Federal Student Loan Refinancing: When It Makes Sense

Table of Contents

Understanding Federal Student Loan Refinancing

Federal student loan refinancing involves replacing your existing federal student loans with a new private loan from a private lender. This is a crucial distinction: you lose the federal protections associated with your original loans when you refinance. Understanding this trade-off is paramount.

Key Players: Private lenders, unlike the federal government, are profit-driven institutions. They assess your creditworthiness and offer refinancing options based on your individual financial profile. Their roles include underwriting your application, setting interest rates, and managing your new loan.

Types of Loans Refinanced: Many federal student loans are eligible for refinancing, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Grad PLUS Loans. However, it's crucial to check with the specific lender regarding their eligibility criteria.

- Lower interest rates: A significant incentive for refinancing.

- Simplified payment plans: Consolidating multiple loans into one simplifies budgeting and tracking.

- Potential for a shorter repayment term: This can lead to paying off your debt faster, but also results in higher monthly payments.

Keywords: federal student loan refinancing, private student loans, refinance federal loans, student loan consolidation

When Refinancing Makes Sense

While refinancing means losing federal protections, there are scenarios where it can be a financially sound decision.

Higher Interest Rates: If you currently have a high interest rate on your federal loans and a private lender offers a significantly lower rate, refinancing can save you substantial money over the life of the loan. For example, let's say you have $50,000 in federal loans at 7% interest and refinance to 4%. Over a 10-year period, you could save thousands of dollars in interest.

Improved Loan Terms: Refinancing might offer better loan terms, such as a longer repayment period (reducing your monthly payment but increasing total interest paid) or a fixed interest rate instead of a variable one, providing predictable payments.

Debt Consolidation: Managing multiple student loans with varying interest rates and due dates can be stressful. Refinancing consolidates these into a single monthly payment, simplifying your finances and improving your organization.

- Significant interest rate reduction: This is the primary driver for many borrowers.

- Desire for a single monthly payment: Streamlines budgeting and reduces administrative burden.

- Need for a longer repayment term: Lowers monthly payments but increases total interest paid.

- Better loan terms overall: A combination of lower rates, fixed interest, and a manageable payment plan.

Keywords: lower interest rates, student loan consolidation, repayment plan, fixed interest rate, variable interest rate

When Refinancing Doesn't Make Sense

Despite the potential benefits, refinancing isn't always the best option.

Loss of Federal Protections: This is the most significant drawback. Federal student loans offer crucial protections, including income-driven repayment plans (IDR), deferment (temporary suspension of payments), and forbearance (temporary reduction in payments). These are lost when you refinance. Defaulting on a private loan can have severe consequences, potentially impacting your credit score and leading to wage garnishment, unlike federal loans which have more flexible default options.

Higher Credit Score Needed: Private lenders typically require higher credit scores than the federal government. Borrowers with lower credit scores might be denied refinancing or offered less favorable terms, negating any potential benefits.

Potential for Higher Fees: Private student loans often come with fees, such as origination fees and potentially prepayment penalties if you pay off the loan early. These fees can eat into any savings from a lower interest rate.

- Need for income-driven repayment plans: If you anticipate needing this flexibility, don't refinance.

- Poor or fair credit score: Refinancing might be difficult or result in unfavorable terms.

- Concerns about potential fees and penalties: Carefully review the loan agreement before signing.

- Uncertain future financial stability: Consider your future earning potential before committing to a new loan.

Keywords: federal student loan benefits, income-driven repayment, credit score requirements, student loan default, prepayment penalty

Analyzing Your Individual Circumstances

Before making a decision, thoroughly analyze your financial situation. Consider your credit score, current interest rates, debt amount, and future financial goals. Compare offers from multiple private lenders to find the best terms. Seeking advice from a financial advisor can provide valuable perspective and help you make an informed decision.

Conclusion

Refinancing federal student loans can offer significant advantages, such as lower interest rates and simplified payments. However, it's crucial to weigh the potential benefits against the loss of federal protections. Carefully evaluate your current financial situation, credit score, and future financial goals before deciding if federal student loan refinancing is the right choice for you. Consider exploring your options and comparing rates from different private lenders to find the best fit. Don't rush into a decision; take your time and thoroughly research federal student loan refinancing to ensure you make the most informed choice for your financial future.

Featured Posts

-

Jackbit Casino A Deep Dive Into Its Bitcoin And Crypto Offerings And Withdrawals

May 17, 2025

Jackbit Casino A Deep Dive Into Its Bitcoin And Crypto Offerings And Withdrawals

May 17, 2025 -

Price Gouging Allegations In La Following Devastating Fires

May 17, 2025

Price Gouging Allegations In La Following Devastating Fires

May 17, 2025 -

Modular Homes A Viable Solution For Canadas Housing Crisis

May 17, 2025

Modular Homes A Viable Solution For Canadas Housing Crisis

May 17, 2025 -

Former Mariners Star Blasts Team For Lackluster Offseason

May 17, 2025

Former Mariners Star Blasts Team For Lackluster Offseason

May 17, 2025 -

Reta Nba Klaida Pistons Ir Knicks Rungtyniu Rezultatas Pakeistas

May 17, 2025

Reta Nba Klaida Pistons Ir Knicks Rungtyniu Rezultatas Pakeistas

May 17, 2025

Latest Posts

-

The Fifteenth Doctor And His New Companion Face Killer Cartoons In Doctor Who Season 2

May 17, 2025

The Fifteenth Doctor And His New Companion Face Killer Cartoons In Doctor Who Season 2

May 17, 2025 -

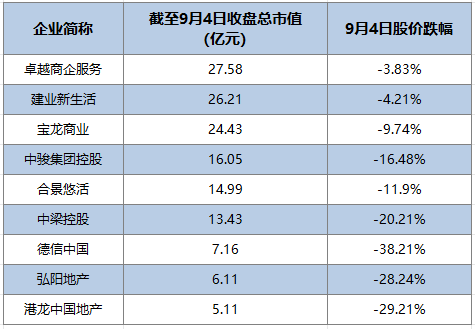

1 4 112

May 17, 2025

1 4 112

May 17, 2025 -

Doctor Who Season 2 Trailer The Fifteenth Doctors New Companion And Killer Cartoons

May 17, 2025

Doctor Who Season 2 Trailer The Fifteenth Doctors New Companion And Killer Cartoons

May 17, 2025 -

Update Valerio Therapeutics S A And The Approval Of Its Financial Statements

May 17, 2025

Update Valerio Therapeutics S A And The Approval Of Its Financial Statements

May 17, 2025 -

Valerio Therapeutics 2024 Financial Report Publication Delayed

May 17, 2025

Valerio Therapeutics 2024 Financial Report Publication Delayed

May 17, 2025