Finance Loans 101: Your Complete Guide To Applying For Loans

Table of Contents

Understanding Different Types of Finance Loans

Choosing the right type of finance loan is the first crucial step. Different loans cater to different needs and come with varying terms and conditions. Let's explore some common types:

Personal Loans

Personal loans are versatile and can be used for a wide range of personal expenses. They're typically short-term or long-term loans depending on the amount borrowed and the repayment schedule.

- Examples: Debt consolidation, home improvements, medical expenses, vacation funding, or even unexpected car repairs.

- Factors affecting interest rates: Your credit score is a major factor. A higher credit score generally means a lower interest rate. The loan amount and the repayment term also play a significant role. Longer repayment periods often mean higher total interest paid, but smaller monthly payments.

Business Loans

Securing funding for your business can be challenging, but various business loans are available to support growth and operations.

- Types: Small business loans, term loans (fixed repayment schedule), lines of credit (access to funds as needed), SBA loans (backed by the Small Business Administration), and merchant cash advances.

- Requirements: Lenders will typically require a detailed business plan demonstrating the viability of your business, comprehensive financial statements showcasing your financial health, and a strong credit history.

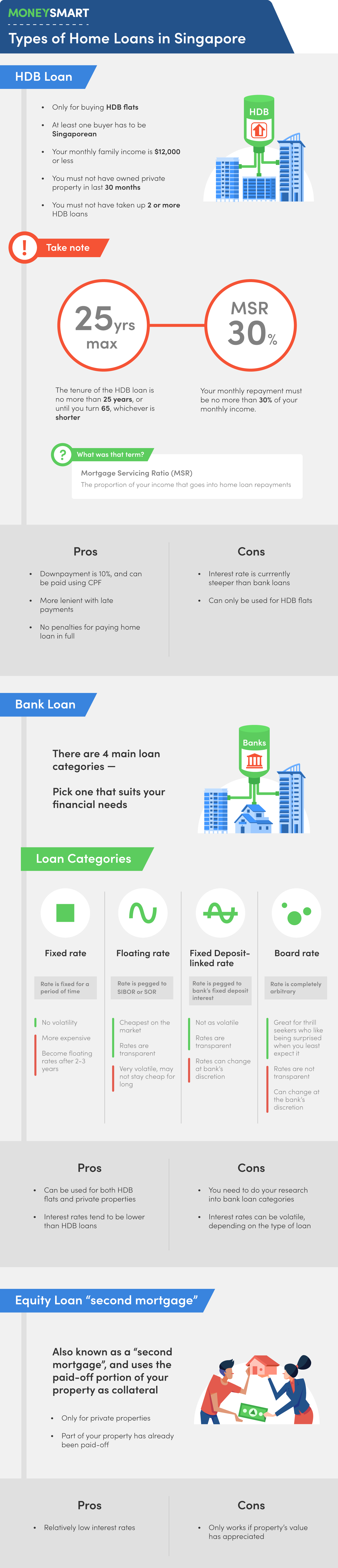

Mortgages

Mortgages are specialized loans used to purchase real estate, whether it's your dream home or an investment property.

- Types: Fixed-rate mortgages (consistent interest rate throughout the loan term), adjustable-rate mortgages (interest rate fluctuates), FHA loans (insured by the Federal Housing Administration), and VA loans (for eligible veterans).

- Key Considerations: The down payment amount significantly impacts your loan terms and monthly payments. Interest rates, loan terms (the length of the loan), and closing costs are all crucial factors to compare carefully when choosing a mortgage.

Student Loans

Student loans help finance higher education, but understanding the different types and repayment options is vital.

- Types: Federal student loans (offered by the government, often with more favorable terms) and private student loans (from banks and other financial institutions).

- Repayment plans: Income-driven repayment plans adjust monthly payments based on your income, while standard repayment plans involve fixed monthly payments over a set period.

Preparing Your Finance Loan Application

A well-prepared application significantly increases your chances of approval and securing favorable terms.

Checking Your Credit Score

Your credit score is a critical factor in determining your eligibility and the interest rate you'll receive.

- Importance: Lenders use your credit score to assess your creditworthiness. A higher score demonstrates responsible financial behavior and makes you a less risky borrower.

- Tips to improve your credit score: Pay all bills on time, consistently, keep your credit utilization low (the amount of credit you use compared to your available credit), and regularly monitor your credit report for any errors.

Gathering Necessary Documents

Having all required documents ready will expedite the application process.

- Common Documents: Proof of income (pay stubs, tax returns, W-2s), bank statements demonstrating consistent financial activity, government-issued identification, and sometimes proof of address. Specific requirements will vary depending on the type of loan and lender.

Shopping Around for the Best Rates

Don't settle for the first offer you receive. Comparing loan offers from multiple lenders is crucial.

- Use online comparison tools: Many websites and apps allow you to compare loan offers from different lenders side-by-side, making it easy to identify the best rates and terms. This saves time and ensures you secure the most favorable deal.

The Finance Loan Application Process

The application process itself involves several steps. Careful attention to detail is critical at each stage.

Completing the Application

Accuracy is key when completing your loan application.

- Double-check all information: Any inaccuracies can lead to delays, rejection, or even complications later on in the process. Take your time and review every detail before submitting your application.

Providing Documentation

Submit all necessary documentation promptly and in an organized manner.

- Organize documents efficiently: Keeping your documents organized and easily accessible will make the review process much smoother and faster for both you and the lender.

Understanding Loan Terms and Conditions

Before signing any loan agreement, carefully review all the terms and conditions.

- Key aspects to consider: The annual percentage rate (APR), any fees associated with the loan, the repayment schedule, and any prepayment penalties. Understand exactly what you're agreeing to before signing on the dotted line.

Managing Your Finance Loan Responsibly

Once you've secured your finance loan, responsible management is essential to avoid financial difficulties.

Creating a Repayment Plan

Develop a realistic budget to ensure you can make your loan payments on time and avoid late fees.

- Budgeting tools and apps: Numerous budgeting tools and apps can help you track your expenses and create a budget that accommodates your loan payments.

Monitoring Your Account

Regularly check your loan account to ensure everything is accurate.

- Stay informed about your balance and payments: This proactive approach helps you catch any errors or discrepancies early on and avoid potential problems.

Seeking Help When Needed

Don't hesitate to contact your lender if you face any financial challenges.

- Explore options for assistance: Many lenders offer hardship programs or alternative repayment options for borrowers experiencing financial difficulties. Reaching out early is key to finding solutions before the situation worsens.

Conclusion

This Finance Loans 101 guide provides a comprehensive overview of the finance loan application process. Understanding different loan types, preparing a strong application, and managing your loan responsibly are vital for securing favorable terms and maintaining good financial health. By following these steps, you can confidently navigate the world of finance loans and achieve your financial goals. Start your journey today by researching different types of finance loans that best suit your needs. Remember, careful planning and understanding are crucial for successful finance loan applications.

Featured Posts

-

Bu Yazin En Bueyuek Transferi Ingiliz Devinden Flas Gelismeler

May 28, 2025

Bu Yazin En Bueyuek Transferi Ingiliz Devinden Flas Gelismeler

May 28, 2025 -

Ajax Six Points Behind After Controversial Referee Decision Against Az

May 28, 2025

Ajax Six Points Behind After Controversial Referee Decision Against Az

May 28, 2025 -

Samsung Galaxy S25 Ultra 1 To Offre Exceptionnelle A 1294 90 E

May 28, 2025

Samsung Galaxy S25 Ultra 1 To Offre Exceptionnelle A 1294 90 E

May 28, 2025 -

Taylor Swift And Beyonces 2025 American Music Award Nominations

May 28, 2025

Taylor Swift And Beyonces 2025 American Music Award Nominations

May 28, 2025 -

Welcome To Wrexham Planning Your Visit

May 28, 2025

Welcome To Wrexham Planning Your Visit

May 28, 2025

Latest Posts

-

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025 -

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025 -

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025 -

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025 -

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025