Five-Year Low Predicted For Nike's Revenue: Market Reaction

Table of Contents

A surprising prediction has sent ripples through the financial world: Nike, the sportswear giant, is facing a forecast of a five-year low in revenue. This potential "Nike revenue dip" carries significant implications for investors, the broader athletic wear market, and Nike's future trajectory. This article delves into the factors contributing to this predicted decline, analyzes the market's reaction, and explores the potential long-term consequences for the company.

<h2>Factors Contributing to the Predicted Nike Revenue Decline</h2>

Several interconnected factors are contributing to the anticipated downturn in Nike's revenue. Understanding these elements is crucial for assessing the severity and longevity of the dip.

<h3>Weakening Consumer Demand</h3>

Decreased consumer spending, fueled by inflation and economic uncertainty, is significantly impacting Nike's sales. Consumers are becoming more cautious with their discretionary spending, particularly when it comes to premium athletic wear.

- Reduced Discretionary Spending: Inflation is eroding purchasing power, forcing consumers to prioritize essential expenses over non-essential items like premium sportswear.

- Impact on Premium Athletic Wear: Nike's products are often positioned at a higher price point, making them particularly vulnerable to reduced consumer spending.

- Shifting Consumer Preferences: Consumers are increasingly turning to more affordable, value-oriented brands, impacting Nike's market share. Data from [insert source, e.g., market research firm] suggests a [insert percentage]% decrease in sales of premium athletic footwear in the last quarter.

<h3>Increased Competition in the Athletic Wear Market</h3>

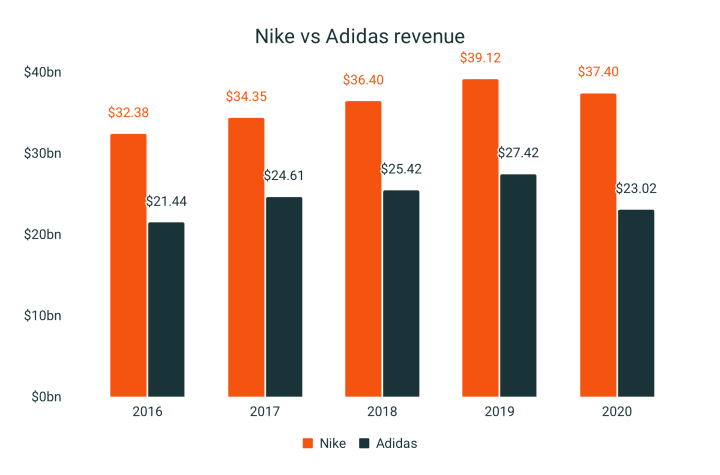

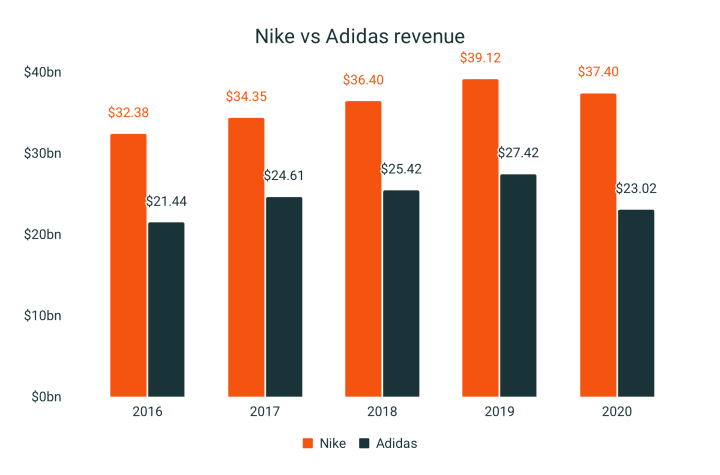

Nike is facing intensifying competition from established rivals like Adidas and Under Armour, as well as a surge of emerging brands offering innovative products and competitive pricing.

- Adidas' Successful Strategies: Adidas' strategic partnerships and innovative product lines, like their collaborations with influencers and their focus on sustainability, are gaining market share.

- Under Armour's Market Share Growth: Under Armour's targeted marketing campaigns and focus on performance technology have helped them maintain a strong presence in the athletic wear market.

- Emerging Brands: Smaller, agile brands are disrupting the market with niche products and direct-to-consumer sales models, further challenging Nike's dominance. Market share analysis indicates that Nike's share has declined by [insert percentage]% in the last [insert timeframe].

<h3>Supply Chain Disruptions and Inflationary Pressures</h3>

Ongoing global supply chain disruptions and escalating raw material costs are squeezing Nike's profit margins and impacting its ability to meet consumer demand efficiently.

- Logistical Hurdles: Delays in shipping and transportation are increasing lead times and impacting inventory levels.

- Raw Material Price Increases: Rising costs of materials like cotton, rubber, and synthetic fibers are pushing up production costs.

- Impact on Profit Margins: The combination of increased costs and weakened demand is significantly impacting Nike's profitability. Nike’s reported profit margins decreased by [insert percentage]% in [insert timeframe]. They are implementing strategies such as [mention specific strategies, e.g., cost-cutting measures, sourcing from alternative suppliers].

<h2>Market Reaction to the Predicted Nike Revenue Decline</h2>

The forecast of a Nike revenue dip has already begun to impact the market in several ways.

<h3>Stock Market Response</h3>

Nike's stock price has experienced [describe the fluctuation - e.g., a significant decline] following the release of the revenue forecast. Investor sentiment has turned [describe sentiment - e.g., cautious], with analyst ratings and predictions varying widely. [Insert relevant stock chart or data if available].

<h3>Impact on Nike's Brand Image and Marketing Strategies</h3>

The revenue decline may necessitate adjustments to Nike's branding and marketing strategies. This could include:

- Adjusted Marketing Campaigns: A shift towards more budget-conscious campaigns, focusing on value and affordability.

- Changes in Product Pricing Strategies: Potential price adjustments to maintain profitability while remaining competitive.

- Focus on New Market Segments: Exploration of untapped markets and expansion into new product categories.

<h3>Potential Long-Term Implications for Nike</h3>

This revenue dip could have significant long-term consequences for Nike, potentially necessitating strategic changes.

- Need for Innovation: Nike must accelerate innovation to maintain its competitive edge and attract consumers.

- Potential Restructuring: Internal restructuring might be necessary to streamline operations and reduce costs.

- Changes in Leadership or Direction: Significant changes in leadership or corporate strategy could be on the horizon.

<h2>Conclusion: Analyzing Nike's Revenue Dip and its Future Outlook</h2>

The predicted Nike revenue dip is a complex issue stemming from weakening consumer demand, increased competition, and supply chain disruptions. The market's reaction has been swift, with stock prices reflecting investor concern. Nike’s long-term success will depend on its ability to adapt to these challenges through innovation, strategic marketing, and efficient cost management. While the outlook presents challenges, opportunities for growth and market share gains remain. Stay updated on the latest news concerning Nike's revenue and its market impact to better understand the evolving sportswear market.

Featured Posts

-

Affordable Finds That Actually Work

May 06, 2025

Affordable Finds That Actually Work

May 06, 2025 -

Rihannas Parisian Glamour Fenty Beauty Fan Encounter

May 06, 2025

Rihannas Parisian Glamour Fenty Beauty Fan Encounter

May 06, 2025 -

Relacionamento De Mindy Kaling Com Ex De The Office A Declaracao De Amor Apos Anos De Silencio

May 06, 2025

Relacionamento De Mindy Kaling Com Ex De The Office A Declaracao De Amor Apos Anos De Silencio

May 06, 2025 -

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025 -

Kim Kardashian And Nike Partner For New Womens Fitness Brand

May 06, 2025

Kim Kardashian And Nike Partner For New Womens Fitness Brand

May 06, 2025

Latest Posts

-

Ndae Alhjylan Ymn Bla Dmae Dewt Llslam Fy Alymn

May 06, 2025

Ndae Alhjylan Ymn Bla Dmae Dewt Llslam Fy Alymn

May 06, 2025 -

Analisis Susunan Pemain Timnas U20 Indonesia Vs Yaman Welber Jardim Main Lagi

May 06, 2025

Analisis Susunan Pemain Timnas U20 Indonesia Vs Yaman Welber Jardim Main Lagi

May 06, 2025 -

Susunan Pemain Timnas U20 Indonesia Vs Yaman Analisis Dan Prediksi

May 06, 2025

Susunan Pemain Timnas U20 Indonesia Vs Yaman Analisis Dan Prediksi

May 06, 2025 -

Timnas U20 Indonesia Vs Yaman Bocoran Susunan Pemain And Peran Welber Jardim

May 06, 2025

Timnas U20 Indonesia Vs Yaman Bocoran Susunan Pemain And Peran Welber Jardim

May 06, 2025 -

Welber Jardim Starter Lagi Prediksi Susunan Pemain Timnas U20 Indonesia Vs Yaman

May 06, 2025

Welber Jardim Starter Lagi Prediksi Susunan Pemain Timnas U20 Indonesia Vs Yaman

May 06, 2025