First Time Since 2020: Hong Kong Buys US Dollars To Defend Currency Peg

Table of Contents

The Hong Kong Dollar's Linked Exchange Rate System

Hong Kong operates under a linked exchange rate system, pegging its currency, the Hong Kong dollar (HKD), to the US dollar (USD) within a narrow band of 7.75–7.85 HKD per USD. This system, established in 1983, has historically provided significant stability, attracting foreign investment and fostering economic growth. The mechanism relies on a currency board system, where the HKMA maintains sufficient US dollar reserves to meet any demand for HKD conversions. This ensures the peg remains largely stable and predictable.

- Stability attracts foreign investment: The consistent exchange rate reduces uncertainty for international investors.

- Reduces exchange rate risk for businesses: Hong Kong businesses engaged in international trade benefit from reduced currency fluctuations.

- Provides price stability for consumers: A stable exchange rate helps control inflation and maintain price stability for imported goods.

Reasons Behind the HKMA's Intervention

The recent intervention by the HKMA reflects mounting pressures on the Hong Kong dollar. Several factors contributed to this situation, including significant capital flows, widening interest rate differentials between the US and Hong Kong, and market speculation. The aggressive monetary policy tightening by the US Federal Reserve, leading to a strengthening US dollar, further exacerbated the situation.

- Increased capital outflows from Hong Kong: Investors moved funds out of Hong Kong seeking higher returns in other markets.

- Strengthening US dollar impacting the HKD: The stronger USD put upward pressure on the HKD/USD exchange rate, threatening to breach the upper limit of the peg.

- Speculative attacks weakening the peg: Market speculators bet against the HKD, putting further pressure on the currency.

The Impact of the US Dollar's Strength

A strong US dollar directly impacts the Hong Kong currency peg. The increasing value of the USD relative to the HKD makes Hong Kong exports more expensive in global markets, potentially harming the territory’s trade balance. Moreover, the rising USD increases the cost of imported goods, fueling inflationary pressures within Hong Kong.

- Makes Hong Kong exports more expensive: Reduced competitiveness in international markets.

- Can lead to increased import costs: Increased prices for consumers and businesses.

- Impacts competitiveness of Hong Kong businesses: Businesses face higher input costs and reduced demand for their products.

Implications for the Hong Kong Economy

The HKMA's intervention carries both short-term and long-term economic consequences. While the intervention protects the currency peg and maintains confidence in the system, it could potentially impact interest rates, influence foreign investment flows, and raise questions about the long-term viability of the linked exchange rate system.

- Potential impact on interest rates: The HKMA's actions may influence interest rates in Hong Kong to maintain the peg.

- Effect on foreign investment flows: Investor confidence plays a significant role in future capital flows.

- Long-term viability of the linked exchange rate: The recent intervention raises questions about the long-term sustainability of the current system.

Future Outlook for the Hong Kong Dollar and its Peg

The future stability of the Hong Kong dollar peg remains uncertain. While the HKMA's intervention demonstrates its commitment to maintaining the peg, the ongoing global economic volatility and the strength of the US dollar will continue to present challenges. The HKMA may need to make further interventions or even consider adjustments or modifications to the current system in the future. Alternative exchange rate mechanisms may be discussed, but the likelihood of abandoning the peg entirely remains low, given its historical success.

- Potential for future interventions by the HKMA: The HKMA may need to intervene again depending on market conditions.

- Discussion of potential reforms to the peg: Adjustments to the band or other mechanisms might be considered.

- Analysis of alternative currency regimes: While unlikely, exploring alternatives remains a possibility for future discussions.

Conclusion

The HKMA's recent intervention to defend the Hong Kong dollar's peg to the US dollar marks a significant event, highlighting the ongoing challenges in maintaining this long-standing monetary policy. Understanding the intricacies of the Hong Kong currency peg, the factors influencing its stability, and the potential implications for the Hong Kong economy is crucial. The future stability of the peg will depend on a multitude of factors, including global economic conditions and the ongoing relationship between the US and Hong Kong economies. Staying informed about the evolving situation surrounding the Hong Kong currency peg is essential for anyone invested in or doing business with Hong Kong. Continue to monitor news and updates regarding the Hong Kong dollar’s exchange rate and the HKMA's actions to gain a comprehensive understanding of this dynamic situation.

Featured Posts

-

Eight Hour Treetop Hideout Migrant Evades Ice Arrest

May 05, 2025

Eight Hour Treetop Hideout Migrant Evades Ice Arrest

May 05, 2025 -

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

May 05, 2025

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

May 05, 2025 -

Ufc Des Moines Predictions A Comprehensive Guide

May 05, 2025

Ufc Des Moines Predictions A Comprehensive Guide

May 05, 2025 -

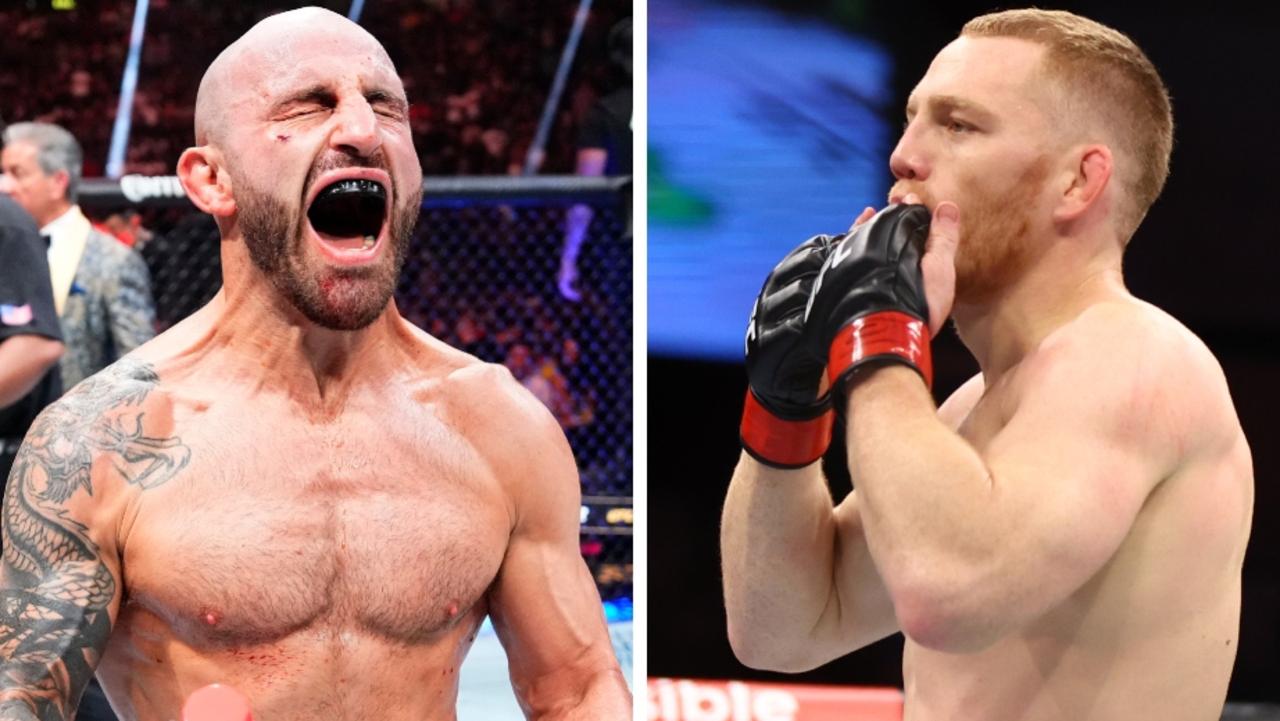

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 05, 2025 -

The Poirier Retirement Debate Insights From Paddy Pimblett

May 05, 2025

The Poirier Retirement Debate Insights From Paddy Pimblett

May 05, 2025

Latest Posts

-

Ufc Fight Night Predictions Sandhagen Vs Figueiredo Expert Picks And Odds

May 05, 2025

Ufc Fight Night Predictions Sandhagen Vs Figueiredo Expert Picks And Odds

May 05, 2025 -

Ufc Des Moines Predictions A Comprehensive Guide

May 05, 2025

Ufc Des Moines Predictions A Comprehensive Guide

May 05, 2025 -

Ufc Des Moines Fight By Fight Predictions And Betting Preview

May 05, 2025

Ufc Des Moines Fight By Fight Predictions And Betting Preview

May 05, 2025 -

Ufc Des Moines Betting Preview Mma Picks And Odds Analysis

May 05, 2025

Ufc Des Moines Betting Preview Mma Picks And Odds Analysis

May 05, 2025 -

Top Mma Bets For Ufc Des Moines Fight Picks And Analysis

May 05, 2025

Top Mma Bets For Ufc Des Moines Fight Picks And Analysis

May 05, 2025