Finance Loans 101: Understanding Interest Rates, EMIs, And Tenure

Table of Contents

Decoding Interest Rates in Finance Loans

Interest rates are the cost of borrowing money. They represent the percentage of the principal loan amount you'll pay as interest over a specific period. A higher interest rate means a higher total loan cost, significantly impacting your overall repayment amount. It's essential to carefully consider the interest rate before accepting any finance loan offer.

- Fixed vs. Variable Interest Rates:

- Fixed interest rates: These remain constant throughout the loan's tenure, offering predictability and stability in your monthly payments. However, they might be slightly higher than variable rates during periods of low-interest rates.

- Variable interest rates: These fluctuate based on market conditions. While they might initially be lower than fixed rates, they can increase or decrease, leading to unpredictable monthly payments.

- Factors Influencing Interest Rates: Several factors influence the interest rate you'll receive, including your credit score (a higher score usually translates to a lower rate), the loan amount (larger loans might attract higher rates), and the type of loan (secured loans typically have lower rates than unsecured loans).

- APR (Annual Percentage Rate): The APR reflects the total cost of the loan, including interest and other fees. Always compare the APR from different lenders to get a comprehensive understanding of the true cost of borrowing. This is vital for comparing finance loan offers accurately.

Understanding EMIs (Equated Monthly Installments) in Finance Loans

Your EMI is the fixed amount you pay each month to repay your finance loan. It's calculated by adding the principal loan amount and the interest accrued over the loan's tenure, then dividing that total by the number of months in the repayment period.

- Factors Affecting EMIs: The EMI amount is directly influenced by three key factors:

- Interest Rate: A higher interest rate results in a higher EMI.

- Loan Amount: A larger loan amount leads to a higher EMI.

- Loan Tenure: A longer loan tenure results in a lower EMI but a higher total interest paid, while a shorter tenure means a higher EMI but lower total interest. For example, a 10-year loan will have lower monthly payments than a 5-year loan for the same principal amount.

- EMI Calculation Methods: Lenders employ various EMI calculation methods, some slightly differing in how they compute interest. Ensure you understand the lender's calculation method before signing the loan agreement.

- Risks of Missed EMI Payments: Missing EMI payments can severely damage your credit score, leading to difficulties securing future loans and impacting your financial reputation. Always prioritize timely payments.

Mastering Loan Tenure in Finance Loans

Loan tenure refers to the repayment period of your finance loan – the length of time you have to repay the borrowed amount. The choice of loan tenure significantly impacts the total interest you pay.

- Shorter vs. Longer Tenures:

- Shorter Tenures: Result in higher EMIs but lower overall interest paid. They are suitable for borrowers with higher disposable income and a preference for paying off debt quickly.

- Longer Tenures: Result in lower EMIs but higher overall interest paid. They are suitable for borrowers with limited disposable income but come at the cost of paying significantly more interest over the loan's life.

- Factors to Consider When Choosing a Tenure: Consider your financial capacity, long-term financial goals, and risk tolerance when selecting a loan tenure. A longer tenure might seem attractive initially due to lower EMIs, but it can lead to paying substantially more interest in the long run.

- Loan Prepayment and Tenure: Most finance loans allow for prepayment, which can reduce your loan tenure and the total interest paid.

Making Informed Decisions with Finance Loans

Understanding interest rates, EMIs, and loan tenure is paramount for making well-informed decisions when taking out finance loans. By grasping these concepts, you'll be better equipped to compare loan offers, choose the best terms, and manage your finances effectively. Use online loan calculators to estimate EMIs and compare offers from different lenders before committing to a loan.

Take control of your finances by understanding the intricacies of finance loans. Compare interest rates, EMIs, and tenures to find the best loan option for your needs!

Featured Posts

-

Garnachos United Struggles A Lyon Players View And Amorims Role

May 28, 2025

Garnachos United Struggles A Lyon Players View And Amorims Role

May 28, 2025 -

Serena Williams Strong Reaction To Jannik Sinners Doping Case

May 28, 2025

Serena Williams Strong Reaction To Jannik Sinners Doping Case

May 28, 2025 -

Rabota Nad Novym Filmom Uesa Andersona Nachalas

May 28, 2025

Rabota Nad Novym Filmom Uesa Andersona Nachalas

May 28, 2025 -

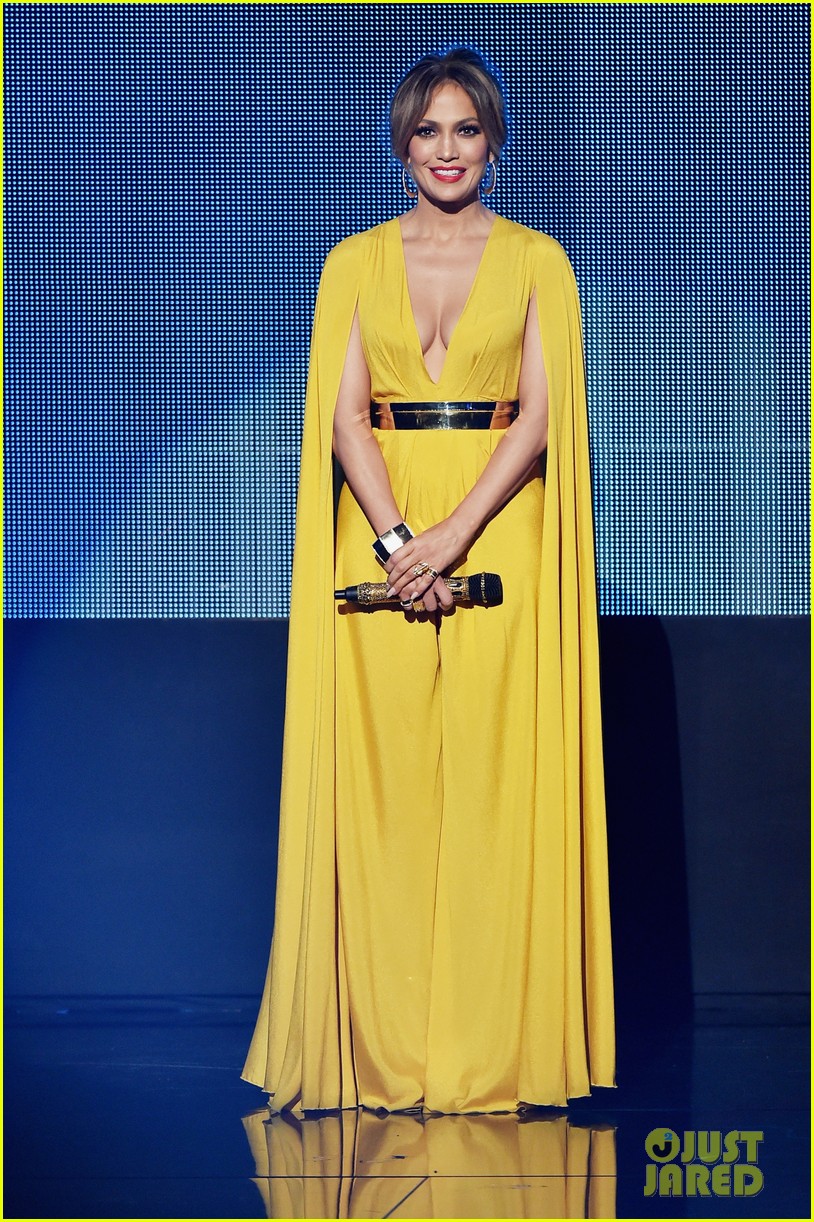

Jennifer Lopezs Potential Hosting Role At The 2025 Amas

May 28, 2025

Jennifer Lopezs Potential Hosting Role At The 2025 Amas

May 28, 2025 -

Psvs 2 3 Win Against Feyenoord The Title Race Heats Up

May 28, 2025

Psvs 2 3 Win Against Feyenoord The Title Race Heats Up

May 28, 2025

Latest Posts

-

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025 -

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025 -

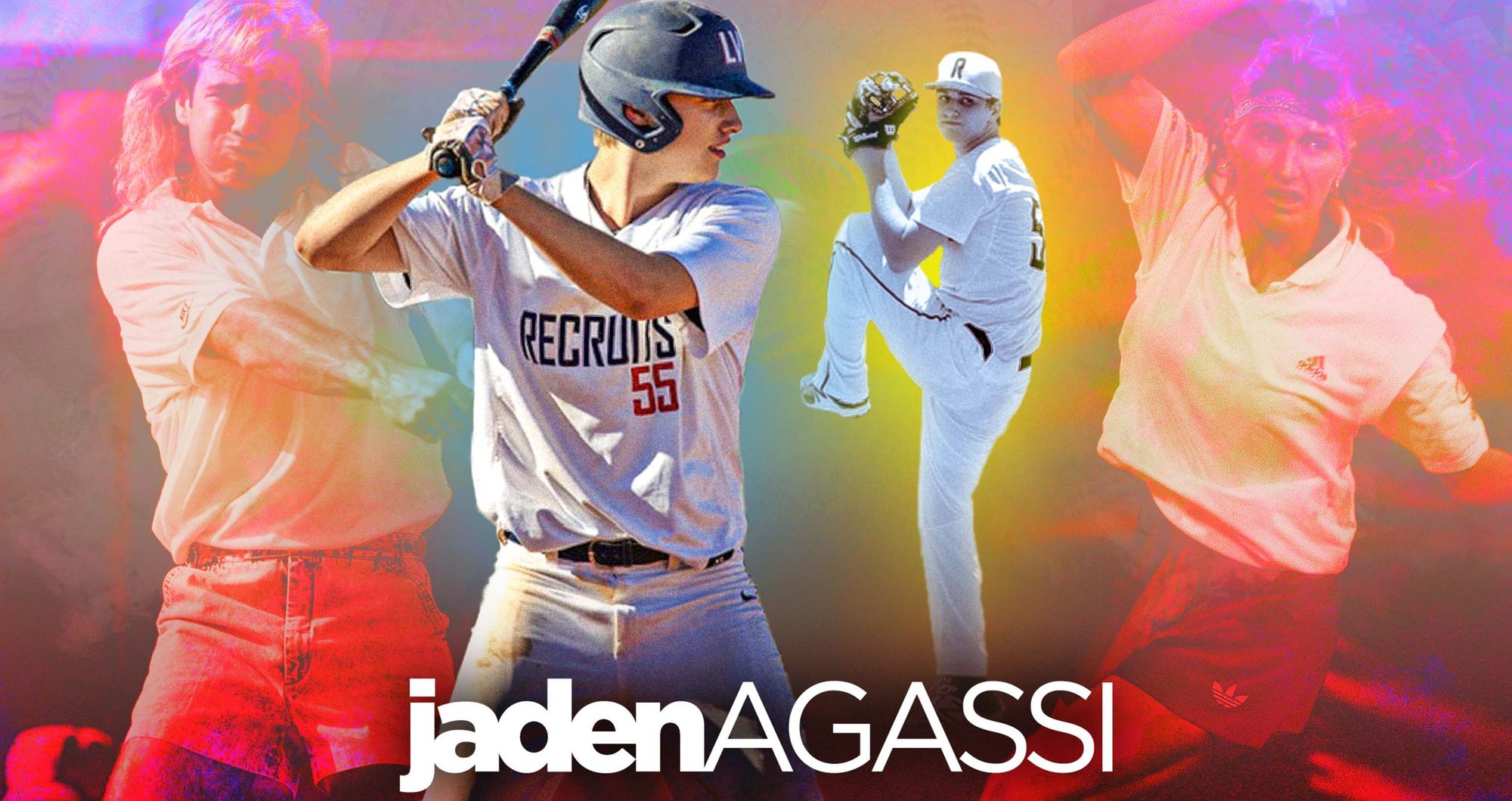

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025 -

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025 -

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025