Faster HMRC Call Times: The Role Of Voice Recognition

Table of Contents

How Voice Recognition Speeds Up HMRC Calls

Voice recognition technology is playing a crucial role in accelerating HMRC call handling and reducing frustrating wait times for taxpayers. This technology streamlines the entire process, from initial contact to final resolution.

Automated Routing and Triage

Voice recognition software acts as a sophisticated call screener, instantly analyzing a caller's initial statement to determine their needs. This intelligent routing system is key to faster HMRC call times.

- Instant Department Routing: The system identifies keywords and phrases to direct calls to the correct department (e.g., self-assessment, PAYE, corporation tax). This eliminates the need for navigating lengthy automated phone menus, saving valuable time.

- Reduced Average Handling Time: By connecting callers directly to the appropriate agent, the system reduces the time spent transferring calls and clarifying the issue. Agents can focus on resolving the query efficiently.

- Improved Call Center Efficiency: Automated routing optimizes agent workload, ensuring that calls are handled by the most knowledgeable representatives, leading to faster resolution times and higher customer satisfaction.

- Example: A caller stating, "I need help understanding my self-assessment tax return," is instantly routed to a specialist in that area, rather than going through multiple menu options.

Self-Service Options and FAQs

Many voice recognition systems offer self-service options, empowering taxpayers to resolve simple queries without speaking to an agent. This significantly reduces call volume and contributes to faster HMRC call times for everyone.

- 24/7 Accessibility: Automated systems are available around the clock, providing instant answers to frequently asked questions (FAQs) regarding tax deadlines, payment methods, and other common issues.

- Reduced Agent Workload: By handling routine inquiries autonomously, voice recognition frees up human agents to focus on more complex and demanding cases.

- Improved Customer Satisfaction: Taxpayers can access information quickly and efficiently, improving their overall experience with HMRC.

- Example: A caller asking, "What is the deadline for filing my tax return?" receives an immediate, accurate automated response, without having to wait on hold for an agent.

Improved Agent Efficiency

Voice recognition doesn't just benefit callers; it also enhances the efficiency of HMRC agents, leading to faster call resolution times.

- Real-time Transcription: The system transcribes calls in real-time, providing agents with a written record of the conversation. This valuable context enables them to understand the issue quickly and efficiently.

- Faster Information Retrieval: Agents can access relevant information more rapidly, as the transcribed call provides key search terms. This reduces the time spent searching for documents or databases.

- Enhanced Note-Taking: Real-time transcription aids in accurate record-keeping, ensuring all relevant information is documented correctly and promptly.

- Improved Accuracy: With less manual note-taking, the chance of errors is significantly reduced, leading to faster and more accurate resolution of issues.

Benefits of Faster HMRC Call Times for Taxpayers

The positive impact of faster HMRC call times extends directly to taxpayers, improving their overall experience and boosting efficiency.

Reduced Waiting Times

The most obvious benefit is the reduction in time spent on hold. This translates directly into:

- Increased Productivity: Taxpayers save valuable time that can be allocated to other tasks.

- Reduced Stress: Waiting on hold can be incredibly frustrating. Faster call times significantly reduce stress and improve the overall experience.

- Higher Customer Satisfaction: Efficient service increases customer satisfaction and trust in HMRC's services.

Improved Accessibility

Faster HMRC call times aren't just about speed; they improve accessibility for all users.

- Disability Support: Voice recognition technology caters to individuals with disabilities, making interactions with HMRC easier and more independent.

- Simplified Navigation: It eliminates the complex menu navigation that can be challenging for some users.

Increased Efficiency and Productivity

Faster call resolution times translate into greater efficiency for taxpayers.

- Quicker Problem Resolution: Tax queries are resolved more efficiently, allowing individuals and businesses to focus on their core activities.

- Streamlined Tax Processes: Faster processing of tax-related matters contributes to smoother business operations and financial planning.

Challenges and Considerations

While the potential benefits of voice recognition are substantial, certain challenges need to be addressed for successful implementation.

Accuracy of Voice Recognition

The accuracy of voice recognition technology can be influenced by several factors:

- Accents and Dialects: Systems need to be trained to recognize a wide range of accents and dialects to ensure accuracy.

- Background Noise: Noise interference can impact the system's ability to accurately transcribe speech.

- Speech Clarity: Mumbling or unclear speech can lead to errors in transcription.

Data Privacy and Security

Handling sensitive taxpayer data requires robust security measures:

- Data Encryption: Strong encryption protocols are essential to protect the confidentiality of personal information.

- Compliance with Regulations: HMRC must adhere to all relevant data protection regulations, such as GDPR.

Implementation Costs

Implementing voice recognition technology requires investment:

- Infrastructure: Upgrading existing phone systems and IT infrastructure is necessary.

- Training: Agents require training to use the new system effectively.

Conclusion

Voice recognition technology offers a significant opportunity to achieve faster HMRC call times, leading to a more efficient and convenient experience for taxpayers. By automating processes, providing self-service options, and improving agent efficiency, this technology tackles the long-standing issue of lengthy wait times. While challenges exist, the potential benefits – including reduced waiting times, improved accessibility, and increased efficiency – make investing in and improving this technology a worthwhile endeavor. To experience the benefits of faster HMRC call times, stay informed about HMRC's technological advancements and utilize available self-service options. Contact HMRC for further information on their use of voice recognition to improve their services.

Featured Posts

-

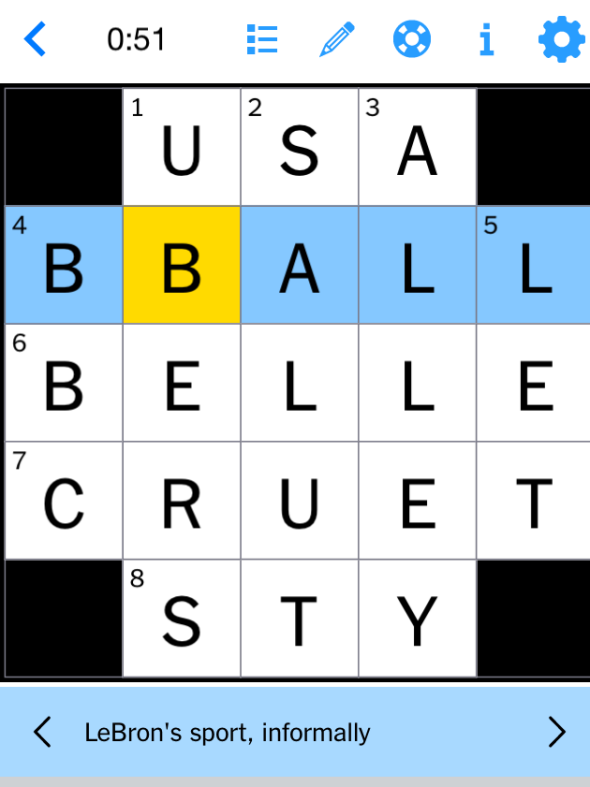

Complete Guide Nyt Mini Crossword April 18 2025 Solutions

May 20, 2025

Complete Guide Nyt Mini Crossword April 18 2025 Solutions

May 20, 2025 -

Tampoy Anazitontas Tin Alitheia Piso Apo Toys Fonoys

May 20, 2025

Tampoy Anazitontas Tin Alitheia Piso Apo Toys Fonoys

May 20, 2025 -

Ajax Fenerbahce Yildizini Kadrosuna Katiyor Transfer Detaylari

May 20, 2025

Ajax Fenerbahce Yildizini Kadrosuna Katiyor Transfer Detaylari

May 20, 2025 -

Abc News Show Future In Jeopardy After Layoffs

May 20, 2025

Abc News Show Future In Jeopardy After Layoffs

May 20, 2025 -

Talisca Ve Fenerbahce Saha Ici Tartismasi Ve Tadic Transferi

May 20, 2025

Talisca Ve Fenerbahce Saha Ici Tartismasi Ve Tadic Transferi

May 20, 2025

Latest Posts

-

Us Four Star Admiral Found Guilty The Corruption Case Explained

May 20, 2025

Us Four Star Admiral Found Guilty The Corruption Case Explained

May 20, 2025 -

Four Star Admirals Corruption Conviction A Detailed Analysis

May 20, 2025

Four Star Admirals Corruption Conviction A Detailed Analysis

May 20, 2025 -

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 20, 2025

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 20, 2025 -

Admirals Bribery Case Examining The Systemic Issues Within The Navy

May 20, 2025

Admirals Bribery Case Examining The Systemic Issues Within The Navy

May 20, 2025 -

Us Four Star Admiral Sentenced Understanding The Corruption Charges

May 20, 2025

Us Four Star Admiral Sentenced Understanding The Corruption Charges

May 20, 2025