Finance Loans 101: A Step-by-Step Guide To Loan Applications

Table of Contents

Understanding Your Loan Eligibility

Before you even begin searching for finance loans, it’s crucial to understand your loan eligibility. Lenders assess your application based on several key factors, primarily focusing on your creditworthiness and financial stability. A strong application hinges on demonstrating your ability to repay the loan.

-

Credit Score: Your credit score is a critical indicator of your creditworthiness. Lenders use it to gauge your history of managing debt. A higher credit score significantly improves your chances of loan approval and often results in better interest rates. Check your credit report from agencies like Equifax, Experian, and TransUnion to identify and address any errors.

-

Debt-to-Income Ratio (DTI): Your DTI compares your monthly debt payments to your gross monthly income. A lower DTI indicates a greater capacity to handle additional debt. Lenders prefer borrowers with a low DTI, usually below 43%. Calculate your DTI to understand your standing.

-

Income Verification: Stable and verifiable income is essential. Lenders will require proof of income, such as pay stubs, tax returns, or bank statements, to confirm your ability to meet your repayment obligations. The consistency and amount of your income directly impact loan approval.

-

Financial History: Your overall financial history, including past loan repayments and any instances of late payments or defaults, plays a crucial role. A history of responsible financial behavior significantly boosts your application's strength.

Choosing the Right Loan Type

The world of finance loans offers a variety of options, each tailored to specific needs and purposes. Choosing the right loan type is crucial for maximizing your chances of approval and securing favorable terms.

-

Personal Loans: Ideal for debt consolidation, home improvements, or unexpected expenses. They offer flexible terms but usually come with higher interest rates than secured loans.

-

Business Loans: Essential for startup capital, expansion, or equipment purchases. These loans often require a detailed business plan and strong financial projections. Types include SBA loans, term loans, and lines of credit.

-

Student Loans: Specifically designed to finance higher education expenses. These loans often have government-backed options with favorable interest rates, but repayment begins after graduation.

-

Mortgage Loans: Used for purchasing a home. These are secured loans, meaning your home serves as collateral. Mortgage rates depend on factors like your credit score, down payment, and the loan-to-value ratio.

-

Consider Loan Terms and Interest Rates: Carefully compare loan terms (repayment period) and interest rates (APR) before making a decision. A longer repayment period lowers monthly payments but increases the total interest paid. Conversely, a shorter term increases monthly payments but reduces the overall interest.

Gathering Required Documentation

The loan application process requires providing accurate and complete documentation. Missing or inaccurate information can cause significant delays or even lead to rejection.

-

Government-Issued Photo Identification: A valid driver's license or passport is typically required.

-

Proof of Income: Provide recent pay stubs, W-2 forms, or tax returns to verify your income.

-

Bank Statements: Bank statements showing your account activity are crucial for demonstrating your financial stability.

-

Proof of Address: Utility bills, lease agreements, or other documents proving your residence are often necessary.

-

Business Plan (for Business Loans): A well-structured business plan is essential for securing business loans. It should outline your business strategy, financial projections, and management team.

Completing the Loan Application

Once you've gathered the necessary documents, carefully complete the loan application form. Accuracy is paramount.

-

Read Instructions Carefully: Thoroughly read the application instructions before starting.

-

Accurate Information: Provide only accurate and truthful information. Inaccuracies can lead to immediate rejection.

-

Double-Check Details: Before submitting, review all the information meticulously to ensure its accuracy.

-

Keep Copies: Maintain copies of all submitted documents for your records.

-

Understand Lender Requirements: Each lender may have specific requirements; understand those requirements fully. Many lenders now offer online application processes which simplifies this step.

Understanding Loan Terms and Conditions

Before signing any loan agreement, thoroughly review the terms and conditions. Understanding these terms is crucial to avoid unexpected costs or challenges.

-

Annual Percentage Rate (APR): The APR represents the annual cost of borrowing, incorporating interest and other fees. Compare APRs from different lenders.

-

Repayment Schedule: Understand the loan's repayment schedule – the frequency and amount of your monthly payments.

-

Fees: Be aware of any associated fees, such as origination fees, prepayment penalties, or late payment fees.

-

Ask Questions: If anything is unclear, contact the lender directly to clarify before signing the agreement.

Conclusion

Successfully navigating the world of finance loans requires careful planning, preparation, and a thorough understanding of the loan application process and loan terms. This guide offers a comprehensive overview of the steps involved, from assessing your loan eligibility and choosing the right loan type to gathering necessary documentation and reviewing the loan agreement. Remember, securing a finance loan can be a powerful tool for achieving your financial goals, but responsible borrowing is crucial. Use this guide as your starting point. Start researching your loan eligibility and the best loan options available to you today!

Featured Posts

-

8 Pilihan Oleh Oleh Kuliner Bali Yang Tak Biasa Cokelat Kacang Dan Lainnya

May 28, 2025

8 Pilihan Oleh Oleh Kuliner Bali Yang Tak Biasa Cokelat Kacang Dan Lainnya

May 28, 2025 -

Rebecca Blacks Vegas Look Decoding Her Ama Style

May 28, 2025

Rebecca Blacks Vegas Look Decoding Her Ama Style

May 28, 2025 -

Research Cuts Spark Nih Staff Walkout Amidst Growing Tensions

May 28, 2025

Research Cuts Spark Nih Staff Walkout Amidst Growing Tensions

May 28, 2025 -

Wawali Balikpapan Taman Kota Baru Di Setiap Kecamatan

May 28, 2025

Wawali Balikpapan Taman Kota Baru Di Setiap Kecamatan

May 28, 2025 -

Kanye Wests Wife Bianca Censori Wears Minimal Clothing Once More

May 28, 2025

Kanye Wests Wife Bianca Censori Wears Minimal Clothing Once More

May 28, 2025

Latest Posts

-

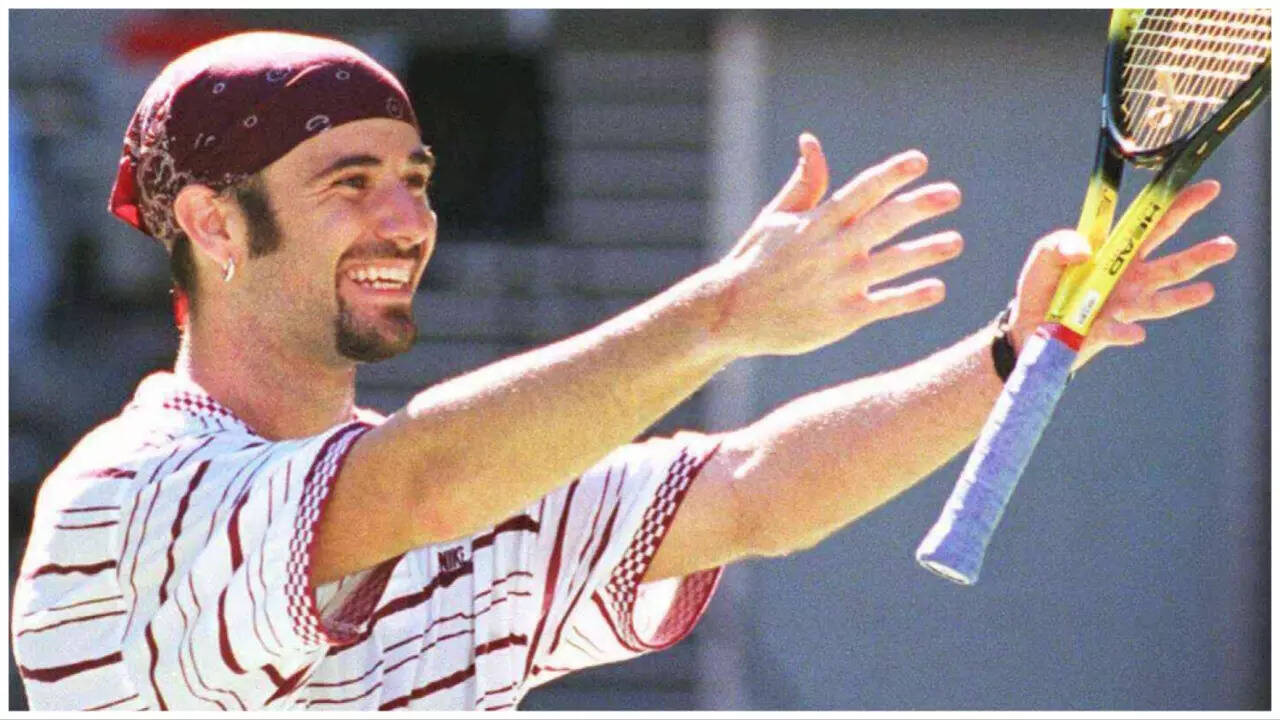

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Sa

May 30, 2025

Nervi De Otel Andre Agassi Vorbeste Despre Anxietatea Sa

May 30, 2025 -

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025

Tennis Legend Andre Agassi Enters The World Of Professional Pickleball

May 30, 2025 -

Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Marturie Sincera

May 30, 2025

Agassi Mai Nervos Decat Un Tigan Cu Ipoteca Marturie Sincera

May 30, 2025 -

Andre Agassi And Ira Khan An Unexpected Encounter And Revelation

May 30, 2025

Andre Agassi And Ira Khan An Unexpected Encounter And Revelation

May 30, 2025 -

Andre Agassi Dezvaluie Tensiunea Inainte De Meciuri

May 30, 2025

Andre Agassi Dezvaluie Tensiunea Inainte De Meciuri

May 30, 2025