Finding The Real Safe Bet: A Guide To Low-Risk Investment Options

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific low-risk investment options, it's crucial to understand your own risk tolerance. This assessment forms the bedrock of a successful investment strategy.

Assessing Your Financial Goals

Your investment choices must align perfectly with your financial objectives. Are you saving for retirement in 20 years, or for a down payment on a house in two?

- Short-term vs. long-term goals: Short-term goals (e.g., a down payment) necessitate more conservative investments to preserve capital. Long-term goals (e.g., retirement) allow for slightly more risk-taking, as there's more time to recover from potential market downturns.

- Impact of time horizon on risk tolerance: The longer your investment horizon, the more time you have to ride out market fluctuations, allowing for a potentially higher-risk, higher-reward strategy (though still within the realm of low-risk options).

- Importance of defining financial needs: Clearly defining your needs – retirement income, college tuition, etc. – helps you determine the amount of capital needed and the appropriate investment strategy.

Identifying Your Risk Profile

Your risk profile reflects your comfort level with potential investment losses.

- Risk questionnaires: Many online resources offer questionnaires to assess your risk tolerance. These tools provide a structured approach to understanding your comfort levels with varying degrees of risk.

- Self-assessment tools: Honest self-reflection is crucial. Consider your emotional reaction to past financial setbacks – how did you feel about small losses? This introspection helps identify your personal risk tolerance levels.

- Professional financial advice: A certified financial advisor can offer personalized guidance, tailoring investment strategies to your specific risk profile and financial goals. They can also help you understand complex investment products and create a diversified portfolio.

Exploring Low-Risk Investment Options

Several investment vehicles offer relatively low risk, providing a safe haven for your capital while generating a return.

High-Yield Savings Accounts (HYSA)

HYSAs offer a convenient and accessible way to earn interest on your deposits.

- Comparing interest rates from different banks: Shop around to find the best interest rates, as rates can vary significantly between financial institutions. Compare Annual Percentage Yields (APYs) to ensure you're getting the most for your money.

- Accessibility of funds: Funds in HYSAs are readily accessible, making them ideal for emergency funds or short-term savings goals.

- Potential for inflation erosion: A key limitation is that the interest earned might not always outpace inflation, potentially reducing your purchasing power over time.

Certificates of Deposit (CDs)

CDs offer a fixed interest rate for a specific period (term).

- Fixed vs. variable rate CDs: Fixed-rate CDs offer predictable returns, while variable-rate CDs offer fluctuating returns based on market interest rates. Consider your risk tolerance and time horizon when choosing between these options.

- CD laddering strategies: To mitigate risk and maximize returns, consider spreading your investments across CDs with varying maturity dates (CD laddering). This strategy provides a steady stream of income and reduces the impact of interest rate fluctuations.

- Risk mitigation through diversification across different CD maturities: Diversification across different maturity periods helps reduce the impact of interest rate changes on your overall portfolio.

Government Bonds (Treasury Bonds, Bills, Notes)

Government bonds are considered among the safest investments due to their backing by the government.

- Understanding bond yields: Bond yields represent the return an investor receives on a bond investment. They fluctuate based on market conditions.

- Inflation-protected securities (TIPS): TIPS are designed to protect investors from inflation, as their principal value adjusts with the inflation rate.

- Tax implications: The tax implications of bond investments can vary depending on the type of bond and your individual tax situation. It is important to understand these implications before investing.

Money Market Accounts (MMAs)

MMAs are similar to HYSAs but often offer slightly higher interest rates and limited check-writing capabilities.

- Interest rate fluctuations: Like HYSAs, interest rates on MMAs can fluctuate, impacting your earnings.

- Minimum balance requirements: Many MMAs require maintaining a minimum balance to avoid fees.

- Transaction limits: Some MMAs might impose limits on the number of withdrawals or transfers you can make within a specific period.

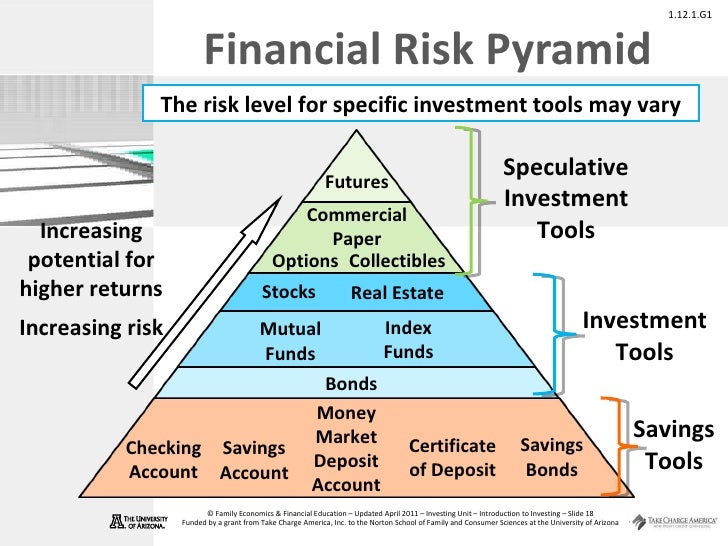

Diversification and Portfolio Management for Low-Risk Investing

Even within the realm of low-risk investments, diversification is key.

The Importance of Diversification

Diversification across different asset classes reduces the overall risk of your portfolio.

- Reducing portfolio volatility: Spreading investments across multiple asset classes helps to lessen the impact of market fluctuations on your overall portfolio value.

- Spreading risk: By not putting all your eggs in one basket, you protect yourself from potential losses if one asset class performs poorly.

- Examples of diversified low-risk portfolios: A diversified portfolio might include a mix of HYSAs, CDs, government bonds, and MMAs, tailored to your risk tolerance and financial goals.

Regular Portfolio Review and Rebalancing

Regularly reviewing and rebalancing your portfolio is crucial for long-term success.

- Frequency of reviews: Ideally, review your portfolio at least annually, or more frequently if market conditions are volatile or your financial circumstances change.

- Considering market changes: Market conditions are constantly evolving. Staying informed and adjusting your portfolio accordingly can help maintain its optimal balance.

- Adjusting asset allocation: Rebalancing involves adjusting your asset allocation (the proportion of your portfolio invested in different asset classes) to maintain your desired risk level.

Conclusion

We've explored several key low-risk investment options, including HYSAs, CDs, government bonds, and MMAs. Remember, understanding your risk tolerance and diversifying your portfolio are fundamental to building a secure financial future. By carefully considering your financial goals and choosing the right mix of low-risk investments, you can confidently navigate the investment landscape and achieve your financial objectives. Find the right low-risk investment options for you today and start building your secure financial future with these low-risk investment strategies.

Featured Posts

-

The Attorney General And Fox News Beyond The Headlines

May 09, 2025

The Attorney General And Fox News Beyond The Headlines

May 09, 2025 -

Call For Simplified Bond Forward Rules From Indian Insurance Sector

May 09, 2025

Call For Simplified Bond Forward Rules From Indian Insurance Sector

May 09, 2025 -

Dijon Celebre Gustave Eiffel Et Son Lien Familial

May 09, 2025

Dijon Celebre Gustave Eiffel Et Son Lien Familial

May 09, 2025 -

The Jesse Watters Controversy Hypocrisy Accusations Following Cheating Joke

May 09, 2025

The Jesse Watters Controversy Hypocrisy Accusations Following Cheating Joke

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025