First Outside China: Lynas's Impact On The Heavy Rare Earths Market

Table of Contents

- Lynas's Position as a Major Player Outside China

- Production Capacity and Geographic Location

- Focus on Heavy Rare Earths

- Impact on the Global Heavy Rare Earths Market

- Price Stability and Competition

- Geopolitical Implications

- Challenges and Future Prospects for Lynas

- Environmental Concerns and Regulation

- Expansion Plans and Technological Advancements

- Conclusion

Lynas's Position as a Major Player Outside China

Lynas has established itself as a leading producer of rare earth elements, offering a crucial alternative to China's dominance in the heavy rare earths market.

Production Capacity and Geographic Location

Lynas's primary production facility is located in Gebeng, Malaysia. This strategic location plays a vital role in diversifying the global supply chain and reducing reliance on a single source, particularly China.

- Production Capacity: Lynas boasts a significant production capacity, producing a substantial percentage of the world's neodymium and dysprosium. While precise figures fluctuate, they represent a notable portion of global output, challenging China's market share.

- Comparison to Chinese Production: While still significantly smaller than China's overall production, Lynas's output represents a considerable increase in non-Chinese heavy rare earths production, providing much-needed diversification.

- Strategic Location Advantages: Malaysia's location offers logistical advantages for supplying the Asian and global markets. It also benefits from a relatively stable political and economic environment conducive to mining and processing operations. This contrasts with some of the geopolitical risks associated with sourcing heavy rare earths solely from China. The strategic location also improves supply chain resilience.

Focus on Heavy Rare Earths

Unlike some Chinese producers with broader portfolios, Lynas specializes in the production of heavy rare earths, particularly neodymium and dysprosium. These elements are critical components in high-tech applications.

- Specific Heavy Rare Earths Produced: Lynas's production includes crucial elements like neodymium and dysprosium, essential for the manufacturing of powerful permanent magnets.

- Applications: These magnets are vital components in electric vehicle motors, wind turbine generators, and other advanced technologies. The increased availability of these elements from Lynas significantly impacts these industries.

- Market Share Analysis: While Lynas doesn't hold the majority market share, its growing presence exerts competitive pressure, impacting pricing and supply chain dynamics within the heavy rare earths market. Its market share is steadily increasing, further challenging China's dominance.

Impact on the Global Heavy Rare Earths Market

Lynas's emergence as a major player has had a substantial impact on the dynamics of the global heavy rare earths market.

Price Stability and Competition

The increased competition introduced by Lynas has had a noticeable impact on the price volatility historically associated with heavy rare earth elements.

- Price Comparisons: Analyzing heavy rare earth prices before and after Lynas's significant expansion reveals a degree of price stabilization, although fluctuations still occur due to factors such as global demand.

- Market Share Data: Lynas's growing market share has increased competition, creating a more balanced market and reducing the pricing power of Chinese producers.

- Impact on Chinese Producers: The presence of a significant non-Chinese producer has forced Chinese producers to become more competitive, potentially leading to more efficient production methods and potentially fairer pricing practices.

Geopolitical Implications

The existence of a substantial heavy rare earths producer outside China has significant geopolitical implications.

- Reduced Geopolitical Risk: Diversifying the supply chain reduces reliance on a single nation for these critical materials, mitigating the geopolitical risks associated with potential supply disruptions from China.

- Increased Supply Chain Resilience: The presence of Lynas strengthens global supply chain resilience and reduces vulnerability to disruptions caused by political instability, trade disputes, or other unforeseen events originating from a single source.

- Potential Implications for International Relations: Lynas's success contributes to a more balanced global landscape for rare earth elements, potentially influencing international relations and reducing the leverage China holds in this strategically crucial sector.

Challenges and Future Prospects for Lynas

Despite its success, Lynas faces ongoing challenges and opportunities for future growth.

Environmental Concerns and Regulation

Like any mining operation, Lynas faces environmental concerns and stringent regulations.

- Environmental Regulations in Malaysia: Lynas operates under strict environmental regulations in Malaysia, requiring responsible waste management and mitigation of environmental impact.

- Waste Management: Lynas's commitment to responsible waste management and environmental protection is crucial for maintaining its operational license and public trust.

- Community Relations: Maintaining positive relationships with local communities and addressing their concerns is essential for the long-term sustainability of Lynas's operations.

Expansion Plans and Technological Advancements

Lynas is actively pursuing expansion plans and investing in technological advancements to enhance its competitiveness.

- Planned Capacity Increases: Lynas has announced plans to significantly increase its production capacity in the coming years, further solidifying its position in the global heavy rare earths market.

- R&D Investments: Investments in research and development are crucial for improving the efficiency of its rare earth processing techniques and reducing production costs.

- Potential for New Technologies: Lynas is exploring new technologies to enhance its extraction and processing methods, potentially leading to more sustainable and cost-effective production of rare earth elements.

Conclusion

Lynas Corporation has undeniably made a significant impact on the global heavy rare earths market. Its emergence as a major producer outside China has increased competition, promoted price stability, and significantly enhanced geopolitical stability by diversifying the supply chain. While challenges remain, including environmental concerns and the need for continued technological advancements, Lynas's future prospects are bright. The company's continued expansion and innovation will be crucial in shaping the future of the heavy rare earths market and ensuring a secure supply of these vital materials for the technologies that power our world. To learn more about Lynas and its contribution to a more diversified and secure heavy rare earths market, visit their website and explore industry reports on rare earth element production and market analysis. Understanding the impact of Lynas on heavy rare earths is crucial for anyone interested in investing in heavy rare earths or the future of clean energy technologies.

Yankees Vs Mariners Mlb Game Predictions Picks And Odds

Yankees Vs Mariners Mlb Game Predictions Picks And Odds

All Fortnite Tmnt Skins Complete Guide And How To Get Them

All Fortnite Tmnt Skins Complete Guide And How To Get Them

Thibodeaus Plea For Resolve Knicks Suffer Devastating 37 Point Loss

Thibodeaus Plea For Resolve Knicks Suffer Devastating 37 Point Loss

Roma Monza Partido En Directo Online

Roma Monza Partido En Directo Online

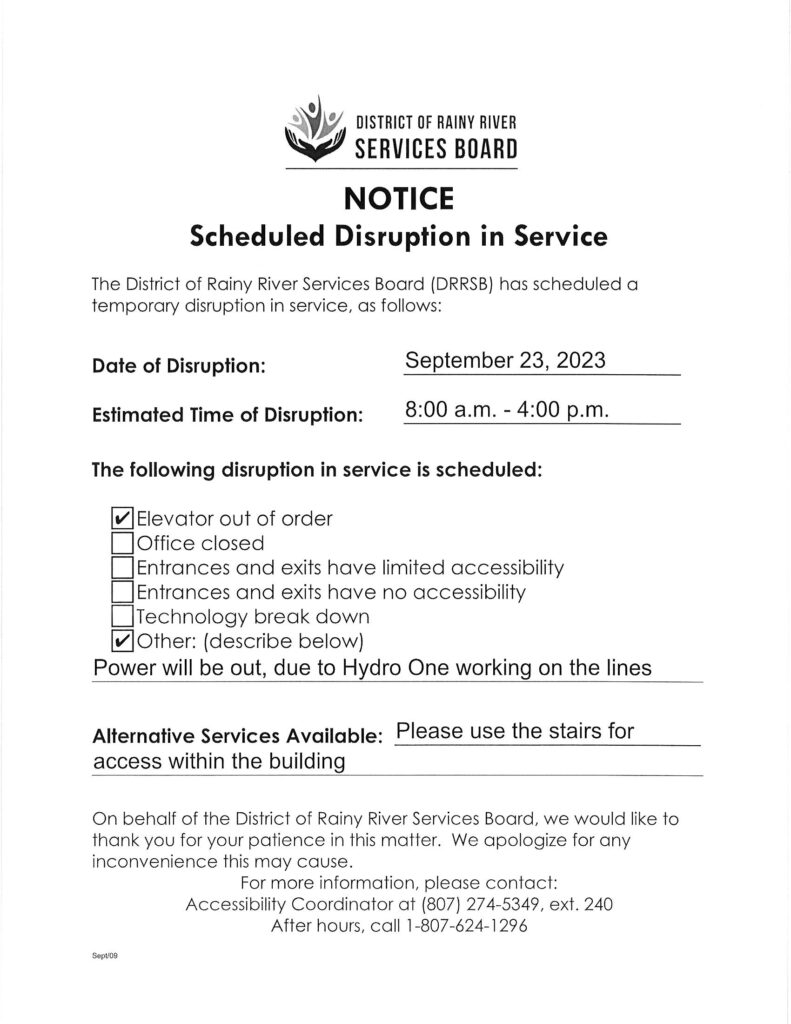

Reddit Downtime Resolved Official Statement On Recent Service Disruption

Reddit Downtime Resolved Official Statement On Recent Service Disruption