Foot Locker Stock Outlook: Analyzing The Impact Of Nike's Q3 Results

Table of Contents

Nike's Q3 Performance: A Deep Dive

Key Highlights from Nike's Earnings Report:

Nike's Q3 earnings report is a crucial indicator for understanding the broader athletic footwear market. Key areas to examine include revenue growth across different product categories. For example, did Nike see continued strong sales in running shoes, or did this category experience a slowdown? Similarly, analyzing performance in basketball shoes, apparel, and other segments provides a clearer picture.

Inventory levels are another critical factor. High inventory can indicate weakening demand and potential for future price reductions, impacting Nike's profitability and, consequently, Foot Locker's. Conversely, well-managed inventory suggests strong demand and efficient supply chain management.

Nike's direct-to-consumer (DTC) strategy is also a key focus. The success of Nike's DTC channels, including its website and retail stores, influences its overall performance and its relationship with retailers like Foot Locker. Any significant shifts in Nike's marketing or distribution strategies, such as increased emphasis on digital marketing or expansion into new markets, should be closely analyzed for their potential downstream effects on Foot Locker.

- Specific numerical data: Let's assume, for example, that Nike reported a 5% increase in overall revenue but a 2% decline in basketball shoe sales. This data point would suggest potential challenges within a specific product category.

- Contributing factors: Macroeconomic factors, such as inflation and consumer spending patterns, play a significant role. Supply chain disruptions could also affect Nike's ability to meet demand.

- Comparison to expectations: Analyzing how Nike's actual Q3 results compare to analyst expectations and performance in previous quarters helps gauge the overall health of the brand and its future prospects.

Impact on Foot Locker's Revenue and Profitability

Foot Locker's Dependence on Nike:

Foot Locker's revenue is significantly reliant on Nike products. Understanding the precise percentage of Foot Locker's sales derived from Nike is crucial. This symbiotic relationship means Nike's performance directly impacts Foot Locker's financial health. However, Foot Locker is working to diversify its product offerings to mitigate this reliance on a single brand. The success of this diversification strategy will influence Foot Locker's resilience to future fluctuations in Nike's performance.

- Projected impact: A decline in Nike's sales could lead to a corresponding decrease in Foot Locker's revenue. The magnitude of this impact depends on the severity of the decline and the effectiveness of Foot Locker's diversification efforts.

- Pricing strategies: Foot Locker might adjust its pricing strategies to maintain profitability in the face of changing Nike product costs or demand.

- Inventory levels: Foot Locker's inventory levels of Nike products will directly influence its profitability. Excess inventory could lead to markdowns, reducing margins.

Foot Locker's Strategic Response and Future Outlook

Adapting to Changing Consumer Preferences:

The athletic footwear and apparel market is dynamic. Understanding evolving consumer trends, such as increasing demand for sustainable products or specific styles, is vital for Foot Locker's long-term success. Foot Locker must adapt its strategies to attract and retain customers in this competitive landscape. Its omnichannel strategy—integrating online and physical retail experiences—is a key component of its approach.

- Strategic initiatives: Foot Locker might introduce new store formats, loyalty programs, or collaborations with other brands to enhance its appeal and drive sales.

- Effectiveness assessment: Analyzing the effectiveness of these initiatives requires examining sales data, customer feedback, and market share changes.

- Potential risks: Competition from other retailers, both online and brick-and-mortar, remains a significant challenge. Changes in consumer preferences and macroeconomic factors also pose risks.

Investment Implications and Stock Valuation

Analyzing Foot Locker's Stock Performance:

Nike's Q3 results directly impact Foot Locker's stock price. Analyzing the stock's recent performance and its correlation with Nike's performance helps assess the market's reaction and investor sentiment. Identifying potential catalysts for future stock price movements is critical for informed investment decisions.

- Stock price comparison: Comparing Foot Locker's stock performance to other retailers in the athletic footwear industry provides context and highlights relative strength or weakness.

- Investor sentiment: Understanding investor sentiment towards Foot Locker, as reflected in analyst reports and market commentary, is vital.

- Investment strategies: Based on the analysis, investors can develop appropriate investment strategies, whether it's buying, holding, or selling Foot Locker stock.

Conclusion:

Nike's Q3 results significantly impact Foot Locker's stock outlook. While Foot Locker's dependence on Nike presents both opportunities and challenges, its strategic response to evolving consumer trends and its diversification efforts will play a crucial role in shaping its future performance. Investors should carefully consider the interplay between these two giants and conduct thorough due diligence before making any investment decisions related to Foot Locker stock. Understanding the detailed analysis of Nike's Q3 earnings and its cascading effects on Foot Locker's prospects is critical for a sound Foot Locker stock investment strategy. Therefore, continuous monitoring of both companies' performance is vital for successful Foot Locker stock investment.

Featured Posts

-

The Ultimate Guide To Creatine Supplementation

May 16, 2025

The Ultimate Guide To Creatine Supplementation

May 16, 2025 -

Blue Mountains Reservoir Dangerous Pfas Levels Detected Investigation Launched

May 16, 2025

Blue Mountains Reservoir Dangerous Pfas Levels Detected Investigation Launched

May 16, 2025 -

Ahy Dan Proyek Giant Sea Wall Implikasi Kerja Sama Dengan China

May 16, 2025

Ahy Dan Proyek Giant Sea Wall Implikasi Kerja Sama Dengan China

May 16, 2025 -

Nba Play In Warriors Grizzlies Matchup Breakdown

May 16, 2025

Nba Play In Warriors Grizzlies Matchup Breakdown

May 16, 2025 -

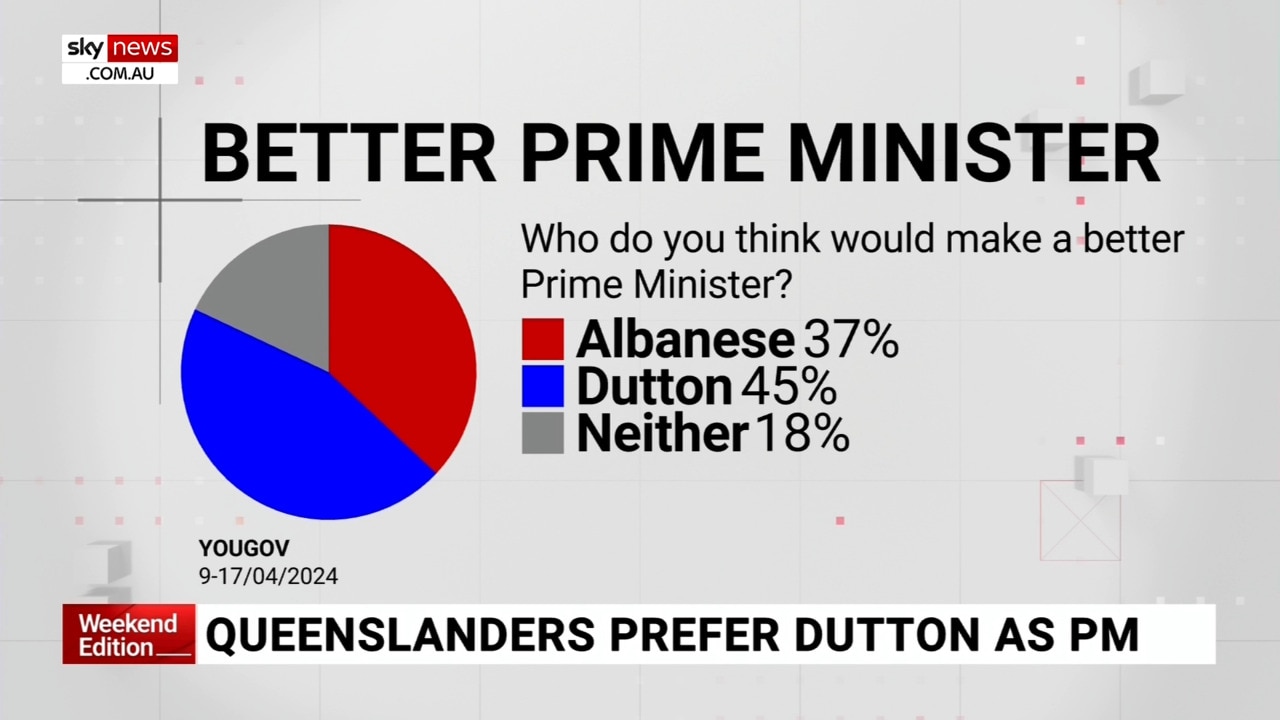

Australian Election Analyzing The Pitches Of Albanese And Dutton

May 16, 2025

Australian Election Analyzing The Pitches Of Albanese And Dutton

May 16, 2025

Latest Posts

-

Ontario Budget 14 6 Billion Deficit And The Impact Of Tariffs

May 17, 2025

Ontario Budget 14 6 Billion Deficit And The Impact Of Tariffs

May 17, 2025 -

14 6 Billion Deficit Projected For Ontario The Role Of Tariffs

May 17, 2025

14 6 Billion Deficit Projected For Ontario The Role Of Tariffs

May 17, 2025 -

Low Lobster Prices And Global Economic Downturn Hit Atlantic Canada Hard

May 17, 2025

Low Lobster Prices And Global Economic Downturn Hit Atlantic Canada Hard

May 17, 2025 -

Ontario Faces 14 6 Billion Deficit Analysis Of Tariff Effects

May 17, 2025

Ontario Faces 14 6 Billion Deficit Analysis Of Tariff Effects

May 17, 2025 -

Atlantic Canadas Lobster Fishermen Struggle Amidst Falling Prices And Global Uncertainty

May 17, 2025

Atlantic Canadas Lobster Fishermen Struggle Amidst Falling Prices And Global Uncertainty

May 17, 2025