Fed Chairman Jerome Powell: Tariffs Create Economic Uncertainty

Table of Contents

Economic uncertainty, characterized by unpredictable market conditions and fluctuating investor confidence, has far-reaching consequences. Businesses postpone investments, consumers become hesitant to spend, and overall economic growth slows. This article aims to analyze how tariffs, as highlighted by Jerome Powell and the Fed's responses, contribute to this very real economic uncertainty.

Jerome Powell's Stance on Tariffs and Economic Uncertainty

Jerome Powell has consistently expressed concerns about the negative impacts of tariffs on the US economy. In numerous public statements and testimonies before Congress, he has emphasized the detrimental effects of trade disputes and protectionist measures. While he hasn't explicitly called for the removal of all tariffs, his remarks consistently highlight the uncertainty they create. He has often pointed to the unpredictable nature of tariff policies as a major factor hindering economic growth and investment.

The Fed views tariffs as a significant factor contributing to several key economic challenges:

- Increased input costs for businesses: Tariffs directly increase the cost of imported goods, raw materials, and components, squeezing profit margins and forcing businesses to raise prices or reduce production.

- Reduced consumer spending: Higher prices for goods and services due to tariffs erode consumer purchasing power, leading to decreased spending and potentially slower economic growth.

- Uncertainty impacting business investment decisions: The unpredictable nature of tariff policies creates uncertainty for businesses, making them hesitant to invest in expansion, new technologies, or hiring.

- Negative effects on global trade and supply chains: Tariffs disrupt established global trade relationships and supply chains, leading to inefficiencies and potentially higher prices for consumers.

The Impact of Tariffs on Inflation (as per Powell's concerns)

Tariffs directly contribute to inflation by increasing the cost of imported goods. This increase is passed on to consumers through higher prices, which, in turn, can lead to a broader inflationary spiral. Powell has repeatedly warned about this inflationary pressure and its potential impact on the Fed's ability to maintain price stability. The Fed's mandate includes controlling inflation, and tariffs complicate this task.

The inflationary effects of tariffs pose several challenges:

- Higher prices for consumers: This reduces purchasing power and can lead to decreased consumer confidence and spending.

- Erosion of purchasing power: As prices rise faster than wages, consumers see a decline in their real income.

- Potential for wage-price spirals: Higher prices could lead to demands for higher wages, further fueling inflation.

- The Fed's challenge in balancing inflation control and economic growth: The Fed faces a difficult balancing act, needing to raise interest rates to combat inflation but risking a slowdown in economic growth in the process.

Economic Uncertainty and Business Investment

Tariff uncertainty significantly discourages business investment. The unpredictability of trade policies makes it difficult for businesses to plan long-term investments, leading to:

- Delayed capital expenditure projects: Businesses postpone investments in new equipment, facilities, and technology due to the risk of unforeseen tariff changes.

- Reduced hiring and job growth: Uncertainty leads to less hiring and slower job creation, negatively impacting employment.

- Negative impact on long-term economic potential: Reduced investment in innovation and expansion hampers long-term economic growth.

- Increased risk aversion among investors: The uncertainty associated with tariffs makes investors more cautious and less likely to take on new risks.

The Fed's Response to Tariff-Induced Uncertainty

The Federal Reserve has responded to tariff-induced uncertainty through various monetary policy tools and communication strategies. While the Fed can't directly address trade policy, it attempts to mitigate the negative economic consequences:

- Interest rate adjustments: The Fed might adjust interest rates to counter inflationary pressures caused by tariffs. However, this can also impact economic growth negatively.

- Quantitative easing or other unconventional monetary policies: In extreme situations, the Fed might resort to unconventional monetary policies to boost liquidity and stimulate the economy.

- Communication strategies: The Fed utilizes clear communication to manage market expectations and ensure transparency regarding its policy responses to the economic uncertainty created by tariffs.

- Challenges in forecasting economic outcomes under tariff uncertainty: The unpredictable nature of tariffs makes accurate economic forecasting extremely difficult for the Fed.

Conclusion: Understanding the Link Between Jerome Powell, Tariffs, and Economic Instability

In conclusion, the link between Jerome Powell, tariffs, and economic instability is undeniable. Chairman Powell's consistent warnings, coupled with the Federal Reserve's actions, underscore the significant negative impact of tariffs on the US economy. The creation of economic uncertainty, fueled by unpredictable trade policies, leads to higher inflation, decreased business investment, and challenges for monetary policy. Understanding the intricate relationship between "Jerome Powell tariffs" and their economic effects is crucial for navigating the complexities of international trade and its impact on economic stability. We encourage further research on this topic by exploring the Federal Reserve's website and other reputable economic sources to gain a deeper understanding of the economic implications of trade policies. Understanding the nuances of the "Jerome Powell tariffs" debate is critical for informed economic discussion and policymaking.

Featured Posts

-

Descubriendo Roc Agel La Propiedad Monegasca Donde Se Refugio Charlene

May 26, 2025

Descubriendo Roc Agel La Propiedad Monegasca Donde Se Refugio Charlene

May 26, 2025 -

Alternative Delivery Capitalizing On Canada Posts Service Challenges

May 26, 2025

Alternative Delivery Capitalizing On Canada Posts Service Challenges

May 26, 2025 -

Roland Whites Review Is Armando Iannuccis Comedy Masterclass Worth Watching

May 26, 2025

Roland Whites Review Is Armando Iannuccis Comedy Masterclass Worth Watching

May 26, 2025 -

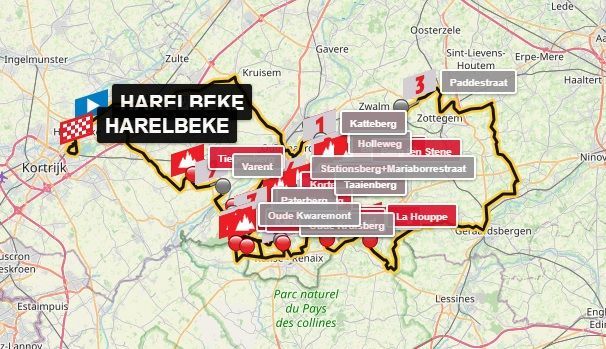

Spectators 300 Fine For Spitting At Mathieu Van Der Poel At E3 Saxo Classic

May 26, 2025

Spectators 300 Fine For Spitting At Mathieu Van Der Poel At E3 Saxo Classic

May 26, 2025 -

Pogacars Solo Ride Seals Tour Of Flanders Win

May 26, 2025

Pogacars Solo Ride Seals Tour Of Flanders Win

May 26, 2025