Finding Reputable Direct Lenders For Bad Credit Personal Loans

Table of Contents

Understanding Direct Lenders vs. Brokers

Before diving into your search for direct lenders for bad credit personal loans, it's crucial to understand the difference between direct lenders and loan brokers. This distinction significantly impacts your loan application process and overall experience.

-

Direct Lender: A direct lender provides the loan funds directly to you. They handle the entire application process, from initial approval to disbursement. This often translates to faster processing times and a simpler application. Direct lenders might also offer slightly better rates because they don't have to share profits with a broker.

-

Broker: A loan broker acts as an intermediary, connecting you with multiple lenders. While convenient, brokers often charge fees, which can increase your overall loan cost. The application process can also be more complex, as you may need to submit multiple applications to different lenders through the broker.

Advantages of Direct Lenders for Bad Credit Loans:

- Faster Processing: Direct lenders typically have streamlined processes, leading to quicker approvals.

- Simpler Application: You only need to complete one application, avoiding redundant paperwork.

- Potentially Better Rates: Without intermediary fees, direct lenders may offer more competitive interest rates.

Identifying Reputable Direct Lenders for Bad Credit

Thorough research is paramount when searching for direct lenders for bad credit personal loans. Don't rush into the first offer you see; take the time to carefully vet potential lenders.

Key Factors to Consider:

-

Licensing and Regulation: Ensure the lender is licensed and complies with all applicable state and federal regulations. You can often find this information on the lender's website or by contacting your state's financial regulatory authority.

-

Transparency and Fees: Reputable lenders provide clear and upfront information about fees, interest rates, and loan terms. Avoid lenders with hidden charges or vague explanations of their fees. Look for a detailed loan agreement that you can easily understand.

-

Customer Reviews and Ratings: Check online reviews on sites like the Better Business Bureau (BBB) and Trustpilot. Be wary of lenders with overwhelmingly positive reviews – they might be fake. Look for a balanced representation of both positive and negative feedback.

-

Security and Privacy: A reputable lender will use secure platforms to protect your personal and financial information. Look for indicators such as HTTPS in the website address and a privacy policy outlining their data protection measures.

-

Terms and Conditions: Always carefully read and understand the loan agreement before signing. Don't hesitate to ask questions if anything is unclear.

Tips for a Successful Application with Bad Credit

Even with bad credit, you can increase your chances of loan approval. Here's how:

-

Improve your credit score: Before applying, try to improve your creditworthiness. This may involve paying down existing debts, correcting errors on your credit report, and using credit responsibly.

-

Provide accurate information: Accuracy is key. Provide truthful and complete information on your application. Inaccuracies can lead to rejection or even legal consequences.

-

Shop around for the best rates: Don't settle for the first offer you receive. Compare offers from multiple lenders to find the best interest rates and terms. Use online comparison tools to simplify this process.

-

Consider secured loans: If you're struggling to secure an unsecured loan, a secured loan, which requires collateral, may be a viable option. This reduces the risk for the lender and can make approval more likely.

Avoiding Loan Scams and Predatory Lending

Unfortunately, the world of bad credit loans attracts scammers and predatory lenders. Be vigilant and aware of the following red flags:

-

Guaranteed Approval: Be wary of lenders who guarantee approval regardless of your credit score. This is a major red flag.

-

High Upfront Fees: Legitimate lenders rarely charge significant upfront fees. Avoid any lender demanding large payments before loan approval.

-

Vague Terms: Unclear or confusing terms and conditions are a sign of potential trouble.

-

Aggressive Sales Tactics: High-pressure sales tactics should be a warning sign. A reputable lender will provide you with time to consider your options.

Reporting Suspicious Activities:

If you encounter a suspicious lender, report them to the Federal Trade Commission (FTC) and your state's attorney general.

Conclusion

Finding reputable direct lenders for bad credit personal loans requires careful research and due diligence. By understanding the differences between direct lenders and brokers, carefully evaluating potential lenders, and following the tips outlined in this article, you can significantly increase your chances of securing a fair and responsible loan. Don't let bad credit define your financial future. Start your search today by comparing lenders and making informed decisions. Remember, a responsible approach will lead you to the best direct lenders for bad credit personal loans for your specific needs.

Featured Posts

-

Justin Baldonis Lawyer Files Opposing Brief To Blake Livelys Motion

May 28, 2025

Justin Baldonis Lawyer Files Opposing Brief To Blake Livelys Motion

May 28, 2025 -

Leeds United Transfer News Verbal Agreement Reached Players Stance Revealed

May 28, 2025

Leeds United Transfer News Verbal Agreement Reached Players Stance Revealed

May 28, 2025 -

2025 Mlb Season Ranking Every Teams Starting Left Fielder

May 28, 2025

2025 Mlb Season Ranking Every Teams Starting Left Fielder

May 28, 2025 -

Ana Peleteiro Y Otros 12 Atletas Espanoles En El Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025

Ana Peleteiro Y Otros 12 Atletas Espanoles En El Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025 -

Man Utd Stars Transformation Sale Sought Despite Ratcliffes Opposition

May 28, 2025

Man Utd Stars Transformation Sale Sought Despite Ratcliffes Opposition

May 28, 2025

Latest Posts

-

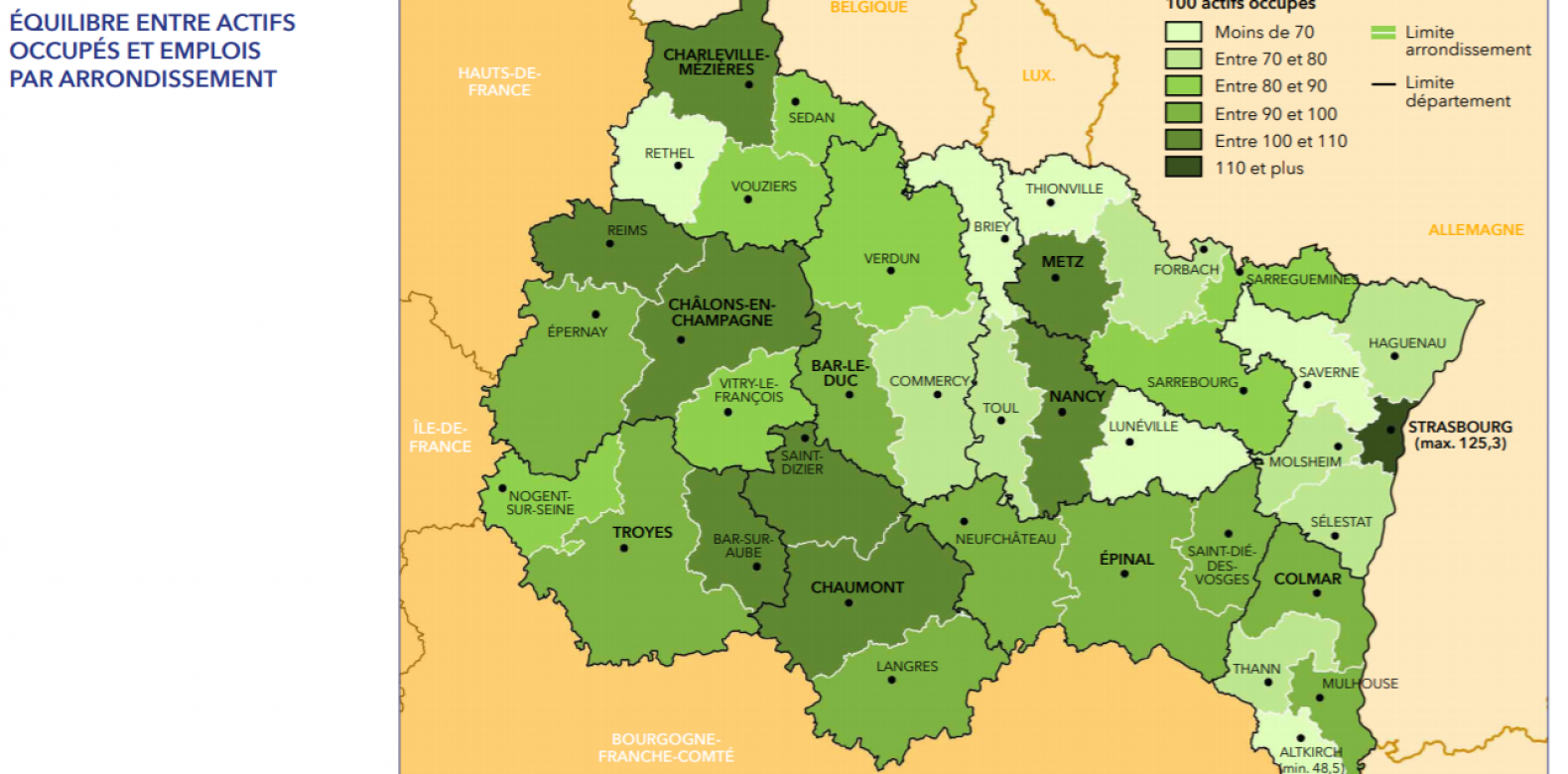

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025 -

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025 -

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025 -

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025 -

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025