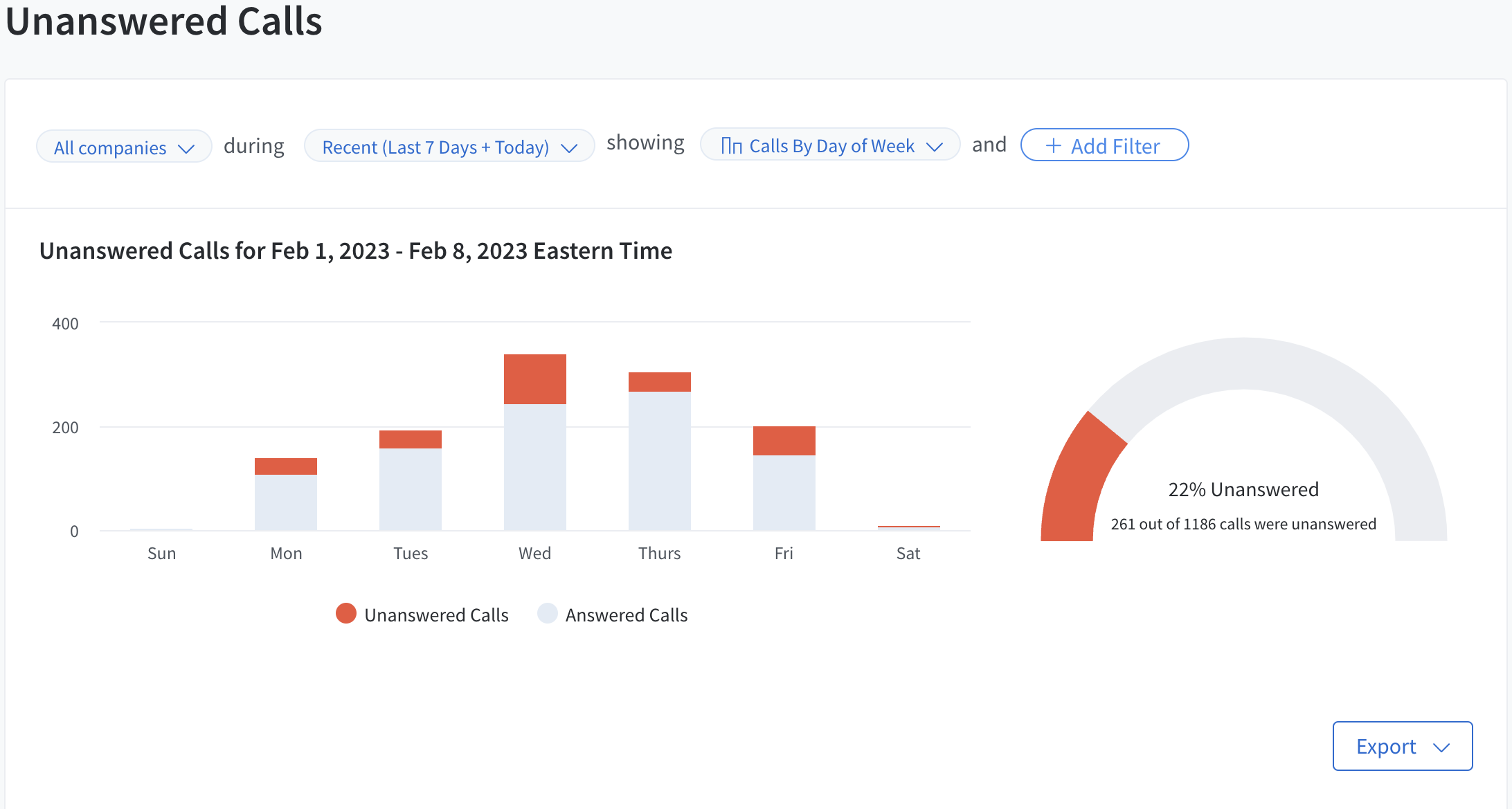

By The Phone An Account Of Unanswered Calls

May 24, 2025

By The Phone An Account Of Unanswered Calls

May 24, 2025

Latest Posts

-

Apple Stock Prediction 254 Analysts Outlook And 200 Buy Recommendation

May 24, 2025

Apple Stock Prediction 254 Analysts Outlook And 200 Buy Recommendation

May 24, 2025 -

Whats Wrong With Sean Penn Fans Respond To His Latest Statements

May 24, 2025

Whats Wrong With Sean Penn Fans Respond To His Latest Statements

May 24, 2025 -

Woody Allen Sean Penns Support Amidst Resurfacing Sexual Abuse Allegations

May 24, 2025

Woody Allen Sean Penns Support Amidst Resurfacing Sexual Abuse Allegations

May 24, 2025 -

Sean Penns Recent Public Appearance A Cause For Alarm

May 24, 2025

Sean Penns Recent Public Appearance A Cause For Alarm

May 24, 2025 -

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025