Falling Gas Prices: Economic Uncertainty And The National Average

Table of Contents

Factors Contributing to Falling Gas Prices

Several interconnected factors contribute to the current decrease in gas prices at the pump. Understanding these dynamics is crucial to assessing the long-term economic outlook.

Reduced Global Oil Demand

A looming global recession is significantly impacting oil demand. Concerns about slowing economic growth in major economies are leading to decreased industrial activity, reduced travel, and a shift in global energy consumption patterns. China's economic slowdown, in particular, plays a considerable role, as it is a massive consumer of energy resources. Geopolitical factors, such as ongoing international conflicts and trade tensions, further contribute to uncertainty and suppress demand.

- Decreased industrial activity: Factories and manufacturing plants are reducing production, leading to lower energy consumption.

- Reduced travel: Concerns about economic hardship are leading to less air travel and driving, impacting fuel demand.

- Shifting global energy consumption patterns: A transition toward renewable energy sources is also contributing to a slower growth in overall oil consumption.

Increased Oil Supply

The increased supply of oil on the global market also plays a significant role in lowering prices. OPEC+ nations, a group of major oil-producing countries, have made adjustments to their production quotas, increasing the overall supply. Simultaneously, US shale oil production has also seen an uptick, further adding to the available oil supply. In addition, the release of strategic oil reserves by some countries has helped to ease market tightness.

- OPEC+ production adjustments: Coordinated increases in oil production by OPEC+ members have increased the global supply.

- US shale oil output increases: The US shale oil industry has ramped up production, contributing to the increased supply.

- Strategic Petroleum Reserve releases: The release of oil from strategic reserves by various governments has helped to alleviate supply concerns.

Strengthening US Dollar

The strengthening of the US dollar against other major currencies also contributes to lower gas prices. Since oil is priced in US dollars, a stronger dollar makes oil more expensive for buyers using other currencies, reducing global demand and thus impacting prices. This dynamic affects international oil trading and influences the overall cost of importing energy.

- Impact on international oil trading: A stronger dollar makes oil more expensive for countries using other currencies, suppressing demand.

- Dollar's effect on import costs: A strong dollar reduces the US dollar cost of imported oil, contributing to lower gas prices domestically.

Economic Implications of Falling Gas Prices

The falling national average gas price presents a mixed bag of economic implications, with both positive and negative consequences.

Positive Impacts on Consumer Spending

Lower gas prices directly translate to increased disposable income for consumers. This extra money can be spent on other goods and services, boosting consumer spending and potentially stimulating economic growth. The increase in consumer confidence that often accompanies falling gas prices further amplifies this effect. This positive ripple effect benefits various sectors of the economy.

- Increased discretionary spending: Consumers have more money to spend on non-essential goods and services.

- Improved consumer sentiment: Falling gas prices can improve overall consumer confidence and willingness to spend.

- Stimulus to related industries: Increased consumer spending benefits industries like retail, hospitality, and entertainment.

Concerns about Deflationary Pressures

While lower gas prices are initially beneficial, sustained falling prices across a broad range of goods and services can lead to deflationary pressures. Deflation can discourage spending as consumers anticipate further price drops, leading to a deflationary spiral that harms business investment and profitability. Businesses may postpone investment decisions due to decreased profitability and lower consumer demand.

- Reduced business investment: Businesses may delay investments due to lower expected profits and reduced consumer demand.

- Decreased profitability: Businesses may experience lower profit margins due to falling prices and increased competition.

- Potential for deflationary spiral: A prolonged period of deflation can create a vicious cycle of falling prices and reduced economic activity.

Uncertainty in the Energy Market

The global energy market is inherently volatile, making it challenging to predict future gas price trends accurately. Geopolitical events, supply chain disruptions, and speculative trading can all lead to significant price swings. The potential for future price spikes remains a significant concern.

- Geopolitical risks: Political instability and conflicts in oil-producing regions can disrupt supply and cause price spikes.

- Supply chain disruptions: Disruptions to oil transportation or refining can lead to localized or even widespread price increases.

- Speculative trading: Speculation in oil futures markets can exacerbate price volatility.

Monitoring the National Average Gas Price

Staying informed about gas price fluctuations is vital for both consumers and businesses. Several reliable sources provide up-to-date data on the national average gas price and related information.

- AAA Fuel Gauge Report: The American Automobile Association (AAA) provides a regularly updated national average gas price.

- EIA Petroleum Data: The US Energy Information Administration (EIA) offers comprehensive data and analysis on petroleum markets.

- GasBuddy price tracking: GasBuddy is a popular website and app that allows users to track gas prices in their local area and across the country.

Utilizing these resources, along with gas price forecasting tools (keeping in mind their limitations), allows for better planning and decision-making in response to changing fuel costs.

Conclusion

The recent fall in the national average gas price presents a mixed economic picture. While lower fuel costs offer a welcome relief to consumers, the underlying reasons for this decline point towards broader economic uncertainties and potential challenges ahead. Monitoring the national average gas price and understanding the interplay of global oil markets, economic conditions, and energy policy remain crucial for individuals, businesses, and policymakers alike. Stay informed about these fluctuating falling gas prices and their impact on your personal finances and the overall economy by regularly consulting reliable sources for updates. Understanding the factors affecting national average gas price is key to navigating this dynamic market.

Featured Posts

-

Abn Amro Verkoop Van Occasions Schiet Omhoog Dankzij Meer Autobezitters

May 22, 2025

Abn Amro Verkoop Van Occasions Schiet Omhoog Dankzij Meer Autobezitters

May 22, 2025 -

3 Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025

3 Njwm Yndmwn Lawl Mrt Lmntkhb Amryka Tht Qyadt Bwtshytynw

May 22, 2025 -

Testez Vos Connaissances Sur La Loire Atlantique Un Quiz Histoire Gastronomie And Culture

May 22, 2025

Testez Vos Connaissances Sur La Loire Atlantique Un Quiz Histoire Gastronomie And Culture

May 22, 2025 -

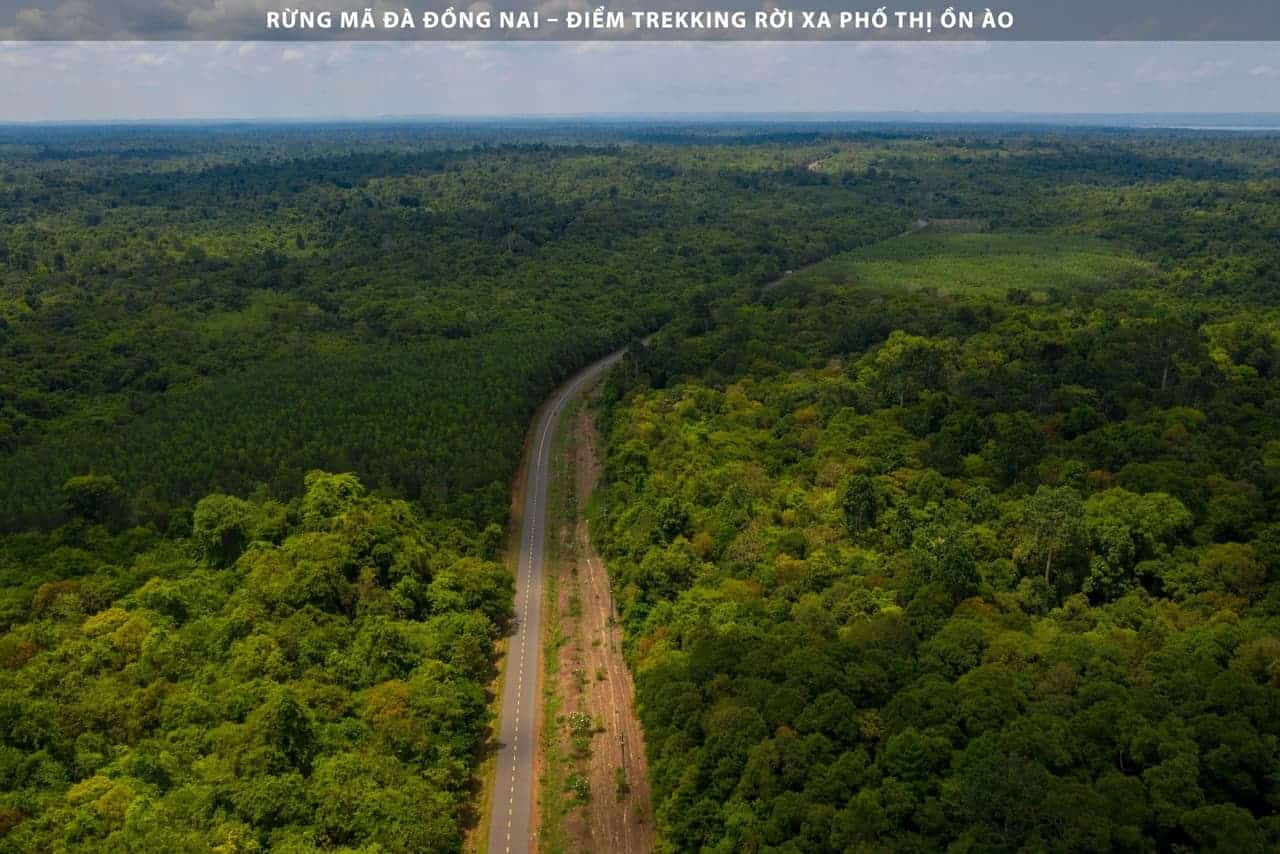

Thong Tin Moi Nhat Ve Tien Do Xay Dung Cau Ma Da Dong Nai

May 22, 2025

Thong Tin Moi Nhat Ve Tien Do Xay Dung Cau Ma Da Dong Nai

May 22, 2025 -

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto Performances Et Impressions

May 22, 2025

L Alfa Romeo Junior 1 2 Turbo Speciale Selon Le Matin Auto Performances Et Impressions

May 22, 2025

Latest Posts

-

Noviy Zakonoproekt Pro Sanktsiyi Zagroza Rosiyi Vid Lindsi Grem

May 22, 2025

Noviy Zakonoproekt Pro Sanktsiyi Zagroza Rosiyi Vid Lindsi Grem

May 22, 2025 -

Washington Attack Chancellor Merz Issues Strong Condemnation

May 22, 2025

Washington Attack Chancellor Merz Issues Strong Condemnation

May 22, 2025 -

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Posilenni Tisku

May 22, 2025

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Posilenni Tisku

May 22, 2025 -

Latest Developments Israeli Diplomat Shot In Washington

May 22, 2025

Latest Developments Israeli Diplomat Shot In Washington

May 22, 2025 -

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025