Farage Reaches Agreement With NatWest Over Account Closure

Table of Contents

The Background of the NatWest Account Closure

The saga began with the abrupt closure of Nigel Farage's personal NatWest bank account. This action, announced on [Insert Date of Announcement], immediately ignited a firestorm of controversy. NatWest's initial justification cited their de-risking policy, a strategy employed by many financial institutions to mitigate potential reputational and financial risks associated with certain clients. The bank claimed that Farage's account presented such a risk, although they didn't publicly specify the precise nature of those risks. This explanation, however, was met with immediate and widespread criticism.

Farage, a prominent political figure known for his outspoken views, publicly accused NatWest of political censorship, arguing that the closure was politically motivated and a violation of his freedom of speech. His statements amplified the public outcry, transforming the issue into a major political controversy. The debate quickly extended beyond the immediate parties involved, touching upon fundamental questions about the role of banks in a democratic society and the potential for financial institutions to unduly influence public discourse.

- Date of account closure announcement: [Insert Date]

- NatWest's initial statement: [Summarize NatWest's initial public statement]

- Farage's response and public statements: [Summarize Farage's public responses and statements]

- Relevant regulatory bodies involved: [Mention any regulatory bodies involved, e.g., the Financial Conduct Authority (FCA)]

Details of the Agreement Between Farage and NatWest

The details of the agreement reached between Nigel Farage and NatWest remain largely confidential. While the specific terms have not been publicly disclosed, it's understood that both parties have agreed to a settlement, bringing an end to the protracted legal battle. It's unclear whether any financial compensation was involved as part of the settlement. The confidentiality surrounding the agreement suggests a desire by both parties to avoid further public scrutiny and potential legal repercussions.

The impact of this agreement is significant. For Farage, it represents a resolution to a highly publicized and personally damaging situation. For NatWest, the settlement avoids a potentially costly and damaging legal battle that could have further eroded public trust in the bank. The implications for NatWest's de-risking policy remain to be seen; the case has raised important questions about the application and transparency of such policies.

- Key points of the agreement (if disclosed): [Mention any publicly available details]

- Confidentiality clauses (if applicable): [Mention if confidentiality clauses were part of the agreement]

- Any public statements released by either party following the agreement: [Mention any official statements]

- Impact on NatWest's de-risking policy (if any): [Speculate on the potential impact, based on available information]

The Wider Implications of the Farage-NatWest Dispute

The Farage-NatWest dispute has far-reaching implications beyond the immediate parties involved. It highlights concerns about freedom of speech in the context of financial services, prompting a crucial debate about the balance between de-risking and the potential for censorship. The case also raises questions about the regulatory environment surrounding bank account closures and the need for greater transparency and accountability from financial institutions.

The precedent set by this case could influence future disputes between banks and high-profile individuals. It could lead to a reassessment of de-risking policies across the banking sector, potentially encouraging a more nuanced and less arbitrary approach to account closures. The impact on public trust in banks is undeniable; the controversy has shaken confidence in the fairness and impartiality of certain financial institutions.

- Potential changes to bank de-risking policies: [Discuss potential future changes based on the case]

- Impact on public trust in banks: [Analyze the potential long-term effects on public trust]

- Discussion of freedom of speech considerations: [Explore the ethical and legal implications regarding freedom of speech]

- Potential legal precedents set: [Analyze the potential legal precedents set by the case]

Farage and NatWest Settle Account Closure Dispute: What's Next?

The agreement between Nigel Farage and NatWest marks the end of a highly publicized and controversial chapter. The case highlighted significant concerns about de-risking policies within the financial services sector, freedom of speech, and the relationship between banks and prominent public figures. While the details of the settlement remain largely confidential, its impact is undeniable. It has raised crucial questions about the balance between risk management and the potential for undue influence on political discourse.

The Farage NatWest settlement serves as a stark reminder of the complexities surrounding bank account closures and the need for greater transparency and accountability from financial institutions. The long-term implications for both parties, as well as the broader banking sector, remain to be seen. What are your thoughts on this Farage NatWest settlement? Share your opinions on the account closure dispute resolution and the future of financial services regulation in the comments below!

Featured Posts

-

Kate Moss And Lila Grace Moss Twin Black Dresses At London Fashion Week

May 03, 2025

Kate Moss And Lila Grace Moss Twin Black Dresses At London Fashion Week

May 03, 2025 -

Milk And Honeys Electronic Music Department Gains New Head Andrew Goldstone

May 03, 2025

Milk And Honeys Electronic Music Department Gains New Head Andrew Goldstone

May 03, 2025 -

Tensions Escalate Tory Chairmans Confrontation With Reform Uk On Populism

May 03, 2025

Tensions Escalate Tory Chairmans Confrontation With Reform Uk On Populism

May 03, 2025 -

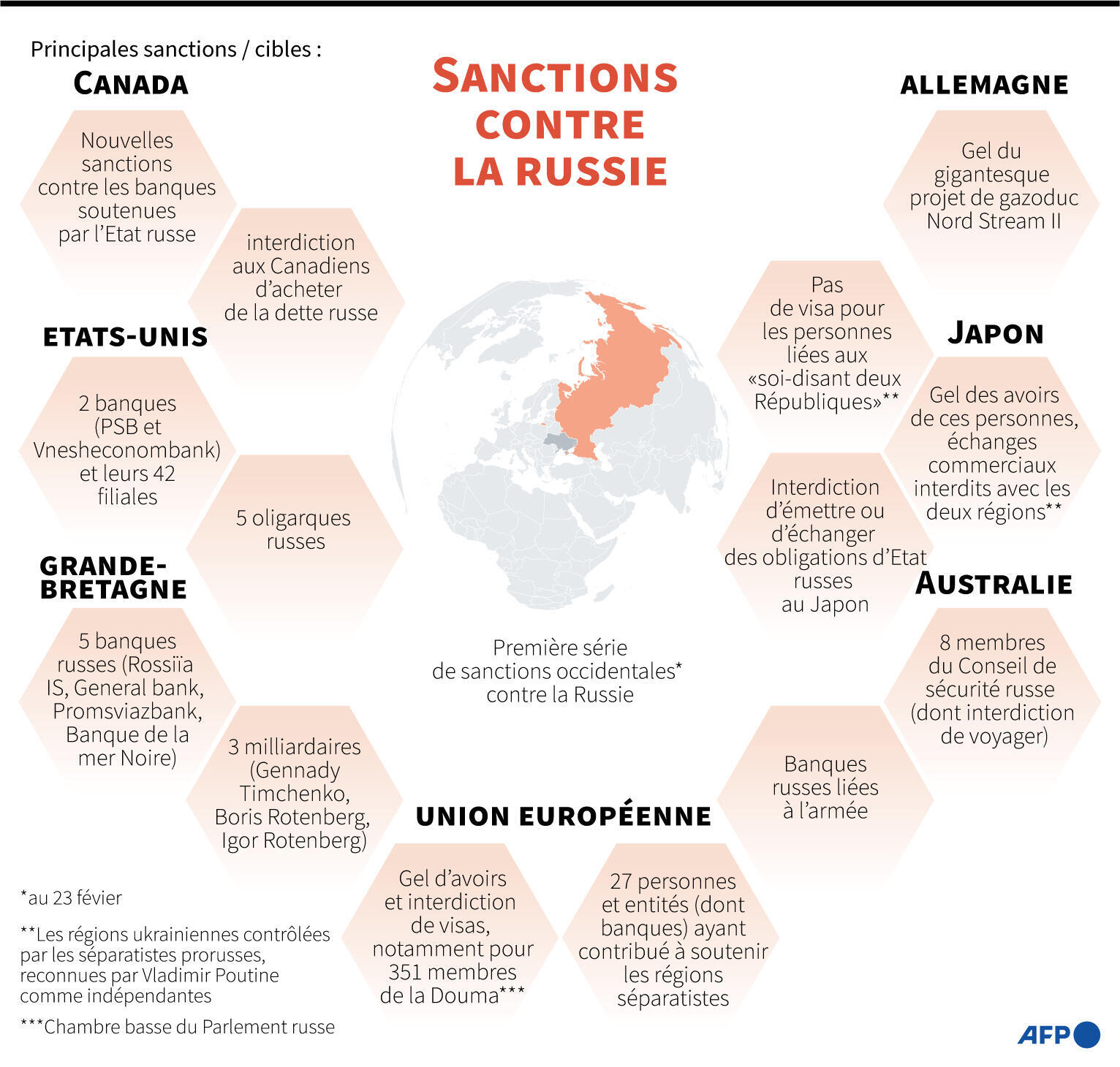

Tensions Accrues Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025

Tensions Accrues Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025 -

Sonys Ps 5 Update Classic Console Themes Make A Comeback

May 03, 2025

Sonys Ps 5 Update Classic Console Themes Make A Comeback

May 03, 2025