Figma IPO: A Year Post-Adobe Deal Rejection

Table of Contents

Figma's Post-Acquisition Performance

Financial Performance and Growth

Since Adobe's bid was rejected, Figma has continued to demonstrate impressive growth. While precise revenue figures aren't publicly available for a privately held company, industry analysts suggest substantial increases. The company's user base has also expanded significantly, solidifying its position as a leading design software platform.

- Revenue Growth: Reports indicate double-digit percentage growth year-over-year. (Specific figures are unavailable due to Figma's private status.)

- User Growth: A substantial increase in registered users and active paying customers has been observed, exceeding industry averages.

- Market Share: Figma has maintained and likely expanded its market share, particularly in the collaborative design space, further strengthening its position against competitors like Adobe XD and Sketch.

- Strategic Initiatives: Following the failed acquisition, Figma likely focused on enhancing its independent capabilities and broadening its enterprise offerings, potentially including targeted acquisitions or strategic partnerships.

Product Development and Innovation

Figma hasn't rested on its laurels. The past year has witnessed a flurry of product updates and new feature releases aimed at enhancing user experience and expanding its capabilities.

- Notable Product Releases: (List specific examples of new features or product updates released by Figma in the last year. This requires up-to-date information from Figma's official website or reputable tech news sources.) Examples could include improved collaboration tools, enhanced prototyping capabilities, or new integrations with other software platforms.

- Improved Functionalities: Focus on specific improvements, for example, faster rendering times, better plugin support, or improved file management.

- Integration with Other Platforms: Mention any new integrations with popular platforms which would broaden Figma's reach and appeal. The impact of these developments on user engagement and market competitiveness needs to be analyzed. Higher engagement rates and positive user reviews would indicate successful product development.

Competitive Landscape

The landscape of design software remains competitive, with established players like Adobe XD and Sketch vying for market share. However, Figma’s unique collaborative features and ease of use have helped it maintain a strong competitive advantage.

- Competitive Analysis: Compare Figma’s strengths and weaknesses against its key competitors (Adobe XD, Sketch, etc.) in terms of features, pricing, user base, and market positioning.

- Market Share Changes: Discuss any noticeable shifts in market share since the Adobe deal fell through, quantifying them if possible using reliable industry reports.

- New Competitors: Mention if any new significant players have entered the market and their potential impact on Figma.

Factors Influencing a Potential Figma IPO

Market Conditions

The current state of the IPO market significantly impacts Figma's decision. A volatile market, marked by economic uncertainty, could delay or discourage an IPO.

- Current Economic Climate: Discuss the current macroeconomic factors impacting the IPO market, such as interest rates, inflation, and overall investor sentiment.

- Investor Sentiment: Analyze the prevailing investor attitude towards tech IPOs, highlighting any trends that might either favor or hinder Figma's prospects.

- Overall IPO Activity: Examine the overall number of IPOs happening currently and their success rates.

Valuation and Investor Interest

Figma's valuation is a critical factor. A high valuation attracts investors but also increases the pressure to deliver strong post-IPO performance.

- Estimates of Figma's Worth: Cite estimates of Figma's current valuation from reputable financial sources. Note the range of valuations and the factors influencing these estimates.

- Potential Investors: Discuss the types of investors likely to be interested in a Figma IPO (venture capitalists, mutual funds, etc.).

- Recent Funding Rounds: Mention any recent funding rounds that provide insights into investor confidence and the company's financial health.

Strategic Considerations

Going public offers advantages but also entails significant drawbacks. Figma must weigh these carefully.

- Access to Capital: Highlight the potential benefits of raising capital through an IPO, such as funding expansion, acquisitions, and R&D initiatives.

- Increased Brand Visibility: Discuss the increased brand awareness and recognition that an IPO could provide.

- Regulatory Compliance: Discuss the increased regulatory scrutiny and compliance requirements associated with being a publicly traded company.

- Loss of Control: Mention the potential dilution of ownership and loss of control that might occur after an IPO.

Predicting the Future: Figma's IPO Timeline

Analyst Predictions

Financial analysts and industry experts offer varying predictions regarding Figma's IPO timeline.

- Predictions from Reputable Sources: Summarize the opinions and predictions from reliable financial analysts and industry experts regarding Figma's IPO timeframe.

- Range of Potential Timelines: Indicate the range of predicted timelines for Figma's IPO, highlighting any consensus or divergence of opinion.

- Reasons Behind Predictions: Explain the reasoning behind these predictions, referencing the factors considered (market conditions, company performance, etc.).

Potential IPO Challenges

Several factors could potentially delay or hinder Figma's IPO.

- Economic Downturns: Explain how potential economic downturns could negatively impact investor confidence and postpone the IPO.

- Regulatory Hurdles: Discuss any potential regulatory hurdles or compliance issues that could slow down or complicate the IPO process.

- Competitive Pressures: Analyze how intense competition in the design software market might influence investor perception and affect the IPO’s success.

Alternative Scenarios

Besides an IPO, other scenarios are possible.

- Likelihood of Each Scenario: Assess the likelihood of alternative scenarios, such as acquisition by another company (perhaps a renewed attempt by Adobe or another tech giant) or remaining private indefinitely.

- Potential Acquirers: If an acquisition is a possibility, mention potential acquirers and the rationale behind such a move.

- Reasons for Choosing to Remain Private: Discuss the potential reasons why Figma might choose to remain a privately held company.

Conclusion: The Figma IPO: A Look Ahead

Figma's journey since the failed Adobe acquisition has been marked by continued growth, product innovation, and strategic maneuvering. While its financial details remain private, the company’s overall trajectory points towards a strong market position. The timing of a Figma IPO remains uncertain, however. Market conditions, investor sentiment, and strategic considerations will play a crucial role in this decision. While several factors could delay the process, the fundamental strength of Figma’s product and its continued growth make a successful Figma's Initial Public Offering a strong possibility within the next few years. The failed Adobe Figma acquisition ultimately spurred Figma to chart its own course, potentially leading to a significant event for the design software market. Stay informed about the latest developments concerning the Figma IPO and related news by subscribing to our updates or following reputable financial news sources for insights into Figma's stock market debut. Keep an eye out for news related to Figma going public.

Featured Posts

-

Naturschutz In Der Saechsischen Schweiz 190 000 Baeume Gepflanzt

May 14, 2025

Naturschutz In Der Saechsischen Schweiz 190 000 Baeume Gepflanzt

May 14, 2025 -

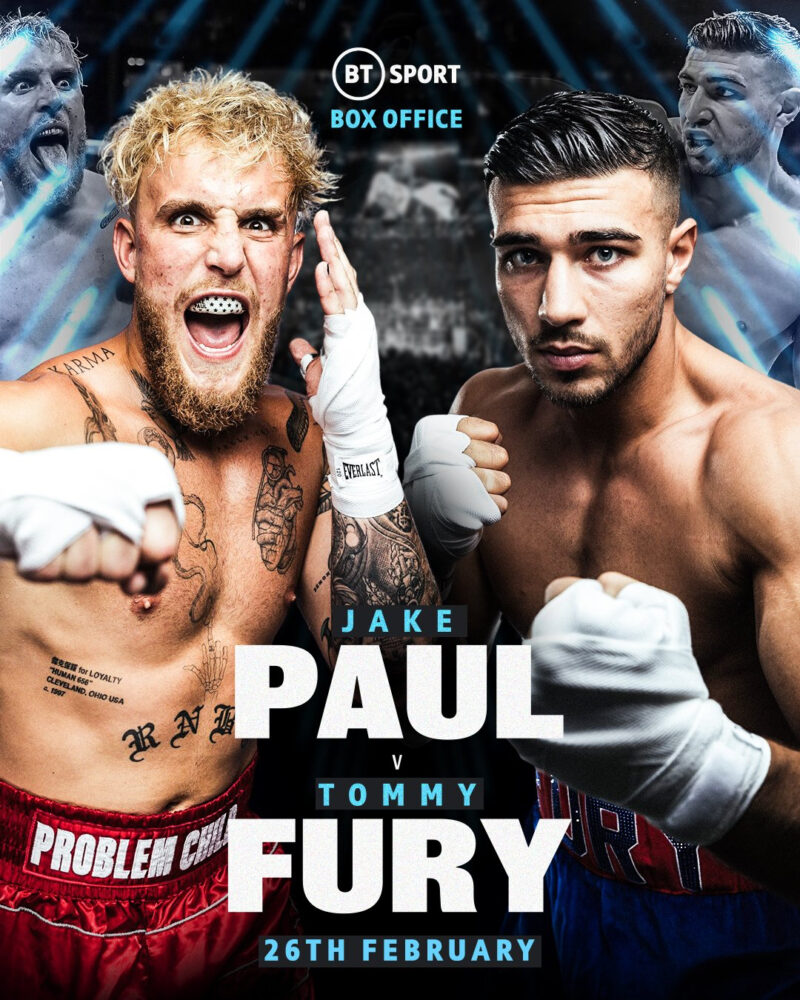

Budapest Tommy Fury Visszaterese Es Uezenete Jake Paulnak

May 14, 2025

Budapest Tommy Fury Visszaterese Es Uezenete Jake Paulnak

May 14, 2025 -

Captain America Brave New World Home Viewing Details

May 14, 2025

Captain America Brave New World Home Viewing Details

May 14, 2025 -

How To Watch Captain America Brave New World At Home

May 14, 2025

How To Watch Captain America Brave New World At Home

May 14, 2025 -

000 Baeume Ein Meilenstein Fuer Den Nationalpark Saechsische Schweiz

May 14, 2025

000 Baeume Ein Meilenstein Fuer Den Nationalpark Saechsische Schweiz

May 14, 2025

Latest Posts

-

The Reality Of Vince Vaughns Italian Ancestry

May 14, 2025

The Reality Of Vince Vaughns Italian Ancestry

May 14, 2025 -

Judd Sisters Docuseries Uncovering Family History And Challenges

May 14, 2025

Judd Sisters Docuseries Uncovering Family History And Challenges

May 14, 2025 -

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025 -

Is Vince Vaughn Of Italian Origin A Detailed Look

May 14, 2025

Is Vince Vaughn Of Italian Origin A Detailed Look

May 14, 2025