Examining The House Republicans' Proposed Trump Tax Cuts

Table of Contents

Proposed Changes to Individual Income Tax Rates

The proposed changes to individual income tax rates aim to simplify the tax code and provide tax relief for many Americans. While echoing certain aspects of the Trump tax cuts, these new proposals introduce some key differences. The core principle seems to be lowering rates across the board, although the extent of the reduction varies significantly across income brackets.

- Specific percentage changes for different income brackets: The exact percentages are still subject to change, but initial proposals suggest reductions ranging from a few percentage points for lower brackets to potentially more substantial decreases for higher-income earners. Details are still emerging as the proposal undergoes revisions and debate.

- Comparison to current tax rates: These proposed reductions represent a decrease from the current individual income tax rates, aiming to stimulate economic activity. The extent of this decrease will vary considerably depending on the final version of the proposed legislation.

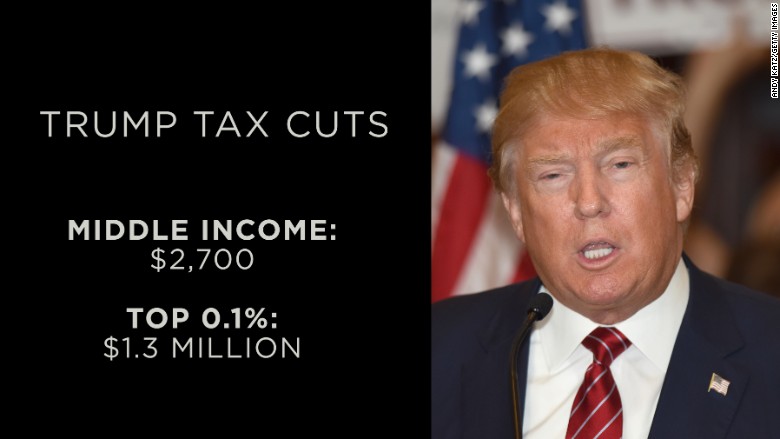

- Impact on different income levels (high, middle, low): While lower-income brackets will see some tax relief, the proposed changes are designed to offer more significant tax savings to higher-income individuals. This aspect is likely to be a significant point of contention during the legislative process.

- Potential for increased tax burdens on specific groups: While the overall goal is tax reduction, some groups may see minimal change or even a slight increase in their tax burden, depending on the specific adjustments to deductions and credits. This potential for unequal impact is a key area of concern for critics.

Related Keywords: individual tax rates, income tax brackets, tax bracket changes, Trump tax reform, tax relief

Corporate Tax Rate Reductions

The proposed legislation includes significant reductions in the corporate tax rate. This is a core element mirroring the Trump-era tax cuts, aiming to boost business investment and job growth.

- Proposed corporate tax rate percentage: The proposed rate is currently under debate, but early indications suggest a significant decrease from the current rate.

- Comparison to the Trump-era corporate tax rate and current rate: The proposed corporate tax rate aims to be lower than the current rate, as well as the rate established by the Tax Cuts and Jobs Act of 2017. The rationale is to encourage competitiveness and stimulate domestic investment.

- Potential impact on business investment and job growth: Proponents argue that the reduction will incentivize businesses to invest more, leading to increased job creation and economic growth. Opponents, however, express concern that the benefits may not trickle down to workers.

- Arguments for and against the reduction: Supporters highlight the potential for increased economic activity, while critics raise concerns about the potential increase in the national debt and the distribution of benefits.

Related Keywords: corporate tax rate, business tax cuts, corporate tax reform, tax incentives for businesses, economic stimulus

Changes to Deductions and Credits

The proposed tax cuts also include adjustments to several significant tax deductions and credits. These changes will have a substantial impact on individual taxpayers.

- Specific changes to key deductions: The specifics are still being finalized, but the proposal may include changes to the standard deduction, itemized deductions (including the mortgage interest deduction), and certain tax credits. This requires careful analysis to understand the overall impact on various income groups.

- Potential impact on taxpayers who utilize these deductions: Depending on the specific changes, some taxpayers may see significant changes to their overall tax liability. For instance, limitations on itemized deductions could disproportionately affect higher-income individuals.

- Analysis of the overall effect on tax liability: The cumulative impact of all proposed changes to deductions and credits needs to be carefully assessed. The net effect on individual tax liabilities will vary significantly depending on income levels and individual circumstances.

- Consideration of any new tax credits proposed: The possibility of new tax credits, such as those focused on specific industries or demographics, could offset some of the impacts of other changes.

Related Keywords: tax deductions, itemized deductions, standard deduction, tax credits, mortgage interest deduction, tax liability

Fiscal Implications and Economic Impact

The proposed Trump Tax Cuts have significant potential implications for the national debt and the overall economy.

- Projected changes to the federal deficit: The tax cuts are expected to increase the federal deficit substantially. The exact amount depends on the final version of the legislation and economic growth following its implementation.

- Potential effects on economic growth (GDP): Proponents believe that the tax cuts will stimulate economic growth, leading to increased tax revenue in the long term. Opponents argue that the deficit increase will outweigh any potential benefits.

- Predictions on inflation and job creation: The impact on inflation and job creation is highly debated. The exact outcome will depend on various factors, including the overall health of the global economy.

- Analysis of potential unintended consequences: Economic models often struggle to fully capture all potential consequences of such large-scale tax changes. Unforeseen impacts may emerge in areas such as income inequality and investment patterns.

Related Keywords: national debt, federal deficit, economic growth, GDP, inflation, job market

Comparison to the Trump Tax Cuts of 2017

The proposed Trump Tax Cuts share similarities with the 2017 Tax Cuts and Jobs Act, but there are also significant differences.

- Point-by-point comparison of key aspects: While both aim for substantial tax reductions, the specifics of rate reductions and deductions differ significantly. A detailed point-by-point comparison will illuminate the key distinctions.

- Analysis of the effectiveness of the 2017 cuts: Analyzing the effectiveness of the 2017 cuts is crucial for assessing the potential success of these new proposals. This analysis needs to consider both economic growth and income distribution effects.

- Lessons learned from the 2017 tax cuts: The experience with the 2017 tax cuts can offer valuable insights into potential successes and pitfalls of the new proposals. Lessons learned should inform any future revisions.

Related Keywords: Tax Cuts and Jobs Act, 2017 tax cuts, tax reform comparison

Conclusion

The proposed House Republican Trump Tax Cuts represent a significant effort to reshape the tax code. The potential effects are far-reaching, impacting individual taxpayers, corporations, and the national economy. While the proposals aim to stimulate economic growth through tax relief, concerns about the increased federal deficit and potential for unequal distribution of benefits remain. Understanding the nuances of these proposals is essential for informed participation in the ongoing debate.

Call to Action: Understanding the intricacies of the proposed Trump Tax Cuts is crucial for informed civic engagement. Stay informed on further developments and potential revisions to this legislation by continuing to follow reputable news sources and economic analysis. Learn more about the potential impact of these proposed Trump Tax Cuts on your personal finances and participate in the conversation shaping the future of American tax policy.

Featured Posts

-

Islanders Secure No 1 Nhl Draft Pick Lottery Win Details

May 13, 2025

Islanders Secure No 1 Nhl Draft Pick Lottery Win Details

May 13, 2025 -

600 Breezy And Tory Lanez Contrasting Legal Outcomes For Similar Cases

May 13, 2025

600 Breezy And Tory Lanez Contrasting Legal Outcomes For Similar Cases

May 13, 2025 -

Ian Mc Kellen In Avengers Doomsday A Chance To Rectify Scarlet Witch And Quicksilvers Mcu Origin Story

May 13, 2025

Ian Mc Kellen In Avengers Doomsday A Chance To Rectify Scarlet Witch And Quicksilvers Mcu Origin Story

May 13, 2025 -

Effective Cross Border Crime Fighting Strategies And Challenges

May 13, 2025

Effective Cross Border Crime Fighting Strategies And Challenges

May 13, 2025 -

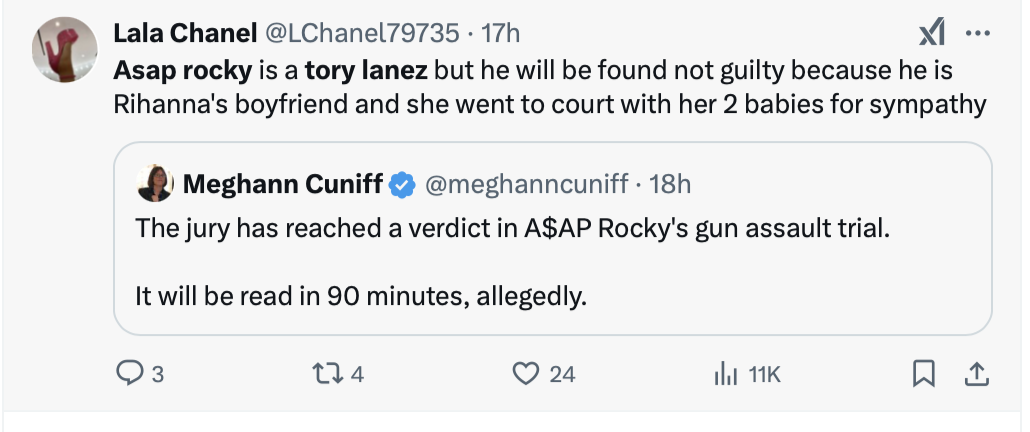

Trumps Trade War Abi Research Analyzes The Lasting Impact On Tech Tariffs

May 13, 2025

Trumps Trade War Abi Research Analyzes The Lasting Impact On Tech Tariffs

May 13, 2025

Latest Posts

-

Tommy Tiernans Wife From Managing His Career To A Vatican Invitation

May 14, 2025

Tommy Tiernans Wife From Managing His Career To A Vatican Invitation

May 14, 2025 -

Rare Appearance Tommy Tiernans Wife And Her Decision To Step Away From His Career

May 14, 2025

Rare Appearance Tommy Tiernans Wife And Her Decision To Step Away From His Career

May 14, 2025 -

Tommy Tiernans Rarely Seen Wife Stepping Back From Management Embracing A New Chapter

May 14, 2025

Tommy Tiernans Rarely Seen Wife Stepping Back From Management Embracing A New Chapter

May 14, 2025 -

Post Split Speeding Ticket For Tommy Fury

May 14, 2025

Post Split Speeding Ticket For Tommy Fury

May 14, 2025 -

Tommy Fury Speeding Fine After Molly Mae Hague Split

May 14, 2025

Tommy Fury Speeding Fine After Molly Mae Hague Split

May 14, 2025