Finance Loans 101: Everything You Need To Know About Loan Applications And Repayments

Table of Contents

Understanding Different Types of Finance Loans

Choosing the right finance loan depends heavily on your specific needs and financial circumstances. Several types of loans cater to various purposes, each with its own set of features, benefits, and interest rates. Understanding these differences is a critical first step in your loan journey. Key factors to consider include loan interest rates and loan terms, which significantly impact your overall cost.

- Personal loans: These versatile loans can be used for a wide range of purposes, from debt consolidation to home improvements. They typically offer flexible repayment options and are unsecured, meaning they don't require collateral.

- Auto loans: Specifically designed for purchasing vehicles, auto loans are secured loans, meaning the vehicle itself serves as collateral. Interest rates and loan terms often depend on the vehicle's make, model, and year.

- Mortgage loans: Used to finance the purchase of a home or other property, mortgage loans are typically long-term loans with a lengthy repayment schedule. They are secured loans, with the property acting as collateral.

- Student loans: These loans help finance higher education expenses. Student loans often come with government assistance programs and potentially lower interest rates than other loan types. Repayment typically begins after graduation.

- Business loans: Essential for funding business operations, expansion, or equipment purchases, business loans often require a detailed business plan and strong financial projections to secure approval. Interest rates can vary greatly depending on the risk assessment.

Comparing interest rates and loan terms across different types is crucial for finding the most suitable and cost-effective option. Online comparison tools can be incredibly helpful in this process.

The Loan Application Process: A Step-by-Step Guide

The loan application process may seem complex, but breaking it down into steps makes it more manageable. Accuracy and honesty are paramount throughout this process, as inaccuracies can lead to delays or rejection.

- Gathering necessary documents: This typically includes income statements (pay stubs, tax returns), bank statements, and proof of address. The specific documents required may vary depending on the loan type and lender.

- Completing the loan application form: Pay close attention to detail when completing the application form. Any inconsistencies or omissions can delay the approval process.

- Understanding credit scores and their impact on loan approval: Your credit score is a significant factor in determining your loan eligibility and interest rate. A higher credit score usually leads to better loan terms. You can obtain your credit report from major credit bureaus to check your score.

- The loan pre-approval process and its benefits: Pre-approval gives you a clear picture of how much you can borrow and the terms you can expect, making the actual application smoother and faster.

- Dealing with loan application rejections and potential appeals: If your application is rejected, understanding the reasons why is crucial. You may be able to appeal the decision by addressing the issues that led to the rejection.

Improving Your Chances of Loan Approval

Improving your financial standing increases your likelihood of loan approval and securing favorable terms. Focus on these key areas:

- Maintaining a good credit score: Regularly paying bills on time and managing your debt responsibly are crucial for building and maintaining a good credit score.

- Lowering your debt-to-income ratio: A lower debt-to-income ratio (DTI) demonstrates your ability to manage debt and repay loans. Reducing high-interest debts is a great starting point.

- Demonstrating financial stability through consistent income: A stable income history shows lenders that you're capable of making regular loan payments.

- Seeking professional help to improve your credit score: Credit counseling agencies can offer guidance and strategies for improving your creditworthiness.

Managing Loan Repayments Effectively

Effective loan repayment requires careful planning and disciplined budgeting. Understanding the terms of your loan and sticking to a repayment plan are essential for avoiding financial difficulties.

- Understanding your loan repayment schedule and amortization schedule: Familiarize yourself with your loan's repayment schedule and amortization schedule to understand the payment amounts and the total interest paid over the life of the loan.

- Creating a realistic budget to accommodate loan payments: Budgeting is critical to ensure timely loan payments without sacrificing essential expenses.

- Exploring different repayment options (e.g., accelerated payments): Making extra payments or accelerating your repayment can save you money on interest and shorten the loan term.

- The consequences of late payments and loan default: Late payments can negatively impact your credit score and may lead to additional fees. Loan default can have severe financial ramifications.

- Debt management strategies for multiple loans: If you have multiple loans, consider strategies like debt consolidation to simplify repayments and potentially reduce interest costs.

Seeking Professional Financial Advice

Seeking guidance from a financial advisor can significantly enhance your understanding of finance loans and help you make informed decisions.

- Consulting a financial advisor to create a personalized financial plan: A financial advisor can help you develop a financial plan that aligns with your goals and circumstances.

- Exploring options like debt consolidation or loan refinancing: A financial advisor can assess your financial situation and recommend the best approach for managing your debt.

- Understanding the long-term financial implications of borrowing: A financial advisor can help you understand the long-term financial implications of taking out loans and making sure you're making responsible borrowing decisions.

Conclusion

Successfully navigating the world of finance loans requires careful planning and understanding. This guide provided a comprehensive overview of the loan application and repayment process, covering different loan types, application procedures, and effective repayment strategies. Remember to research thoroughly, compare offers, and prioritize responsible borrowing practices. Don't hesitate to seek professional financial advice to ensure you make informed decisions regarding your finance loans and achieve your financial goals. Start your journey toward securing the right finance loans today!

Featured Posts

-

To Foinikiko Sxedio Toy Goyes Anterson Imerominies Provolon Kai Trailer

May 28, 2025

To Foinikiko Sxedio Toy Goyes Anterson Imerominies Provolon Kai Trailer

May 28, 2025 -

Nintendos Bold New Era A Calculated Risk

May 28, 2025

Nintendos Bold New Era A Calculated Risk

May 28, 2025 -

How Journaling Helped Kyle Stowers Breakout Season With The Marlins

May 28, 2025

How Journaling Helped Kyle Stowers Breakout Season With The Marlins

May 28, 2025 -

Lainavertailu Auttaa Loeytaemaeaen Edullisimman Lainan Korkeiden Korkojen Aikana

May 28, 2025

Lainavertailu Auttaa Loeytaemaeaen Edullisimman Lainan Korkeiden Korkojen Aikana

May 28, 2025 -

Cuaca Jawa Timur Besok 6 5 Hujan Di Beberapa Daerah

May 28, 2025

Cuaca Jawa Timur Besok 6 5 Hujan Di Beberapa Daerah

May 28, 2025

Latest Posts

-

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025

El Odio Y La Admiracion Un Tenista Argentino Y La Leyenda De Rios

May 30, 2025 -

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025

Marcelo Rios El Dios Del Tenis Segun Un Rival Argentino

May 30, 2025 -

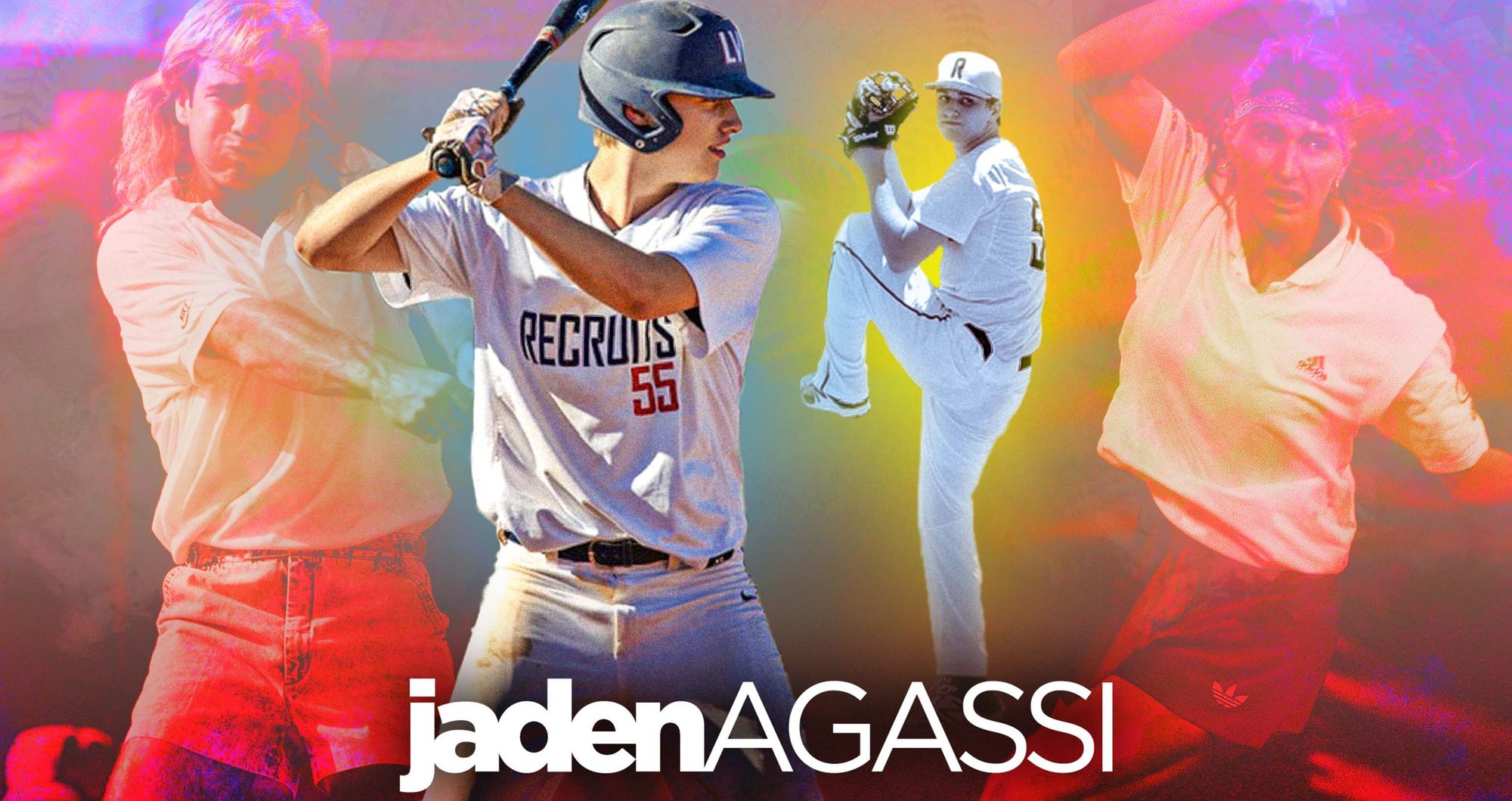

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025

De La Raqueta A La El Sorprendente Regreso De Andre Agassi Al Deporte

May 30, 2025 -

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025

So Spielen Steffi Graf Und Andre Agassi Erfolgreich Pickleball

May 30, 2025 -

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025

Un Tenista Argentino Reconoce La Grandeza De Rios A Pesar De Su Odio

May 30, 2025