Flatline Forecast: OECD Sees No Recession, But Slow Growth For Canadian Economy In 2025

Table of Contents

Slowing Growth: Key Indicators Pointing to a Flatline Forecast

The OECD forecast projects a significantly reduced GDP growth rate for Canada in 2025. While the precise figure varies depending on the model used, the overall consensus points to a substantial slowdown compared to previous years. This "flatline" forecast for the Canadian economy isn't a surprise given several key economic indicators.

- Inflation rates and their impact on consumer spending: High inflation continues to erode purchasing power, dampening consumer confidence and reducing discretionary spending. This reduced consumer spending significantly impacts GDP growth Canada.

- Interest rate hikes and their effect on investment: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are increasing borrowing costs for businesses. This, in turn, is leading to decreased investment and potentially impacting job creation. The interest rate effect on the Canadian economy is multifaceted and warrants close monitoring.

- Global economic uncertainty and its influence on Canadian exports: Global economic uncertainty, including potential slowdowns in major trading partners, poses a considerable threat to Canadian exports. This external pressure is a significant factor influencing the GDP growth Canada is expected to achieve.

- Labor market dynamics – unemployment rates and potential workforce participation: While the Canadian labor market remains relatively strong, there are signs of softening. Changes in unemployment rates and workforce participation will influence economic indicators Canada relies on for growth assessments.

Why No Recession? Factors Mitigating Economic Downturn

Despite the projected slow growth, the OECD forecast suggests that a recession is unlikely in 2025. Several factors contribute to this relatively optimistic outlook for the Canadian economy:

- Strong fundamentals of the Canadian economy: Canada's generally sound fiscal position, a diversified economy, and a robust financial sector provide a buffer against significant economic downturns. The Canadian economic resilience is a significant factor in the OECD's positive outlook.

- Government spending and fiscal policies: Government spending on infrastructure projects and social programs is expected to provide a degree of support to economic activity, helping to offset the negative impacts of other factors. The fiscal policy impact is a key consideration in the 2025 economic outlook.

- Resilience in specific sectors of the Canadian economy: Certain sectors, such as technology and healthcare, continue to show strength and potential for growth, contributing to overall sectoral growth Canada.

- Potential for future economic growth drivers: The long-term potential for growth in areas like renewable energy and resource development could eventually offset the current slowdown. These potential future economic growth drivers offer a cause for optimism amidst the predicted "flatline."

Potential Risks and Uncertainties: Factors That Could Change the Forecast

While the OECD's "flatline" prediction is cautiously optimistic, several risks and uncertainties could significantly alter the forecast and potentially lead to a recessionary scenario:

- Geopolitical instability and its impact on the Canadian economy: The ongoing geopolitical instability globally creates uncertainty for Canadian businesses and could disrupt supply chains and international trade. The geopolitical impact Canada faces is a significant variable in the 2025 economic outlook.

- Unexpected shifts in global commodity prices: Fluctuations in global commodity prices, particularly energy prices, can significantly affect the Canadian economy, given its reliance on resource exports. Commodity price volatility is a major factor influencing the Canadian economy’s resilience.

- Potential for further inflation surges: A resurgence of inflation could force the Bank of Canada to implement further interest rate hikes, potentially deepening the economic slowdown and increasing the risk of a recession.

- Unforeseen shocks to the global financial system: Unexpected events, such as a major financial crisis, could trigger a sharp contraction in the global economy and negatively impact Canada. Global financial risk is a critical consideration when analyzing the Canadian economic outlook 2025.

Navigating the Flatline Forecast: Understanding the 2025 Canadian Economic Outlook

The OECD's 2025 economic outlook for Canada projects slow growth, but not a recession. This "flatline" prediction is influenced by a complex interplay of factors, including high inflation, interest rate hikes, global economic uncertainty, and the resilience of certain sectors of the Canadian economy. However, several risks, like geopolitical instability and commodity price volatility, could disrupt this prediction. It is crucial to monitor economic indicators closely and adapt to potential changes in the forecast. Staying informed about the Canadian economic outlook 2025 is essential. Follow OECD reports for updates on the OECD economic forecast and ensure you understand how to manage personal finances amidst this unique economic environment. Learn more about financial planning Canada to navigate this period of slow growth effectively. Understanding the nuances of the Canadian economy is key to making informed financial decisions in the coming year.

Featured Posts

-

Abd Tueketici Kredileri Mart 2024 Artisi Ve Gelecek Tahminleri

May 28, 2025

Abd Tueketici Kredileri Mart 2024 Artisi Ve Gelecek Tahminleri

May 28, 2025 -

Tennis Star Jannik Sinners Day Off A Papal Audience At The Italian Open

May 28, 2025

Tennis Star Jannik Sinners Day Off A Papal Audience At The Italian Open

May 28, 2025 -

Diamondbacks Dodgers Matchup Analyzing The Odds And Predictions

May 28, 2025

Diamondbacks Dodgers Matchup Analyzing The Odds And Predictions

May 28, 2025 -

Samsung Galaxy S25 128 Go Offre Exceptionnelle A 814 22 E

May 28, 2025

Samsung Galaxy S25 128 Go Offre Exceptionnelle A 814 22 E

May 28, 2025 -

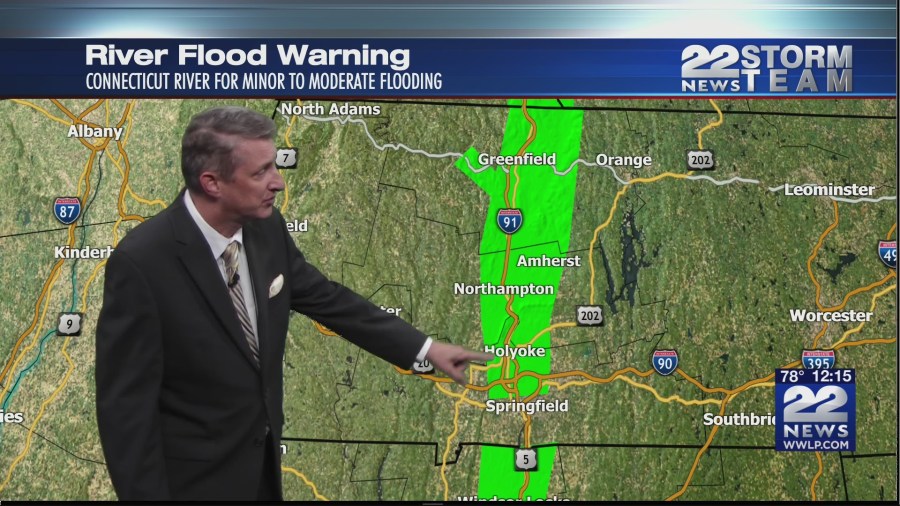

Climate Changes Influence On Rainfall Patterns In Western Massachusetts

May 28, 2025

Climate Changes Influence On Rainfall Patterns In Western Massachusetts

May 28, 2025

Latest Posts

-

Mein Schiff Relax A New Era In Cruising Begins

May 29, 2025

Mein Schiff Relax A New Era In Cruising Begins

May 29, 2025 -

Cruise News Mein Schiff Relax Sets Sail

May 29, 2025

Cruise News Mein Schiff Relax Sets Sail

May 29, 2025 -

Buying Nike Air Jordan 9 Retro Cool Grey Online Price Comparison And Retailers

May 29, 2025

Buying Nike Air Jordan 9 Retro Cool Grey Online Price Comparison And Retailers

May 29, 2025 -

Giant E360 Million Cruise Liner At Liverpool Port

May 29, 2025

Giant E360 Million Cruise Liner At Liverpool Port

May 29, 2025 -

Dont Miss Out Nike Dunks Discounted At Revolve

May 29, 2025

Dont Miss Out Nike Dunks Discounted At Revolve

May 29, 2025