Financial Mistakes Women Should Avoid

Table of Contents

- Underestimating the Power of Saving and Investing

- The Importance of Early Saving

- Ignoring Investment Opportunities

- Neglecting Financial Planning and Budgeting

- The Importance of a Budget

- Lack of Long-Term Financial Planning

- Falling Prey to Debt and High-Interest Rates

- High-Interest Debt Traps

- Avoiding Unnecessary Spending

- Failing to Negotiate and Advocate for Yourself Financially

- Negotiating Salary and Benefits

- Seeking Financial Advice and Education

- Conclusion

Underestimating the Power of Saving and Investing

Many women underestimate the transformative power of consistent saving and strategic investing. Taking control of your financial future starts early, and understanding the principles of compounding interest is key.

The Importance of Early Saving

The magic of compounding interest allows your earnings to generate further earnings over time. Starting early maximizes this effect, leading to significantly larger returns in the long run.

- Example: Investing $100 per month at age 25 versus age 35, with a 7% annual return, will result in a substantially larger nest egg by retirement age.

- Saving Vehicles: Explore various options such as 401(k)s (employer-sponsored retirement plans), IRAs (Individual Retirement Accounts – Roth and Traditional), and high-yield savings accounts to maximize your returns. Take advantage of employer matching contributions to your 401(k) – it's essentially free money!

Ignoring Investment Opportunities

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket! Explore various investment vehicles tailored to your risk tolerance and financial goals:

- Stocks: Offer higher potential returns but also carry higher risk.

- Bonds: Generally considered less risky than stocks, offering more stability.

- Mutual Funds: Diversified portfolios managed by professionals.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded on stock exchanges.

Debunking Myths: Don't let fear or misinformation prevent you from investing. Many women are hesitant due to perceived complexity, but seeking professional advice or utilizing online resources can demystify the process.

Neglecting Financial Planning and Budgeting

A solid financial foundation is built on meticulous planning and budgeting. Proactive financial planning empowers you to achieve your financial goals and build wealth steadily.

The Importance of a Budget

Creating and adhering to a budget is paramount. Track your income and expenses diligently to identify areas where you can save and allocate funds toward your goals.

- Budgeting Apps: Mint, YNAB (You Need a Budget), and Personal Capital are popular tools to simplify the process.

- Budgeting Methods: Consider the 50/30/20 rule (50% needs, 30% wants, 20% savings & debt repayment) or zero-based budgeting (allocating every dollar).

Lack of Long-Term Financial Planning

Planning for retirement, estate planning, and other long-term goals is crucial. Don’t delay these vital steps.

- Retirement Planning: Determine your retirement goals, estimate your expenses, and adjust your savings accordingly. Consider consulting with a financial advisor.

- Estate Planning: Draft a will, designate a power of attorney, and consider life insurance to protect your loved ones.

Falling Prey to Debt and High-Interest Rates

High-interest debt can severely hinder your financial progress. Understanding and managing debt is vital to avoid long-term financial difficulties.

High-Interest Debt Traps

Credit card debt, payday loans, and other high-interest loans can quickly spiral out of control.

- Debt Payoff Strategies: Explore the debt snowball (paying off smallest debts first) or debt avalanche (paying off highest-interest debts first) methods.

- Understanding APR and Credit Scores: Become familiar with Annual Percentage Rates (APR) and how your credit score impacts your borrowing ability.

Avoiding Unnecessary Spending

Impulse buying and emotional spending can deplete your resources. Practice mindful spending.

- Mindful Spending: Pause before making purchases; ask yourself if it's a need or a want.

- Spending Limits: Set daily or weekly spending limits to curb impulsive purchases.

- Prioritize Needs: Focus on essential expenses before indulging in non-essential items.

Failing to Negotiate and Advocate for Yourself Financially

Women often undersell their skills and undervalue their contributions. Learning to negotiate and advocate for your financial well-being is essential.

Negotiating Salary and Benefits

Research salary ranges for your position and confidently negotiate for fair compensation. Don't underestimate your worth!

- Salary Negotiation Tips: Prepare with data, present your accomplishments, and be assertive but respectful.

- Addressing Gender Pay Gaps: Be aware of potential gender bias and advocate for equal pay.

Seeking Financial Advice and Education

Don't hesitate to seek professional guidance and utilize free resources.

- Reliable Resources: Explore government websites (e.g., the Consumer Financial Protection Bureau), non-profit organizations (e.g., the National Foundation for Credit Counseling), and certified financial planners.

Conclusion

Avoiding these financial mistakes women should avoid requires proactive planning, mindful spending, and a commitment to financial literacy. By understanding the importance of saving, investing wisely, managing debt effectively, and advocating for your financial well-being, you can build a secure and prosperous financial future. Take action today! Start by creating a budget, reviewing your investment portfolio, or scheduling a consultation with a financial advisor. Remember, your financial well-being is a priority, and taking control of your finances empowers you to achieve your dreams. Learn more about how to avoid common financial mistakes women should avoid by visiting [link to a relevant resource].

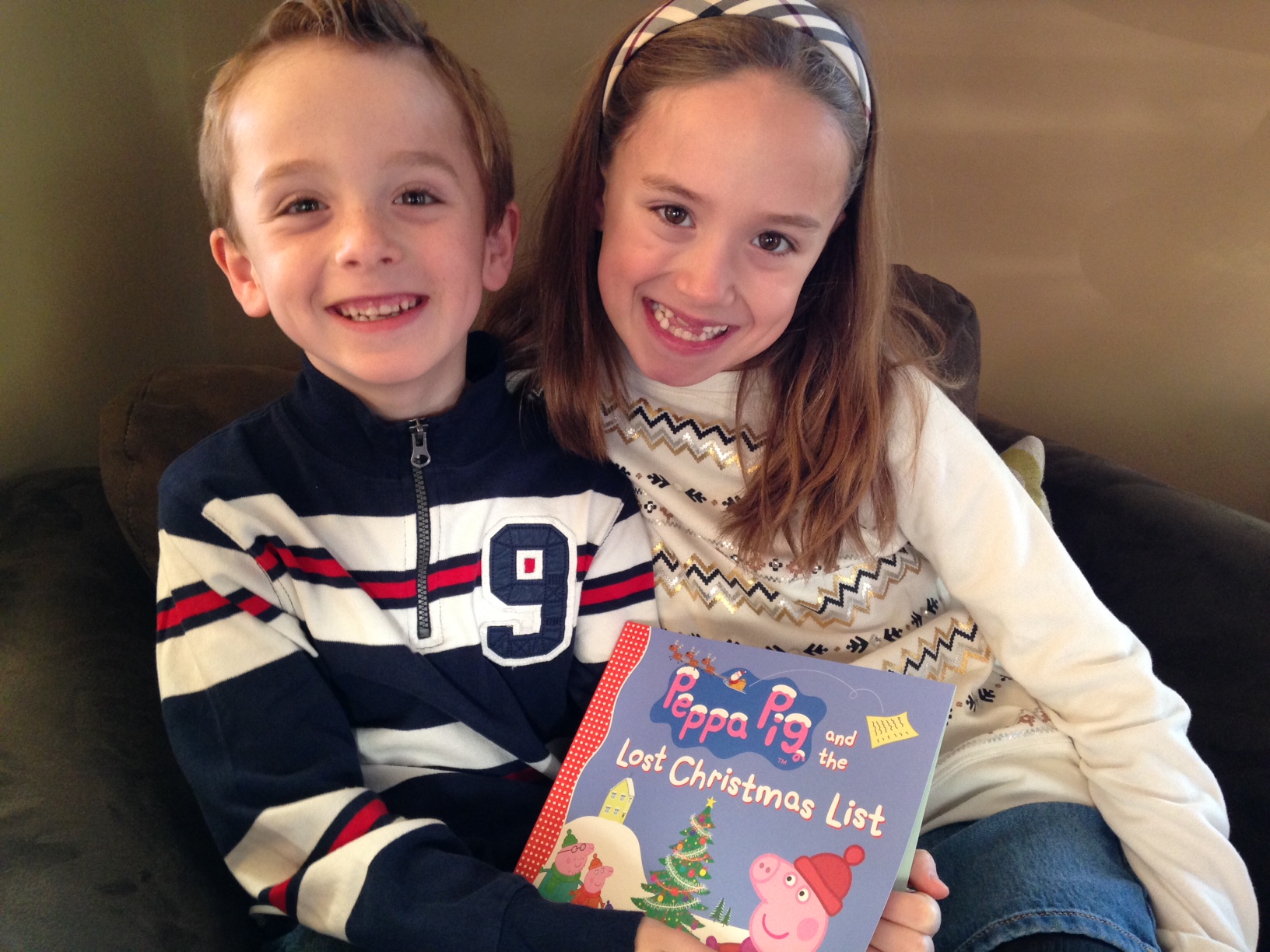

Fans Discover Peppa Pigs Real Name Ahead Of New Siblings Arrival

Fans Discover Peppa Pigs Real Name Ahead Of New Siblings Arrival

John Lithgow And Jimmy Smits A Dexter Resurrection Reunion

John Lithgow And Jimmy Smits A Dexter Resurrection Reunion

Succession Planning For High Net Worth Individuals Challenges And Strategies

Succession Planning For High Net Worth Individuals Challenges And Strategies

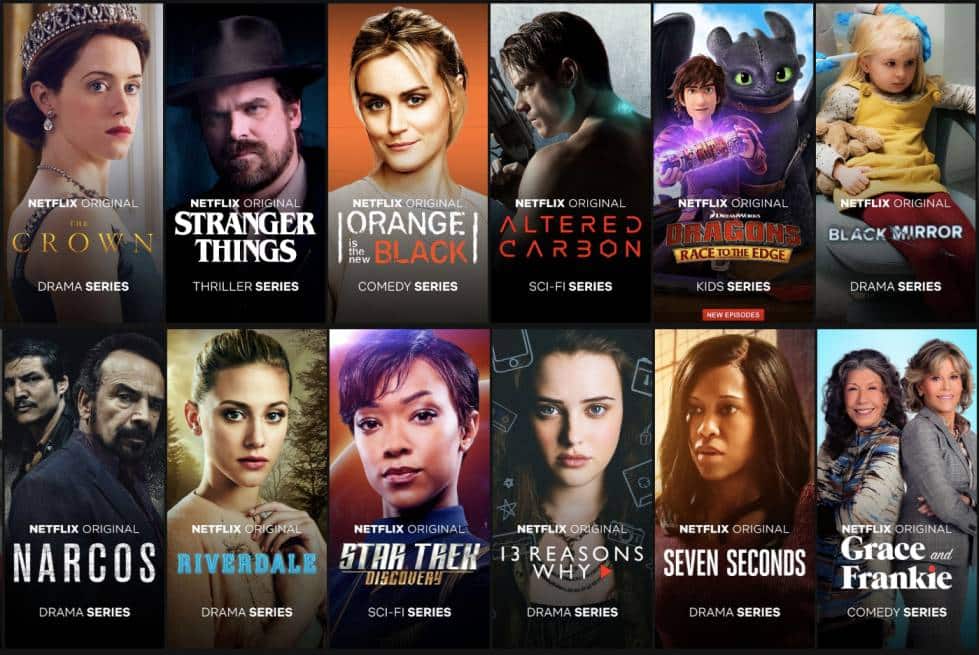

Whats New On Netflix In May 2025

Whats New On Netflix In May 2025

Fan Favorite Villain Returns In Dexter Resurrection

Fan Favorite Villain Returns In Dexter Resurrection