Financial Times: BP CEO Targets Valuation Doubling, Rejects US Listing

Table of Contents

BP's CEO's Ambitious Valuation Target

Doubling the Current Market Capitalization

BP's current market capitalization fluctuates, but let's assume, for the sake of discussion, it's around $100 billion. A doubling of this BP valuation would represent a staggering $100 billion increase, pushing the company's market cap to $200 billion. This ambitious target requires significant growth and improved performance across various sectors.

-

Factors Driving the Goal: This ambitious goal is fueled by several factors. BP is heavily investing in renewable energy sources, aiming to become a leader in the transition to cleaner energy. Increased profitability from existing oil and gas operations, coupled with streamlined operations and cost reductions, is also expected to contribute significantly. Furthermore, strategic acquisitions and partnerships could play a crucial role.

-

Challenges in Achieving the Target: The path to doubling BP's valuation is fraught with challenges. Intense competition from other energy giants, volatile global energy markets subject to geopolitical instability and fluctuating demand, and strict environmental regulations present significant hurdles. Moreover, successfully navigating the energy transition and managing the risks associated with significant investments in renewable energy will be crucial.

-

Expert Opinions: Financial analysts have offered mixed opinions. Some express skepticism, citing the volatile nature of the energy sector and the challenges of competing with established players in the renewable energy market. Others are more optimistic, highlighting BP's significant resources, its history of innovation, and the potential for substantial growth in the renewable energy sector.

Rejection of a US Stock Market Listing

Reasons Behind the Decision

The decision to forgo a US stock market listing is a significant strategic move. While the exact reasons haven't been explicitly stated, several factors likely influenced the decision.

-

Regulatory Compliance Concerns: Listing on the US stock exchanges comes with stringent regulatory compliance requirements, potentially leading to increased administrative burdens and compliance costs. These costs could detract from resources allocated to growth initiatives.

-

Impact on Investor Access and Ownership Dilution: While a US listing could broaden investor access, it might also lead to a dilution of ownership for existing shareholders. BP may have prioritized maintaining a stronger degree of control over its company direction.

-

Advantages of the Existing Listing: BP's current stock exchange listing offers certain advantages that outweigh the potential benefits of adding a US listing, potentially including lower listing fees and a more favorable regulatory environment.

Implications for Investors and the Energy Sector

Impact on Share Prices

The announcement of BP's ambitious valuation goal and the rejection of a US listing are likely to impact the company's share price.

-

Investor Reactions: Short-term reactions could be mixed. Some investors might be encouraged by the ambitious growth strategy, while others might be concerned about the challenges involved. The market’s response will depend on the perceived feasibility of the BP valuation doubling plan and the overall confidence in the company's leadership and execution abilities.

-

Broader Implications for the Energy Sector: This strategic move by BP could influence other major energy players to re-evaluate their own growth strategies and market positioning. The decision to prioritize existing listing demonstrates a confidence in the company's existing investor base and strategy.

BP's Long-Term Strategy

This announcement provides valuable insights into BP's long-term strategy.

-

Transition to Cleaner Energy: The emphasis on achieving a doubled BP valuation aligns with the company's stated commitment to transitioning to cleaner energy sources. Achieving this target will require significant investments and successful execution in this area.

-

Changes to Investment Priorities: We can expect BP to prioritize investments in renewable energy projects, research and development in low-carbon technologies, and strategic partnerships within this emerging sector to support the ambitious BP valuation doubling objective.

Conclusion

The Financial Times report highlights BP's ambitious goal to double its valuation, a bold move accompanied by a rejection of a US stock market listing. This strategy reflects BP's commitment to growth and its focus on the transition to cleaner energy. While achieving this ambitious BP valuation target will present significant challenges, the potential rewards are substantial. The strategic implications for BP and the broader energy sector are considerable, triggering a reassessment of growth strategies and market positioning.

Call to Action: Stay informed about the progress BP makes towards its ambitious goal of doubling its valuation. Follow future news and analysis regarding the BP valuation doubling strategy to understand the evolving landscape of the energy sector. Keep an eye on future developments in BP's valuation and its impact on the global energy market.

Featured Posts

-

A Family Legacy The Traversos Of Cannes Film Festival Photography

May 21, 2025

A Family Legacy The Traversos Of Cannes Film Festival Photography

May 21, 2025 -

Defining The Sound Perimeter Music And Collective Identity

May 21, 2025

Defining The Sound Perimeter Music And Collective Identity

May 21, 2025 -

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Voedingsbedrijven En De Afhankelijkheid Van Goedkope Arbeidsmigranten

May 21, 2025 -

Louth Food Heros Entrepreneurial Journey Inspiring Other Businesses

May 21, 2025

Louth Food Heros Entrepreneurial Journey Inspiring Other Businesses

May 21, 2025 -

Original Sins Finale A Re Evaluation Of Dexters Debra Morgan Handling

May 21, 2025

Original Sins Finale A Re Evaluation Of Dexters Debra Morgan Handling

May 21, 2025

Latest Posts

-

British Ultrarunner Targets Trans Australia Speed Record

May 21, 2025

British Ultrarunner Targets Trans Australia Speed Record

May 21, 2025 -

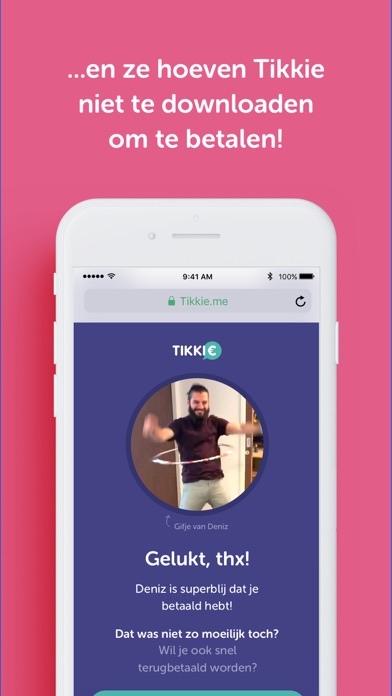

Nederlandse Bankieren Vereenvoudigd De Tikkie Methode

May 21, 2025

Nederlandse Bankieren Vereenvoudigd De Tikkie Methode

May 21, 2025 -

British Ultrarunner Attempts Australian Speed Record

May 21, 2025

British Ultrarunner Attempts Australian Speed Record

May 21, 2025 -

Betalingen Met Tikkie Een Handleiding Voor Nederland

May 21, 2025

Betalingen Met Tikkie Een Handleiding Voor Nederland

May 21, 2025 -

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 21, 2025

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 21, 2025